VIRGINIA DEPARTMENT OF AGRICULTURE AND CONSUMER SERVICES

OFFICE OF CHARITABLE AND REGULATORY PROGRAMS

PO Box 526, Richmond, VA 23218-0526

Phone: 804-786-1343 • www.vdacs.virginia.gov

OCRP-102 Revised 11/21

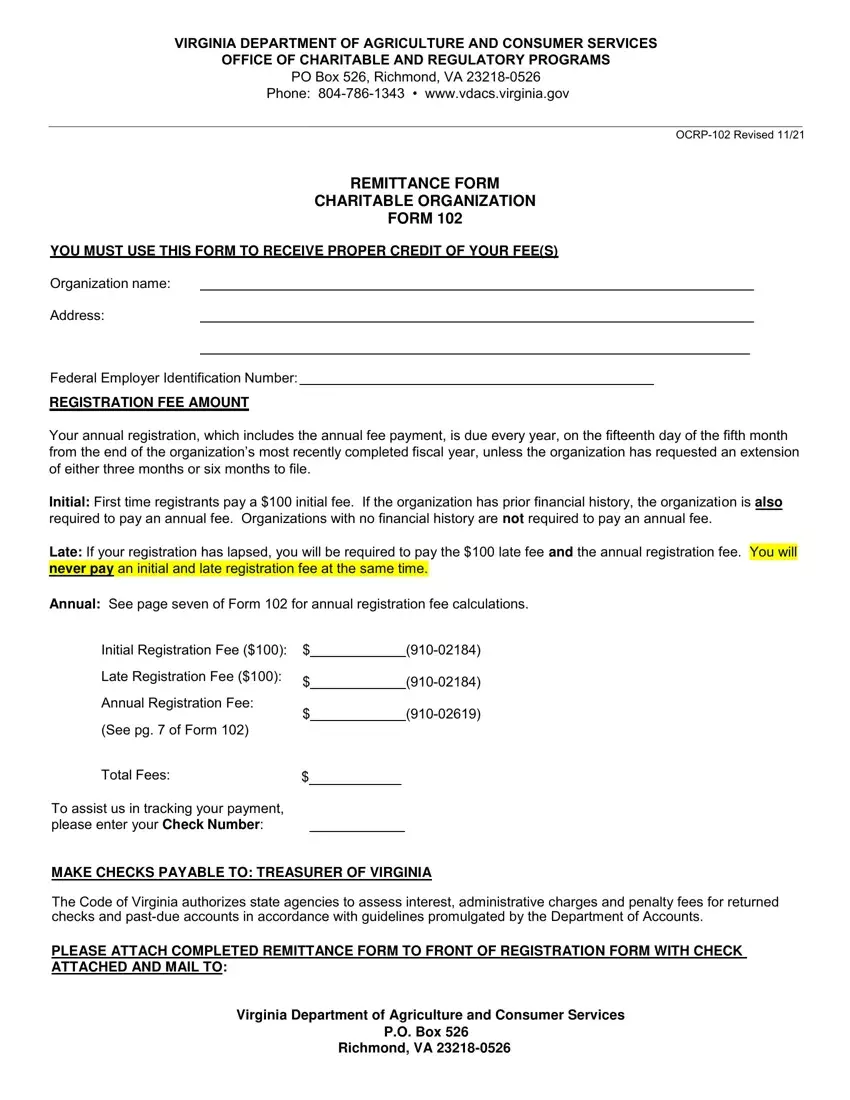

REMITTANCE FORM

CHARITABLE ORGANIZATION

FORM 102

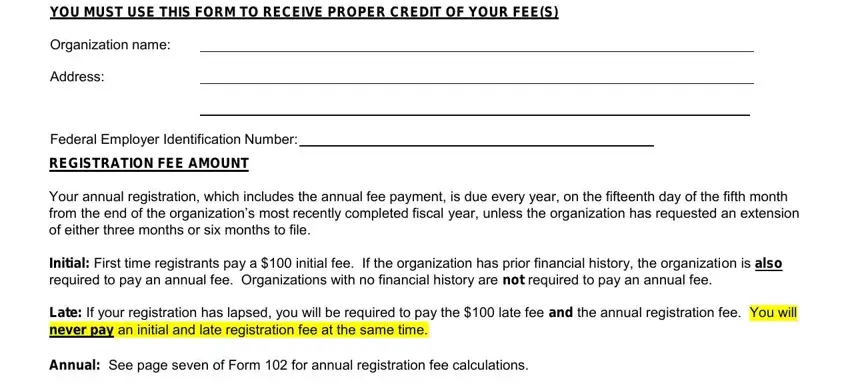

YOU MUST USE THIS FORM TO RECEIVE PROPER CREDIT OF YOUR FEE(S)

