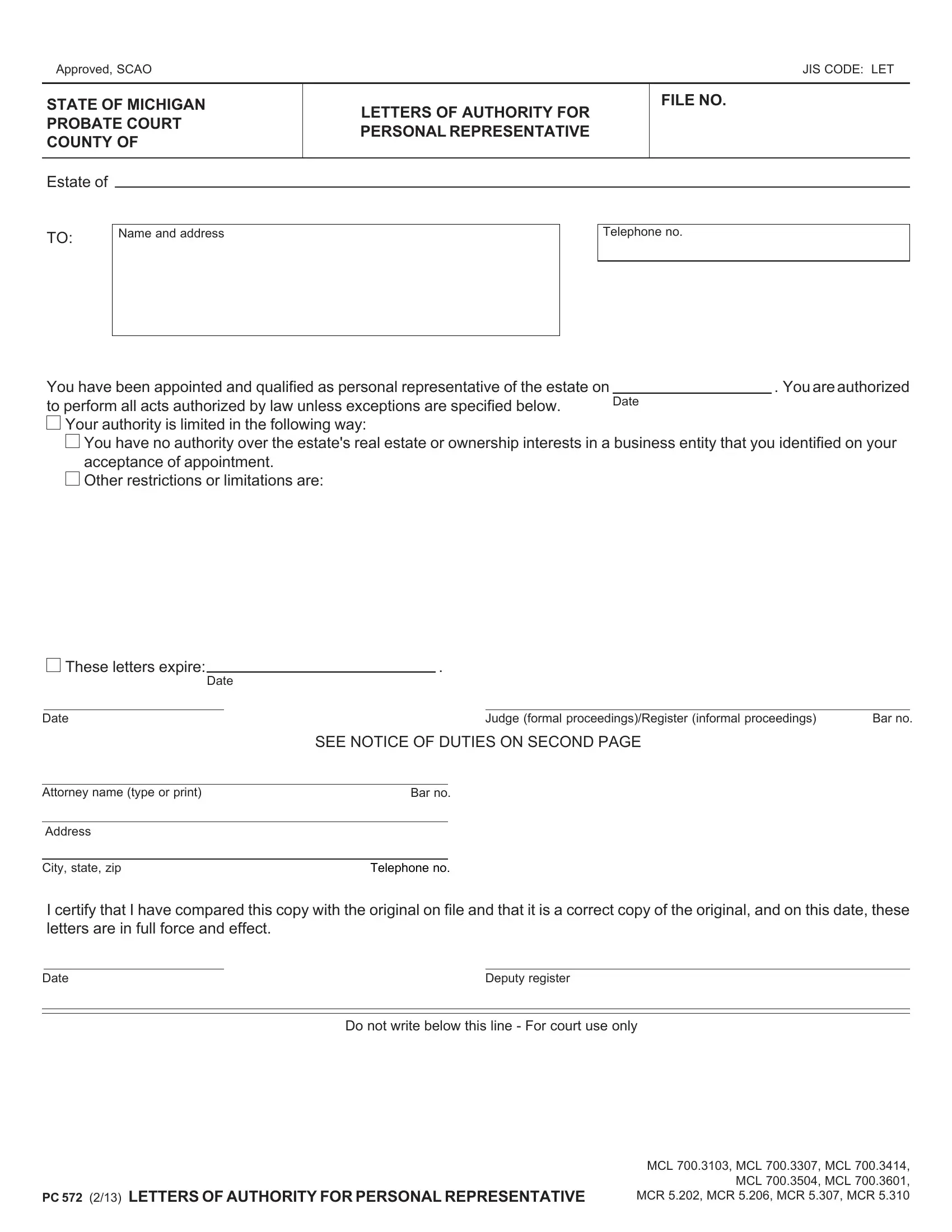

Approved, SCAO |

JIS CODE: LET |

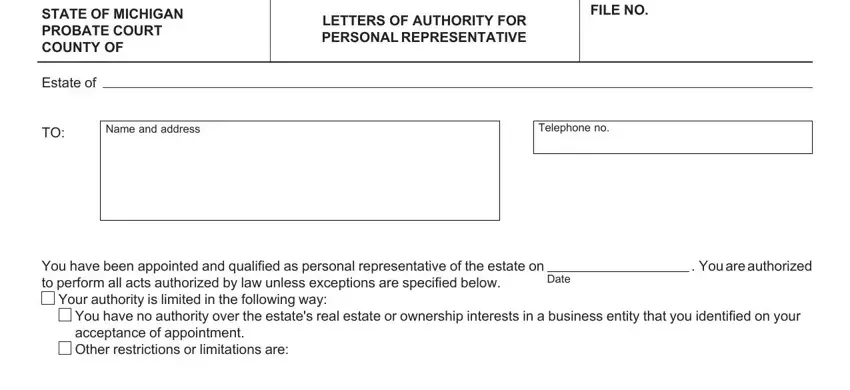

STATE OF MICHIGAN PROBATE COURT COUNTY OF

LETTERS OF AUTHORITY FOR PERSONAL REPRESENTATIVE

You have been appointed and qualified as personal representative of the estate on. Youareauthorized

to perform all acts authorized by law unless exceptions are specified below. |

Date |

|

Your authority is limited in the following way: |

|

You have no authority over the estate's real estate or ownership interests in a business entity that you identified on your acceptance of appointment.

Other restrictions or limitations are:

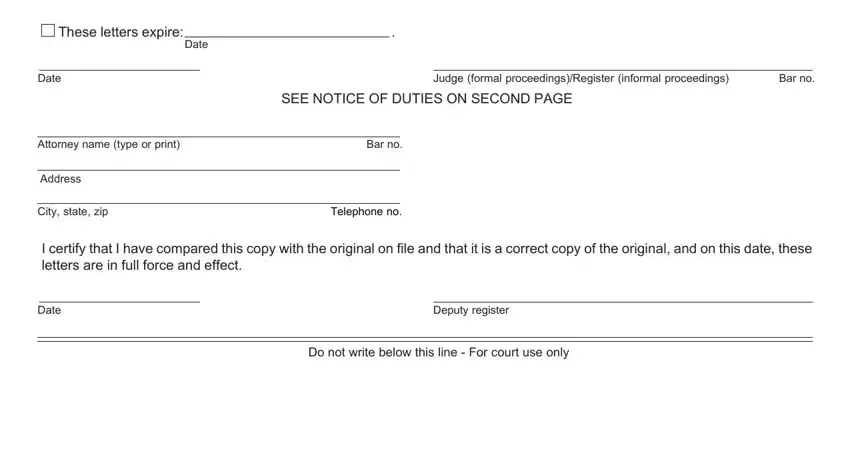

These letters expire: |

|

|

. |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

Judge (formal proceedings)/Register (informal proceedings) |

Bar no. |

|

|

SEE NOTICE OF DUTIES ON SECOND PAGE |

|

|

|

|

|

|

|

|

Attorney name (type or print) |

|

Bar no. |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City, state, zip |

|

Telephone no. |

|

|

I certify that I have compared this copy with the original on file and that it is a correct copy of the original, and on this date, these letters are in full force and effect.

Do not write below this line - For court use only

|

MCL 700.3103, MCL 700.3307, MCL 700.3414, |

|

MCL 700.3504, MCL 700.3601, |

PC 572 (2/13) LETTERS OF AUTHORITY FOR PERSONAL REPRESENTATIVE |

MCR 5.202, MCR 5.206, MCR 5.307, MCR 5.310 |

The following provisions are mandatory reporting duties specified in Michigan law and Michigan court rules and are not

the only duties required of you. See MCL 700.3701 through MCL 700.3722 for other duties. Your failure to comply may result in the court suspending your powers and appointing a special fiduciary in your place. It may also result in your removal as fiduciary.

