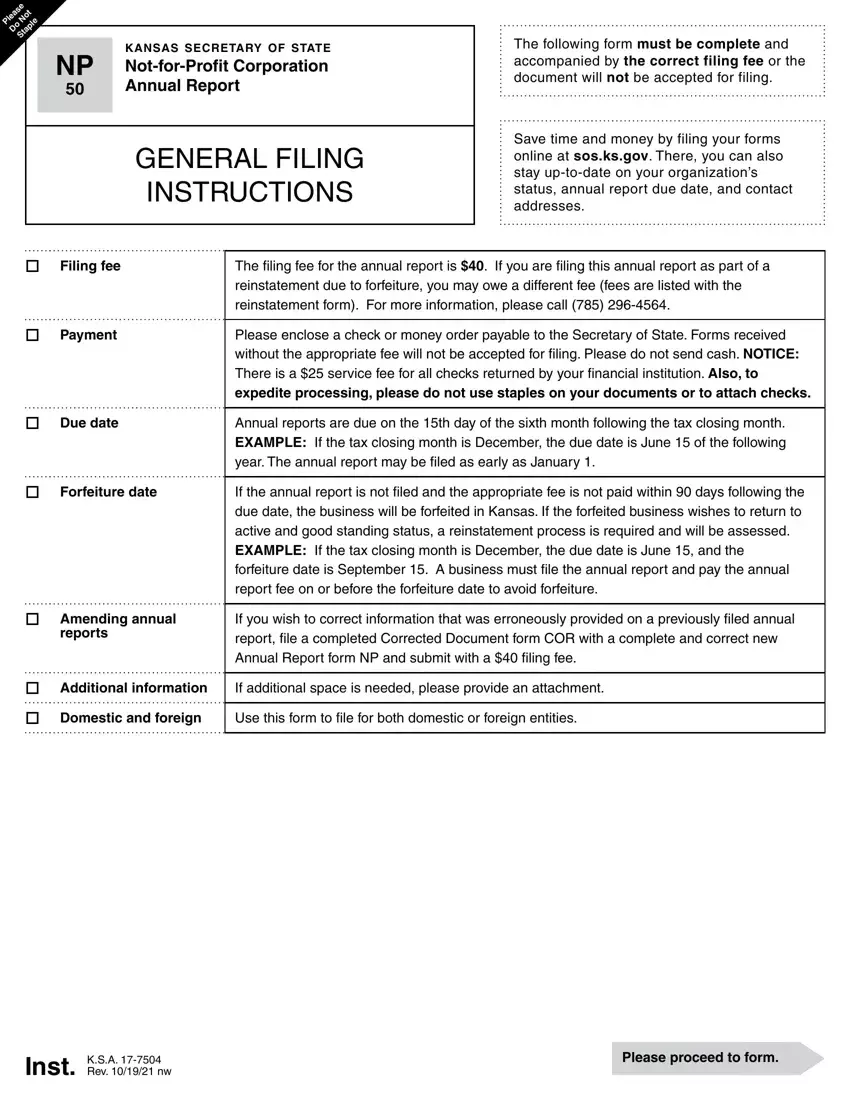

Submitting files using this PDF editor is more straightforward as compared to nearly anything. To update kansas form annual the document, there's nothing you have to do - just proceed with the steps listed below:

Step 1: Click the "Get Form Here" button.

Step 2: You are now allowed to enhance kansas form annual. You've got lots of options with our multifunctional toolbar - you'll be able to add, delete, or customize the text, highlight its specific components, as well as carry out other commands.

