In the realm of corporate taxation within New York City, the intricacies of the NYC 3A Combined General Corporation Tax Return form serve as a pivotal element for entities operating under its jurisdiction. This comprehensive document, intended for the calendar year 2003 or for fiscal years beginning within the same timeframe, stands as a testament to the city's fiscal regulations and the reporting obligations of corporations. The form caters to various scenarios, including special short periods, amendments, and final returns signaling a corporation's cessation of operations. It mandates detailed financial disclosures, starting with allocations of combined net income and capital, and extends to intricate computations like alternative tax requirements and minimum tax for reporting corporations. Accommodations are made for credits such as the UBT Paid Credit and others stemming from Forms NYC-9.5 and NYC-9.6, which underscore the city's nuanced approach to taxing entities based on a broad spectrum of financial activities and capital allocations. The form delves into the calculation of net income, investment, and subsidiary capital, underlining the importance of accurate financial representation for entities engaged in business within New York City. This document not only encapsulates the fiscal responsibilities of corporations but also reflects the city's regulatory framework designed to ensure equitable and comprehensive tax collection. Significantly, it emphasizes post-9/11 financial relief benefits, highlighting the city's ongoing recovery efforts and support for affected businesses. As such, the NYC 3A form embodies a critical interface between corporate entities and municipal finance regulations, encapsulating a wide range of tax considerations tailored to the diverse and dynamic corporate landscape of New York City.

| Question | Answer |

|---|---|

| Form Name | Form Nyc 3A |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | nyc3a_03 new york city short period tax return form |

F I N A N C E NEW ● YORK

w w w .nyc.gov/ finance

N Y C CO MBIN ED GEN ERAL |

|

|

|

|

||

3 A |

CORPORATION TAX RETU RN |

|

|

|

|

|

● ■ Special short period return. See Instr . |

|

▲ DO NOT WRITE IN THIS SPACE - FOR OFFICIAL USE ONLY ▲ |

|

|||

|

|

|

||||

|

|

|

|

|

||

Check "yes" if you claim any |

|

|

|

|||

|

|

|

||||

benefits (see inst.) ● ■ YES |

|

|

||||

● ■ Am ended return |

● ■ Final return. Check box if corporation has ceased operations. |

2 0 0 3 |

|

|||

|

|

|

|

|

|

|

For CALENDAR YEAR 2003 or FISCAL YEAR beginning ________________ 2003, and ending __________________

*30110391*

N Y C - 3 L R E T U R N S F O R A L L C O R P O R A T I O N S I N C L U D E D I N T H E C O M B I N E D R E T U R N M U S T B E A T T A C H E D T O T H I S R E T U R N

|

Nam e of reporting corporation |

|

|

EM PLOYER IDENTIFICATION NUM BER OF REPORTING CORPORATION |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▼ |

Address (num ber and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Type |

|

|

|

BUSINESS CODE NUM BER |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

IMPORTANT: All corporations licensed |

|

|||||||||||||||||

City and State |

Zip Code |

|

|

||||||||||||||||||||

|

AS PER FEDERAL RETURN |

|

|

and/or regulated by the NYC Taxi and |

|

||||||||||||||||||

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limousine Commission use business |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Business Telephone Num ber |

Date business began in NYC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

code 999900 in lieu of federal code. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

▼ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e of parent of controlled group |

