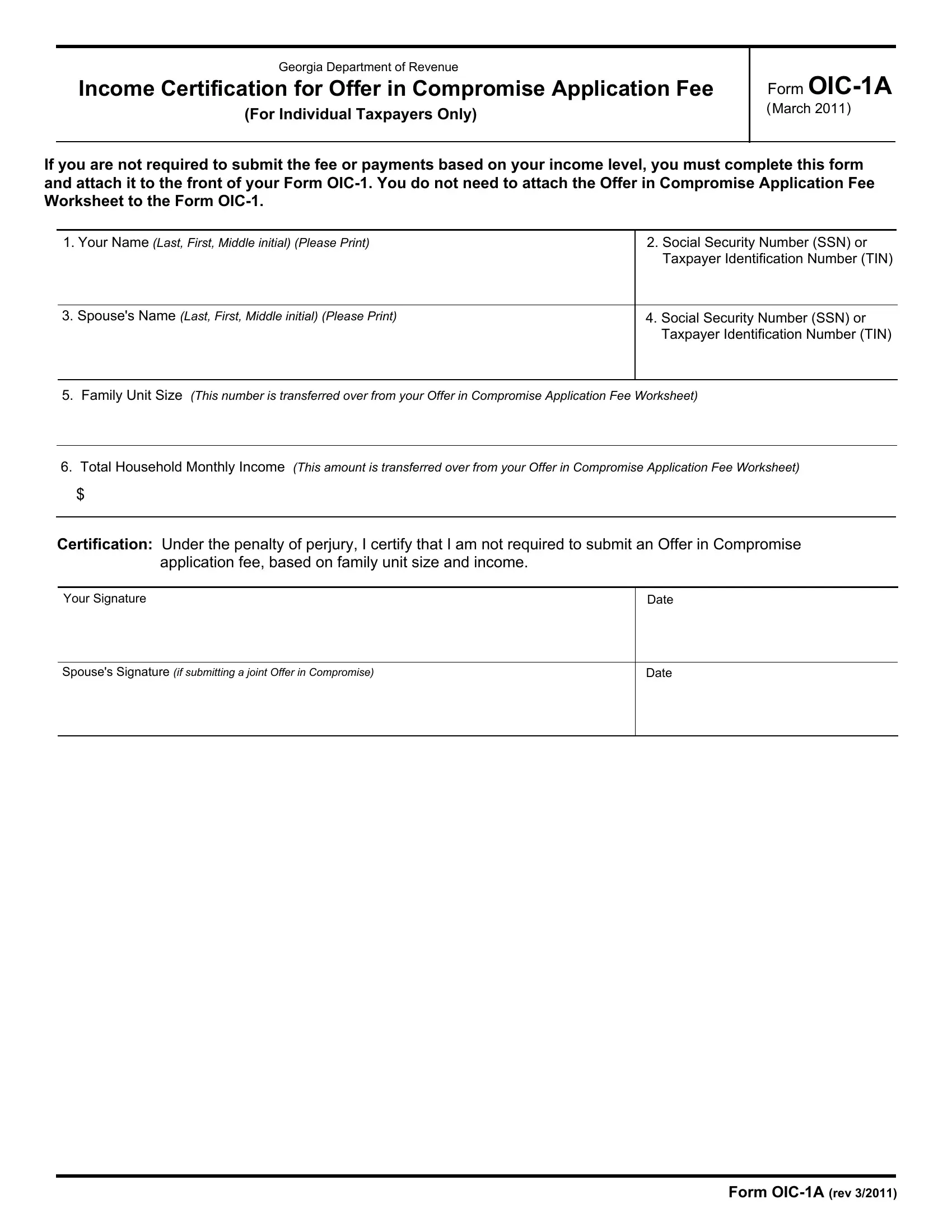

Georgia Department of Revenue

Income Certification for Offer in Compromise Application Fee

(For Individual Taxpayers Only)

If you are not required to submit the fee or payments based on your income level, you must complete this form and attach it to the front of your Form OIC1. You do not need to attach the Offer in Compromise Application Fee Worksheet to the Form OIC1.

