Navigating the specifics of tax abatements for veterans and the blind in relation to motor vehicle fees and property taxes in Utah requires understanding the Pt 032 form, a crucial document introduced by the state legislature under the Utah Code Annotated (UCA) §59-2-110 through 1106. This form facilitates the application process for those seeking either a veteran or blind exemption from uniform fees or property tax on their motor vehicles. It meticulously outlines the required fields of information, starting with claimant and vehicle details, guiding applicants through the computation of the abatement amount, and concluding with mandatory certification and signatures from both the claimant and the county auditor/treasurer. The form also delves into the calculation of taxable value for a range of tangible personal property, from passenger cars to personal watercraft, based on applicable uniform fees. Such detailed structuring ensures that eligible individuals can precisely calculate potential abatements, leveraging guidelines like the administrative rule R884-24P-64 for tangible personal property valuation. Additionally, it provides essential contact information for further assistance, underscoring the form's role in making the exemption application process as clear and accessible as possible for Utah residents with qualifying disabilities.

| Question | Answer |

|---|---|

| Form Name | Form Pt 032 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | pt 032 uca form pt 032 |

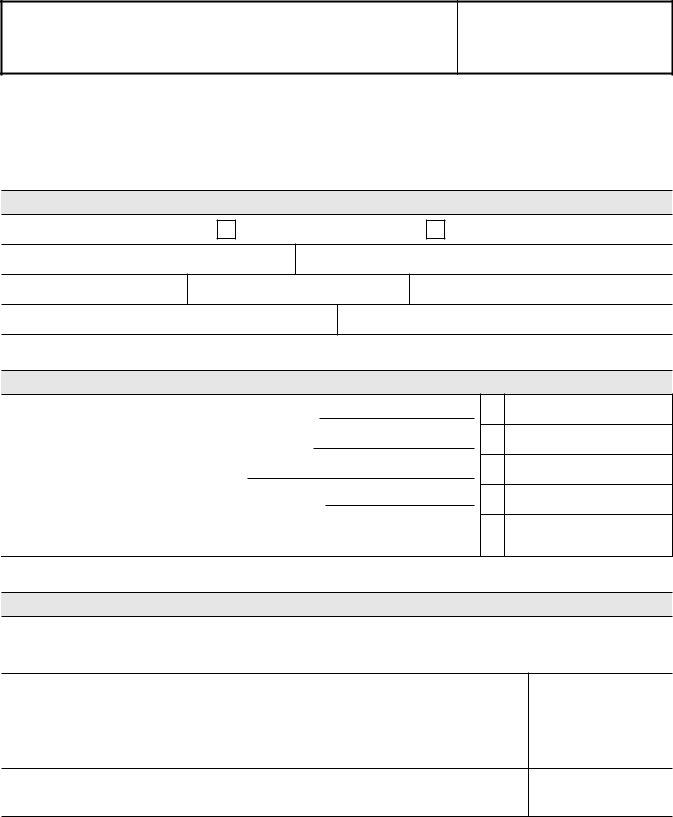

Veteran or Blind Abatement of Motor Vehicle

Uniform Fees and Property Tax

UCA

Form

Claimant: complete Section 1 and sign in Section 3

County Auditor/Treasurer: complete Section 2 and sign in Section 3

After form is completed by claimant and by county auditor/treasurer, form should be taken to local motor vehicle office.

Section 1 – Claimant and Vehicle Information

Applying for (select one)

Veteran Exemption

Blind Exemption

First name

Last name

Vehicle model year

Make

Model

Vehicle Identification Number (VIN)

License plate number

Section 2 – Abatement Computation

1.Uniform fee or property tax amount

(obtain from Vehicle Registration Renewal Notice)

2.Appropriate property tax rate (see reverse side)

3.Divide line 1 by line 2 = taxable value

4.Exemption value available (from Auditor's records)

5.Abatement Amount

(the smaller of line 3 or line 4, multiplied by the property tax rate on line 2)

1.$

3.$

4.$

5.$

Section 3 – Certification and Signature

Under penalties of perjury, I declare to the best of my knowledge and understanding, that this information is true, correct, and complete. I further testify that I am a lawful resident of the State of Utah.

Claimant’s signature or preparer’s name, address, and telephone number

Date

County Auditor/Treasurer’s Office signature/seal

Date

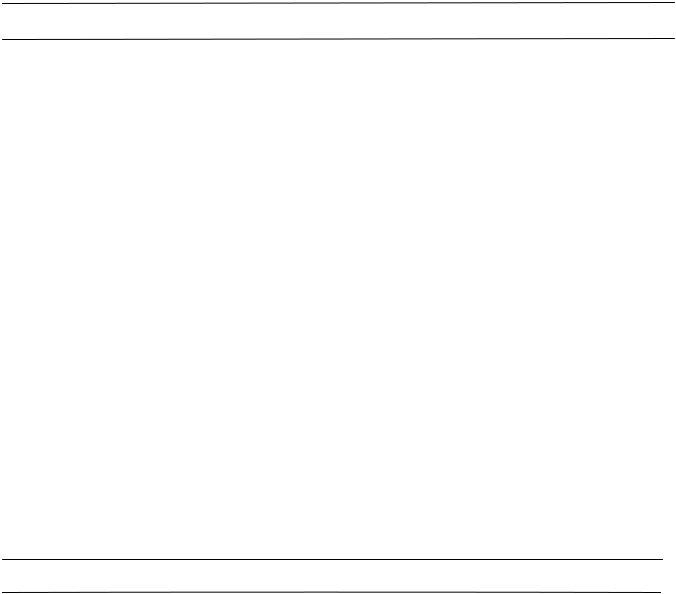

Page 2 - Veteran or Blind Abatement of Motor Vehicle Uniform Fees and Property Tax

Uniform Fee on Personal Property Required to be Registered with the State

For purposes of the disabled veterans exemption and the blind exemption, the taxable value of tangible personal property subject to a uniform fee under Section

As an example of how

Age of Passenger Car |

Uniform Fee |

Taxable Value |

Less than 3 years |

$150 |

$10,000 |

3 to 5 years |

110 |

7,330 |

6 to 8 years |

80 |

5,330 |

9 to 11 years |

50 |

3,330 |

12 plus years |

10 |

670 |

Likewise, the taxable value of other tangible personal property required to be registered with the state is to be calculated by dividing the appropriate uniform fee as located in Section

♦Heavy and medium duty trucks and commercial

♦Vessels 31 Ft and longer (yachts and houseboats), are subject to a 1.5 % Uniform Fee (.015)

♦Motor Homes are subject to a 1.25% Uniform Fee (.0125)

♦Aircraft are subject to a .4% Uniform Fee (.004)

♦Aerial Applicators are subject to a .2% Uniform Fee (.002)

Personal Property Subject to Ad Valorem Property Tax Rate

♦Vintage Vehicles – local ad valorem property tax rate

♦