Em ployer Identification Num ber |

|

|

|

|

|

|

NYC PRINCIPAL BUSINESS ACTIVITY |

|

||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

●

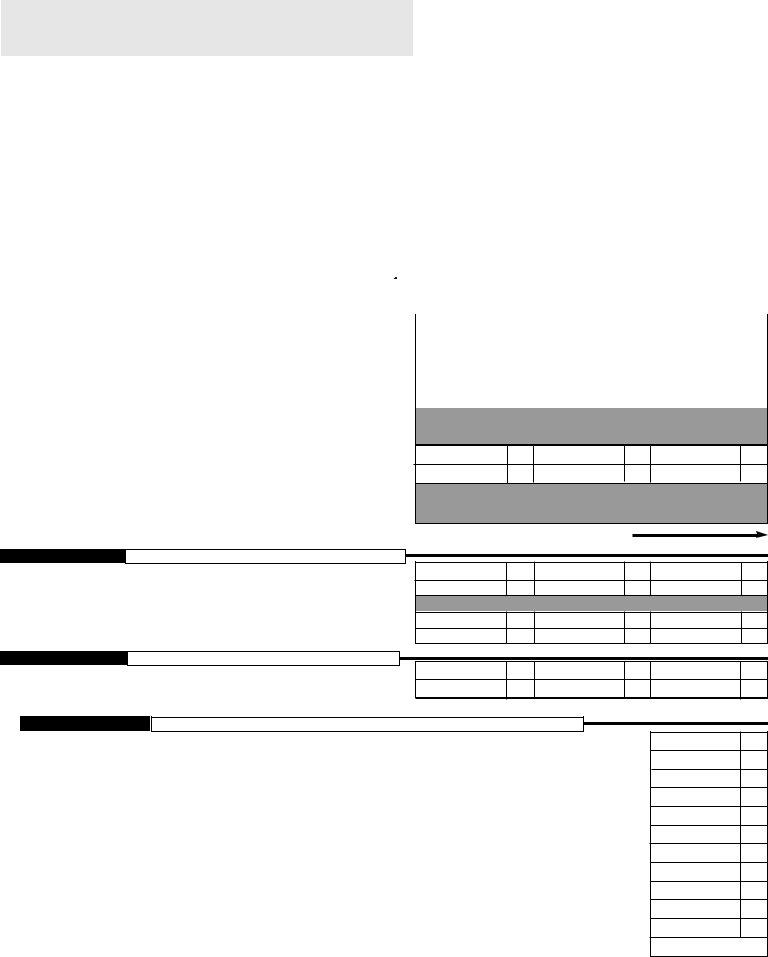

S C H E D U LE A

Computation of Tax - BEGIN WITH SCHEDULE I ON PAGE 2 - COM PLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AM OUNTS TO SCHEDULE A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

|

A. |

Payment |

Pay amount shown on line 23 - Make check payable to: NYC Department of Finance ● |

|

|

|

|

|

|

|||||||||||||||

1. |

|

Allocated combined net income (from Schedule M, line 7) .. |

● 1. |

|

|

|

|

|

|

|

|

|

X .0885 |

● 1. |

|

|

|

|

|

||||

2. |

|

Allocated combined capital (from Schedule M, line 10) (see instr.).. |

● 2. |

|

|

|

|

|

|

|

|

|

X .0015 |

● 2. |

|

|

|

|

|

||||

3. Alternative tax (applies to all corporations including professional corporations) |

|

● 3. |

|

|

|

|

|

||||||||||||||||

4. Minimum tax for reporting corporation only |

|

|

|

|

|

|

|

|

|

|

|

4. |

|

300 |

00 |

||||||||

5. |

|

Allocated subsidiary capital (from Schedule M, line 11) |

● 5. |

|

|

|

|

|

|

|

|

|

|

X .00075 |

● 5. |

|

|

|

|

|

|||

6. Combined tax (line 1, 2, 3, or 4, whichever is largest, PLUS line 5) |

|

|

|

|

|

|

|

|

● 6. |

|

|

|

|

|

|||||||||

7. |

|

Minimum tax for taxable corporations (see instr.) - number of corporations |

● |

|

|

|

|

X $300 |

● 7. |

|

|

|

|

|

|||||||||

8. Total combined tax - add line 6 and line 7 |

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

|

|

|

|

||||||

9. UBT Paid Credit (attach Form |

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

|

|

|

||||||

10 |

. Credits from Form |

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

|

|

|

|||||

11 |

. |

Credits from Form |

|

|

|

|

|

|

|

|

|

|

|

● 11. |

|

|

|

|

|

||||

12 |

. Tax after credits (line 8, less total of lines 9, 10 and 11) |

|

|

|

|

|

|

|

|

|

|

|

● 12. |

|

|

|

|

|

|||||

13 |

. First installment of estimated tax for period following that covered by this return: |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

a) If application for extension has been filed, enter amount from line 4 of Form |