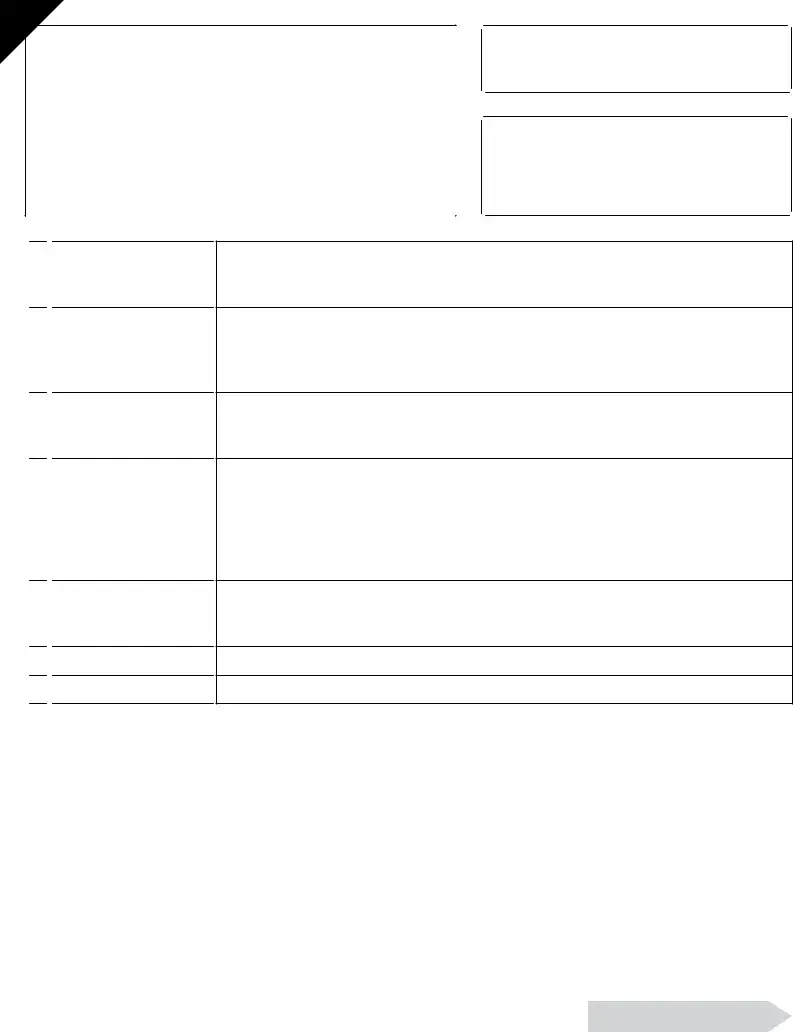

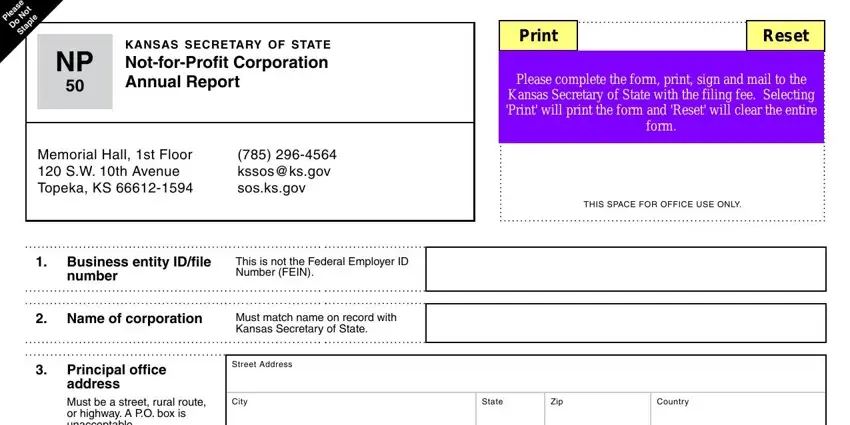

Prepare the kansas form annual PDF by providing the information meant for each part.

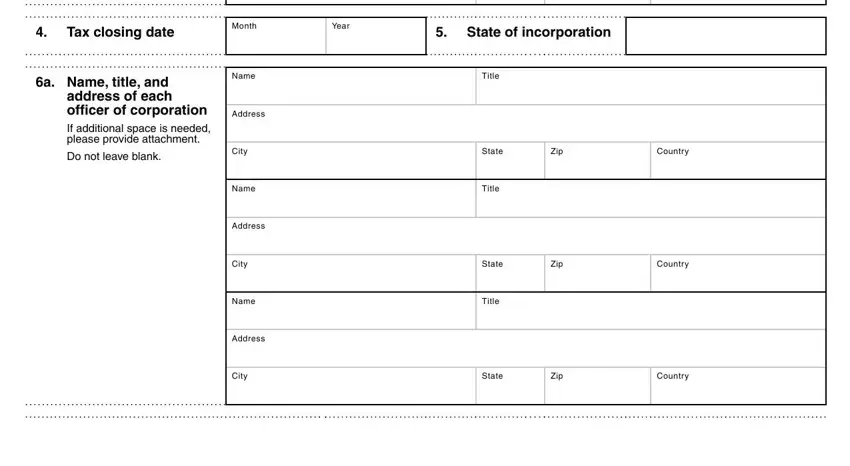

Write down the expected details in the field Tax closing date, Month, Year, State of incorporation, a Name title and address of each, Do not leave blank, Name, Address, City, Name, Address, City, Name, Address, and City.

