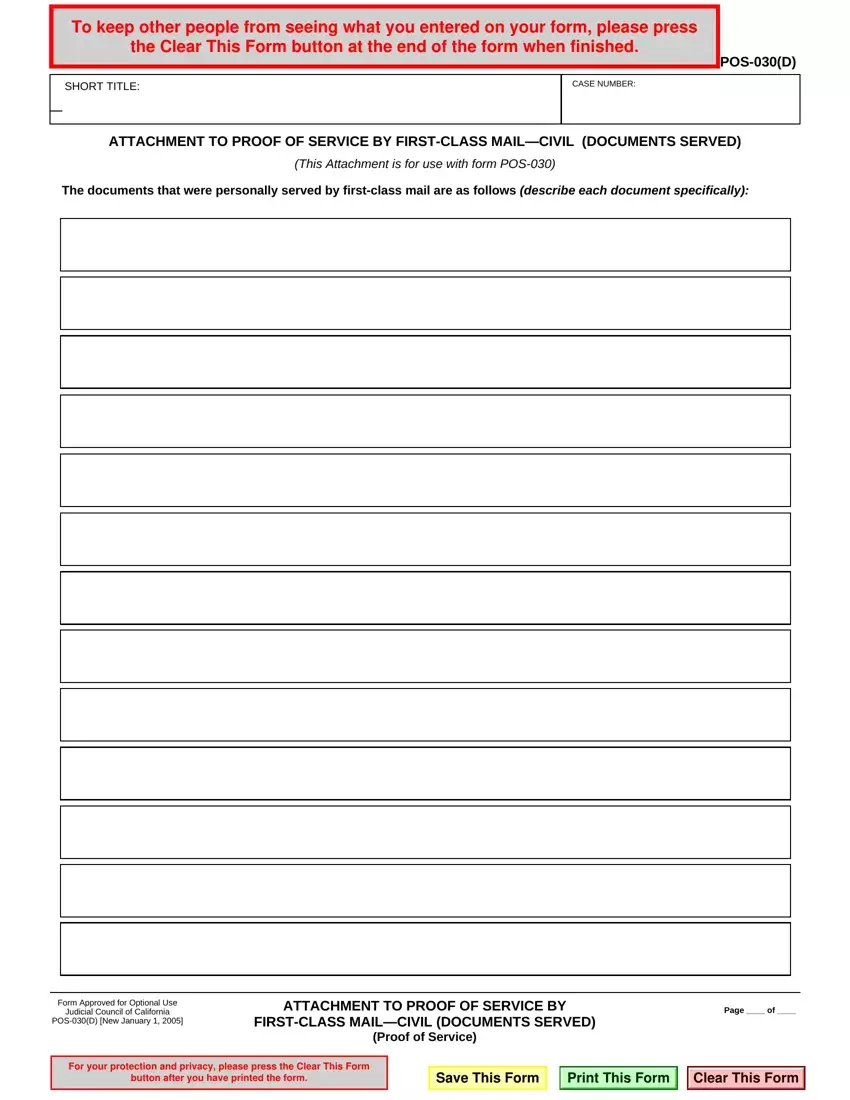

You can certainly fill in forms taking advantage of our PDF editor. Enhancing the california pos030 d form is not hard if you use the next steps:

Step 1: To begin the process, select the orange button "Get Form Now".

Step 2: You are now on the file editing page. You may edit, add text, highlight certain words or phrases, place crosses or checks, and include images.

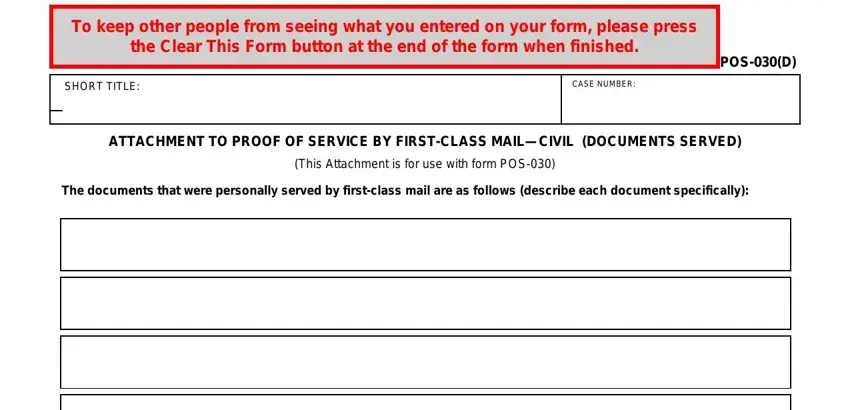

Fill in the next segments to fill in the document:

Fill out the fields with any information which may be asked by the system.

You will be required to write down the details to let the system fill in the part Form Approved for Optional Use, ATTACHMENT TO PROOF OF SERVICE BY, and Page of.

Step 3: Choose the Done button to save your document. Then it is available for upload to your gadget.

Step 4: In order to prevent different difficulties as time goes on, try to have around two or three duplicates of the document.