Organization name:

Address:

Federal Employer Identification Number:

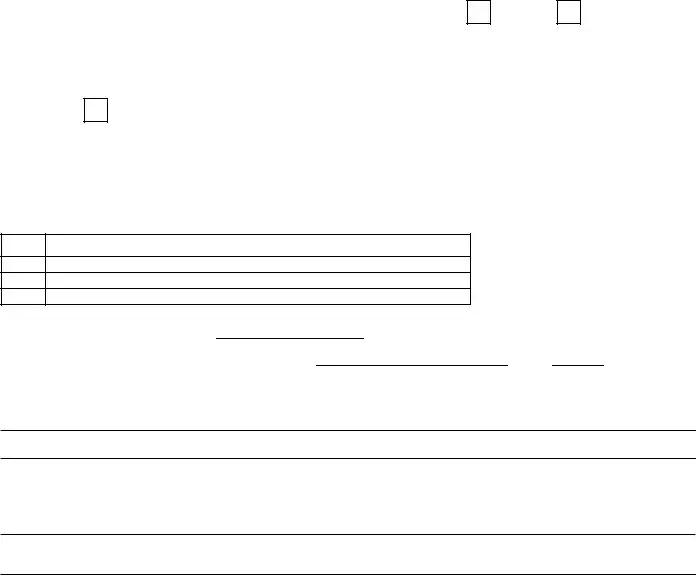

REGISTRATION FEE AMOUNT

Your annual registration, which includes the annual fee payment, is due every year, on the fifteenth day of the fifth month from the end of the organization’s most recently completed fiscal year, unless the organization has requested an extension of either three months or six months to file.

Initial: First time registrants pay a $100 initial fee. If the organization has prior financial history, the organization is also required to pay an annual fee. Organizations with no financial history are not required to pay an annual fee.

Late: If your registration has lapsed, you will be required to pay the $100 late fee and the annual registration fee. You will never pay an initial and late registration fee at the same time.

Annual: See page seven of Form 102 for annual registration fee calculations.

|

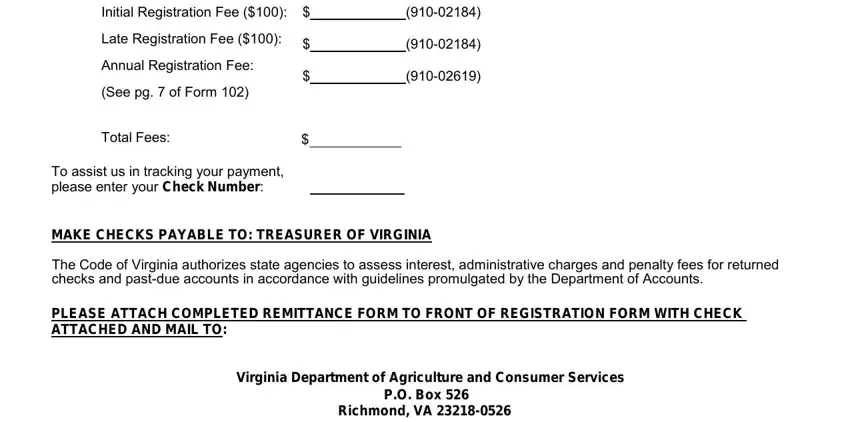

Initial Registration Fee ($100): |

$ |

(910-02184) |

|

Late Registration Fee ($100): |

|

|

|

|

|

$ |

(910-02184) |

|

|

|

Annual Registration Fee: |

|

|

|

|

|

$ |

(910-02619) |

|

(See pg. 7 of Form 102) |

|

|

|

|

|

|

Total Fees: |

$ |

|

|

|

To assist us in tracking your payment, please enter your Check Number:

MAKE CHECKS PAYABLE TO: TREASURER OF VIRGINIA

The Code of Virginia authorizes state agencies to assess interest, administrative charges and penalty fees for returned checks and past-due accounts in accordance with guidelines promulgated by the Department of Accounts.