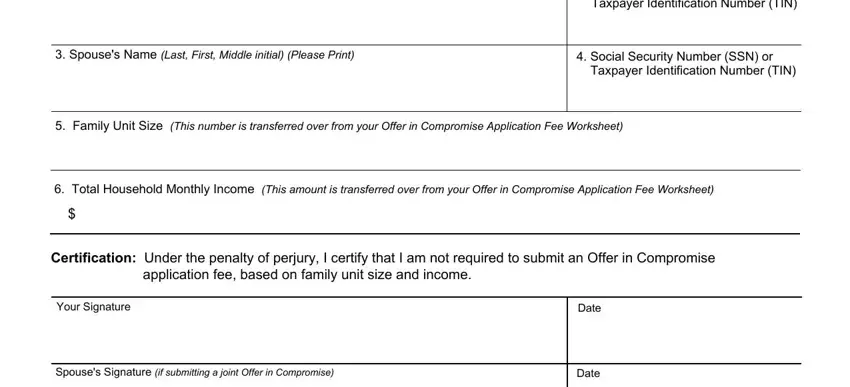

1. Your Name (Last, First, Middle initial) (Please Print) |

2. Social Security Number (SSN) or |

|

Taxpayer Identification Number (TIN) |

|

|

3. Spouse's Name (Last, First, Middle initial) (Please Print) |

4. Social Security Number (SSN) or |

|

Taxpayer Identification Number (TIN) |

|

|

5.Family Unit Size (This number is transferred over from your Offer in Compromise Application Fee Worksheet)

6.Total Household Monthly Income (This amount is transferred over from your Offer in Compromise Application Fee Worksheet)

$

Certification: Under the penalty of perjury, I certify that I am not required to submit an Offer in Compromise application fee, based on family unit size and income.

Spouse's Signature (if submitting a joint Offer in Compromise)

Georgia Department of Revenue

Offer in Compromise Application Fee Worksheet

This worksheet should only be completed if you are requesting an exception to the $100 application fee because of your income.

Individuals whose income falls at or below levels based on Georgia Department of Revenue Offer in Compromise Low Income Guidelines are not required to pay the application fee. This exception only applies to individuals; it does not apply to other entities such as corporations or partnerships. You should use the worksheet below to determine if you meet the eligibility requirements.

If you are an individual, follow the steps below to determine if you must pay the application fee with your Offer in Compromise application.

1.Family Unit Size_____.

Enter the total number of dependants you will be claiming on this year’s federal income tax return plus yourself and your spouse. Transfer this number to Form OIC-1A, Item 5.

2.Total Household Monthly Income_____________.

If using Form CD-14A, enter the amount of your total monthly income from Section D. If using Form CD-14C, enter the amount of your total monthly income from Section 4, Line 32. Transfer this number to Form OIC-1A, Item 6.

3.Compare the information you entered in items 1 and 2, above, to the Georgia Department of Revenue OIC Low Income Guidelines table below. Find the "Family Unit Size" equal to the number you entered in item 1. Next, find the column which represents where you reside (48 Contiguous states, DC …, Hawaii or Alaska). Compare the “Total Household Income” you entered in item 2 to the number in the row and column that corresponds to your family unit size and residence. For example, if you reside in one of the 48 contiguous states, and your family unit size from item 1 above is 4, and your total household monthly income from item 2 above is $3000, then you are exempt from the application fee and payment because your income is less than the $4,594 guideline amount.

GA DOR OIC Low Income Guidelines

Size of Family Unit |

48 Contiguous States and D.C. |

Hawaii |

Alaska |

|

|

|

|

1 |

$2,256 |

$2,596 |

$2,819 |

|

|

|

|

2 |

$3,035 |

$3,492 |

$3,794 |

|

|

|

|

3 |

$3,815 |

$4,388 |

$4,769 |

|

|

|

|

4 |

$4,594 |

$5,283 |

$5,744 |

|

|

|

|

5 |

$5,373 |

$6,179 |

$6,719 |

|

|

|

|

6 |

$6,152 |

$7,075 |

$7,694 |

|

|

|

|

7 |

$6,931 |

$7,971 |

$8,669 |

|

|

|

|

8 |

$7,710 |

$8,867 |

$9,644 |

|

|

|

|

For each additional person, add |

$779 |

$896 |

$975 |

|

|

|

|

4.If the total household monthly income you entered in item 2 is more than the amount shown for your family unit size and residence in the monthly Georgia Department of Revenue OIC Low Income Guidelines table above, you must send the $100 application fee with each OIC you submit. Your check or money order should be made payable to the "Georgia Department of Revenue” and attached to the front of your Form OIC-1, Offer In Compromise (short or long form). Do Not Send Cash. Send a separate application fee with each OIC; do not combine it with any other tax payments as this may delay processing of your OIC. Your OIC will be returned to you without further consideration if the application fee is not properly remitted or if your check is returned for insufficient funds.

5.Do not send the application fee if the total income you entered in item 2 is equal to or less than the amount shown for your family unit size and residence in the table above. Sign and date Form OIC-1A, Income Certification for Offer in Compromise Application Fee. Attach the certification to the front of your Form OIC-1.