● 13a. |

|

|

|

|

|

|

||||||||||||||

|

|

b) If application for extension has not been filed and line 12 exceeds $1,000, enter 25% of line 12 |

● 13b. |

|

|

|

|

|

|

||||||||||||||

14 |

. Sales tax addback per Admin. Code |

|

● 14. |

|

|

|

|

|

|||||||||||||||

15 |

. Net tax (total of lines 12, 13a or 13b and 14) |

|

|

|

|

|

|

|

|

|

|

|

● 15. |

|

|

|

|

|

|||||

16 |

. Total prepayments listed on each attached return (see instructions) |

|

|

|

|

|

|

|

|

● 16. |

|

|

|

|

|

|

|||||||

17 |

. Balance due (line 15 less line 16) |

|

|

|

|

|

|

|

|

|

|

|

● 17. |

|

|

|

|

|

|

||||

18 |

. Overpayment (line 16 less line 15) |

|

|

|

|

|

|

|

|

|

|

|

● 18. |

|

|

|

|

|

|||||

19a. Interest (see Form |

|

|

|

19a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

....................................19b. Additional charges (see Form |

|

|

|

19b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

19c. Penalty for underpayment of estimated tax (attach Form |

● 19c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

20 |

. Total of lines 19a, 19b and 19c |

|

|

|

|

|

|

|

|

|

|

|

● 20. |

|

|

|

|

|

|||||

21 |

. Net overpayment (line 18 less line 20) |

|

|

|

|

|

|

|

|

|

|

|

● 21. |

|

|

|

|

|

|

||||

22 |

. Amount of line 21 to be: (a) Refunded |

|

|

|

|

|

|

|

|

|

|

|

● 22a. |

|

|

|

|

|

|||||

|

|

|

(b) Credited to 2004 estimated tax |

|

|

|

|

|

|

|

|

● 22b. |

|

|

|

|

|

||||||

23 |

. |

TOTAL REMITTANCE DUE (see instructions). Enter payment amount on line A above |

|

● 23. |

|

|

|

|

|

||||||||||||||

24 |

. |

Combined group's issuer’s allocation percentage (from Schedule M, line 12) |

|

● 24. |

% |

|

|

|

|||||||||||||||

25 |

. |

Gross receipts or sales from page 3, column C, line A |

|

|

|

|

|

|

|

|

|

|

|

● 25. |

|

|

|

|

|

||||

26 |

. |

Total assets from page 3, column C, line B |

|

|

|

|

|

|

|

|

|

|

|

● 26. |

|

|

|

|

|

|

|||

27 |

. |

Compensation of more than 5% stockholders as used in computation of line 3 |

|

● 27. |

|

|

|

|

|

||||||||||||||

28 |

. |

NYC rent or NYC rent deducted on federal return - THIS LINE MUST BE COMPLETED |

|

● 28. |

|

|

|

|

|

||||||||||||||

29 |

. |

Combined Group Business Allocation Percentage (from Schedule J, line 12) |

|

● 29. |

% |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C E R T I F I C A T I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R A T I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) |

YES ■ |

SIGN

HERE → Signature of officer

PREPARER'S Preparer's signature

USE

ONLY →

Title |

|

Date |

Check if |

■ |

Date |

|

|

|

Preparer's Social Security Number or PTIN

●

Firm's Employer Identification Number

●

|

|

|

|

|

|

● Firm's name (or yours, if |

▲ Address |

▲ Zip Code |

|

||

|

|

|

|

||

30110391 ATTACH REMITTANCE TO THIS PAGE ONLY - MAKE REMITTANCE PAYABLE TO: NYC DEPARTMENT OF FINANCE (SEE PAGE 3 FOR MAILING INSTRUCTIONS) |

