You'll find nothing complex in relation to filling out the pt 100 form once you start using our editor. By simply following these easy steps, you'll get the fully filled out PDF document in the shortest period feasible.

Step 1: Click the orange "Get Form Now" button on this page.

Step 2: Now, you can start modifying your pt 100 form. The multifunctional toolbar is readily available - add, delete, adjust, highlight, and undertake various other commands with the words and phrases in the document.

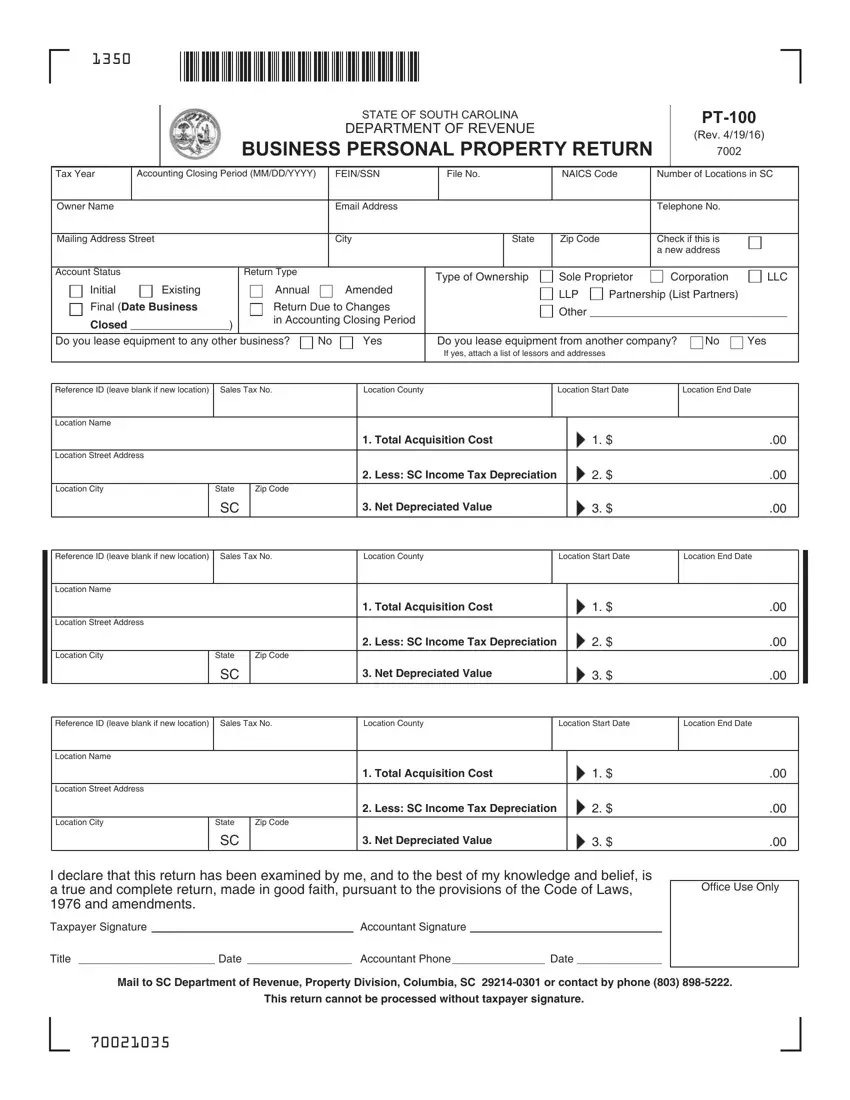

To fill in the pt 100 form PDF, provide the details for all of the sections:

