The Form No. 16, as outlined by rule 31(1)(a) under the Income-tax Act, 1961, is a vital document that holds immense importance for both employers and employees within India. It serves as a certificate for tax deducted at source (TDS) on salary and combines comprehensive information which includes the name and address of the employer, the PAN and TAN of the deductor, details of the employee, and a summary of TDS throughout the fiscal year. The form is divided into two parts: Part A, which summarizes the tax deducted at source by the employer and deposited on behalf of the employee, and Part B, which details the salary paid, other income, deductions under various sections, and the resultant tax payable or refundable. Notably, the form also accommodates details on allowances, deductions under Chapter VI-A, including those under sections 80C, 80CCC, and 80CCD, which have a collective cap on deductions. It further lays out any other income reported by the employee, education cess, and relief under section 89, ensuring a comprehensive record for both the filing of income tax returns and future reference. The certification by the employer regarding the deduction and deposit of TDS to the Central Government validates the form. Special considerations are given to instances where an individual may have multiple employers within a year or when government and non-government entities are the deductors, showcasing the form’s adaptability to various employment scenarios. Effective from April 1, 2010, Form No. 16 remains a fundamental document for documenting and streamlining the TDS process, thereby facilitating an organized approach to tax deductions and declarations in India.

| Question | Answer |

|---|---|

| Form Name | Form No 16 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | form 16 pdf, income tax form 16 pdf, form no 16, form 16 download 2020 21 |

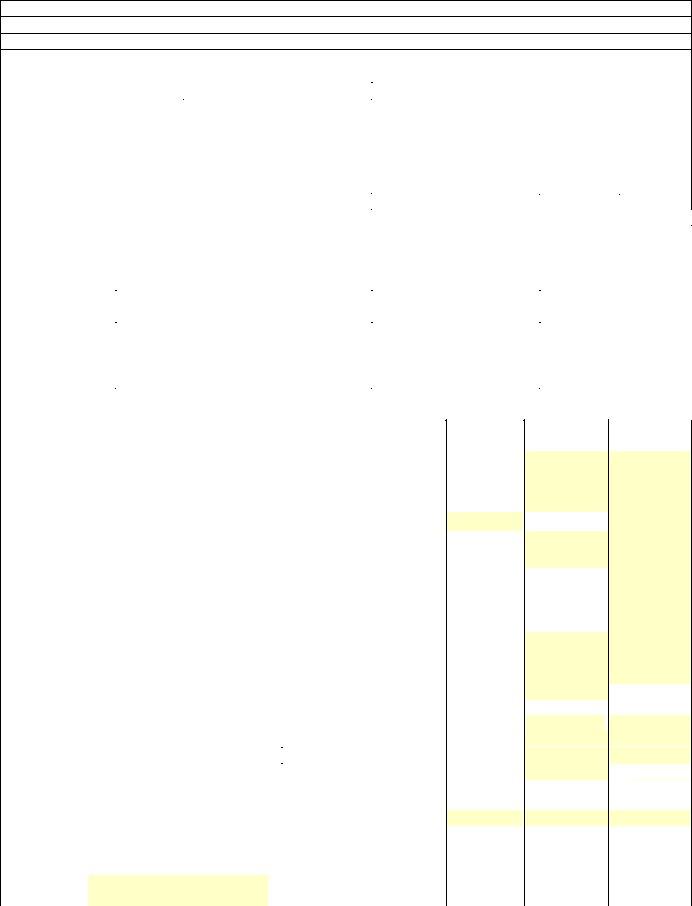

FORM NO. 16

[See rule 31(1)(a)]

PART A

Certificate under section 203 of the

|

|

|

|

Name and address of the Employer |

Name and Designation of the Employee |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAN of the Deductor |

|

|

TAN of the Deductor |

PAN of the Employee |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIT (TDS) |