CONTINUED ADMINISTRATION: If the estate is not settled within 1 year after the first personal representative's appointment, you must file with the court and send to each interested person a notice that the estate remains under administration, specifying the reasons for the continued administration. You must give this notice within 28 days of the first anniversary of the first personal representative's appointment and all subsequent anniversaries during which the administration remains uncompleted. If such a notice is not received, an interested person may petition the court for a hearing on the necessity for continued administration or for closure of the estate. [MCL 700.3703(4), MCL 700.3951(3), MCR 5.144, MCR 5.307, MCR 5.310]

DUTY TO COMPLETE ADMINISTRATION OF ESTATE: You must complete the administration of the estate and file appropriate closing papers with the court. Failure to do so may result in personal assessment of costs. [MCR 5.310]

CHANGE OF ADDRESS: You are required to inform the court and all interested persons of any change in your address within 7 days of the change.

Additional Duties for Supervised Administration

If this is a supervised administration, in addition to the above reporting duties, you are also required to prepare and file with this court the following written reports or information.

INVENTORY: You are required to file with the probate court an inventory of the assets of the estate within 91 days of the date your letters of authority are issued or as ordered by the court. You must send a copy of the inventory to all presumptive distributeesandallotherinterestedpersonswhorequestit. Theinventorymustlistinreasonabledetailalltheproperty owned by the decedent at the time of death. Each listed item must indicate the fair market value at the time of the decedent's death andthetypeandamountofanyencumbrance. Wherethedecedent'sdateofdeathisonorafterMarch28,2013,thelienamount will be deducted from the value of the real property for purposes of calculating the inventory fee under MCL 600.871(2). If the valueofanyitemhasbeenobtainedthroughanappraiser,theinventoryshouldincludetheappraiser'snameandaddresswith the item or items appraised by that appraiser. You must also provide the name and address of each financial institution listed on your inventory at the time the inventory is presented to the court. The address for a financial institution shall be either that of the institution's main headquarters or the branch used most frequently by the personal representative.

[MCL 700.3706, MCR 5.307, MCR 5.310(E)]

ACCOUNTS: You are required to file with this court once a year, either on the anniversary date that your letters of authority were issued or on another date you choose (you must notify the court of this date) or more often if the court directs, a complete itemized accounting of your administration of the estate. This itemized accounting must show in detail all income and disbursements and the remaining property, together with the form of the property. Subsequent annual and final accountings must be filed within 56 days following the close of the accounting period. When the estate is ready for closing, you are also required to file a final account with a description of property remaining in the estate. All accounts must be served on the required persons at the same time they are filed with the court, along with proof of service.

ESTATE(ORINHERITANCE)TAXINFORMATION: You are required to submit to the court proof that no estate (or inheritance) taxes are due or that the estate (or inheritance) taxes have been paid. Note: The estate may be subject to inheritance tax.

Additional Duties for Unsupervised Administration

If this is an unsupervised administration, in addition to the above reporting duties, you are also required to prepare and provide to all interested persons the following written reports or information.

INVENTORY: You are required to prepare an inventory of the assets of the estate within 91 days from the date your letters of authority are issued and to send a copy of the inventory to all presumptive distributees and all other interested persons who request it. The inventory must list in reasonable detail all the property owned by the decedent at the time of death. Each listeditemmustindicatethefairmarketvalueatthetimeofthedecedent'sdeathandthetypeandamountofanyencumbrance. Where the decedent's date of death is on or after March 28, 2013, the lien amount will be deducted from the value of the real propertyforpurposesofcalculatingtheinventoryfeeunderMCL600.871(2). Youarerequiredwithin91daysfromthedateyour letters of authority are issued, to submit to the court the information necessary to calculate the probate inventory fee that you must pay to the probate court. You may use the original inventory for this purpose. [MCL 700.3706, MCR 5.307]

ESTATE (OR INHERITANCE) TAX INFORMATION: You may be required to submit to the court proof that no estate (or inheritance) taxes are due or that the estate (or inheritance) taxes have been paid. Note: The estate may be subject to inheritance tax.