Rev.11/17/03 |

||||

Form |

|

|

|

|

|

|

|

|

|

|

Page 2 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATION NAME |

CORPORATION NAME |

CORPORATION NAME |

|||||||||

|

|

|

|

|

COLUMN 1 |

|

COLUMN 2 |

|

COLUMN 3 |

||||||

|

|

|

|

|

● Employer |

|

|

● Employer |

|

|

● Employer |

|

|||

|

|

|

|

|

Identification Number |

|

|

Identification Number |

|

|

Identification Number |

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

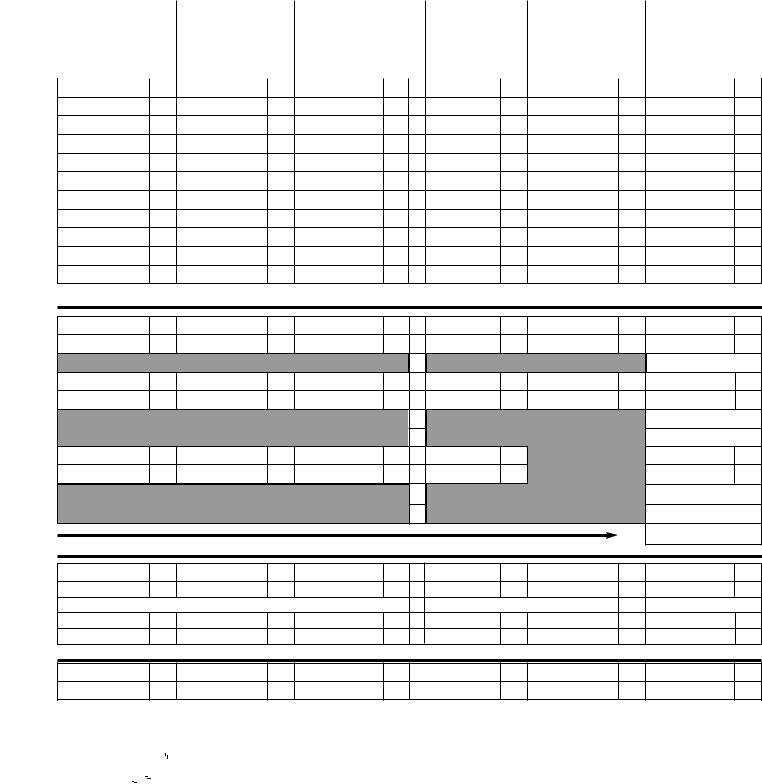

SCHEDULE I |

Analysis of income & capital from Form |

|

|

|

|

|

|

|

|

|

|

|

|

||

1. |

Entire net income (Schedule B, line 19 or 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. |

....................................................Investment income (Schedule B, line 23) |

● 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

.......................................................Business income (Schedule B, line 24) |

● 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

.............................NYC gain (loss) on qualified property (See instructions) |

● 4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

.....................................................Optional depreciation (See instructions) |

● 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

.................................................................Total capital (Schedule E, line 7) |

● 6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

........................................................Subsidiary capital (Schedule E, line 8) |

● 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

.....................................................Investment capital (Schedule E, line 10) |

● 8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

........................................................Business capital (Schedule E, line 11) |

● 9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

..................................A. Gross receipts or sales (federal Form 1120, line 1c) |

● A. |

|

|

|

|

|

|

|

|

|

|

|

|

||

..................B. Total assets from federal return (Schedule E, line 1, column C) |

● B. |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE J |

Business allocation from Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

Property - New York City (Schedule H, line 1f, column A) |

● 1. |

|

|

|

|

|

|

|

|

|

|

|||

2. |

Property - total (Schedule H, line 1f, column B) |

● 2. |

|

|

|

|

|

|

|

|

|

|

|||

3. |

................................................................New York City percent, line 1 ÷ line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Receipts - New York City (Schedule H, line 2g, column A) |

● 4. |

|

|

|

|

|

|

|

|

|

|

|

||

5 Receipts - total (Schedule H, line 2g, column B) |

● 5. |

|

|

|

|

|

|

|

|

|

|

||||

6.New York City percent, line 4 ÷ line 5 ................................................................

7.Additional Receipts Factor (enter percent from line 6) (See instructions) ..........

8. |

Payroll - New York City (Schedule H, line 3a, column A) |

● 8. |

9. |

Payroll - total (Schedule H, line 3a, column B) |

● 9. |

10.New York City percent, line 8 ÷ line 9 ................................................................