PLEASE ATTACH COMPLETED REMITTANCE FORM TO FRONT OF REGISTRATION FORM WITH CHECK ATTACHED AND MAIL TO:

Virginia Department of Agriculture and Consumer Services

P.O. Box 526

Richmond, VA 23218-0526

VIRGINIA DEPARTMENT OF AGRICULTURE AND CONSUMER SERVICES

OFFICE OF CHARITABLE AND REGULATORY PROGRAMS

PO Box 526, Richmond, VA 23218-0526

Phone: 804-786-1343 • www.vdacs.virginia.gov

OCRP-102 Revised 11/21

Form 102, Page 1

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION

FORM 102

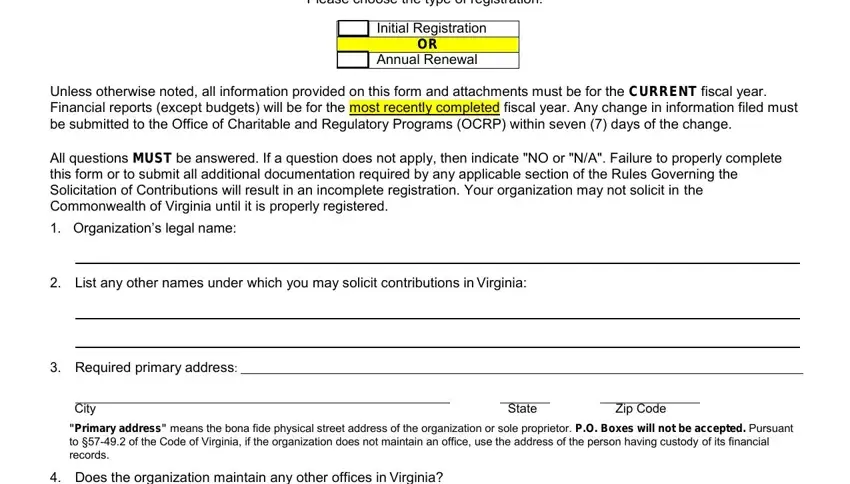

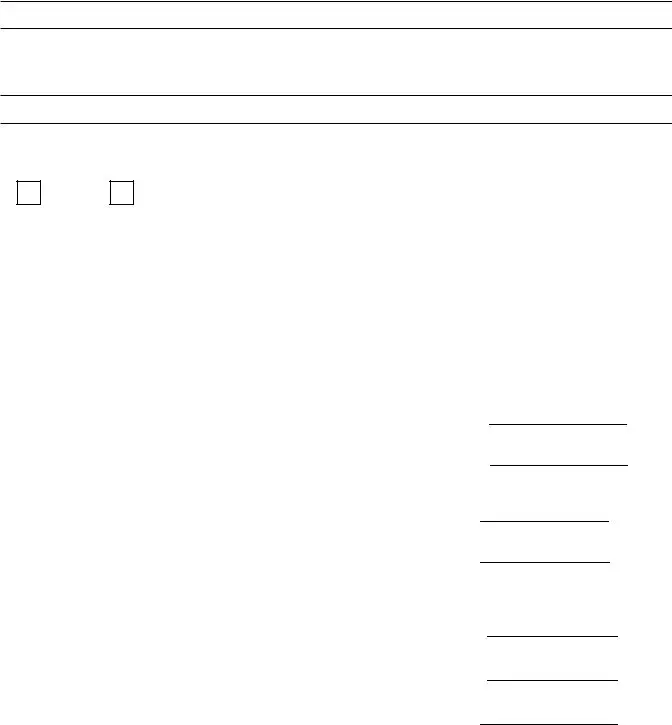

Please choose the type of registration:

Initial Registration

OR

Annual Renewal

Unless otherwise noted, all information provided on this form and attachments must be for the CURRENT fiscal year. Financial reports (except budgets) will be for the most recently completed fiscal year. Any change in information filed must be submitted to the Office of Charitable and Regulatory Programs (OCRP) within seven (7) days of the change.

All questions MUST be answered. If a question does not apply, then indicate "NO or "N/A". Failure to properly complete this form or to submit all additional documentation required by any applicable section of the Rules Governing the Solicitation of Contributions will result in an incomplete registration. Your organization may not solicit in the Commonwealth of Virginia until it is properly registered.

1.Organization’s legal name:

2.List any other names under which you may solicit contributions in Virginia:

3.Required primary address:

"Primary address" means the bona fide physical street address of the organization or sole proprietor. P.O. Boxes will not be accepted. Pursuant to §57-49.2 of the Code of Virginia, if the organization does not maintain an office, use the address of the person having custody of its financial records.

