It is possible to prepare iReg instantly using our PDFinity® PDF editor. The tool is constantly maintained by our staff, receiving handy functions and growing to be greater. Here's what you would have to do to get started:

Step 1: First, access the tool by clicking the "Get Form Button" above on this site.

Step 2: When you launch the file editor, you will find the form made ready to be filled in. Besides filling out different fields, you can also perform various other actions with the file, particularly putting on any textual content, changing the original textual content, inserting illustrations or photos, putting your signature on the form, and a lot more.

This form will require you to provide specific information; to guarantee accuracy, you need to heed the following tips:

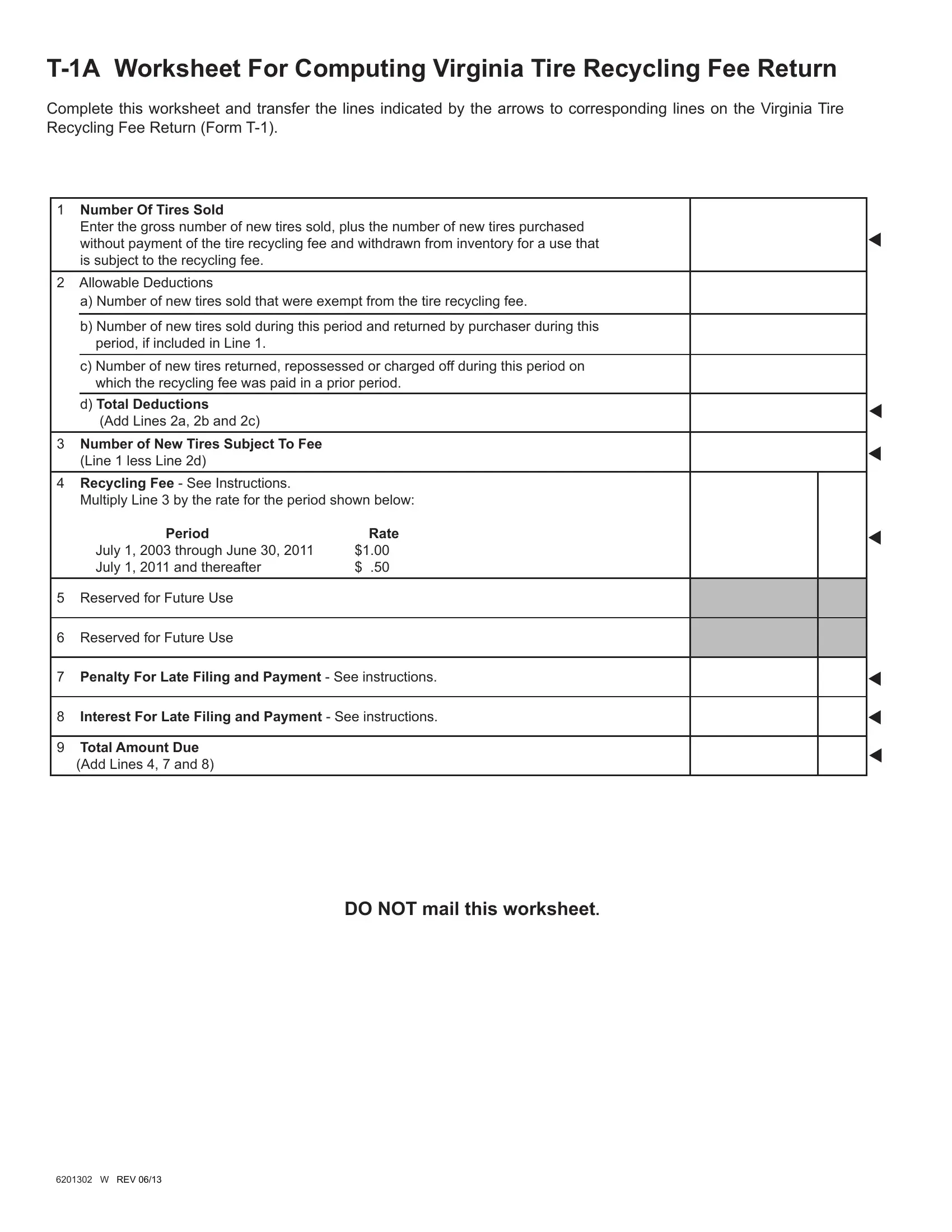

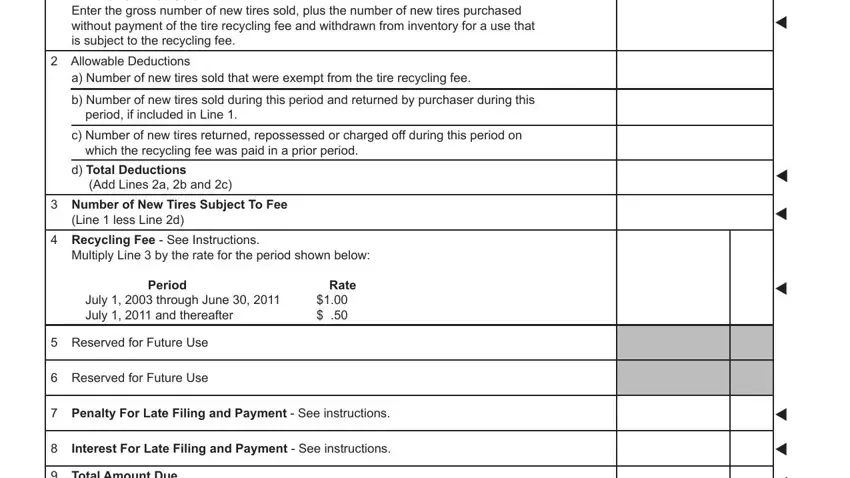

1. Before anything else, while filling in the iReg, start with the area containing subsequent blank fields:

Step 3: Soon after double-checking the filled in blanks, press "Done" and you are good to go! Get the iReg after you sign up for a 7-day free trial. Readily use the pdf within your personal account, with any edits and changes being conveniently preserved! We do not share the details that you type in whenever working with forms at FormsPal.