11.Total New York City percents, sum of lines 3, 6, 7 and 10.................................

12. Business allocation percentage, line 11 ÷ three or by the number of percentages used if other than three (see instructions)

SCHEDULE K

Investment allocation from Form

1.New York City (Schedule D, line 1, column G)............................................

2.Total (Schedule D, line 1, column E) ...........................................................

3.Investment allocation percentage, line 1 ÷ line 2 (see instructions) ............

4.Cash (Schedule D, line 3, column E)...........................................................

5.Total Investment Capital (Schedule D, line 4, column E) ............................

●1.

●2.

●4.

●5.

SCHEDULE L

Subsidiary allocation from Form

1. |

New York City (Schedule C, line 2, column G) |

1. |

2. |

Total (Schedule C, line 1, column E) |

2. |

SCHEDULE M

Summary (References in this Schedule M are to schedules in this return)

*30120391*

1. |

New York City investment income (Schedule I, line 2, column C x Schedule K, line 3) |

1. |

2. |

New York City business income (Schedule I, line 3, column C x Schedule J, line 12) |

2. |

3. |

Total New York City income, line 1 plus line 2 |

3. |

4. |

NYC gain (loss) on qualified property (Schedule I, line 4, column C) |

4. |

5. |

Total, line 3 plus line 4 |

5. |

6. |

Optional depreciation (Schedule I, line 5, column C) |

6. |

7. |

Allocated combined net income, line 5 minus line 6 (enter here and on Schedule A, line 1) |

7. |

8. |

New York City investment capital (Schedule I, line 8, column C x Schedule K, line 3) |

8. |

9. |

New York City business capital (Schedule I, line 9, column C x Schedule J, line 12) |

9. |

10. |

NYC investment & business capital, line 8 plus line 9 (enter here and on Schedule A, line 2) |

10. |

11. |

New York City subsidiary capital (Schedule L, line 1, column C) (enter here and on Schedule A, line 5) |

11. |

12. |

Issuer's allocation percentage (Schedule M, line 10 plus line 11 ÷ Schedule I, line 6, col. C) (enter here and on Sch. A, line 24) (see instr.) ... |

12. |

%

30120391

Form |

Page 3 |

SCHEDULE I

● 1.

● 2.

● 3.

● 4.

● 5.

● 6.

● 7.

● 8.

● 9.

● A.

● B.

|

CORPORATION NAME |

CORPORATION NAME |

|

CORPORATION NAME |

|

COLUMN A |

|

COLUMN B |

|

COLUMN C |

|||||||

|

|

COLUMN 4 |

|

COLUMN 5 |

|

|

COLUMN 6 |

|

|

|

INTERCORPORATE |

|

TOTAL |

||||

|

|

● Employer |

|

|

|

● Employer |

|

|

|

● Employer |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

TOTAL |

|

ELIMINATIONS |

|

LESS INTERCORPORATE |

||||

|

|

Identification Number |

|

|

|

Identification Number |

|

|

|

Identification Number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

(EXPLAIN ON RIDER) |

|

ELIMINATIONS |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

A.

B.

SCHEDULE J

● 1. |

1. |

|

● 2. |

2. |

|

● 3. |

3. |

% |

● 4. |

4. |

|

● 5. |

5. |

|

● 6. |

6. |

% |

|

||

● 7. |

7. |

% |

● 8. |

8. |

|

● 9. |

9. |

|

● 10. |

10. |

% |

● 11. |

11. |

% |

● 12. |

|

% |

|

|

SCHEDULE K

● 1. |

1. |

● 2. |

2. |

●3. 3.

● 4. |

4. |

● 5. |

5. |

SCHEDULE L

1.

2.