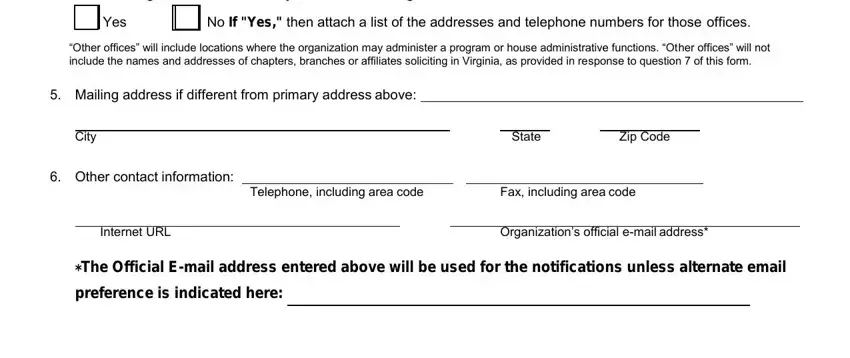

4. Does the organization maintain any other offices in Virginia?

No If "Yes," then attach a list of the addresses and telephone numbers for those offices.

“Other offices” will include locations where the organization may administer a program or house administrative functions. “Other offices” will not include the names and addresses of chapters, branches or affiliates soliciting in Virginia, as provided in response to question 7 of this form.

5. Mailing address if different from primary address above:

CityStateZip Code

6. Other contact information:

Telephone, including area code |

Fax, including area code |

Internet URL |

Organization’s official e-mail address* |

*The Official E-mail address entered above will be used for the notifications unless alternate email preference is indicated here:

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION

Form 102, Page 2

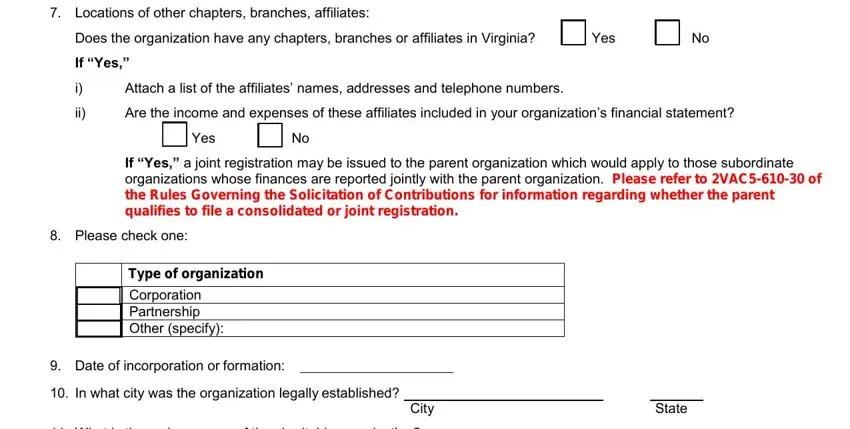

7.Locations of other chapters, branches, affiliates:

Does the organization have any chapters, branches or affiliates in Virginia?

If “Yes,”

i)Attach a list of the affiliates’ names, addresses and telephone numbers.

ii)Are the income and expenses of these affiliates included in your organization’s financial statement?

If “Yes,” a joint registration may be issued to the parent organization which would apply to those subordinate organizations whose finances are reported jointly with the parent organization. Please refer to 2VAC5-610-30 of the Rules Governing the Solicitation of Contributions for information regarding whether the parent qualifies to file a consolidated or joint registration.

8. Please check one:

Type of organization

Corporation

Partnership

Other (specify):

9.Date of incorporation or formation:

10.In what city was the organization legally established?

11.What is the main purpose of the charitable organization?

12.Name and address of designated agent for receipt of process (service of legal documents) within the Commonwealth of Virginia. NOTE: If no agent is designated, the organization shall be deemed to have designated the Secretary of the Commonwealth.

Name and Company Name Address

13.Organization’s fiscal year:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Dates of the CURRENT fiscal year: From: |

|

|

|

|

|

|

|

To: |

|

|

|

b) Has the organization recently changed its fiscal year? |

|

Yes |

|

|

No |

|

|

|

If "Yes," then provide the dates of the “short” fiscal year: |

|

|

|

|

|

|

|

|

|

|

|

From: |

|

To: |

|

|

|

|

|

|

|

|

|

|

|

|

14. Is the organization exempt under the Internal Revenue Code? |

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION |

Revised 11/21 |

Form 102, Page 3

15.Key personnel:

a)Full name and title of the individuals having signatory power over the organization’s funds:

b)Full name and title of the individuals who approve the organization’s budget:

c)Has the organization, or any officer, professional fund-raiser or professional solicitor thereof, ever been convicted of a felony?