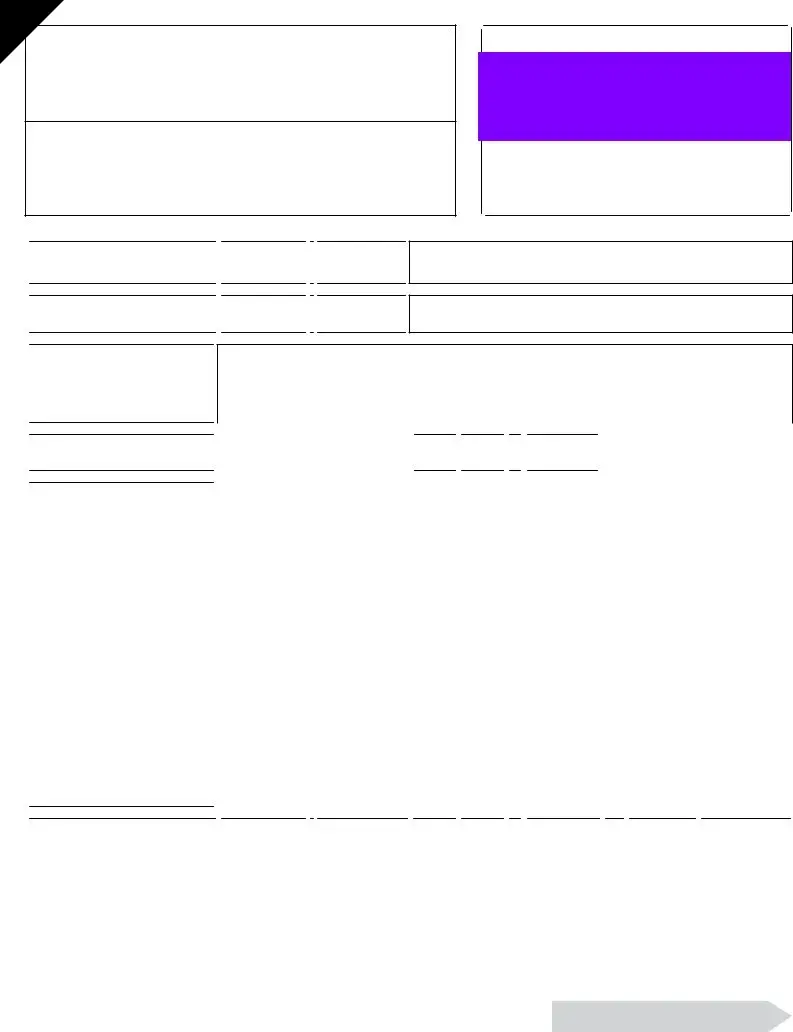

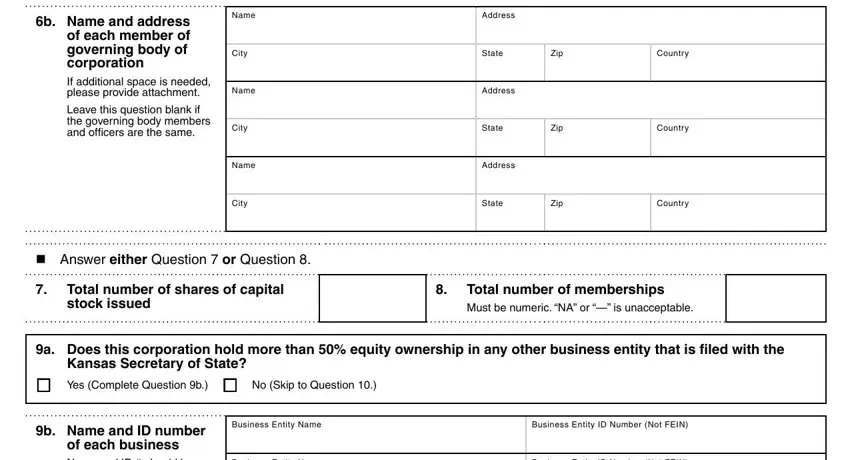

In the section talking about b Name and address of each member, Leave this question blank if the, Name, City, Name, City, Name, City, Address, State, Zip, Country, Address, State, and Zip, you will need to note down some expected data.

