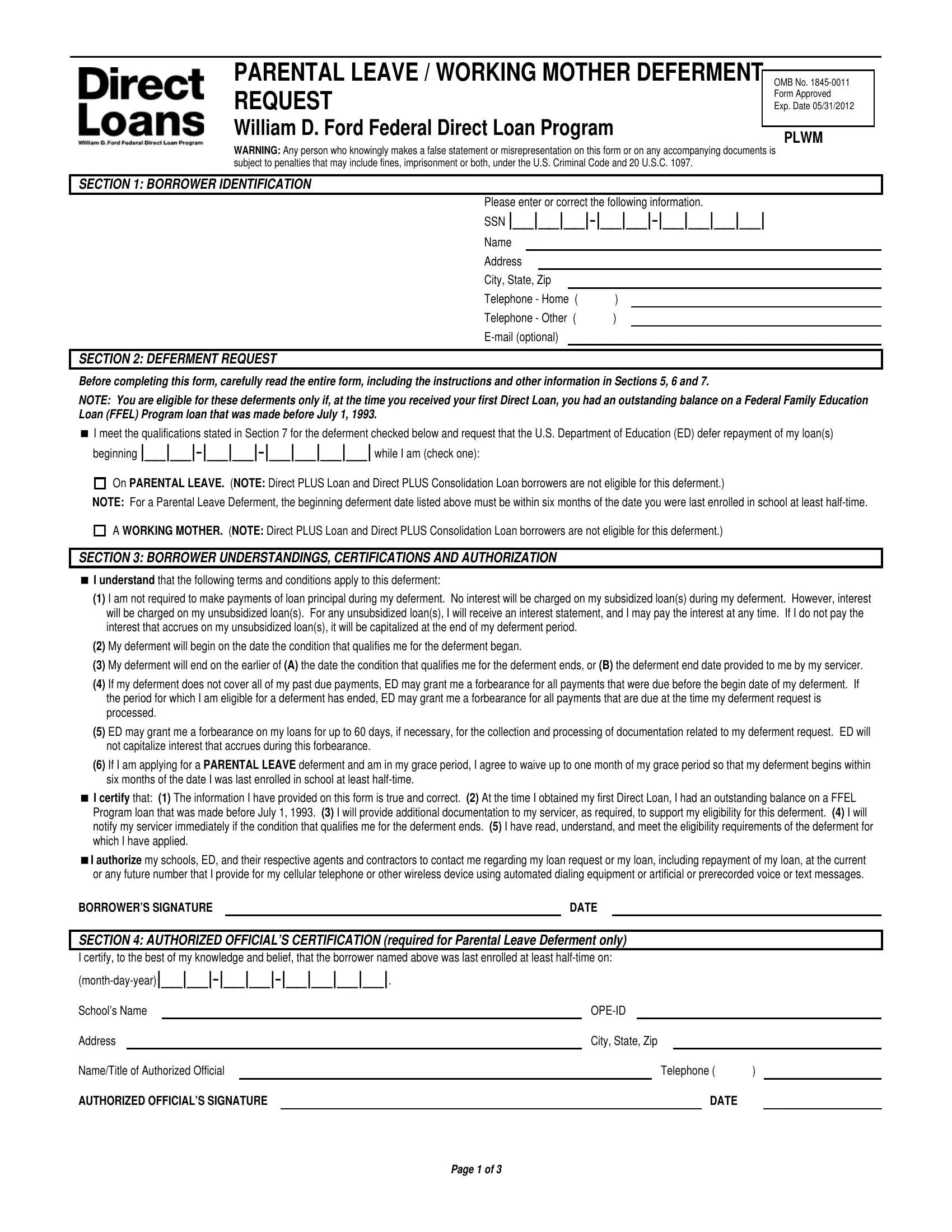

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying documents is subject to penalties that may include fines, imprisonment or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

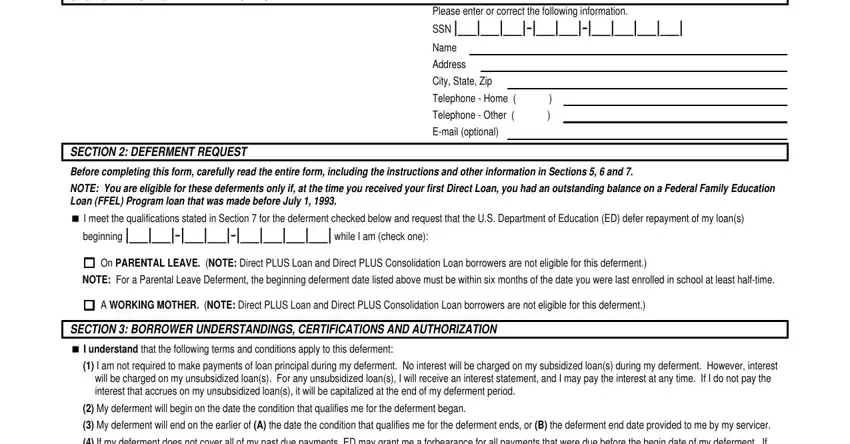

SECTION 1: BORROWER IDENTIFICATION

Please enter or correct the following information.