No If “Yes,” then attach a statement providing a description of the pertinent facts.

d)For the CURRENT fiscal year, attach a listing of the organization’s officers, directors, trustees, and principal salaried executive staff which includes names, addresses, and titles. We will not accept the listing provided in the IRS Form 990. Note: Your registration will be considered incomplete if the listing does not include titles. Addresses are not required if the named individuals are to be contacted at the organization's primary address.

16.Financial statements – please complete the following calculations using your financials from the most recently

completed fiscal year. In order to complete VDACS Form 102, organizations will need to refer to internal financials to list fundraising and management expenses:

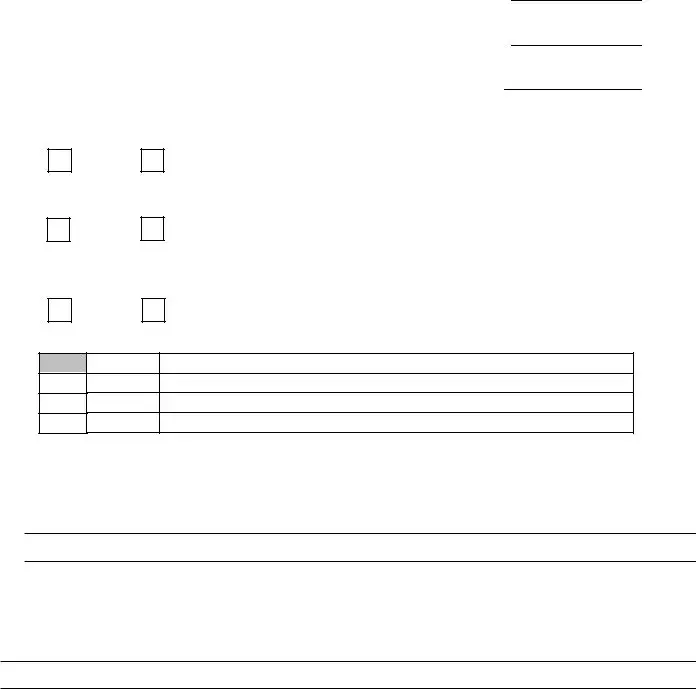

16(A): Percentage of fundraising expenses:

1)Total amount of contributions received directly from the public: (found on the IRS Form 990, Page 9, Part VIII, line 1h / 990EZ, Page 1, Part 1, Line 1 (less government grants)

2)Total spent on fundraising, including contracts with professional fund- raising counsel or professional solicitors: (found on IRS Form 990, Page 10, Part IX, Line 25, Column D / 990EZ, Page 1, Part 1, Line 13)

3)Percent of fundraising expenses: (found on this form, OCRP-102, Line 16A(2) divided by Line 16A(1))

4)For federated fundraising organizations ONLY: State the percentage withheld from a donation designated for a member agency.

16(B): Percentage of charitable services expenses:

1)Total amount of expenses dedicated to providing charitable services: (found on IRS Form 990, Page 10, Part IX, Line 25, Column B / 990EZ, Page 2, Part III, Line 32)

2)Total amount of expenses of the organization: (found on IRS

Form 990, Page 10, Part IX, Line 25, Column A / 990EZ, Page 1, Part 1, Line 17)

3)Percent of program services expenses: (found on this form, OCRP-102, Line 16B(1) divided by Line 16B(2))

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION

Form 102, Page 4

16(C): Percentage of administrative expenses:

1)Total amount of expenses dedicated to administrative costs: (found on IRS Form 990, Page 10, Part IX, Line 25, Column C / 990EZ, Page 1, Part 1, Line 12)

2)Total amount of expenses of the organization: (found on IRS From 990,

Page 10, Part IX, Line 25, Column A / 990EZ, Page 1, Part 1, Line 17)

3)Percent of administrative expenses: (found on this form, OCRP-102,

Line 16C(1) divided by Line 16C(2))

17.Does the organization intend to solicit contributions from the public directly (including corporate grant proposals, door- to-door or telephone solicitations, special events, direct mail, etc.)?