Assessment Year |

Period |

|

|

||||||

Address |

………………………………………………………… |

|

|

|

|

|

|

|

|

|||||||

|

…………………………………………………………………… |

|

|

|

|

|

|

|

||||||||

City |

……………………….. |

Pin Code |

…………………………… |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary of tax deducted at source |

|

|

|

|

||||

|

|

Quarter |

|

Receipt Numbers of original statements of |

Amount of tax deducted in |

Amount of tax deposited |

|

|||||||||

|

|

|

|

|

TDS under |

respect of the employee |

remitted in respect of the |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

employee |

|

|

|

|

|

Quarter 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

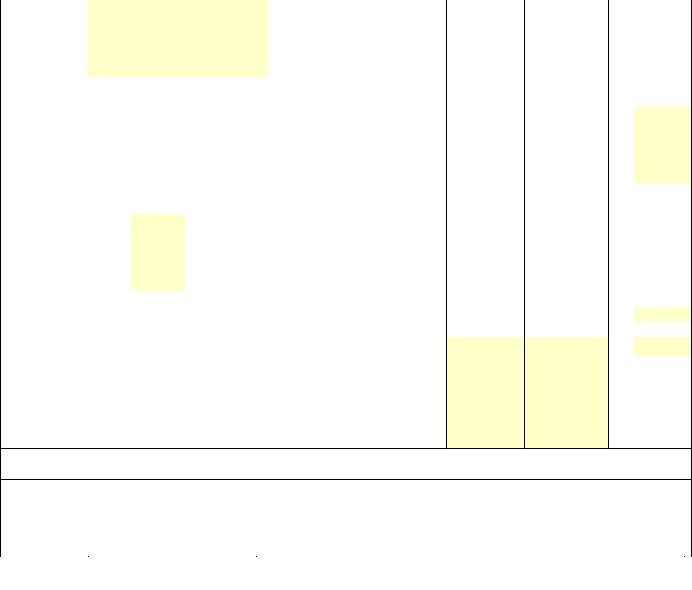

PART B (Refer Note 1) |

|

|

|

|

||||

|

|

|

|

|

|

|

||||||||||

Details of Salary paid and any other income and tax deducted |

|

|

|

|

|

|||||||||||

1. |

Gross Salary |

Rs. |

|

|

(a) |

Salary as per provisions contained in sec.17(1) |

Rs. |

|

(b) |

Value of perquisites u/s 17(2) (as per Form No.12BB, wherever |

Rs. |

|

|

applicable) |

|

(c)Profits in lieu of salary under section 17(3) (as per Form No.12BB, Rs.

wherever applicable)

(d) Total

2.Less: Allowance to the extent exempt u/s 10

|

|

Allowance |

|

Rs. |

|

||||

|

|

|

|

|

|

|

|

Rs. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Balance |

|

|

|

|

|

|||

4 |

Deductions : |

|

|

|

|

|

|||

|

(a) |

Entertainment allowance |

|

|

|

Rs. |

|

||

|

(b) |

Tax on employment |

|

|

|

Rs. |

|

||

5 |

Aggregate of 4(a) and (b) |

|

|

|

|

|

|||

6. |

Income chargeable under the head 'salaries' |

|

|

|

|

|

|||

7. |

Add: Any other income reported by the employee |

|

|

|

|

|

|||

|

|

Income |

|

Rs. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8 |

Gross total income (6+7) |

|

|

|

|

|

|||

9 Deductions under Chapter VIA

(A)Sections 80C, 80CCC and 80CCD

(a)Section 80C

(i)…………………………………..

(ii)…………………………………..Rs.

Rs.

Rs.

Rs.

Rs. Rs.

Rs. Rs.

Gross Amount Deductible Amount

[ITR62;16,1]{1}

Printed from

(iii)…………………………………..

(iv)…………………………………..

(v)…………………………………..

(vi)…………………………………..

(vii)…………………………………..

(b)Section 80CCC

(c)Section 80CCD

Note:1. Aggregate amount deductible under section 80C shall not exceed one lakh rupees.

2.Aggregate amount deductible under the three sections, i.e., 80C, 80CCC and 80CCD shall not exceed one lakh rupees

(B)Other sections (e.g. 80E, 80G etc.) under Chapter

(i)Section …………

(ii)Section …………

(iii)Section …………

(iv)Section …………

(v)Section …………

10Aggregate of deductible amount under Chapter VIA

11Total Income

12Tax on total income

13Education cess @ 3% (on tax computed at S. No. 12)

14Tax Payable (12+13)

15Less: Relief under section 89 (attach details)

16Tax payable

Rs.

