When you intend to fill out Form Otc 935 Mh, it's not necessary to download any applications - just use our online tool. To maintain our tool on the leading edge of efficiency, we work to put into action user-oriented capabilities and enhancements regularly. We're always grateful for any feedback - assist us with revolutionizing PDF editing. With some basic steps, you may begin your PDF journey:

Step 1: Simply press the "Get Form Button" in the top section of this webpage to get into our form editing tool. This way, you will find all that is required to fill out your document.

Step 2: Using this advanced PDF editing tool, you are able to accomplish more than simply fill out blank fields. Edit away and make your docs look perfect with customized textual content incorporated, or fine-tune the original input to excellence - all comes with an ability to add any pictures and sign the file off.

With regards to the fields of this precise PDF, here's what you need to do:

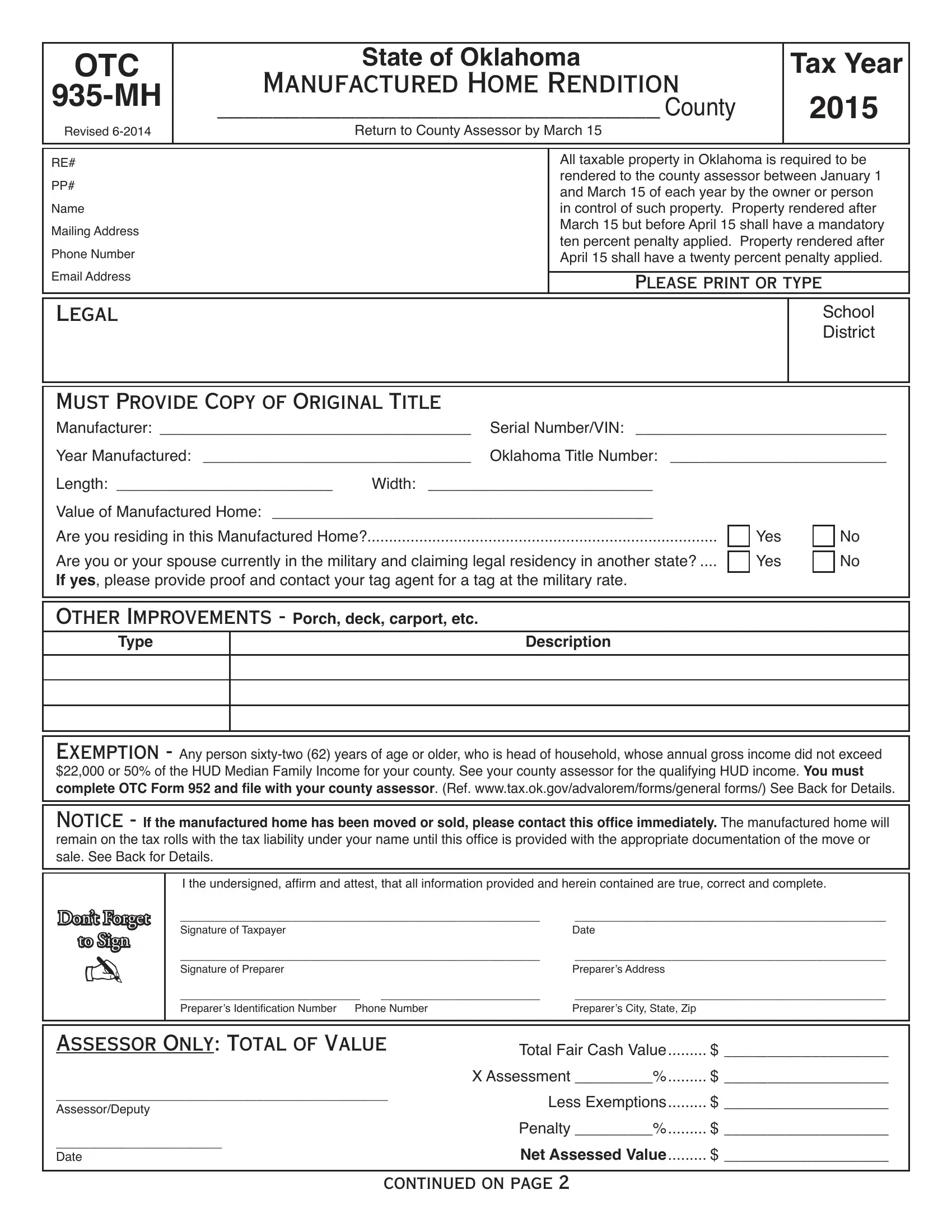

1. To begin with, while filling in the Form Otc 935 Mh, start with the form section that has the following blanks:

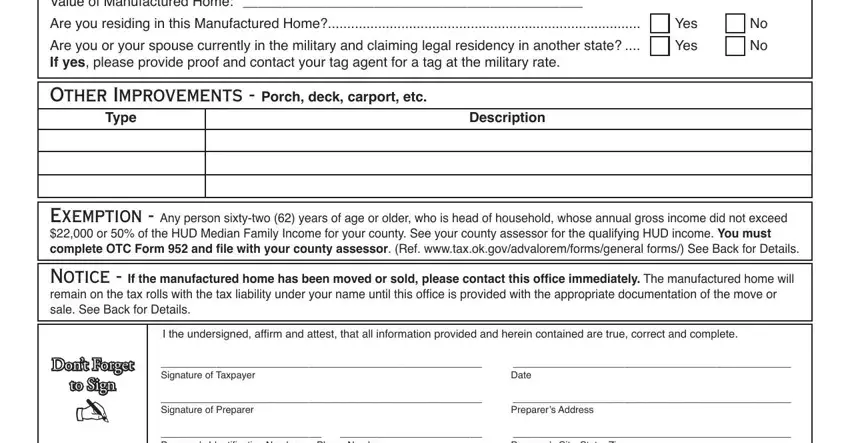

2. Given that this segment is completed, it is time to add the essential particulars in Value of Manufactured Home, Are you residing in this, Are you or your spouse currently, Yes, Yes, Other Improvements Porch deck, Type, Description, Exemption Any person sixtytwo, I the undersigned afirm and attest, Dont Forget, to Sign, Signature of Taxpayer, Date, and Signature of Preparer in order to go further.