%

*30130391*

|

|

|

|

|

|

|

|

|

▼ M A I L I N G |

I N S T R U C T I O N S ▼ |

||

|

|

|

|

|

|

|

Attach |

Make remittance payable to the order of |

To receive proper credit, you must |

|||

|

|

|

|

federal |

|

|

||||||

|

|

|

tax |

|

|

copy of all pages |

NYC DEPARTMENT OF FINANCE |

enter your correct Employer |

||||

|

|

|

return |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of your federal tax return |

Payment must be made in U.S. dollars, |

Identification Number on your tax |

|||

or pro forma federal tax return. |

drawn on a U.S. bank. |

return and remittance. |

||||||||||

RETURNS WITH REMITTANCES |

RETURNS CLAIMING REFUNDS |

ALL OTHER RETURNS |

||||||||||

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

||||||||||

P.O. BOX 5040 |

P.O. BOX 5050 |

P.O. BOX 5060 |

||||||||||

KINGSTON, NY |

KINGSTON, NY |

KINGSTON, NY |

||||||||||

The due date for the calendar year 2003 return is on or before March 15, 2004.

For fiscal years beginning in 2003, file on or before the 15th day of the 3rd month following the close of the fiscal year.

30130391

Form |

Page 4 |

*30140391*

A F F I L I A T I O N S S C H E D U L E

COMPLETE THIS SCHEDULE OR ATTACH FEDERAL FORM 851

Tax year beginning ______________, ______ and ending ______________, ______

Name of reporting corporation on |

|

|

Employer Identification Number: |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of common parent corporation on consolidated federal income tax return:

P a r t I

Ge n e r a l I n f o r m a t i o n

Corp. |

Name and address of corporation |

|

|

|

Employer Identification Number |

|

|||||||||

No. |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Com m on parent corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 1. |

on federal return: |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Reporting corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 2. |

on NYC- 3A: |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 3. |

Affiliated |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

corporations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

● 4. |

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 5. |

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 6. |

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 7. |

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P a r t I I

P r i n c i p a l Bu s i n e s s Ac t i v i t y , V o t i n g S t o c k I n f o r m a t i o n , Et c .

STOCKHOLDINGS AT BEGINNING OF YEAR

Corp. |

|

|

|

number |

|

percent of |

|

percent |

|

Owned by |

|

|

|

|

|

|

|||||

No. |

Principal business activity (PBA) |

NAICS |

|

of |

|

voting |

|

of |

|

corporation |

|

|

|

|

shares |

|

power |

|

value |

|

number |

● 1. |

Com m on parent corporation on federal return: |

|

1. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 2. |

Reporting corporation on NYC- 3A: |

|

2. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 3. |

Affiliated corporations: |

|

3. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 4. |

|

|

4. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 5. |

|

|

5. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 6. |

|

|

6. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 7. |

|

|

7. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

|

8. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

9. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

10. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

30140391

Form |

Page 5 |

*30150391*

- CO M BINED GRO UP INFO RM ATIO N SCHEDULE -

NAM E OF REPORTING CORPORATION: |

EM PLOYER IDENTIFICATION |

|

|

|

NUM BER OF REPORTING |

|

CORPORATION: |

|

|

THE FOLLOWING INFORMATION MUST BE PROVIDED

FOR THIS RETURN TO BE CONSIDERED COMPLETE

Refer to instructions before completing this section.

PART 1 |

General Information |

|

|

|

|

1.Have there been ANY CHANGES in the COMPOSITION of the group of corporations INCLUDED in this Combined General Corporation Tax Return from the PRIOR TAX PERIOD OR ANY MATERIAL CHANGES in the ACTIVITY of any member of the group OR ANY corporation NOT INCLUDED in the group that meets the stock ownership requirements for filing on a

combined basis? |

(See instructions, page 1) |

■ YES |

■ NO |

|

2. Check this box |

■ |

and attach an explanation if you meet ANY of the following conditions: |

||

a.NO MEMBERS of this group FILED or REQUESTED AN EXTENSION to file a combined return under Article

REPORT, OR

b.TWO (2) OR MORE MEMBERS of this group FILED or REQUESTED AN EXTENSION to file a New York State combined return for the TAX PERIOD COVERED BY THIS REPORT but there are differences in the membership of this group and the group that filed or will file a New York State combined return, OR

c.A combined filing by any member(s) of this group has been REVISED or DISALLOWED by New York State for THIS or ANY PRIOR TAX PERIOD.