18.Does the organization intend to have others outside the organization (e.g. volunteers, federated fund- raising organizations, etc.) conduct solicitations on its behalf?

19.For the current fiscal year, has your organization entered into an agreement or contract with any person(s) to conduct any aspects (including planning, managing, or carrying out) of a completed, current or upcoming solicitation?

No If “Yes” to question 19, please indicate the arrangement with your agency by checking below:

Category |

Type of Arrangement |

|

|

AA bona fide, salaried officer or employee of the charitable organization or its parent organization

BAn outside consultant or professional fundraising counsel

CA paid professional solicitor

If in Question 19 either B or C are checked, then please provide the following information:

a)List the name and address(es) of the professional fundraising counsel or professional solicitor(s) and note the date of each contract that was previously submitted to the Commissioner:

b)Attach a copy of the organization’s current fundraising contract(s) that were not previously submitted as required by Section 57-54 of the Code of Virginia.

20.Please indicate how the organization will use the contributions received during the CURRENT fiscal year:

21.Has the organization been authorized by any other state or governmental agency to solicit contributions?

|

|

Yes |

|

No |

If "Yes," then name all such agencies. Submit an attachment if necessary. |

|

|

|

|

|

|

|

|

|

|

|

|

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION |

Revised 11/21 |

Form 102, Page 5

22.Is the organization, or any officer, professional fund-raising counsel, or professional solicitor for the organization CURRENTLY enjoined by any court or otherwise prohibited from soliciting in any jurisdiction?

No If "Yes," then attach a copy of the Order that states the reasons and time period for the injunction or prohibition.

23.Has any officer, professional fund-raising counsel, or professional solicitor for the organization ever been convicted in any jurisdiction of embezzlement, larceny or other crimes involving the obtaining of money under false pretenses, or the misapplication of funds impressed with a trust?

No If "Yes," then attach a copy of the court Order that states the reasons for the conviction, or a copy of any applicable pardon.

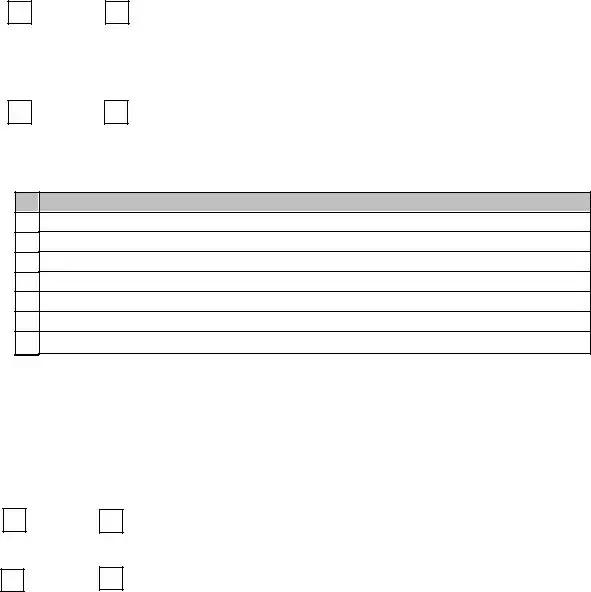

24.Please indicate the type of solicitation activities that your organization may pursue during the current fiscal year (check all that apply):

XType of Solicitation Telephone

Direct mail Internet Special events Door-to-door Personal contact Other (Specify):

25.Except as otherwise provided, all information required to be filed under Chapter 5 of Title 57 of the Code of Virginia shall become public records in the Office of the Commissioner, and shall be open to the general public for inspection. You are required by law to supply this information as a prerequisite to the solicitation of charitable contributions. If you do not provide the required information, you may not solicit in Virginia. Any change in information filed must be submitted to OCRP within seven (7) days of the change. In order to assist you in determining whether you have provided the required information, please respond to the following:

i)Are all questions on the form answered?

No If “No,” then the registration will be considered incomplete.

ii) Are all required attachments included (see page 7 for “Checklist of Required Attachments”)?

No If “No,” then the registration will be considered incomplete.

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION |

Revised 11/21 |

Form 102, Page 6

26. OATH OR AFFIRMATION. (MUST BE WET INK SIGNATURES)

*Two (2) different officers must sign this registration form. The original signature page (page 6) must then be filed with the Office of Charitable and Regulatory Programs. Copies are not allowed.

