Making use of the online PDF editor by FormsPal, you're able to fill out or alter p60 template ireland right here and now. Our tool is consistently evolving to grant the very best user experience achievable, and that's due to our dedication to constant improvement and listening closely to customer feedback. By taking some basic steps, you may begin your PDF journey:

Step 1: Hit the "Get Form" button above. It's going to open up our tool so that you could begin filling in your form.

Step 2: As soon as you launch the tool, you will find the document prepared to be filled in. Aside from filling in different fields, you could also do various other things with the PDF, such as putting on any words, modifying the original text, inserting illustrations or photos, affixing your signature to the document, and much more.

It's simple to complete the pdf using out practical guide! This is what you must do:

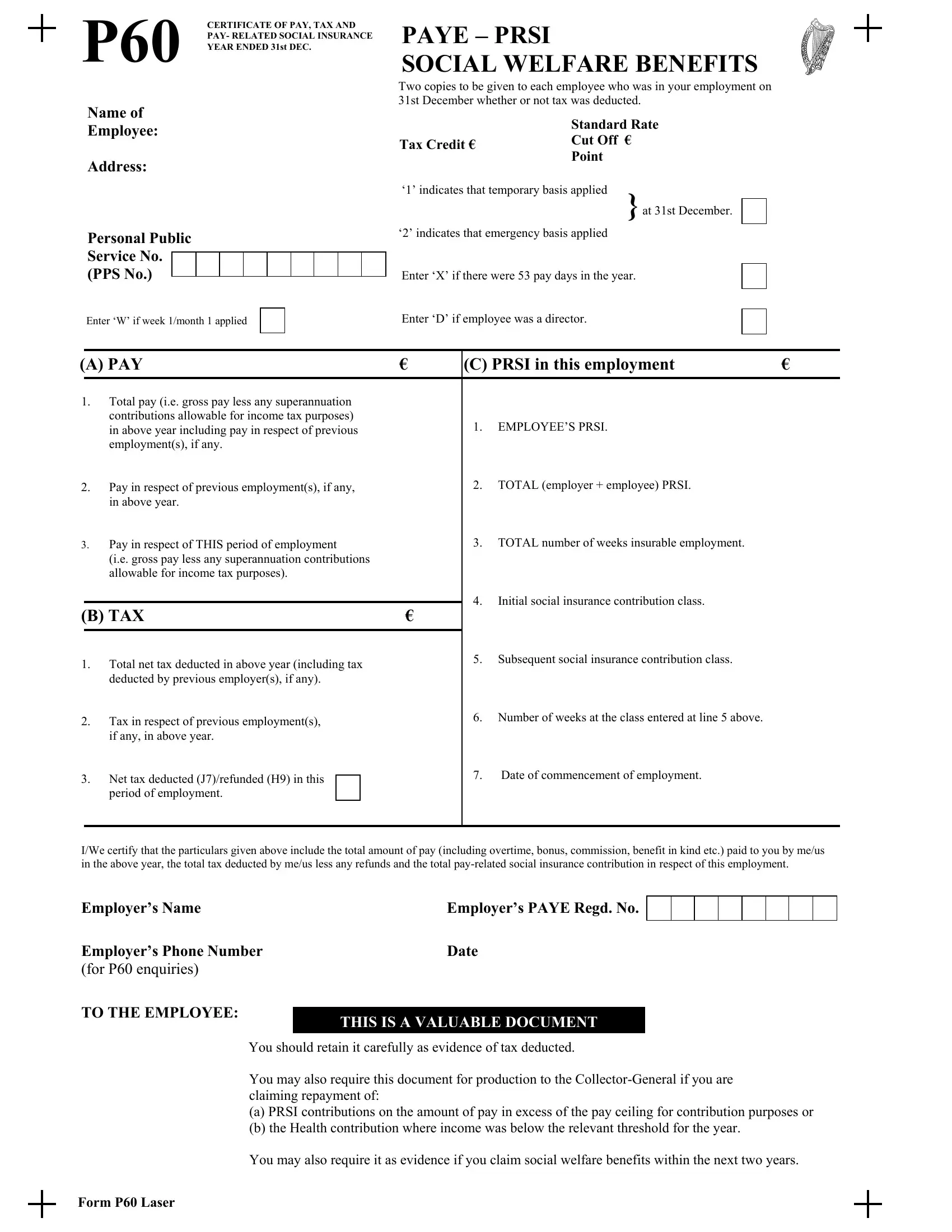

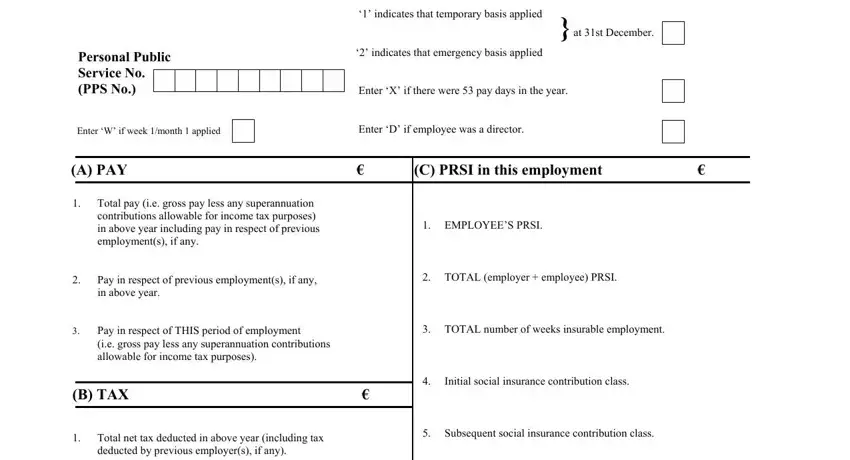

1. First, when filling out the p60 template ireland, beging with the part containing next blanks:

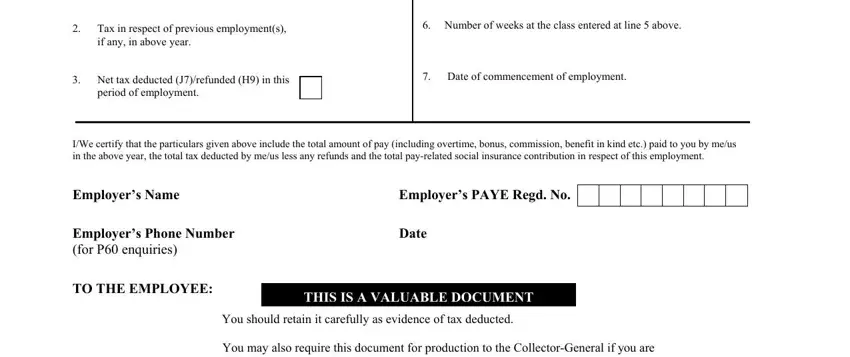

2. Now that this segment is done, you should put in the necessary details in Total net tax deducted in above, Tax in respect of previous, Net tax deducted Jrefunded H in, Number of weeks at the class, Date of commencement of employment, IWe certify that the particulars, Employers PAYE Regd No, Employers Phone Number for P, Date, TO THE EMPLOYEE You should retain, and THIS IS A VALUABLE DOCUMENT so that you can proceed further.

Those who use this form often make some errors when filling out Date in this section. Ensure that you re-examine what you enter right here.

Step 3: You should make sure your details are correct and then simply click "Done" to continue further. Get the p60 template ireland after you sign up at FormsPal for a free trial. Conveniently access the pdf form in your personal account page, together with any edits and adjustments being automatically preserved! FormsPal ensures your information privacy by using a protected system that never records or shares any private information involved. Feel safe knowing your files are kept confidential each time you use our editor!