Form Pd F 4000 E can be completed with ease. Simply make use of FormsPal PDF tool to get it done promptly. To make our editor better and more convenient to utilize, we consistently design new features, taking into account suggestions coming from our users. To get the ball rolling, go through these simple steps:

Step 1: Open the PDF in our editor by clicking on the "Get Form Button" in the top section of this page.

Step 2: With our advanced PDF file editor, you can accomplish more than merely fill out blank fields. Edit away and make your documents look professional with custom text put in, or optimize the file's original content to perfection - all that comes with the capability to add stunning graphics and sign the PDF off.

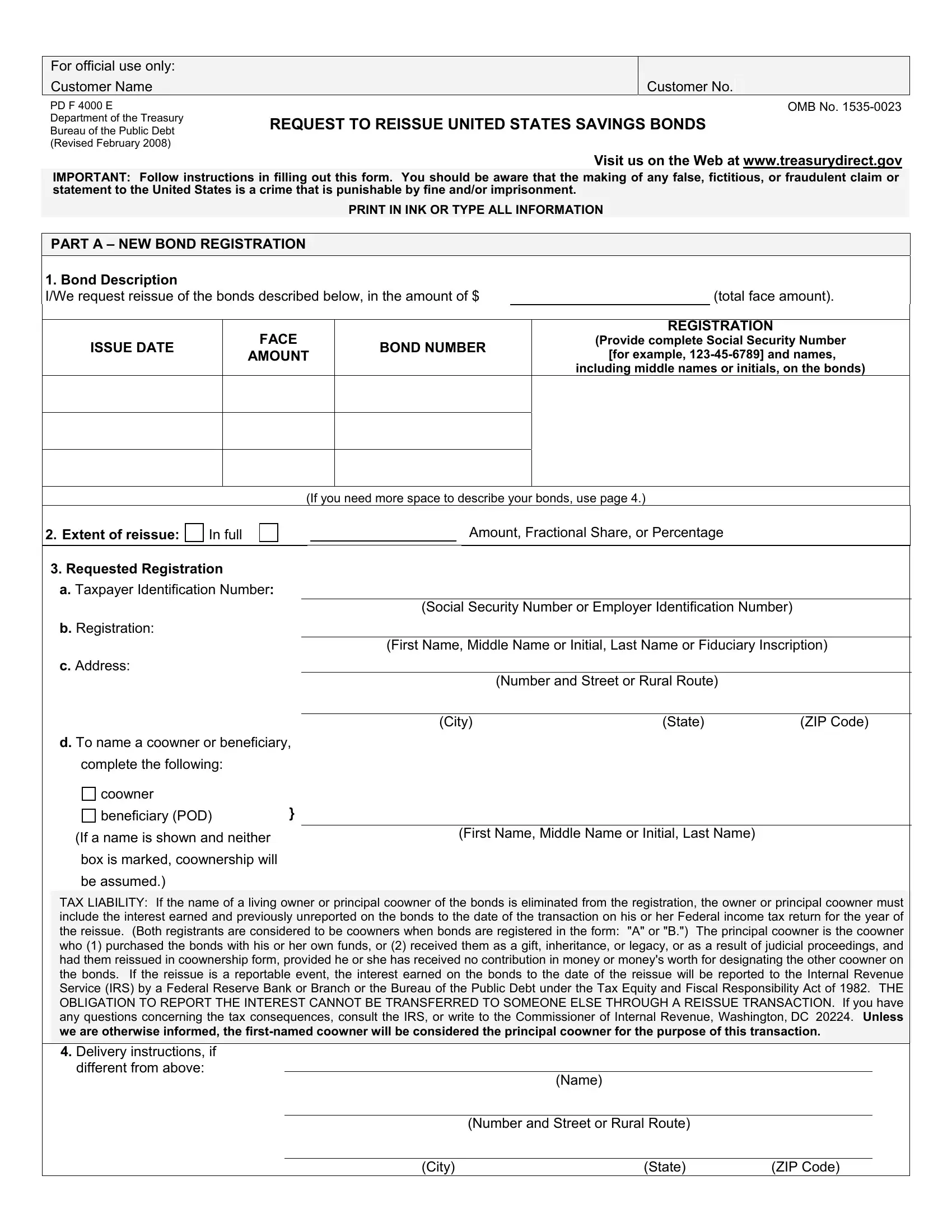

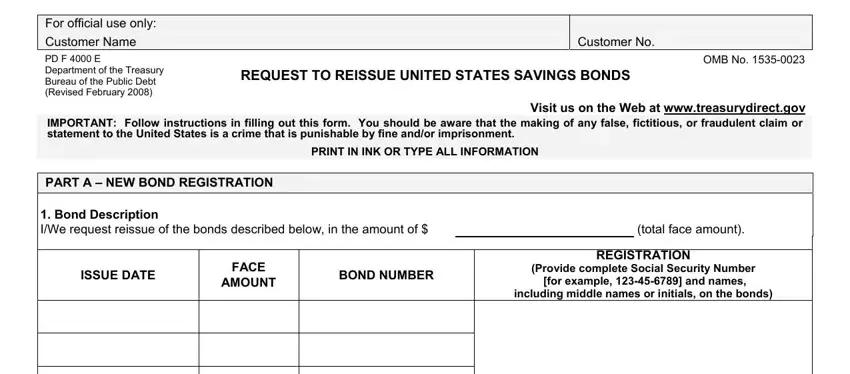

If you want to complete this PDF document, ensure that you provide the necessary details in each and every field:

1. Fill out your Form Pd F 4000 E with a group of necessary blank fields. Consider all the necessary information and be sure there is nothing overlooked!