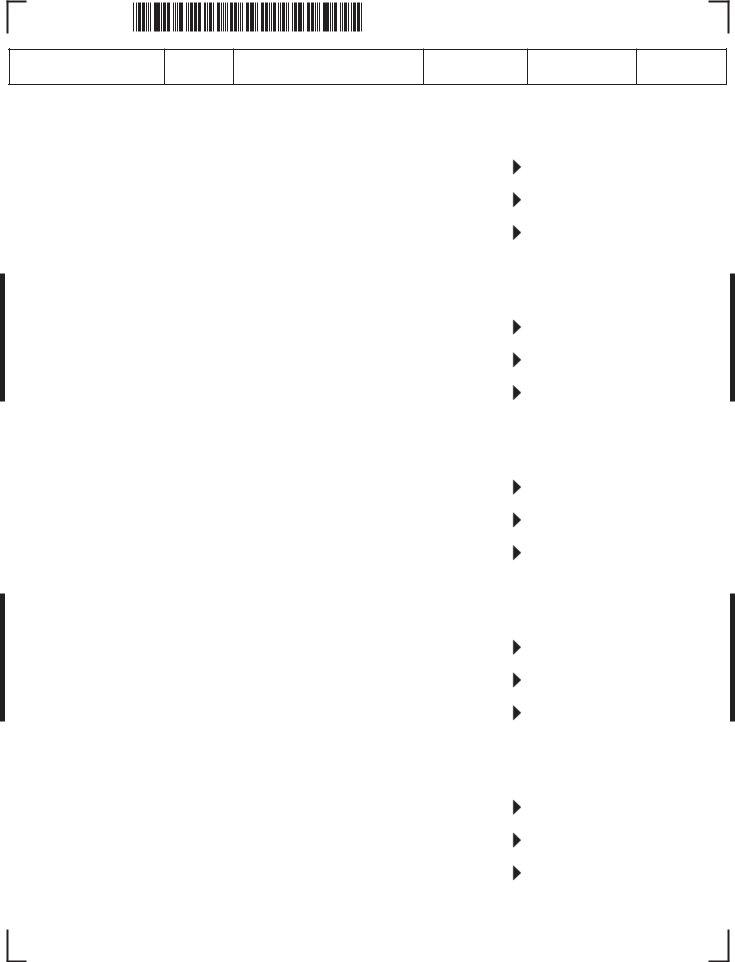

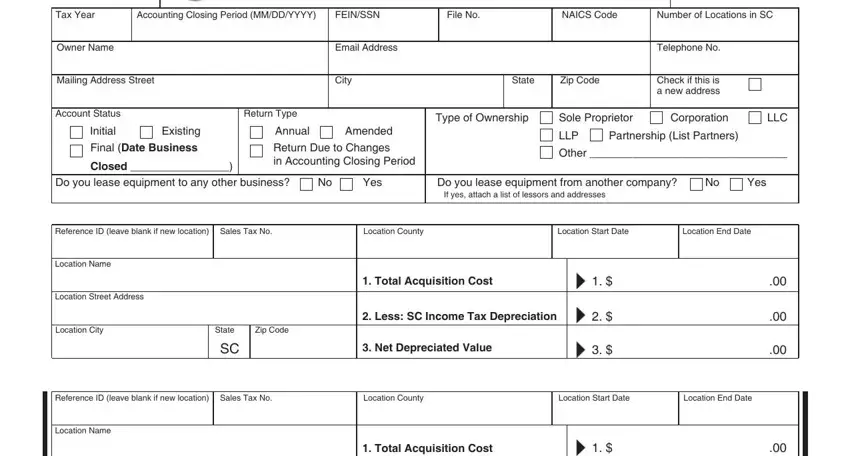

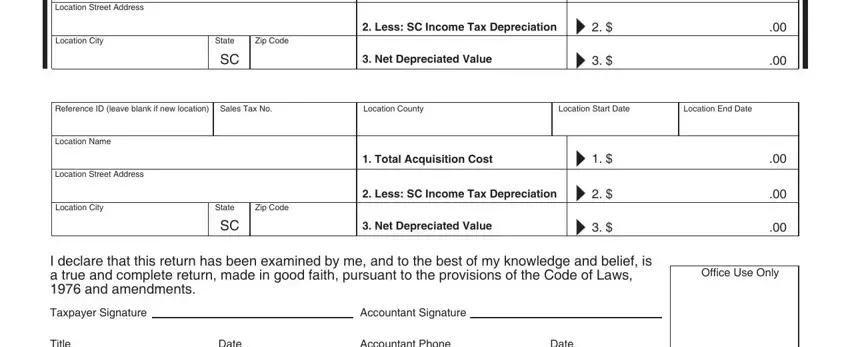

Type in the expected information in the Location, Street, Address Less, SC, Income, Tax, Depreciation Location, City State, Zip, Code Net, Depreciated, Value Location, County Location, Start, Date Location, EndDate Location, Name Location, Street, Address Total, Acquisition, Cost Less, SC, Income, Tax, Depreciation Location, City and State field.