3.You MUST complete Part 2 of this schedule if you meet ANY of the following conditions:

a.This is the FIRST Combined General Corporation Tax Return being FILED FOR THIS GROUP of corporations, OR

b.There have been CHANGES in the COMPOSITION of the group of corporations SINCE the PRIOR

TAX PERIOD, OR

c.There have been ANY MATERIAL CHANGES in the STOCK OWNERSHIP or ACTIVITY of any corporation INCLUDED in the group or in ANY corporation NOT INCLUDED in the group that meets the stock ownership requirements for filing on a combined basis. (See instructions, page 1)

30150391

*30160391* |

|

Form |

|

|

Page 6 |

|

|

|

|

|

|

|

|

|

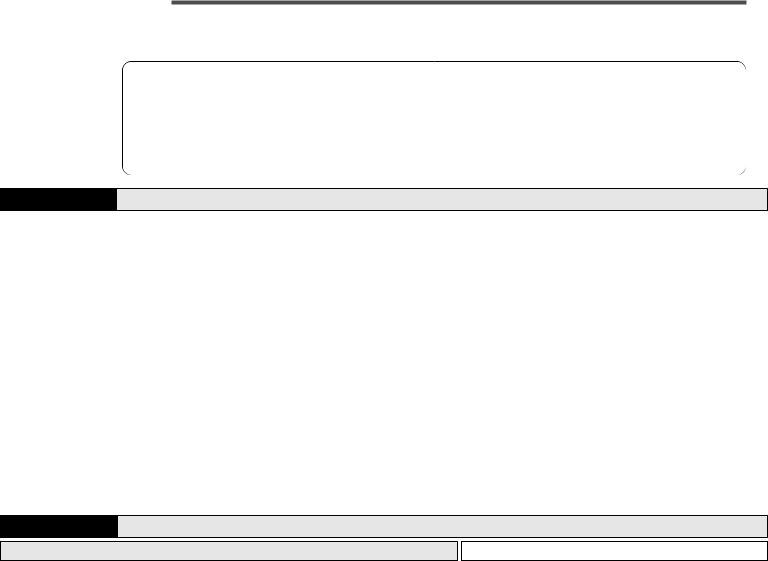

PART 2 |

|

Distortion Requirement |

|

||

|

|

|

|

|||

|

|

|

|

|

||

|

|

A Complete this Subpart A for each corporation included in the Combined General Corporation Tax Return that (i) was not |

||||

|

|

included in the Combined General Corporation Tax Return for the prior tax period; or (ii) for which there has been any |

||||

|

|

material change in the stock ownership or activity during the tax period covered by this report. |

||||

|

|

Explain how the filing of a return on a separate basis distorts the corporation’s activities, business, income or capital in New |

||||

|

|

York City, including the nature of the business conducted by the corporation, the source and amount of its gross receipts and |

||||

|

|

expenses and the portion of each derived from transactions with other corporations listed on the Affiliations Schedule. |

||||

Subpart A |

|

|

|

|

|

|

NAME OF CORPORATION / EIN |

REASON(S) INCLUDED IN COMBINED RETURN |

|||||

Name:

1.

EIN:

Name:

2.

EIN:

IF ADDITIONAL SPACE IS REQUIRED, PLEASE USE THIS FORMAT ON A SEPARATE SHEET AND ATTACH IT TO THIS PAGE.

BComplete this Subpart B for each corporation excluded from the Combined General Corporation Tax Return that (i) was included in the Combined General Corporation Tax Return for the prior tax period; or (ii) for which there has been any material change in the stock ownership or activity during the tax period covered by this report.

Explain the reason(s) for the exclusion of each corporation for the combined return, including a description of the nature of the business conducted by the corporation, the source and amount of its gross receipts and expenses and the portion of each derived from transactions with other corporations listed on the Affiliations Schedule.

Subpart B

NAME OF CORPORATION / EIN |

REASON(S) EXCLUDED FROM COMBINED RETURN |

Name:

1.

EIN:

Name:

2.

EIN:

30160391 |

IF ADDITIONAL SPACE IS REQUIRED, PLEASE USE THIS FORMAT ON A SEPARATE SHEET AND ATTACH IT TO THIS PAGE. |

|