SSN |__|__|__|-|__|__|-|__|__|__|__|

Name

Address

City, State, Zip

Telephone - Home ( |

) |

|

Telephone - Other ( |

) |

|

E-mail (optional) |

|

|

|

SECTION 2: DEFERMENT REQUEST

Before completing this form, carefully read the entire form, including the instructions and other information in Sections 5, 6 and 7.

NOTE: You are eligible for these deferments only if, at the time you received your first Direct Loan, you had an outstanding balance on a Federal Family Education Loan (FFEL) Program loan that was made before July 1, 1993.

I meet the qualifications stated in Section 7 for the deferment checked below and request that the U.S. Department of Education (ED) defer repayment of my loan(s)

beginning |__|__|-|__|__|-|__|__|__|__|while I am (check one):

On PARENTAL LEAVE. (NOTE: Direct PLUS Loan and Direct PLUS Consolidation Loan borrowers are not eligible for this deferment.)

NOTE: For a Parental Leave Deferment, the beginning deferment date listed above must be within six months of the date you were last enrolled in school at least half-time.

A WORKING MOTHER. (NOTE: Direct PLUS Loan and Direct PLUS Consolidation Loan borrowers are not eligible for this deferment.)

SECTION 3: BORROWER UNDERSTANDINGS, CERTIFICATIONS AND AUTHORIZATION

I understand that the following terms and conditions apply to this deferment:

(1)I am not required to make payments of loan principal during my deferment. No interest will be charged on my subsidized loan(s) during my deferment. However, interest will be charged on my unsubsidized loan(s). For any unsubsidized loan(s), I will receive an interest statement, and I may pay the interest at any time. If I do not pay the interest that accrues on my unsubsidized loan(s), it will be capitalized at the end of my deferment period.

(2)My deferment will begin on the date the condition that qualifies me for the deferment began.

(3)My deferment will end on the earlier of (A) the date the condition that qualifies me for the deferment ends, or (B) the deferment end date provided to me by my servicer.

(4)If my deferment does not cover all of my past due payments, ED may grant me a forbearance for all payments that were due before the begin date of my deferment. If the period for which I am eligible for a deferment has ended, ED may grant me a forbearance for all payments that are due at the time my deferment request is processed.

(5)ED may grant me a forbearance on my loans for up to 60 days, if necessary, for the collection and processing of documentation related to my deferment request. ED will not capitalize interest that accrues during this forbearance.

(6)If I am applying for a PARENTAL LEAVE deferment and am in my grace period, I agree to waive up to one month of my grace period so that my deferment begins within six months of the date I was last enrolled in school at least half-time.

I certify that: (1) The information I have provided on this form is true and correct. (2) At the time I obtained my first Direct Loan, I had an outstanding balance on a FFEL Program loan that was made before July 1, 1993. (3) I will provide additional documentation to my servicer, as required, to support my eligibility for this deferment. (4) I will notify my servicer immediately if the condition that qualifies me for the deferment ends. (5) I have read, understand, and meet the eligibility requirements of the deferment for which I have applied.

I authorize my schools, ED, and their respective agents and contractors to contact me regarding my loan request or my loan, including repayment of my loan, at the current or any future number that I provide for my cellular telephone or other wireless device using automated dialing equipment or artificial or prerecorded voice or text messages.

BORROWER’S SIGNATURE |

|

DATE |

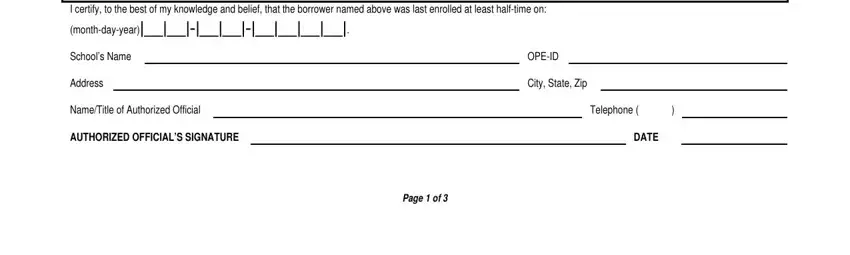

SECTION 4: AUTHORIZED OFFICIAL’S CERTIFICATION (required for Parental Leave Deferment only)

I certify, to the best of my knowledge and belief, that the borrower named above was last enrolled at least half-time on:

(month-day-year)|__|__|-|__|__|-|__|__|__|__|.

School’s Name |

|

|

OPE-ID |

|

|

|

Address |

|

|

City, State, Zip |

|

|

|

Name/Title of Authorized Official |

|

|

|

|

Telephone ( |

) |

|

AUTHORIZED OFFICIAL’S SIGNATURE |

|

|

|

|

|

DATE |

|

|

|

|

|

|

Page 1 of 3 |

|

|