When working in the online PDF editor by FormsPal, you'll be able to fill in or edit NJ-2210 right here. Our development team is constantly endeavoring to improve the tool and insure that it is much faster for users with its handy features. Discover an endlessly progressive experience now - take a look at and find out new possibilities as you go! It merely requires a few simple steps:

Step 1: Click on the orange "Get Form" button above. It's going to open up our tool so that you could begin completing your form.

Step 2: With this state-of-the-art PDF file editor, you can actually accomplish more than just fill out blanks. Try all the features and make your forms seem professional with customized text put in, or optimize the original input to excellence - all that supported by the capability to insert your own images and sign it off.

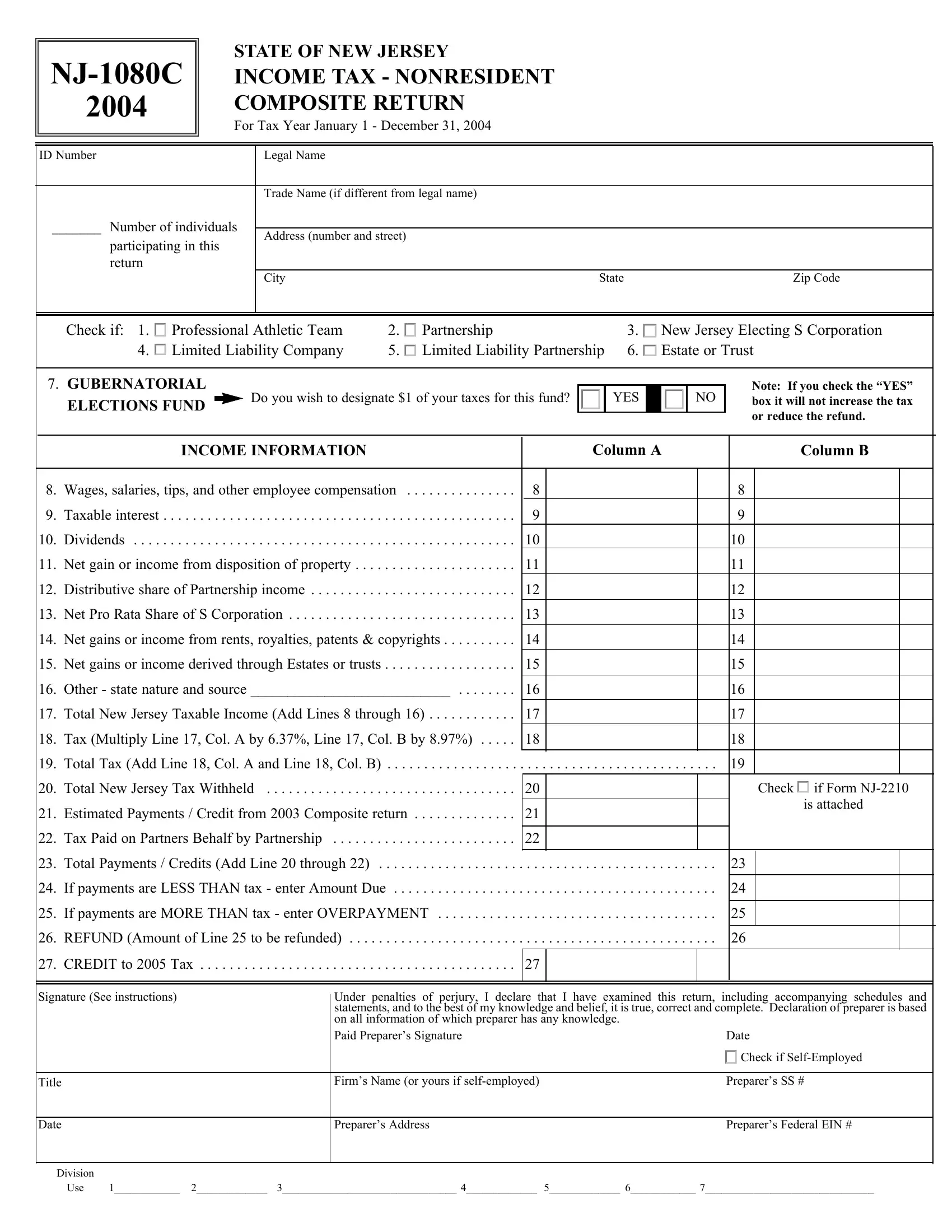

As for the fields of this precise document, here's what you should do:

1. You will need to fill out the NJ-2210 accurately, therefore take care while filling in the parts comprising these specific fields:

2. Now that the last segment is done, you'll want to add the required specifics in Dividends, Net gain or income from, Distributive share of Partnership, Net Pro Rata Share of S, Net gains or income from rents, Net gains or income derived, Other state nature and source, Total New Jersey Taxable Income, Tax Multiply Line Col A by Line, Total Tax Add Line Col A and, Total New Jersey Tax Withheld, Estimated Payments Credit from, Tax Paid on Partners Behalf by, Total Payments Credits Add Line, and If payments are LESS THAN tax so you can move on further.

People generally make mistakes while filling out Net Pro Rata Share of S in this part. Make sure you go over what you enter right here.

3. The following part should be quite straightforward, Title, Date, Division, Under penalties of perjury I, Date, cid Check if SelfEmployed, Firms Name or yours if selfemployed, Preparers SS, Preparers Address, Preparers Federal EIN, and Use - all these blanks needs to be completed here.

