Understanding the complexity and importance of tax compliance, especially for payments made to non-residents, is critical for businesses operating across borders. The No 27Q form plays a pivotal role in this process, ensuring that tax deductions on transactions other than salaries to non-residents are properly documented and reported to the Indian Tax Authorities every quarter. This form, as mandated by sections 194E, 195, 196A, 196B, 196C, 196D, and ruled under 31A and 37A, encompasses a wide range of information including the Tax Deduction and Collection Account Number (TAN), the Permanent Account Number (PAN), and details regarding the financial and assessment years. It requires a concise reporting of tax deducted at source (TDS), including any relevant surcharge, education cess, interest, or other fees, and how these amounts were paid to the Central Government. Additionally, the form demands detailed particulars about the deductor and the responsible person, including addresses and contact information, to ensure traceability and accountability. The annexure provides a deductee-wise break-up of TDS, capturing the specifics of each transaction, making the No 27Q form an essential document for audit and compliance purposes. It's not just about fulfilling a regulatory requirement; it's also about fostering transparency and diligence in international financial dealings.

| Question | Answer |

|---|---|

| Form Name | Form No 27Q |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | 27q form online, how to fill form 27q online, form 27q online filing, form 27q tds online payment |

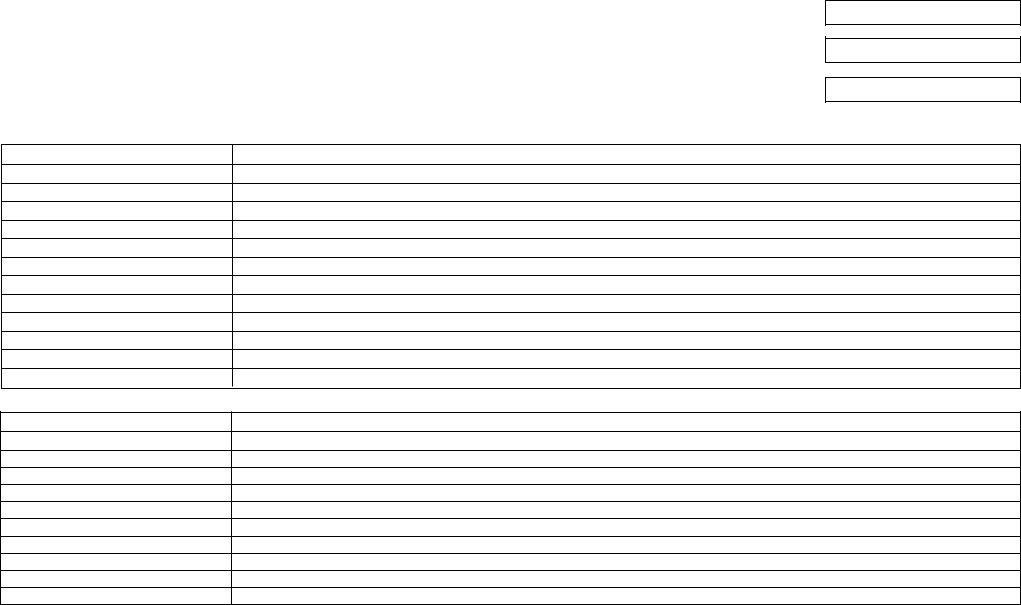

FormNo.27Q

[Seesections194E,195,196A*,196B,196C,196Dand rule31Aand37A]

Quarterly statement of deduction of tax under

quarter ended June / September / December / March (tick which ever appicable) ………….. (year)

1 ( a ) |

Tax Deduction and CollectionAccount No. (TAN) |

|

|

( d ) |

Assessmentyear |

( b ) |

PermanentAccount No. (PAN) |

|

|

( e ) |

Has any statement been filed |

|

|

||||

|

|

||||

|

|

|

|

|

earlier for this quarter (Yes / no) |

|

|

|

|

|

|

( c ) |

Financialyear |

|

|

( f ) |

If answer to (e) is ‘Yes’, then Provisional |

|

|

||||

|

|

|

|

|

Receipt no. of original statement |

|

|

|

|

|

2Particulars of the deductor

(a)Name

(b)Type of deductor 1

(c)Branch / division (if any)

(d)Address Flat No.

Name of the premises / building Road / street / lane

Area / location Town / City / District State

Pincode TelephoneNo.

3Particulars of the person responsible for deduction of tax

(a)Name

(b)Address Flat No.

Name of the premises / building Road / street / lane

Area / location Town / City / District State

Pincode TelephoneNo.

*Relevant in respect ofTax Deduction at source before 1.4.2003.

