|

|

|

RESET |

|

|

|

|

For official use only: |

Customer Name |

Case or SR# |

Customer No |

|

|

|

|

FS Form 1048 (Revised November 2021) |

|

|

OMB No. 1530-0021 |

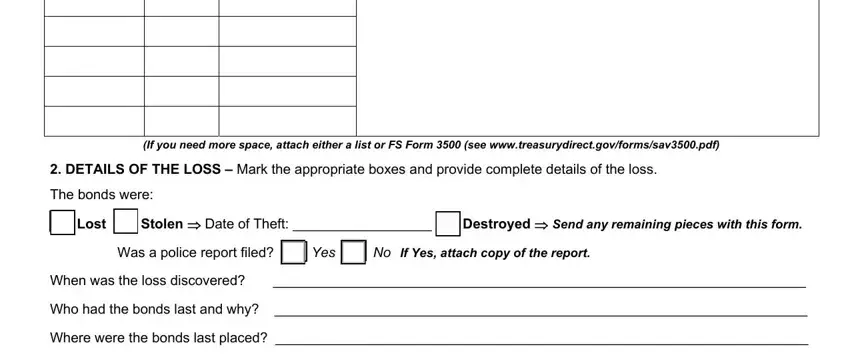

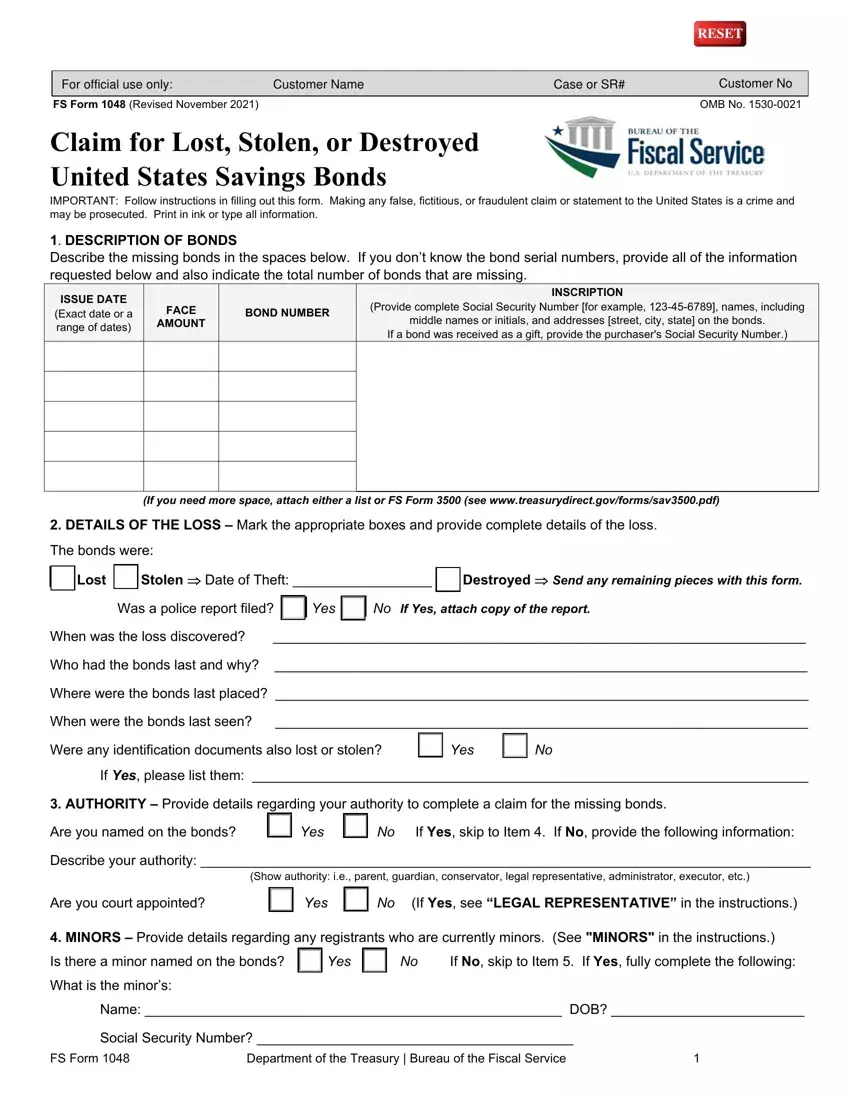

Claim for Lost, Stolen, or Destroyed

United States Savings Bonds

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information.