We, the undersigned chief fiscal officer (chief financial officer, or treasurer) and president (or other authorized officer, if president is unavailable to sign), duly authorized to act on behalf of the organization for which this statement is made, certify that this statement and including any accompanying appendices have been examined by us and are, to the best of our knowledge and belief, true, correct and complete pursuant to the laws of the Commonwealth of Virginia.

We affirm and attest that no funds have been or will knowingly be used, directly or indirectly, to benefit or provide support, in cash or in kind, to terrorists, terrorist organizations, terrorist activities, or the family members of any terrorist. We understand that no person shall be registered by the Commonwealth or by any locality to solicit funds that are intended to benefit or support a family member of any terrorist.

Wet ink signature of the chief fiscal officer, chief financial officer, or treasurer

Print name

Title

Date

Wet ink signature of the president or other

authorized officer

Print name

Title

Date

*The persons signing this form as chief fiscal officer (chief financial officer/treasurer) and president (or other authorized

officer) must be designated by title on the current fiscal year’s list of officers, directors, trustees, and principal salaried

executive staff (see §57-49.D. of the Code of Virginia).

Section 57-61.1.A. of the Code of Virginia states that "Registrations by charitable organizations, professional solicitors, and professional fund-raising counsel are effective, if complete, upon receipt by the Commissioner.” For more information on determining whether your registration is complete, see: http://www.vdacs.virginia.gov/consumer/pdf/oca-102registration.pdf.

Rules Governing the Solicitation of Contributions: http://www.vdacs.virginia.gov/forms-

pdf/cp/oca/charitable/ocasolicitationreg.pdf.

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION |

Revised 11/21 |

Form 102, Page 7

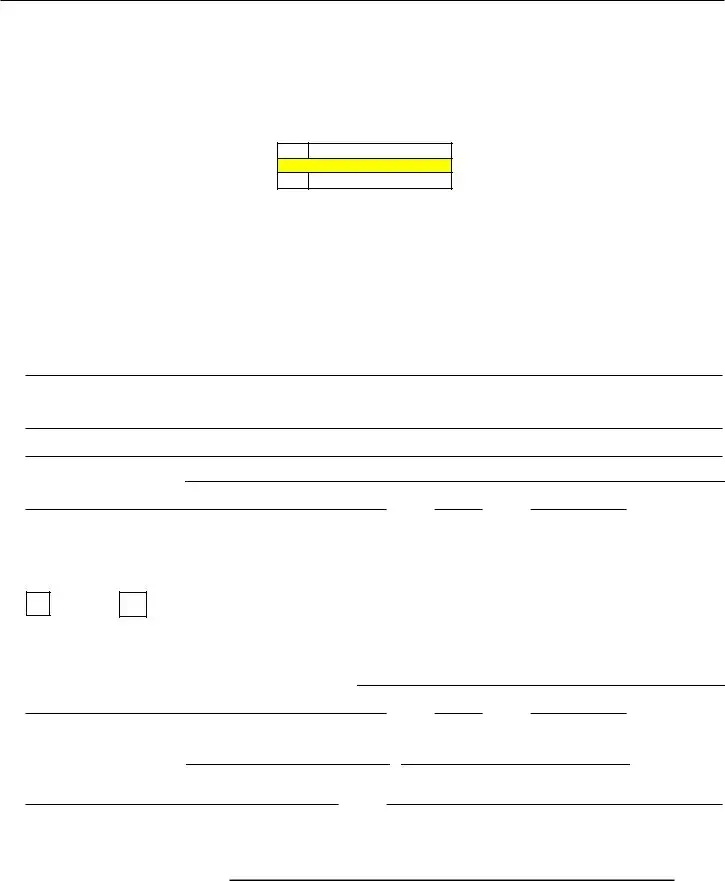

SCHEDULE OF REGISTRATION FEES

FEE CRITERIA*

$30 If your gross contributions $50 If your gross contributions $100 If your gross contributions $200 If your gross contributions $250 If your gross contributions $325 If your gross contributions

for the preceding year do not exceed $25,000 exceed $25,000, but do not exceed $50,000 exceed $50,000, but do not exceed $100,000 exceed $100,000, but do not exceed $500,000 exceed $500,000, but do not exceed one million dollars exceed one million dollars

“Gross contributions” means the total contributions received by the organization from all sources, excluding government grants (this amount is found on Line E under Computation of Fee Criteria below).

Organizations with no prior financial history filing an initial registration shall be required to pay an initial fee of $100.