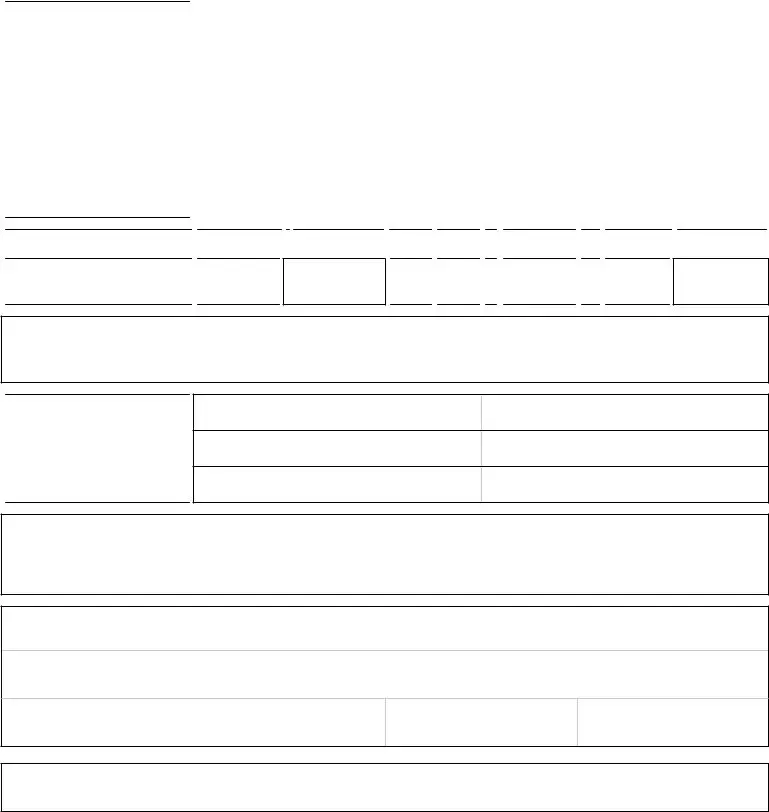

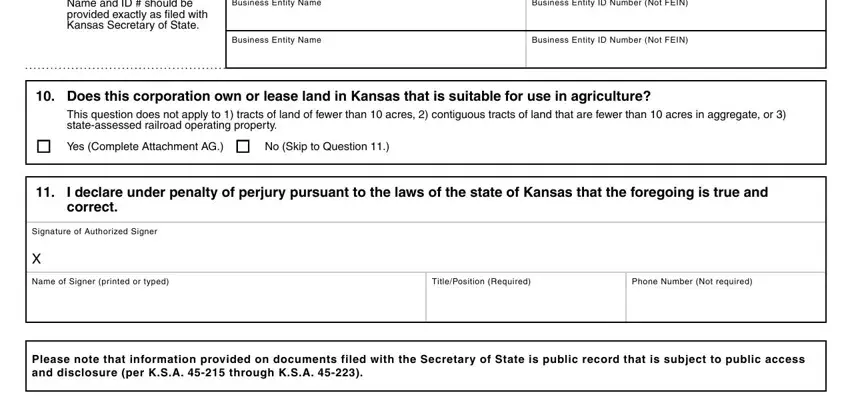

The b Name and ID number of each, Business Entity Name, Business Entity ID Number Not FEIN, Business Entity Name, Business Entity ID Number Not FEIN, Does this corporation own or, This question does not apply to, o Yes Complete Attachment AG o No, I declare under penalty of, correct, Signature of Authorized Signer, Name of Signer printed or typed, TitlePosition Required, Phone Number Not required, and Please note that information field is the place to add the rights and responsibilities of each party.

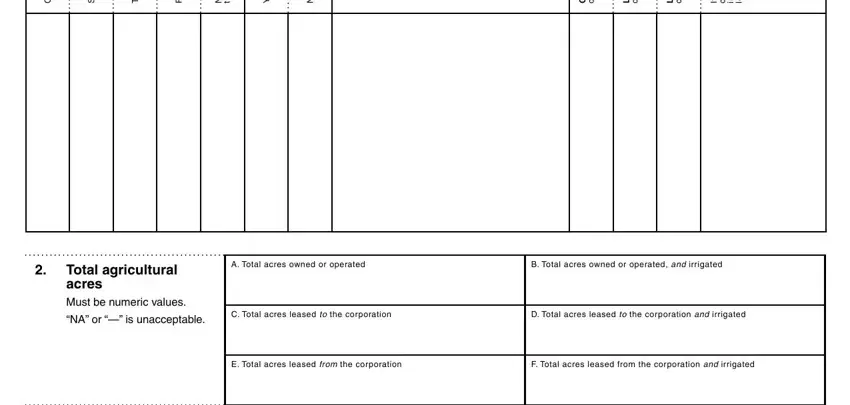

End up by reviewing the following areas and preparing them as required: y t n u o C, i t c e S, h s n w o T, e g n a R, s e Y, o N, r e b m u N, t c a r t, i t a r o p r o c, d e n w O, i t a r o p r o c, d e s a e L, d e s a e L, i t a r o p r o c, and d n.

Step 3: As soon as you choose the Done button, your ready document may be transferred to each of your devices or to electronic mail specified by you.

Step 4: To protect yourself from possible future troubles, make sure you have at the very least a couple of copies of any file.