Rs.

Gross

amount Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Qualifying

amount

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Deductible

amount

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Verification

I,…………………………, son/daughter of ………………………… working in the capacity of ………………………

(designation) do hereby certify that a sum of Rs. ………………………… [Rs. ………………………… (in words)] has

been deducted and deposited to the credit of the Central Government. I further certify that the information given about is true, complete and correct and is based on the books of account, documents, TDS statement, TDS deposited and other available records.

Place |

|

|

|

Date |

|

Signature of person responsible for deduction of tax |

|

Designation |

|

Full Name: |

|

Notes:

1.If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No. 16 pertaining to the period for which such assessee was employed with each of the employers. Part B may be issued by each of the employers or the last employer at the option of the assessee.

2.Government deductors to enclose

3.

4.The deductor shall furnish the address of the Commissioner of

5.This Form shall be applicable only in respect of tax deducted on or after 1st day of April, 2010.

[ITR62;16,1]{1}

Printed from

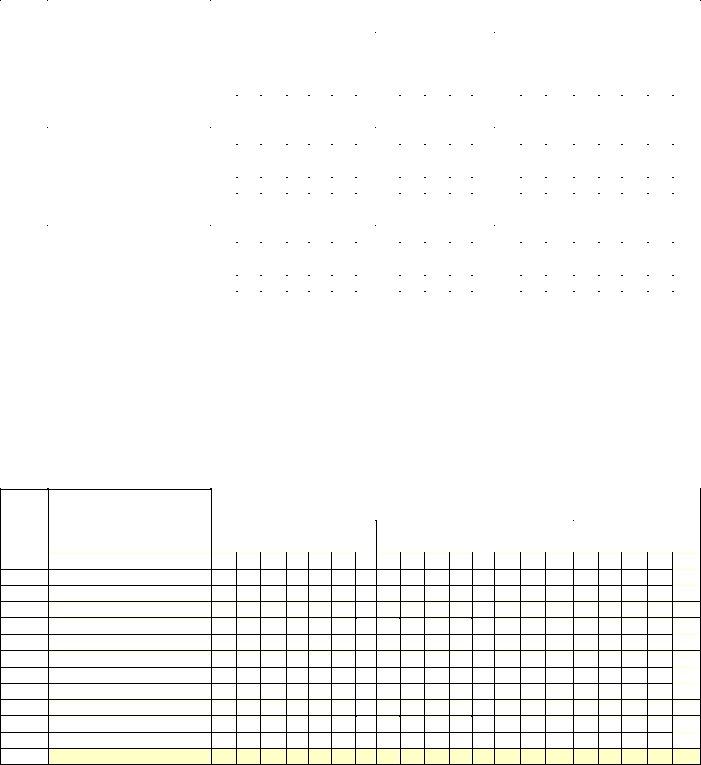

DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ENTRY

(The Employer to provide payment wise details of tax deducted and deposited with respect to the employee)

S. No. |

Tax Deposited in respect on |

|

|

|

|

|

|

Book identification number (BIN) |

|||||||||||||

|

of the employee (Rs.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receipt numbers of form |

DDO Sequence |

Date on which tax deposited |

|||||||||||||||||

|

|

|

|

No. 24G |

|

|

Number in the |

|

|

(dd/mm/yyyy) |

|||||||||||

|

|

|

|

|

|

|

|

|

Book Adjustment |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Mini Statement |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. In the column for TDS, give total amount for TDS, Surcharge (if applicable) and education cess.

DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The Employer to provide payment wise details of tax deducted and deposited with respect to the employee)

S. No. Tax Deposited in respect on |

Challan identification number (CIN) |

|

|

|||||

|

of the employee (Rs.) |

|

|

|

|

|

||

|

|

BSR Code of the Bank |

Date on which tax deposited |

Challan Serial |

||||

|

|

|

Branch |

|

|

(dd/mm/yyyy) |

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Note:

1. In the column for TDS, give total amount for TDS, Surcharge (if applicable) and education cess.

[ITR62;16,1]{1}

Printed from