1. DESCRIPTION OF BONDS

Describe the missing bonds in the spaces below. If you don’t know the bond serial numbers, provide all of the information requested below and also indicate the total number of bonds that are missing.

|

ISSUE DATE |

|

|

|

|

|

|

|

INSCRIPTION |

|

|

|

FACE |

|

|

BOND NUMBER |

|

(Provide complete Social Security Number [for example, 123-45-6789], names, including |

|

(Exact date or a |

|

|

|

|

|

|

range of dates) |

|

|

AMOUNT |

|

|

|

|

middle names or initials, and addresses [street, city, state] on the bonds. |

|

|

|

|

|

|

|

If a bond was received as a gift, provide the purchaser's Social Security Number.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If you need more space, attach either a list or FS Form 3500 (see www.treasurydirect.gov/forms/sav3500.pdf)

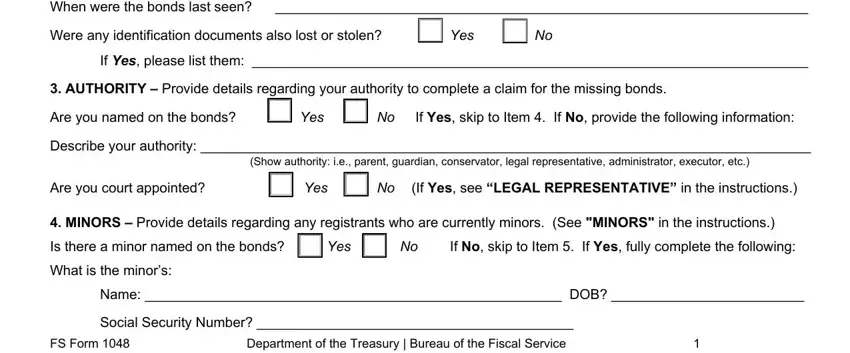

2.DETAILS OF THE LOSS – Mark the appropriate boxes and provide complete details of the loss. The bonds were:

Stolen Date of Theft: __________________

Destroyed Send any remaining pieces with this form.

|

|

|

|

|

|

Was a police report filed? |

|

Yes |

|

No If Yes, attach copy of the report. |

When was the loss discovered? |

_____________________________________________________________________ |

Who had the bonds last and why? _____________________________________________________________________

Where were the bonds last placed? _____________________________________________________________________

When were the bonds last seen? _____________________________________________________________________

Were any identification documents also lost or stolen? |

|

Yes |

|

No |

If Yes, please list them: ________________________________________________________________________

3.AUTHORITY – Provide details regarding your authority to complete a claim for the missing bonds.

Are you named on the bonds? |

|

Yes |

|

No If Yes, skip to Item 4. If No, provide the following information: |

Describe your authority: _______________________________________________________________________________

(Show authority: i.e., parent, guardian, conservator, legal representative, administrator, executor, etc.)

No (If Yes, see “LEGAL REPRESENTATIVE” in the instructions.)

4.MINORS – Provide details regarding any registrants who are currently minors. (See "MINORS" in the instructions.)

Is there a minor named on the bonds? |

|

Yes |

|

No |

If No, skip to Item 5. If Yes, fully complete the following: |

What is the minor’s: |

|

|

|

|

|

Name: ______________________________________________________ DOB? _________________________

Social Security Number? _________________________________________

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

1 |

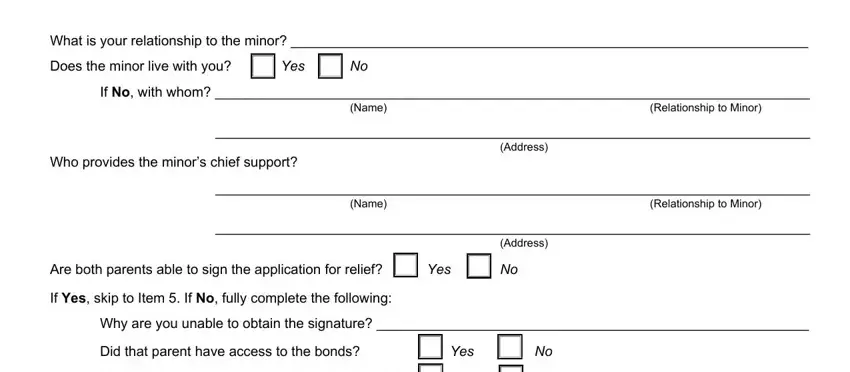

What is your relationship to the minor? ___________________________________________________________________

Does the minor live with you?

