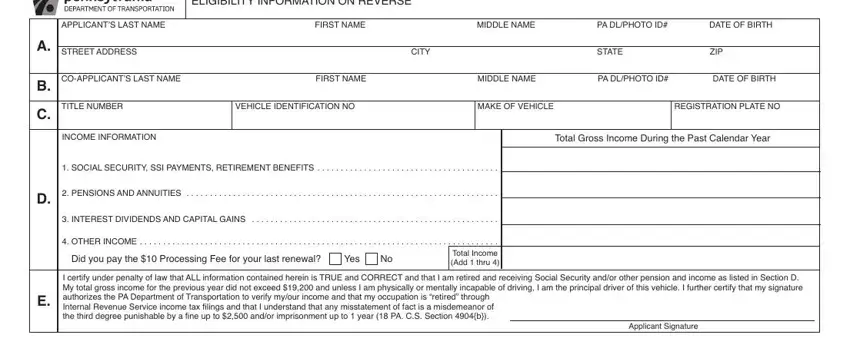

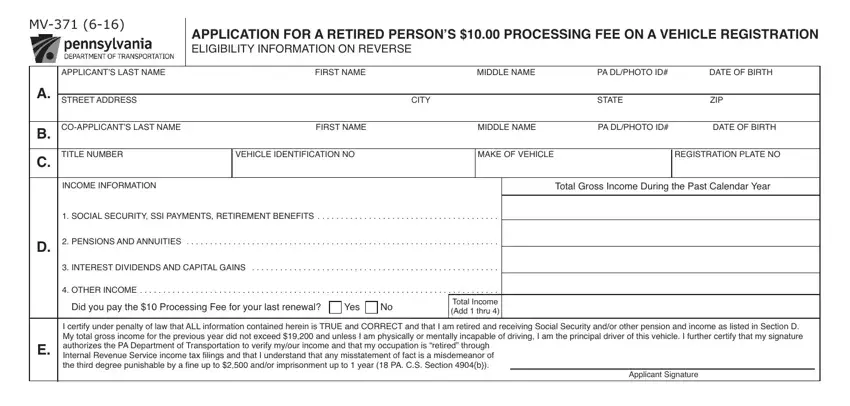

ELIGIBILITY REQUIREMENTS AND INSTRUCTIONS FOR THE $10.00 PROCESSING FEE

1. You must be retired and receiving Social Security or other pension payments as described in Section D on the front of this application, regardless of age. Part-time employment is permitted if you are retired from your principal occupation.

If you receive only unemployment compensation or public assistance, or are a student or other individual who is not retired, you do not qualify.

2. Total gross income from all sources must not exceed $19,200. Other income includes Business/Rental Income, Wages, Public Assistance and Unemployment Compensation.

3. To be eligible for the retired status processing fee, the applicant must meet the qualifications above and the applicant must be listed as an owner on the vehicle’s registration. The vehicle may be owned jointly, however, the applicant must be the principal operator of the vehicle, unless physically or mentally incapable of operating the vehicle. The vehicle must be a passenger car or truck with a registered gross weight of not more than 9,000 lbs. Only one vehicle per qualified applicant may be registered for the retired status processing fee.

4. This application must be submitted in conjunction with Form MV-1, MV-4ST, MV-105, MV-120 or MV-140.

5. NOTE: Individuals should list their PA Driver’s License (PA DL) or Photo ID# in the space provided. Return the completed application with your vehicle registration application and include a $10 check or money order made payable to PA Department of Transportation. DO NOT SEND CASH.