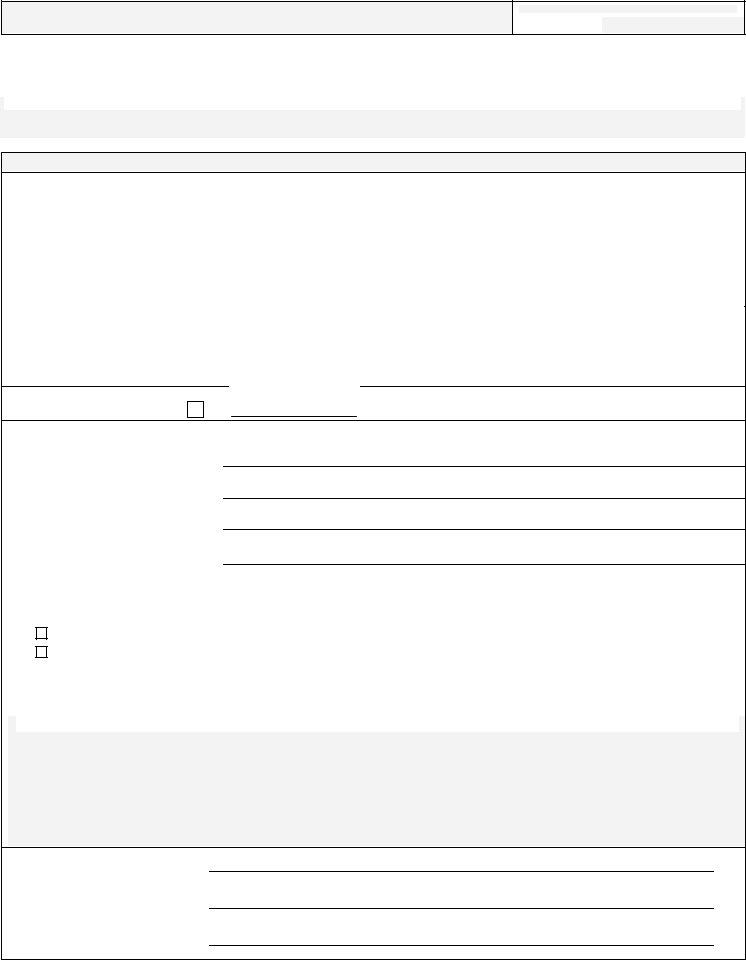

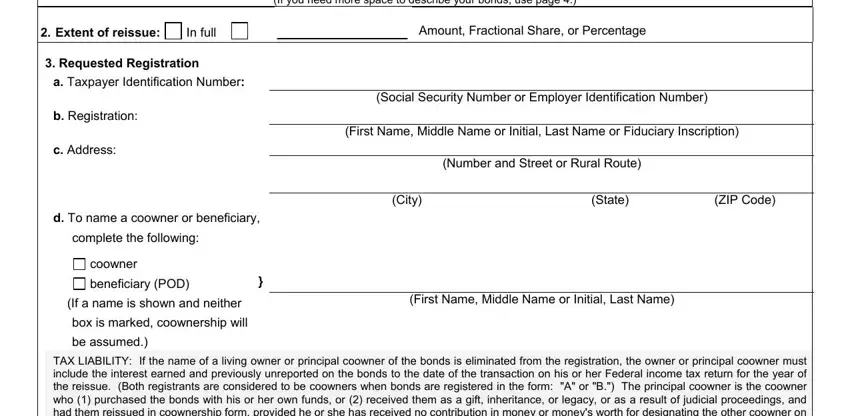

2. When the last part is done, it's time to include the required particulars in Extent of reissue Requested, In full, a Taxpayer Identification Number, b Registration, c Address, d To name a coowner or beneficiary, complete the following, coowner, beneficiary POD, If a name is shown and neither, box is marked coownership will, be assumed, If you need more space to describe, Amount Fractional Share or, and Social Security Number or Employer in order to move forward further.

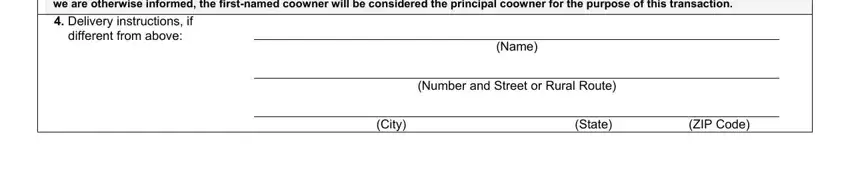

3. The following section is mostly about TAX LIABILITY If the name of a, Delivery instructions if, Name, Number and Street or Rural Route, City, State, and ZIP Code - fill out all these blank fields.

