In the state of Massachusetts, businesses involved in the leasing and/or renting of motor vehicles face a specific formality through the MVU-5A Application. This application, overseen by the Massachusetts Department of Revenue, mandates careful documentation for companies wishing to join or renew their position on the Motor Vehicle Leasing List. Essential to this process is the detailing of the business's credentials, including the vendor registration number issued by the Commissioner of Revenue, alongside an explicit affirmation that all to-be-registered vehicles are intended solely for leasing or rental purposes. Furthermore, the form caters to a comprehensive range of vehicle types from automobiles to limousines and even specialized vehicles, requiring vendors to specify the nature of their fleet. It highlights the need for accuracy and honesty, with stern penalties outlined for any fraudulent statements. The inclusion of a declaration under the penalties of perjury underscores the seriousness with which this documentation is treated, aiming to ensure the integrity and legality of motor vehicle leasing operations within the state.

| Question | Answer |

|---|---|

| Form Name | Form Mvu 5A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | ma mvu certification form, massachusetts application leasing make, ma mvu list, mvu certification form |

Form

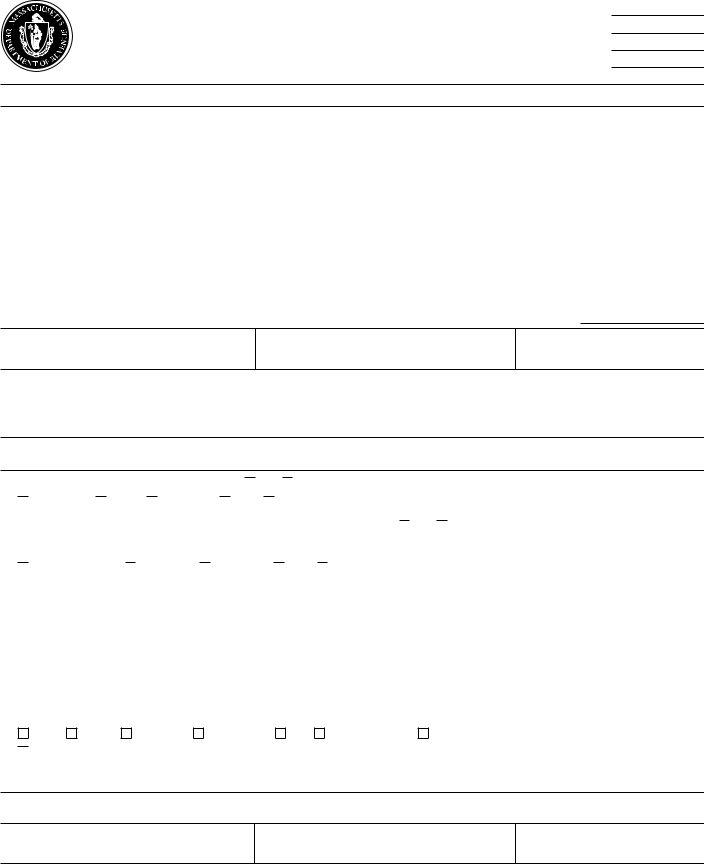

Application for Certification/Recertification to

the Motor Vehicle Leasing List

Rev. 4/99

Massachusetts

Department of

Revenue

All entries must be printed or typed, except for signatures.

Name of vendor |

|

Telephone number |

|

|

|

|

|

Address of vendor |

City/Town |

State |

Zip |

|

|

|

|

I, |

|

|

|

, certify that I am the owner and/or authorized representative of the |

||||

|

|

– |

|

– |

|

issued by the Commissioner of Revenue and |

||

that the vendor is engaged in Massachusetts in the business of leasing and/or renting motor vehicles. |

|

|||||||

It is further certified that all motor vehicles which are or will be registered by the vendor under this certificate are or will be used exclusively for leasing or rental.

Please indicate the total number of motor vehicles of the vendor used for leasing/rental currently registered in Massachusetts:

Owner or authorized representative

Title

Date

Any person who willfully delivers or discloses to the Commissioner of Revenue any false or fraudulent statement shall be fined for not more than $10,000 or $50,000 in the case of a corporation, or by imprisionment for not more than one year, or both.

Motor Vehicle Leasing List Questionnaire

Definition: The term motor vehicles, as it is used in this questionnaire, relates to all motor vehicles which are or will be registered to an individual or business on the Motor Vehicle Leasing List.

1.Does the business lease or rent motor vehicles? Yes No. If yes, please state type(s) of motor vehicle(s) leased or rented (check all that apply):

Automobiles Trucks Limousines Taxis Other: ____________________________________________________________________

2.Does the business lease or rent any of its motor vehicles to any of its employees? Yes No.

3.Please state whether the business for which certification is sought is a (check one):

Sole proprietorship Corporation Partnership Trust Other (explain): ___________________________________________________

______________________________________________________________________________________________________________________

4.Does the business lease or rent limousines? If yes, please state whether a chauffeur/driver is provided when such vehicles are leased or rented.

______________________________________________________________________________________________________________________

5.If the business is a taxi company, are the taxis used exclusively for leasing or rental on all shifts? If not, please explain briefly.

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

6.Please indicate all purposes for which the exempted motor vehicles will be used (check all that apply):

Lease |

Courier |

Private use |

Business use |

Taxi |

Limousine service |

Funeral service |

Other (explain): _______________________________________________________________________________________________________

Declaration

I declare under the pains and penalties of perjury that I have reviewed this application and the statements I have made in it and declare that they are true.

Signature

Title

Date

Mail to: Massachusetts Department of Revenue

Customer Service Bureau

Motor Vehicle Leasing Certification PO Box 7010

Boston, MA 02204 (617)

This form is approved by the Commissioner of Revenue and may be reproduced.