Organizations with prior financial history filing an initial registration shall be required to pay an initial fee of $100 in addition to the applicable annual registration fee.

**Any organization which allows its registration to lapse shall be required to pay a $100 late fee in addition to the annual registration fee.

*COMPUTATION OF FEE CRITERIA

Due to the diversity in reporting, the following computation should be used as a guide for calculating the required annual registration fee.

Total contributions, gifts, grants, etc. (IRS Form 990, Part VIII, Line 1h) |

A |

Subtract

Funds received from federated fundraising organization (FFO)**

(IRS Form 990, Part VIII, Line 1a): |

B |

|

|

Government Grants (IRS Form 990, Part VIII, Line 1e) |

C |

|

|

Total Deductions (add Lines B and C) |

D |

|

GROSS CONTRIBUTIONS (subtract Line D from Line A) |

|

|

E |

|

|

**The federated fundraising organization (FFO), as defined in §57-48 of the Code, must register annually with the Commissioner to qualify for subtraction of funds in the fee computation. Enter the complete name of the FFO below:

Name of FFO:

REGISTRATION STATEMENT FOR A CHARITABLE ORGANIZATION |

Revised 11/21 |

Form 102, Page 8

FORM 102 – CHECKLIST OF REQUIRED ATTACHMENTS

XALL Registrants MUST file the following Items:

Remittance form and check, made payable to "Treasurer of Virginia."

Listing of names, titles, and addresses of the current officers, directors, trustees, and any principal salaried executive staff. Titles are required; addresses are not required if the named individuals are to be contacted at the organization's primary address. We will not accept the listing included in the most recently completed IRS Form 990 since that listing is not for the current year.

Financial report. All organizations with prior financial history shall file a copy of one of the following:

(1)The most recently completed IRS Form 990, 990-PF, or 990-EZ, with all schedules, as required by the IRS, except Schedule B, and with all attachments, as filed with the IRS. The form must be signed or, if the form is filed electronically with the IRS, the organization must submit a signed copy of the IRS e-file signature authorization; or

(2)Certified audited financial statements for the most recently completed fiscal year; or

(3)If the annual income of the organization qualifies the organization to file Form 990-N with the IRS, a certified treasurer’s report for the past fiscal year. Form 990-N is NOT an acceptable financial statement. A "certified treasurer's report" is an income and expense statement and a balance sheet for the most recently completed fiscal year and include the certification signed by the treasurer, “I hereby certify that, to the best of myknowledge, the financial statement above is accurate and correct. //signed.”

Important Note: If your most recently completed financial report is not ready by the registration due date, you may request an extension of time to file your registration statement for either 3 or 6 months. The extension request may be mailed, faxed to our office at 804-225-2666, or emailed to OCARPUNIT.vdacs@vdacs.virginia.gov, and must include: 1) the organization’s name, 2) Federal Identification Number (FEIN), and 3) the extension request length of time, which is either for 3 months or 6 months.

If you do not provide the correct financial report by the required/extended due date, and have not requested an extension of time to file, you will be assessed a late fee of $100.

Newly formed organizations: shall file a copy of the board-approved budget of anticipated revenues and expenses for the CURRENT year. Please notate on the budget the date of board approval.

A list of the addresses and telephone numbers for any branch offices in Virginia, if you answered “yes” to question 4.

A list of any chapters, branches or affiliates' names, addresses and telephone numbers, if you are a parent organization as identified by your response to question 7.

Copy of signed contract(s) between your organization and each professional fundraising counsel and / or professional solicitor, if you answered “yes” to question 19.

Copy of any amendments to your articles of incorporation, not previously filed. If unincorporated, file any amendments to the governing documents, not previously filed.

Copy of amendments to your by-laws, not previously filed.

IRS determination letter and any subsequent modifications, if the organization is listed with the IRS as tax exempt, not previously filed. If tax-exemption is pending, the completed IRS application form, as filed with the IRS.

XFirst-time / Initial filers MUST also file copies of the following Items:

Certificate of incorporation, if the organization is incorporated. If the organizing jurisdiction does not issue a certificate, the articles must bear a state stamp or seal.

Articles of incorporation, if the organization is incorporated, and any subsequent amendments to those documents. If unincorporated, file any other governing documents.

Bylaws and any amendments.

IRS determination letter and any subsequent modifications, if the organization is listed with the IRS as tax exempt. If tax-exemption is pending, the completed IRS application form, as filed with the IRS.