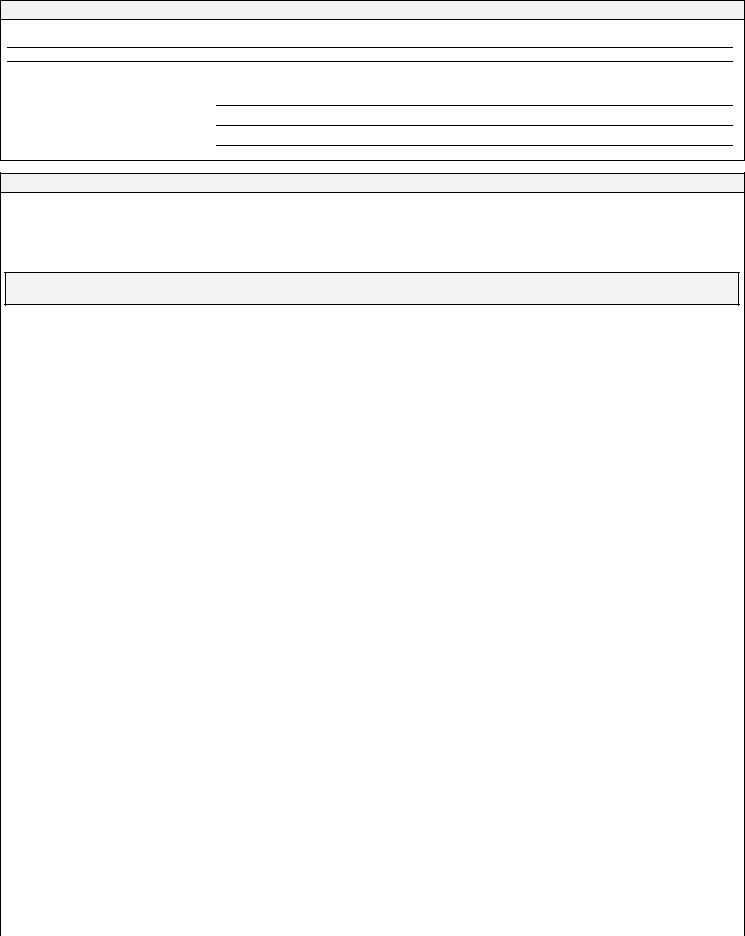

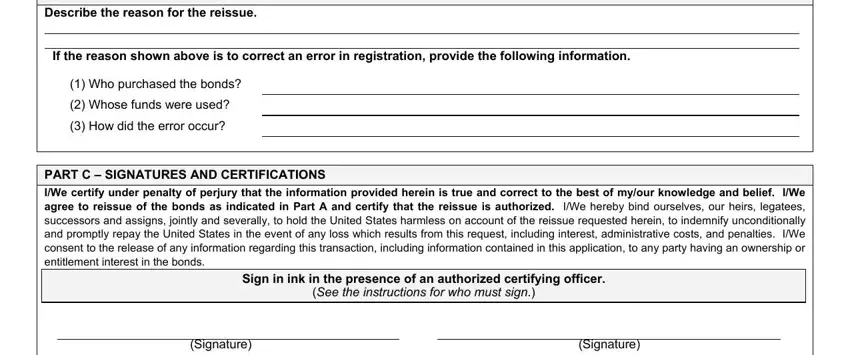

4. To go ahead, this part will require filling out a handful of fields. Examples include PART B REASON FOR REISSUE, If the reason shown above is to, Who purchased the bonds, Whose funds were used, How did the error occur, PART C SIGNATURES AND, IWe certify under penalty of, Sign in ink in the presence of an, See the instructions for who must, Signature, and Signature, which are integral to continuing with this particular process.

When it comes to See the instructions for who must and Signature, be sure that you get them right here. These could be the most significant fields in the file.

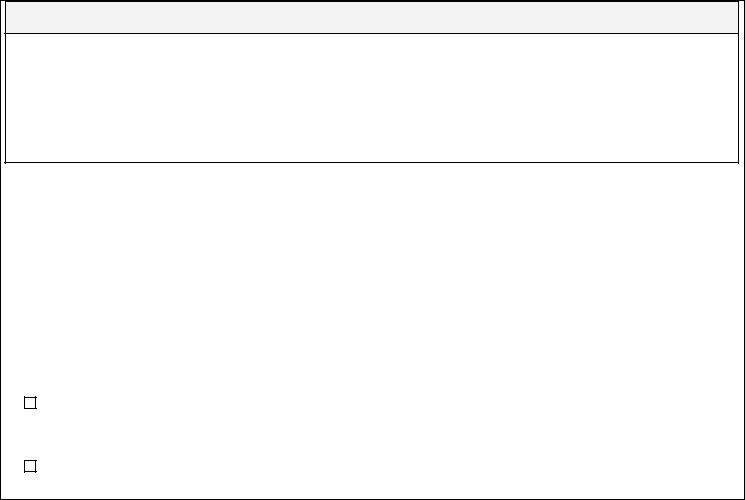

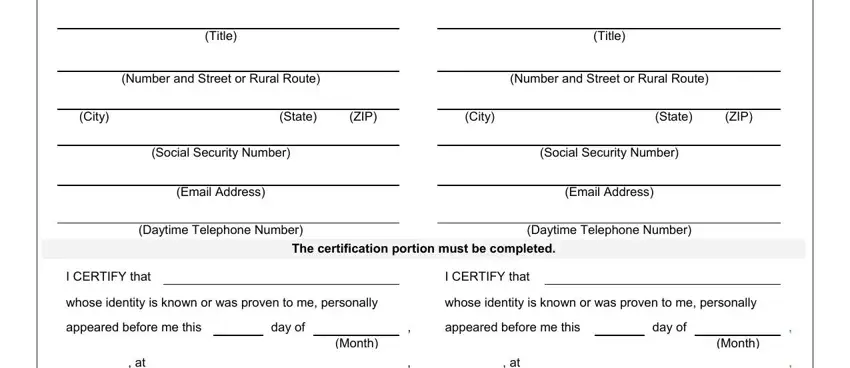

5. Lastly, the following last subsection is what you have to complete before using the PDF. The blank fields here include the following: Title, Number and Street or Rural Route, City, State, ZIP, Social Security Number, Email Address, Daytime Telephone Number, Title, Number and Street or Rural Route, City, State, ZIP, Social Security Number, and Email Address.

Step 3: Check the details you've inserted in the blank fields and click the "Done" button. Get hold of your Form Pd F 4000 E once you register online for a 7-day free trial. Readily access the pdf file within your personal account page, with any edits and changes being all preserved! FormsPal ensures your data confidentiality via a secure system that in no way saves or shares any private information provided. Feel safe knowing your files are kept confidential whenever you work with our service!