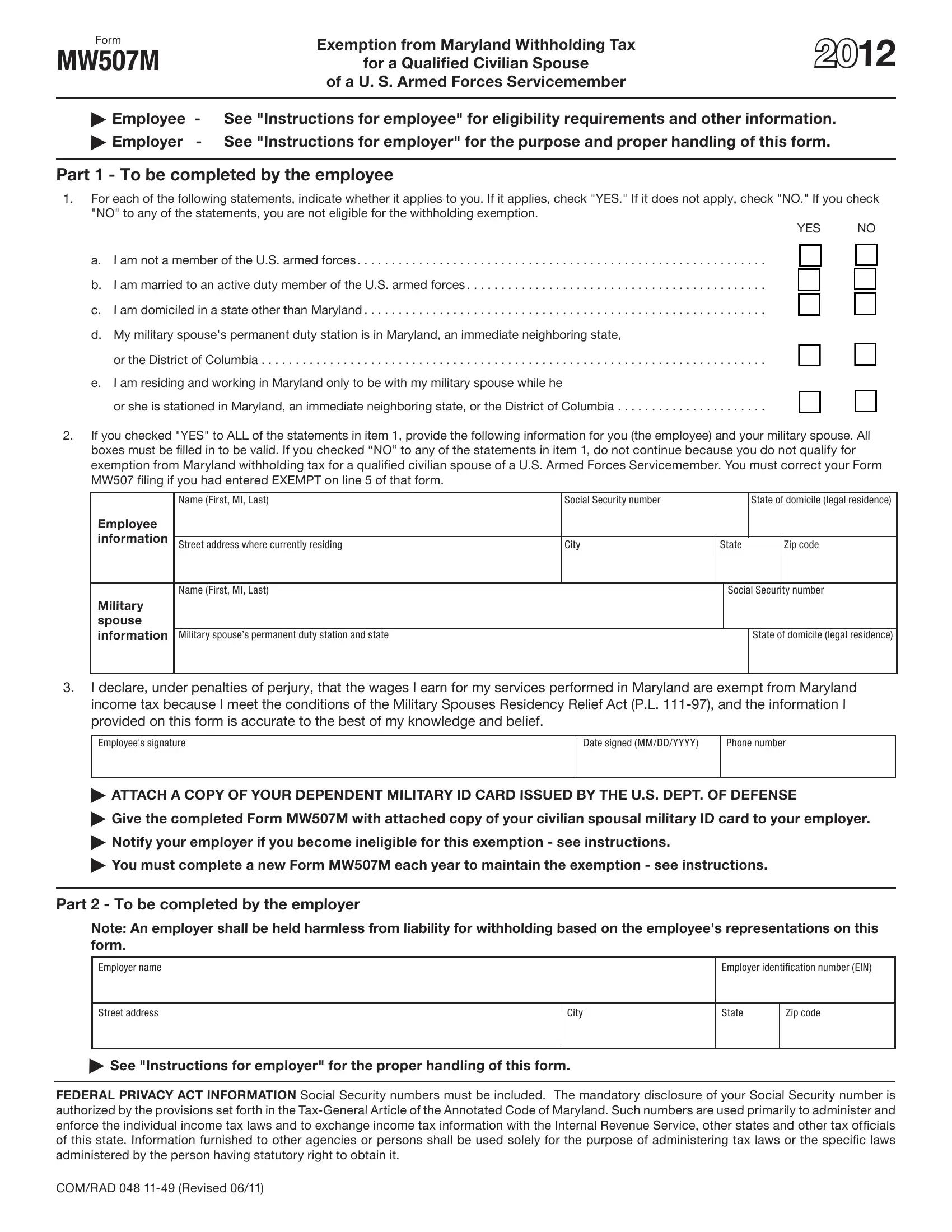

Purpose of form

The Military Spouses Residency Relief Act (“Act”) (P.L. 111-97)

is federal legislation that was signed into law on November 11, 2009. This Act amended the Servicemembers Civil Relief Act to provide a number of beneits to civilian spouses of active

duty U.S. armed forces servicemembers. If certain conditions are met, one of the beneits exempts from income tax a civilian

spouse’s compensation received for working in the state where the servicemember spouse is stationed.

An employee whose wages are exempt from Maryland income tax because of the Act must use Forms MW507 and MW507M to apply for exemption from Maryland income tax withholding.

Instructions for employee

Eligibility

If you are a civilian spouse of an active duty U.S. armed forces servicemember, you need to complete Form MW507M if you meet all of the following conditions:

•You maintain domicile in a state other than Maryland. See “Domicile outside Maryland” below, and Administrative

Release No. 1.;

•Your servicemember spouse’s permanent duty station is

in Maryland, an immediate neighboring state of Maryland

(Delaware, Pennsylvania, Virginia or West Virginia), or the

District of Columbia; and,

•You are in Maryland only to be with your servicemember spouse who is stationed in Maryland, an immediate neighboring state of Maryland, or the District of Columbia.

Domicile outside Maryland

“Domicile” refers to your residence by law, and is also referred to as your legal residence. It is the place that is your permanent home, and is the place to which you always intend to return whenever you are absent from it. Domicile is based on your intent and actions, which must be consistent.

