Our best computer programmers worked hard to design the PDF editor we're extremely pleased to present to you. Our application will let you instantly complete PT001 and will save you valuable time. You just need to try out this particular procedure.

Step 1: Choose the button "Get Form Here" and then click it.

Step 2: Now you are ready to edit PT001. You've got many options thanks to our multifunctional toolbar - it's possible to add, delete, or change the information, highlight the particular areas, as well as undertake many other commands.

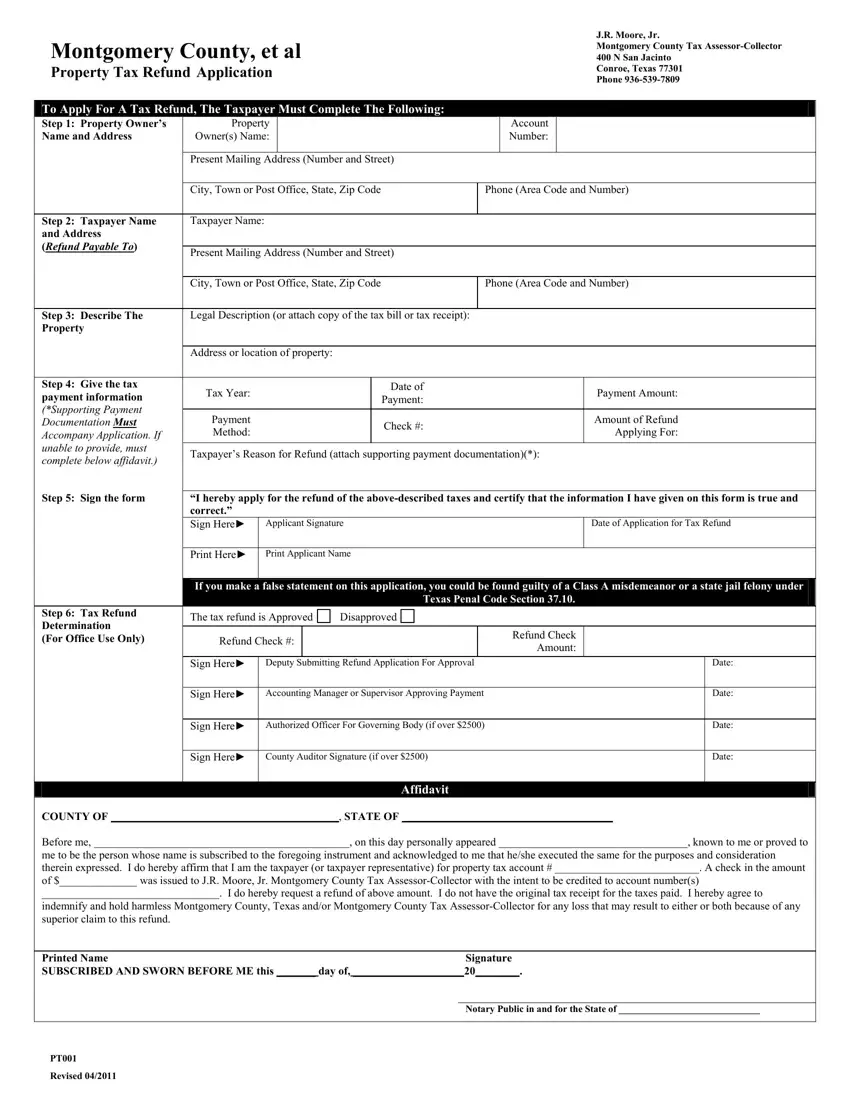

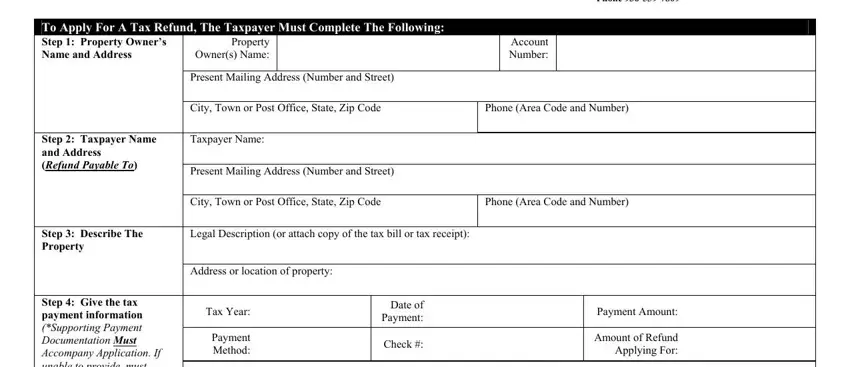

Provide the content demanded by the platform to create the document.

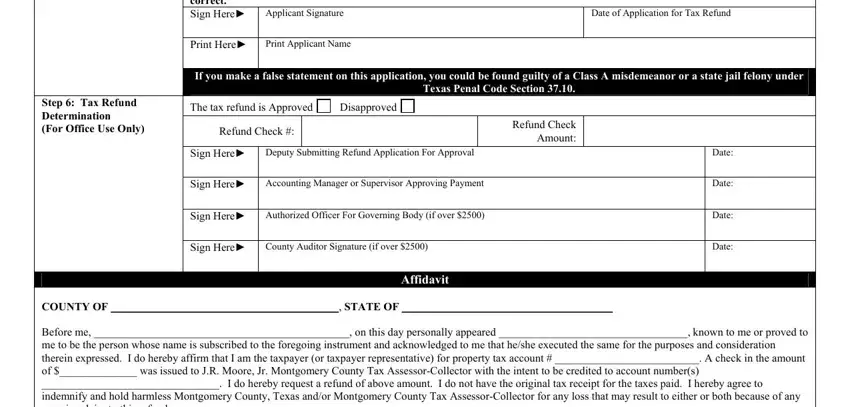

Inside the section I hereby apply for the refund of, Date of Application for Tax Refund, Applicant Signature, Print Here, Print Applicant Name, If you make a false statement on, Step Tax Refund Determination For, The tax refund is Approved, Disapproved, Refund Check, Refund Check Amount, Sign Here, Deputy Submitting Refund, Sign Here, and Accounting Manager or Supervisor write down the particulars the program asks you to do.

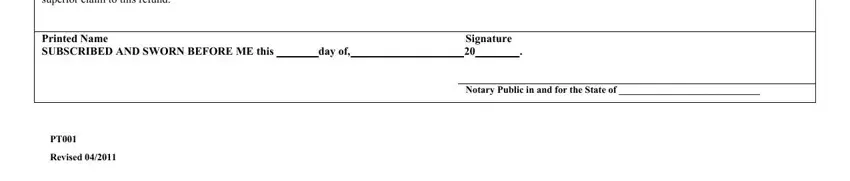

You can be asked to provide the information to help the program fill in the section Before me on this day personally, Printed Name SUBSCRIBED AND SWORN, Signature, Notary Public in and for the State, and Revised.

Step 3: Click the Done button to save your document. Now it is accessible for upload to your electronic device.

Step 4: Generate duplicates of the file - it will help you stay away from potential complications. And don't be concerned - we don't share or read your information.