It's straightforward to complete the nc 4 ez printable form gaps. Our tool makes it nearly effortless to prepare any kind of PDF. Below are the only four steps you'll want to take:

Step 1: The very first step requires you to select the orange "Get Form Now" button.

Step 2: Once you enter our nc 4 ez printable form editing page, you will see each of the options you may take about your template at the top menu.

The next segments are within the PDF template you'll be creating.

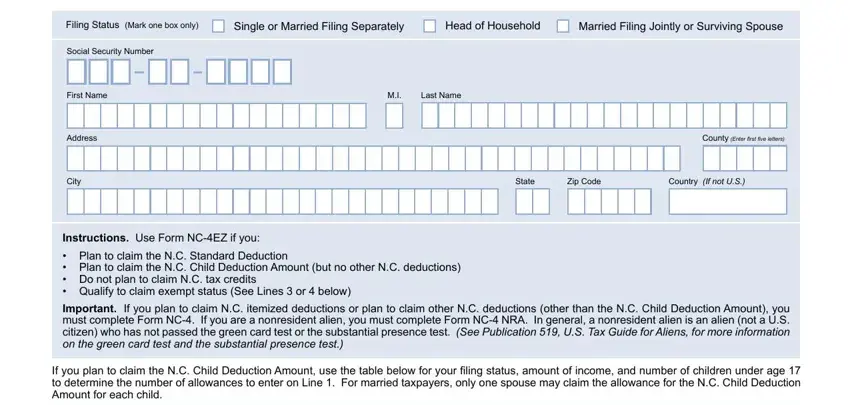

Type in the requested data in the NCEZ Employees Withholding, Filing Status Mark one box only, Single or Married Filing Separately, Head of Household, Married Filing Jointly or, Social Security Number, First Name, Address, City, Last Name, County Enter first five letters, State, Zip Code, Country If not US, and Instructions Use Form NCEZ if you section.

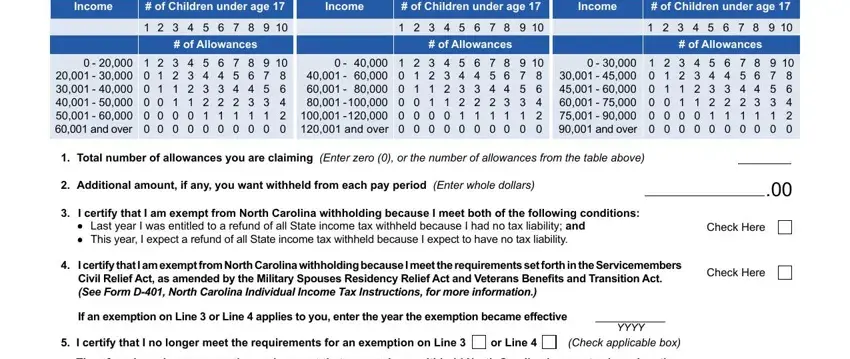

You're going to be demanded certain fundamental details to be able to fill up the Income, of Children under age, Income, of Children under age, Income, of Children under age, of Allowances, of Allowances, of Allowances, Total number of allowances you, Additional amount if any you want, I certify that I am exempt from, I certify that I am exempt from, Check Here, and Check Here section.

The Therefore I revoke my exemption, number of allowances entered on, Check Here, CAUTION If you furnish an employer, Employees Signature, Date, and I certify under penalties provided field will be your place to insert the rights and responsibilities of all sides.

Step 3: Click the "Done" button. Then, you may export your PDF file - save it to your electronic device or forward it by means of email.

Step 4: Make copies of your document - it will help you keep away from potential challenges. And don't worry - we are not meant to publish or read the information you have.

®

® ,

,