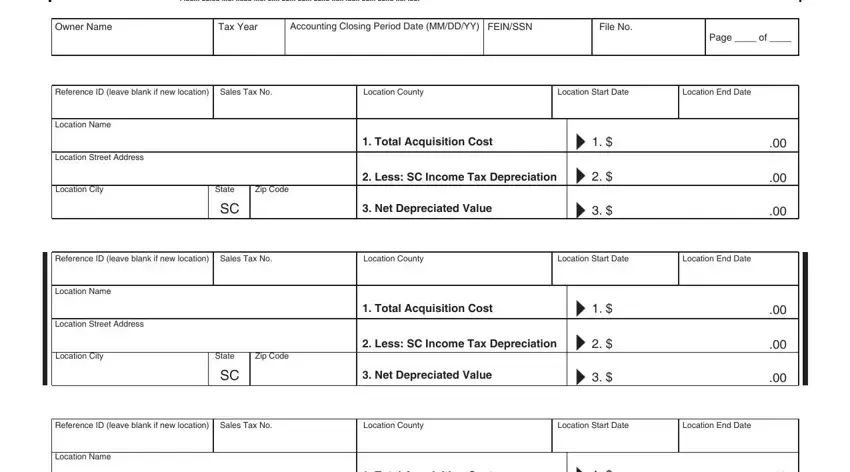

Focus on the crucial details the Owner, Name Tax, Year File, No Page, of Location, County Location, Start, Date Location, EndDate Location, Name Location, Street, Address Total, Acquisition, Cost Less, SC, Income, Tax, Depreciation Location, City State, Zip, Code and Net, Depreciated, Value area.

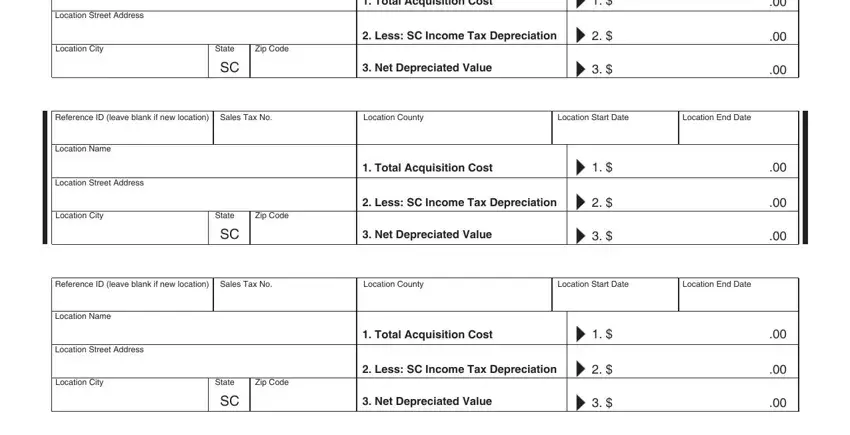

The space Location, Street, Address Total, Acquisition, Cost Less, SC, Income, Tax, Depreciation Location, City State, Zip, Code Net, Depreciated, Value Location, County Location, Start, Date Location, EndDate Location, Name Location, Street, Address Total, Acquisition, Cost Less, SC, Income, Tax, Depreciation and Location, City is where you can add both parties, ' rights and responsibilities.

Step 3: Click the "Done" button. Now you may transfer the PDF document to your device. As well as that, you'll be able to deliver it by means of email.

Step 4: Generate a duplicate of each file. It will save you some time and allow you to avoid worries down the road. By the way, the information you have will not be used or monitored by us.