If No, with whom? _____________________________________________________________________________

(Name)(Relationship to Minor)

_____________________________________________________________________________

(Address)

Who provides the minor’s chief support?

_____________________________________________________________________________

(Name)(Relationship to Minor)

_____________________________________________________________________________

(Address)

Are both parents able to sign the application for relief?

If Yes, skip to Item 5. If No, fully complete the following:

Why are you unable to obtain the signature? ________________________________________________________

Did that parent have access to the bonds?

Could that parent have possession of the bonds?

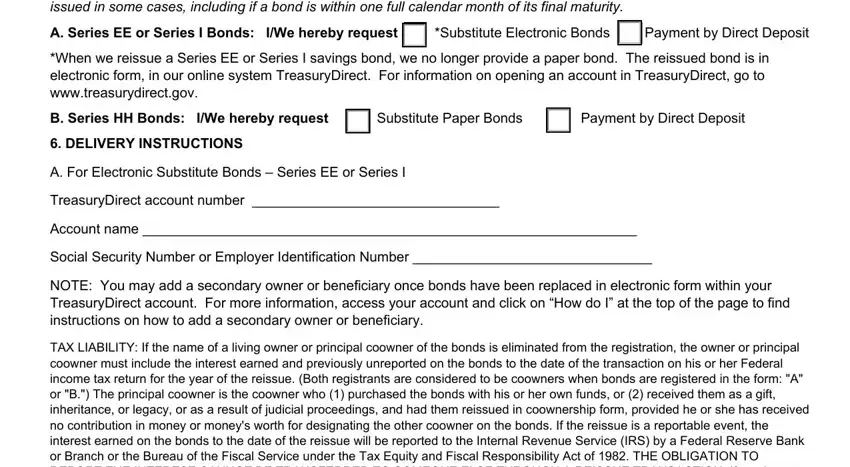

5.RELIEF REQUESTED – Indicate whether you want substitute bonds or payment. NOTE: Substitute bonds can’t be issued in some cases, including if a bond is within one full calendar month of its final maturity.

A. Series EE or Series I Bonds: I/We hereby request

*Substitute Electronic Bonds  Payment by Direct Deposit

Payment by Direct Deposit

*When we reissue a Series EE or Series I savings bond, we no longer provide a paper bond. The reissued bond is in electronic form, in our online system TreasuryDirect. For information on opening an account in TreasuryDirect, go to www.treasurydirect.gov.

B. Series HH Bonds: I/We hereby request |

|

Substitute Paper Bonds |

6. DELIVERY INSTRUCTIONS |

|

|

Payment by Direct Deposit

A. For Electronic Substitute Bonds – Series EE or Series I

TreasuryDirect account number ________________________________

Account name ________________________________________________________________

Social Security Number or Employer Identification Number _______________________________

NOTE: You may add a secondary owner or beneficiary once bonds have been replaced in electronic form within your TreasuryDirect account. For more information, access your account and click on “How do I” at the top of the page to find instructions on how to add a secondary owner or beneficiary.

TAX LIABILITY: If the name of a living owner or principal coowner of the bonds is eliminated from the registration, the owner or principal coowner must include the interest earned and previously unreported on the bonds to the date of the transaction on his or her Federal income tax return for the year of the reissue. (Both registrants are considered to be coowners when bonds are registered in the form: "A" or "B.") The principal coowner is the coowner who (1) purchased the bonds with his or her own funds, or (2) received them as a gift, inheritance, or legacy, or as a result of judicial proceedings, and had them reissued in coownership form, provided he or she has received no contribution in money or money's worth for designating the other coowner on the bonds. If the reissue is a reportable event, the interest earned on the bonds to the date of the reissue will be reported to the Internal Revenue Service (IRS) by a Federal Reserve Bank or Branch or the Bureau of the Fiscal Service under the Tax Equity and Fiscal Responsibility Act of 1982. THE OBLIGATION TO REPORT THE INTEREST CANNOT BE TRANSFERRED TO SOMEONE ELSE THROUGH A REISSUE TRANSACTION. If you have questions concerning the tax consequences, consult the IRS, or write to the Commissioner of Internal Revenue, Washington, DC 20224. Unless we are otherwise informed, the first-named coowner will be considered the principal coowner for the purpose of this transaction.