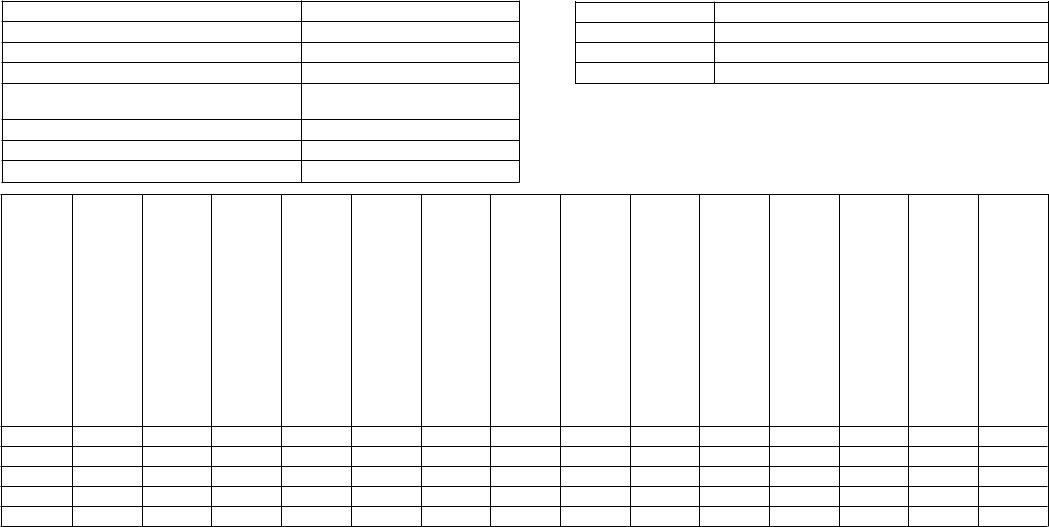

4.Details of tax deducted and paid to the credit of Central Government :

Sr. No. |

Section |

TDS |

Surcharge |

Education |

Interest |

Others |

Total tax |

Cheque/ |

BSR code |

Date on |

Transfer |

Whether |

|

Code |

Rs. |

Rs. |

Cess |

Rs. |

Rs. |

deposited |

DD No. |

|

which tax |

voucher/ |

TDS |

|

|

|

||||||||||

|

|

|

|

Rs. |

|

|

Rs. |

(ifany) |

|

deposited |

Challan |

depositedby |

|

|

|

|

|

|

|

|

|

|

|

serial No.2 |

bookentry? |

|

|

|

|

|

|

|

|

|

|

|

|

Yes/No.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

701 |

702 |

703 |

704 |

705 |

706 |

707 |

708 |

709 |

710 |

711 |

712 |

713 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.Details of amounts paid and tax deducted thereon from the deductees (see annexure)

|

|

|

VERIFICATION |

||||

I, |

|

|

, hereby certify that all the particulars furnished above are correct and complete. |

||||

Place : |

Signature of person responsible for deducting tax at source |

|

|

|

|

||

Date : |

Name and designation of person responsible for deducting tax at source |

|

|

||||

Note :

(1)Indicate the type of deductor "Government" / "Others".

(2)Government deductors to give particulars of transfer vouchers; other deductors to give particulars of challan no. regarding deposit into bank.

(3)Column is relevant only for Government deductors.

(PleaseuseseparateAnnexureforeachlineiteminthetableatS.No.4ofmainForm27Q)

Details of amounts paid / credited during the quarter ended

BSRcodeofthebranchwheretaxisdeposited

ChallanSerialNo.

Sectionunderwhichpaymentmade

TotalTDStobeallocatedamongdeductees asintheverticaltotalofcol.725

Interest

Others

Totaloftheabove

Name of Deductor

TAN

Sr. No. |

Deductee |

PAN of the |

Name of |

Date of |

Amount |

Paidby |

TDS |

Surcharge |

Education |

Total Tax |

Total Tax |

Date of |

Rate at |

Reason |

|

code (01- |

deductee |

the |

Payment/ |

paid / |

bookentry |

Rs. |

Rs. |

Cess |

deducted |

deposited |

deduction |

which |

for non- |

|

Company, |

|

deductee |

Credit |

credited |

or other- |

|

|

Rs. |

(721+722+ |

Rs. |

|

deducted |

deduction/ |

|

|

|

|

Rs. |

wise |

|

|

|

723) Rs. |

|

|

|

lower |

|

|

than |

|

|

|

|

|

|

|

|

|

deduction/ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Company |

|

|

|

|

|

|

|

|

|

|

|

|

grossing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

up (if any)* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

714 |

715 |

716 |

717 |

718 |

719 |

720 |

721 |

722 |

723 |

724 |

725 |

726 |

727 |

728 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

VERIFICATION |

||||

I, |

|

|

, hereby certify that all the particulars furnished above are correct and complete. |

||||

Place : |

Signature of person responsible for deducting tax at source |

|

|

|

|

||

Date : |

Name and designation of person responsible for deducting tax at source |

|

|

||||

Note : * Write "A" if the "lower deduction" or "no deduction" is on account of a certificate under Section 197.

Write "B" if no deduction is on account of declaration under Section 197A.

Write "G" if grossing up has been done".