The Servicemembers Civil Relief Act provides that the domicile of a U.S. armed forces servicemember does not change based

only on the servicemember’s presence in a state in compliance with military orders. The Military Spouses Residency Relief

Act provides that a civilian spouse’s domicile does not change based only on the civilian spouse’s presence in a state to be with the servicemember.

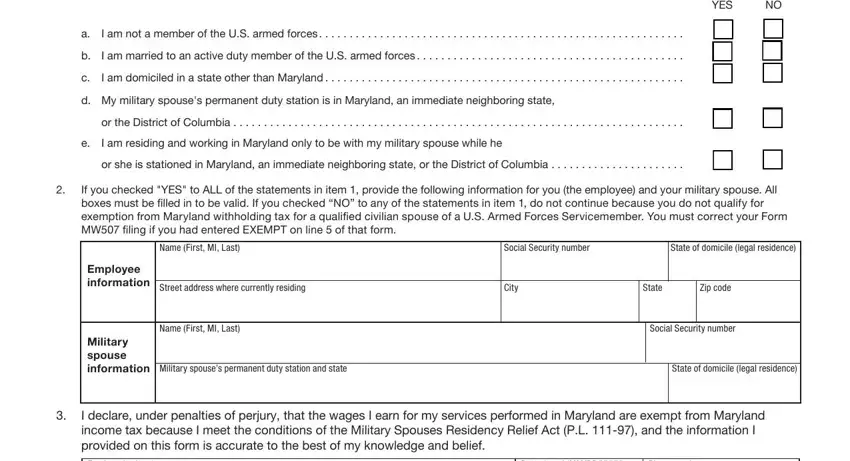

Completing Form MW507M

If you meet all of the eligibility requirements for the exemption from withholding, ill out lines 1 through 3 of Part 1. Attach a

copy of your dependent military ID card to Form MW507M, Form MW507 and give them to your employer.

When the withholding exemption takes effect

Form MW507M takes effect on the later of (1) the date you give it to your employer or (2) the irst payroll period your employer is able to put the exemption into effect. The exemption does

not apply to wages paid prior to the date Form MW507M takes effect.

Annual renewal

Form MW507M is valid only for the calendar year for which it is completed. Provided you are still eligible, you must ile a new Form MW507 and MW507M for each subsequent year you

want to continue the exemption from Maryland withholding.

The due date for renewing Forms MW507 and MW507M is

February 15. Your employer may discontinue this exemption

from Maryland withholding in the absence of a completed MW507, MW507M and the required documentation showing

that you are still eligible for this exemption.

Notiication of ineligibility

You must notify your employer to begin the withholding of

Maryland income tax from your wages if you become ineligible for the exemption. This would occur in the following cases:

•Divorce from the servicemember;

•Death of the servicemember;

•Change in your domicile to Maryland; or

•A change in the servicemember’s permanent duty station to a location other than Maryland, an immediate neighboring state of Maryland, or the District of Columbia.

Instructions for employer

Requirement to withhold

Maryland income tax law requires you to withhold Maryland income tax from wages paid to an employee if the employee performs services within Maryland and the wages are subject to federal income tax withholding.

Form MW507M exemption

An exception to the requirement to withhold Maryland income

tax applies if an employee completes and gives to you Forms MW507 and MW507M. This exception applies only if you have these forms on ile for the employee; it is not enough that the

employee is eligible for the exemption under the Act.

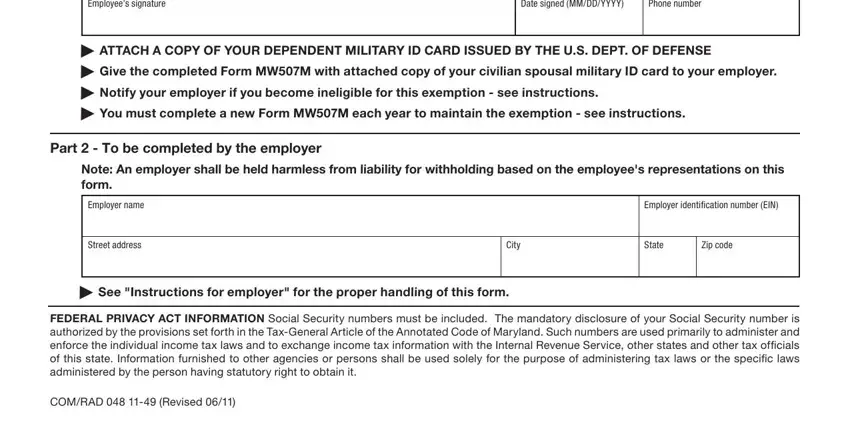

What you must do

If an employee gives you a completed Form MW507M, do the following:

1.Check to see that all lines in Part 1 are illed in and a copy of the employee’s dependent military ID card is attached. If not, return the form to the employee;

2.Fill in Part 2;

3.Keep the original signed Form MW507M and the attached copy of the military ID card for your payroll records; it relieves you of your obligation to withhold Maryland income tax, and you shall be held harmless from liability for withholding based on the employee’s representations on the form; and,

4.Mail a copy of the completed Forms MW507, MW507M and attached military ID card to:

Comptroller of Maryland

Compliance Division

Compliance Programs Section

301 West Preston Street

Baltimore, MD 21201

Questions

If you have questions about this form, visit our Web site

www.marylandtaxes.com or call the Comptroller of Maryland at 410-260-7980 or toll free 1-800-638-2937.