Once you open the online PDF tool by FormsPal, you are able to complete or change hawaii 196 n196 right here and now. The tool is constantly updated by our team, acquiring new awesome functions and becoming much more convenient. All it takes is a few basic steps:

Step 1: Just hit the "Get Form Button" in the top section of this site to launch our pdf file editing tool. This way, you'll find everything that is required to fill out your document.

Step 2: As soon as you launch the file editor, you will notice the document prepared to be completed. Besides filling out various fields, it's also possible to do other sorts of things with the PDF, that is putting on custom textual content, changing the original text, adding graphics, placing your signature to the document, and more.

This PDF form needs specific details; in order to ensure correctness, be sure to bear in mind the suggestions below:

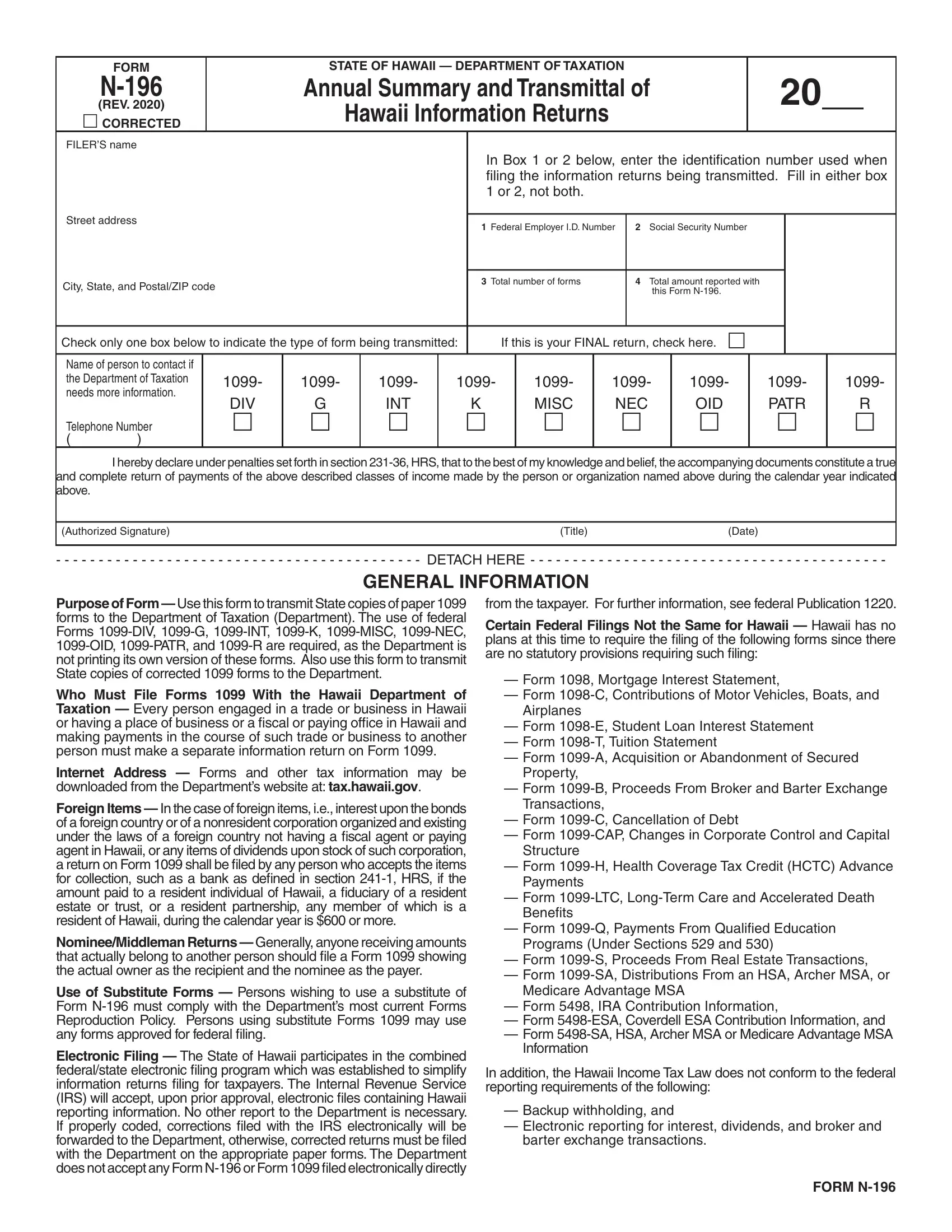

1. Firstly, while completing the hawaii 196 n196, start with the part with the next blanks:

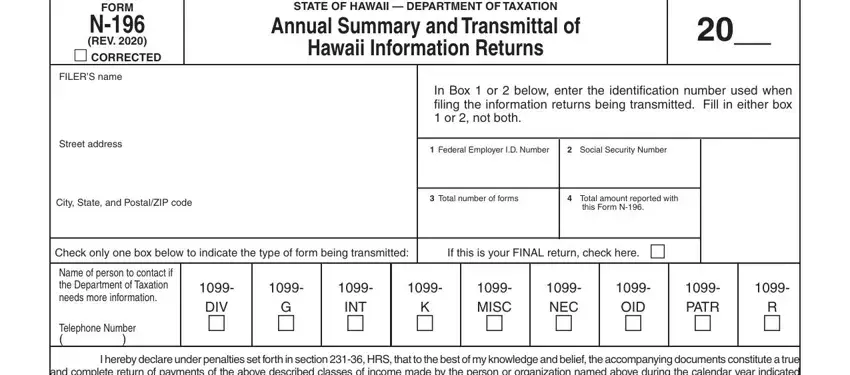

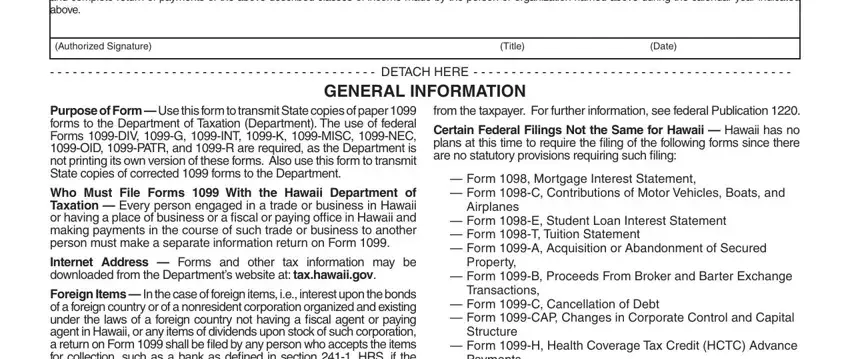

2. Given that the last section is finished, you need to include the essential particulars in I hereby declare under penalties, Authorized Signature, Title, Date, GENERAL INFORMATION, Purpose of Form Use this form to, Who Must File Forms With the, Internet Address Forms and other, Foreign Items In the case of, from the taxpayer For further, Certain Federal Filings Not the, Form Mortgage Interest Statement, Airplanes, Form E Student Loan Interest, and Property allowing you to proceed to the third stage.

It's very easy to make errors when completing the Form Mortgage Interest Statement, hence ensure that you go through it again before you finalize the form.

Step 3: Just after going through your fields, press "Done" and you are done and dusted! Find your hawaii 196 n196 when you sign up for a 7-day free trial. Easily gain access to the pdf form in your FormsPal account, together with any modifications and adjustments all saved! FormsPal guarantees risk-free form completion without personal information recording or any type of sharing. Feel comfortable knowing that your information is in good hands with us!