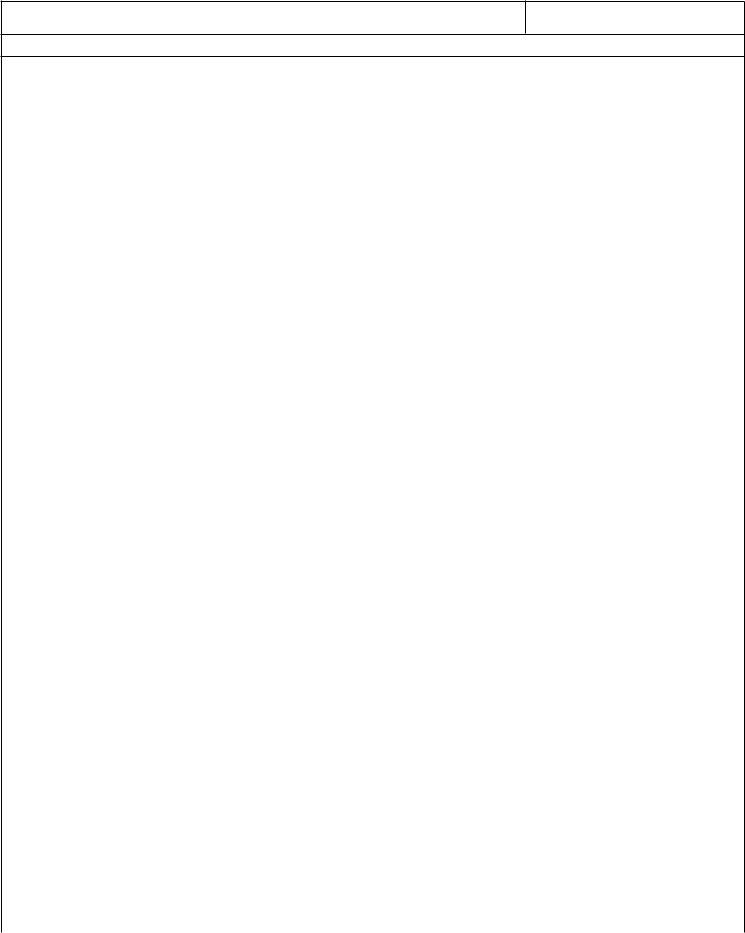

4. Filling out Legal name as shown on Form NJC, ID Number, List all participants including, Social Security Number or EIN, Taxable Income, NJ Income Tax, Social Security Number or EIN, Taxable Income, NJ Income Tax, Social Security Number or EIN, Taxable Income, NJ Income Tax, Name, Address, and City is vital in this fourth part - ensure that you don't hurry and fill out each field!

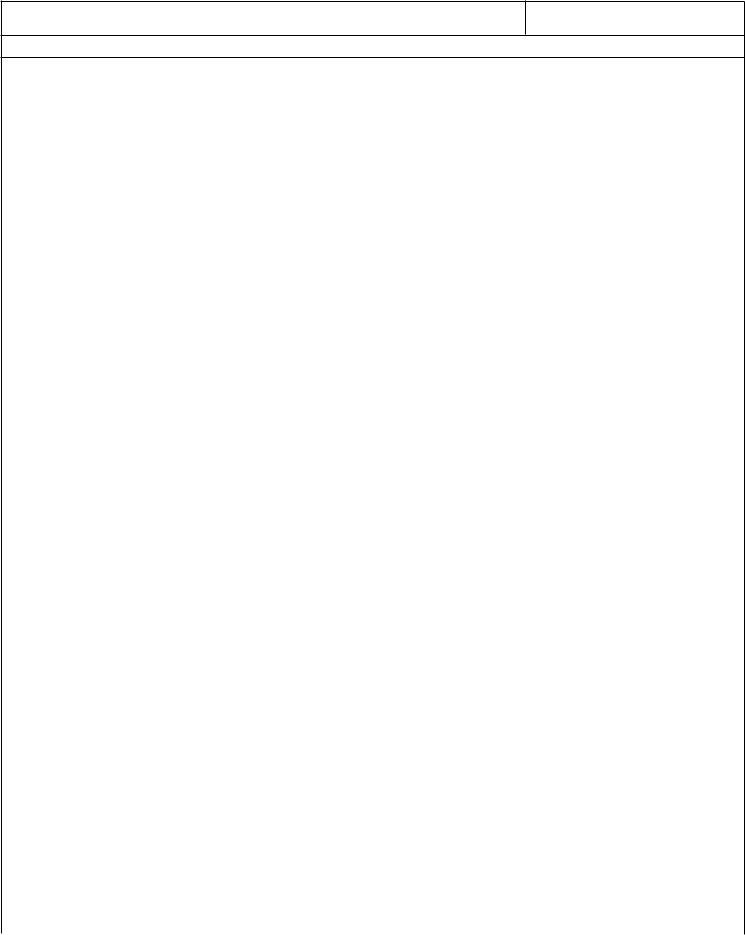

5. The last step to finish this PDF form is pivotal. Make sure that you fill in the necessary blanks, particularly Social Security Number or EIN, Taxable Income, NJ Income Tax, Social Security Number or EIN, Taxable Income, NJ Income Tax, Social Security Number or EIN, Taxable Income, NJ Income Tax, Name, Address, City, Name, Address, and City, prior to using the form. If not, it might end up in an incomplete and probably unacceptable form!

Step 3: Immediately after double-checking your form fields you have filled out, press "Done" and you are all set! After registering a7-day free trial account here, it will be possible to download NJ-2210 or send it via email right off. The document will also be at your disposal via your personal account page with your every single edit. FormsPal is dedicated to the confidentiality of all our users; we make certain that all personal information handled by our tool continues to be protected.