B. For Substitute Paper Bonds—Series HH

Mail Bonds To: _________________________________________________________________________

(Name)

____________________________________________________________________________________________

|

|

|

|

|

(Number and Street, Rural Route, or P O Box) |

(City) |

(State) |

(ZIP Code) |

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

|

2 |

C. For Direct Deposit Payment--Any Series of Bonds

Payee must provide a Social Security Number or Employer Identification Number:

______________________________________ OR |

__________________________________________ |

(Social Security Number of Payee) |

(Employer Identification Number of Payee) |

________________________________________________________________________________________

(Name/Names on the Account)

Bank Routing No. (nine digits and begins with 0, 1, 2, or 3): _______________________________

_________________________________________ |

Type of Account |

(Depositor’s Account No.)

___________________________________________________ |

______________________________ |

(Financial Institution’s Name) |

(Financial Institution’s Phone No.) |

7. Signatures and Certification

I/We severally petition the Secretary of the Treasury for relief as authorized by law and, if relief is granted, acknowledge that the original securities will become the property of the United States. Upon the granting of relief, I/we assign all our right, title, and interest in the original securities to the United States and hereby bind myself/ourselves, my/our heirs, executors, administrators, successors and assigns, jointly and severally: (1) to surrender the original securities to the Department of the Treasury should they come into my/our possession; (2) to hold the United States harmless on account of any claim by any other parties having, or claiming to have, interests in these securities; and (3) upon demand by the Department of the Treasury, to indemnify unconditionally the United States and repay to the Department of the Treasury all sums of money which the Department may pay due to the redemption of these original securities, including any interest, administrative costs and penalties, and any other liability or losses incurred as a result of such redemption. I/We consent to the release of any information in this form or regarding the securities described to any party having an ownership or entitlement interest in these securities.

I/We certify, under penalty of perjury, and severally affirm and say that the securities described on this form have been lost, stolen, or destroyed, and that the information given is true to the best of my/our knowledge and belief.

Sign in ink in the presence of a notary or certifying officer and provide the requested information.

Sign

Here:___________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

_____________________________________________________ |

______________________________________________ |

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Sign

Here:___________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

_____________________________________________________ |

______________________________________________ |

(City) |

(State) |

(ZIP Code) |

(Email Address) |

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

3 |

Sign

Here:___________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

_____________________________________________________ |

______________________________________________ |

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. Original signature is required if a Medallion stamp is used. 3. Person(s) must sign in your presence.

I CERTIFY that _________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

|

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

|

________________________________________________________ |

|

|

(Signature and Title of Notary or Certifying Officer) |

|

|

________________________________________________________ |

|

|

(Name of Financial Institution) |

|

|

________________________________________________________ |

|

|

(Address) |

|

|

________________________________________________________ |

|

|

(City, State, ZIP code) |

|

|

________________________________________________________ |

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION |

(Telephone) |

|

|

|

I CERTIFY that _________________________________________________________________________ , whose identity(ies) |

|

|

(Names of Persons Who Appeared) |

|

|

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

|

|

|

(Month) |

(Year) |

|

at ___________________________________________________ and signed this form. |

|

|

|

(City, State) |

|

|

|

________________________________________________________ |

|

|

|

|

(Signature and Title of Notary or Certifying Officer) |

|

|

|

________________________________________________________ |

|

|

|

|

(Name of Financial Institution) |

|

|

|

________________________________________________________ |

|

|

|

|

(Address) |

|

|

|

________________________________________________________ |

|

|

|

|

(City, State, ZIP code) |

|

|

|

________________________________________________________ |

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION |

|

|

(Telephone) |

|

|

|

|

|

|

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

4 |

I CERTIFY that _________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

|

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

|

________________________________________________________ |

|

|

(Signature and Title of Notary or Certifying Officer) |

|

|

________________________________________________________ |

|

|

(Name of Financial Institution) |

|

|

________________________________________________________ |

|

|

(Address) |

|

|

________________________________________________________ |

|

|

(City, State, ZIP code) |

|

|

________________________________________________________ |

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION |

(Telephone) |

|

|

INSTRUCTIONS

IF YOU LIVE IN A DECLARED DISASTER AREA: You need to complete only parts 1, 5, 6.B. and 7. Write the word “DISASTER” on the top of the first page of the form and on the front of the envelope.