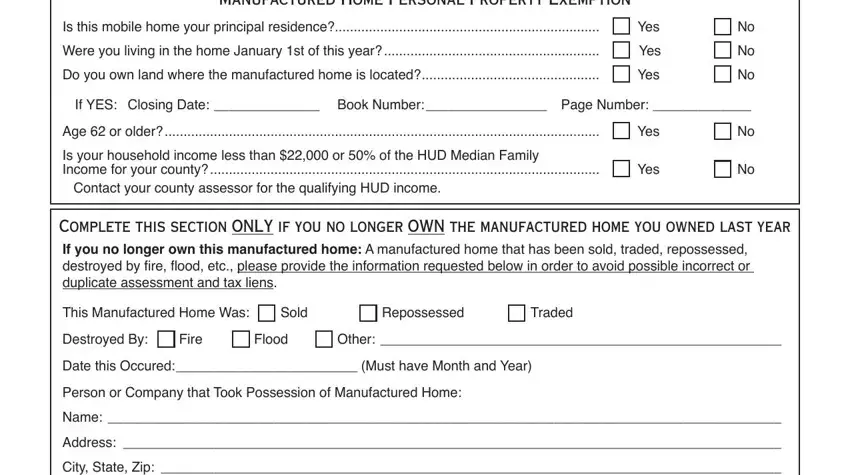

3. Completing Manufactured Home Personal, Is this mobile home your principal, Were you living in the home, Do you own land where the, Yes, Yes, Yes, If YES Closing Date Book Number, Age or older, Yes, Is your household income less than, Yes, Complete this section ONLY if you, This Manufactured Home Was, and Sold is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be extremely careful while filling in Sold and If YES Closing Date Book Number, because this is where many people make mistakes.

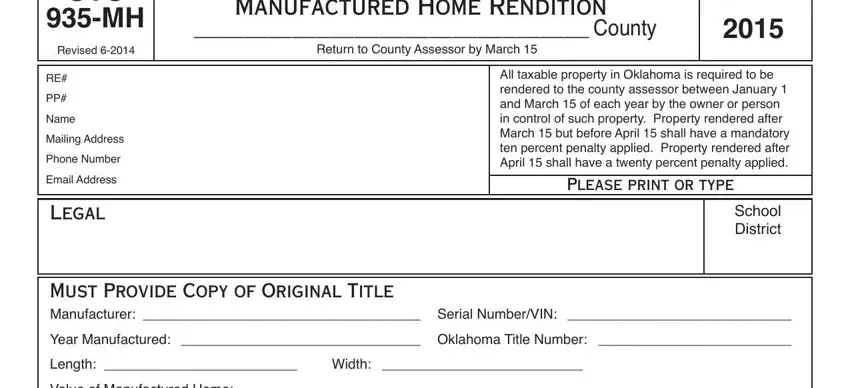

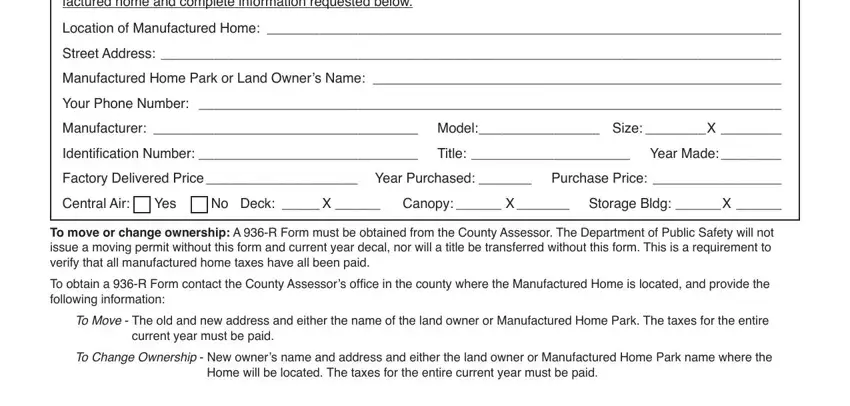

4. To move onward, this fourth part requires filling in several blank fields. Examples include If manufactured home was traded, Location of Manufactured Home, Street Address Manufactured Home, Manufacturer Model Size X, Central Air, Yes, No Deck X Canopy X Storage, To move or change ownership A R, To Move The old and new address, current year must be paid, To Change Ownership New owners, and Home will be located The taxes for, which are crucial to going forward with this document.

Step 3: After looking through the form fields, press "Done" and you're done and dusted! Get the Form Otc 935 Mh the instant you join for a free trial. Easily view the form from your FormsPal account page, together with any modifications and adjustments being conveniently synced! FormsPal ensures your information privacy with a protected system that in no way records or shares any type of private information typed in. You can relax knowing your files are kept confidential every time you use our service!