PURPOSE OF FORM – Use this form to apply for relief on account of the loss, theft, or destruction of United States Savings Bonds. "Bonds," as used on this form, refers to Savings Bonds, Savings Notes, Retirement Plan Bonds, or Individual Retirement Bonds.

WHO MAY APPLY – This form must be completed and signed by all persons named on the bonds, or by an authorized representative.

PROOF OF DEATH – If a registrant is deceased, you must submit a certified copy of his or her official death certificate with this form.

LEGAL REPRESENTATIVE – If you were appointed as legal representative because:

the owner is deceased (with no surviving coowner or beneficiary named on the bonds), or

the owner or coowner is a minor, or

the owner or coowner is incapacitated,

complete the form and submit a court certificate or certified copy of your letters of appointment, under court seal and dated within one year of submission, showing the appointment is still in full force. If your name and official capacity are shown in the registration of the bonds, evidence of your appointment is not necessary.

If no legal representative has been appointed for a deceased or incompetent owner, advise the Bureau of the Fiscal Service and additional instructions will be provided.

AMOUNT OF BONDS EXCEEDS $5,000 – If the amount of the bonds involved exceeds $5,000 and an investigation was made by a law enforcement agency or an insurance, transportation, or similar business organization, provide a copy of the report.

COMPLETION OF FORM – Print clearly in ink or type all information requested.

ITEM 1. Describe the missing bonds by bond serial number. If you don't know the bond serial numbers, you must provide the exact issue date or a range of dates, and the Social Security Number, name (including middle name or initial), and complete address (street, city, state) that appear on the bonds. Also state the total number of missing bonds. If you need more space, attach either a “Continuation Sheet for Listing Securities” (FS Form 3500), available at http://www.treasurydirect.gov/forms/sav3500.pdf or a plain sheet of paper.

ITEM 2. Mark the appropriate boxes and provide complete details of the loss, theft, or destruction.

ITEM 3. Provide details regarding your authority to complete a claim for the missing bonds. If you have been court-appointed, see "LEGAL REPRESENTATIVE" above.

ITEM 4. A minor (who does not have a court-appointed guardian) who is requesting payment or who is named on Series HH bonds may complete and sign the form on his or her own behalf if, in the opinion of the notary or certifying officer, he or she is of sufficient competency and understanding to comprehend the nature of the transaction. The parents or parent with whom the minor resides must complete this item if a minor is named on the bonds and he or she is not of sufficient competency and understanding to complete the form on his or her own behalf, or is requesting electronic substitute bonds for Series EE or Series I. Provide the minor’s name, date of birth, Social Security Number, and all other requested information. If the minor does not reside with either parent, the form must be completed and signed by the individual who furnishes the minor’s chief support.

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

5 |

ITEM 5. Indicate whether you want substitute bonds or payment by direct deposit.

For Series EE and Series I bonds, we no longer issue substitute bonds in paper form. We issue those substitute bonds in electronic form, in our online system TreasuryDirect.

If you want substitute Series EE bonds or substitute Series I bonds, provide the TreasuryDirect account number. If you don’t have an account, you may open one at www.treasurydirect.gov.

Series EE and Series I bonds issued February 2003 and later are not eligible for payment until one full year after issue; if payment is requested and such bonds are less than one year old, substitute bonds will be issued instead.

If substitute bonds are requested and a bond is within less than one full calendar month of reaching its final maturity, or has reached final maturity, payment will be made instead.

ITEM 6. Complete either section A, B, or C. Which section is appropriate for you depends on which series of bonds you have and whether you want payment or substitute bonds.

CERTIFICATION – Each person whose signature is required must appear before and establish identification to the satisfaction of a notary or authorized certifying officer. The signatures to the form must be signed in the presence of the notary or officer. The notary or certifying officer must affix the seal or stamp which is used when certifying requests for payment. Authorized certifying officers are available at financial institutions, including credit unions, in the United States. Examples of acceptable seals and stamps:

The seal or stamp of a notary

A financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying agent seal or stamp (including name, location, and four-digit identification number or nine-digit routing number)

The seal or stamp of Treasury-recognized Signature Guarantee Programs or other Treasury-approved Medallion Programs

WHERE TO SEND – Send this form and any additional information to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN 55480-9150

NOTICE UNDER PRIVACY ACT AND PAPERWORK REDUCTION ACT

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 20 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV 26106-1328. DO NOT SEND completed form to this

address; send to the address shown in "WHERE TO SEND" in the Instructions.

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

6 |

Payment by Direct Deposit

Payment by Direct Deposit