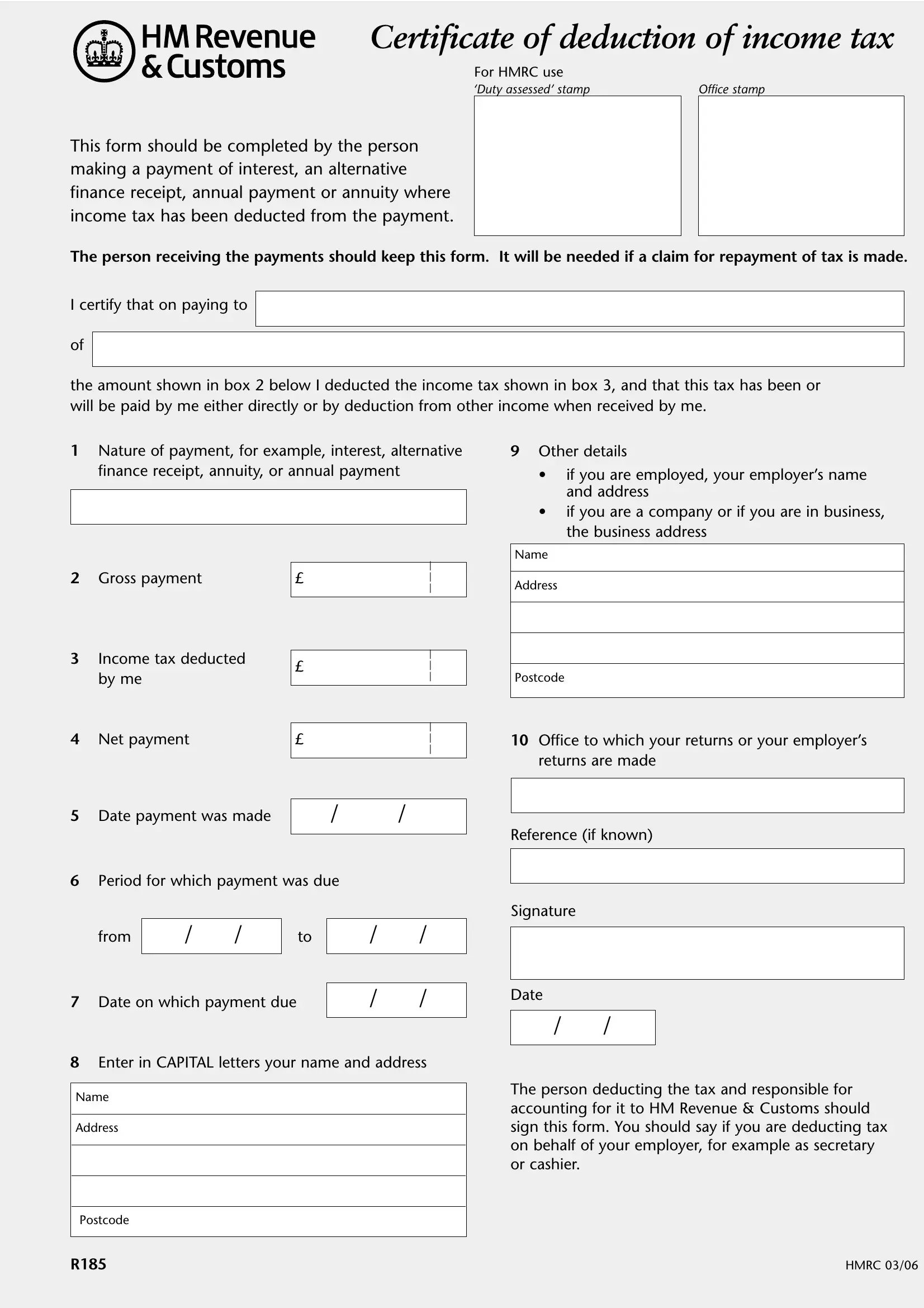

When using the online tool for PDF editing by FormsPal, you'll be able to fill in or edit fill 185 right here. The editor is consistently maintained by our staff, receiving new features and turning out to be greater. Starting is effortless! Everything you need to do is take the next easy steps below:

Step 1: Access the PDF in our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: After you launch the file editor, you'll see the form all set to be filled in. Other than filling out different blank fields, you can also perform many other actions with the Document, that is adding custom words, editing the initial textual content, adding graphics, signing the form, and a lot more.

It is simple to finish the document adhering to our helpful guide! Here is what you need to do:

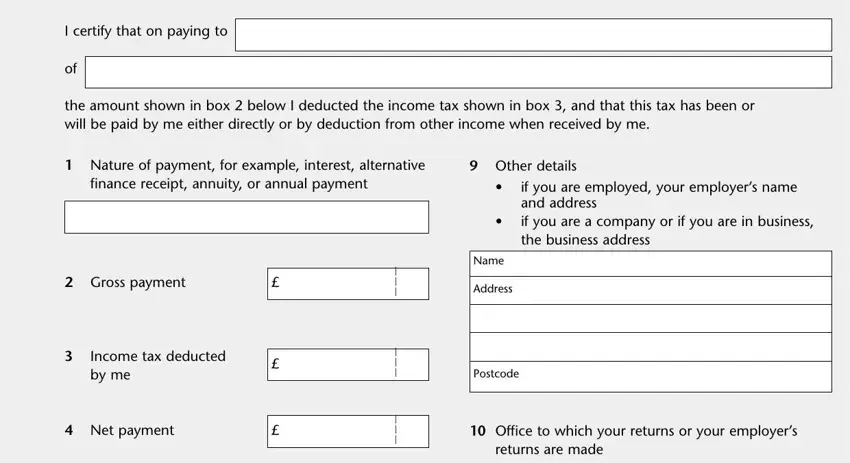

1. It is important to fill out the fill 185 correctly, thus be mindful while filling out the sections containing these blank fields:

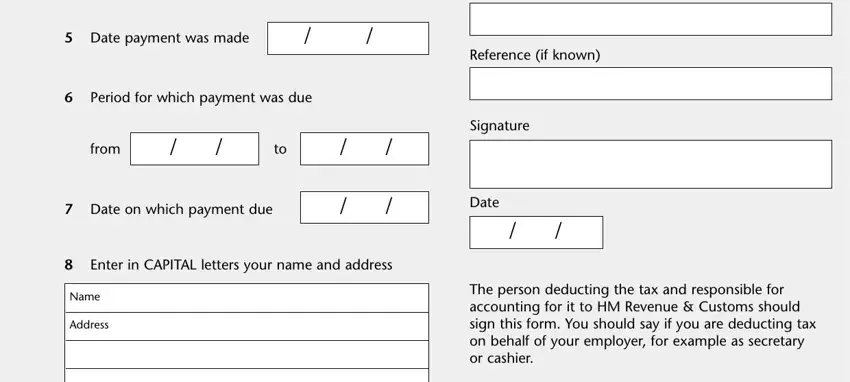

2. Given that the previous part is complete, it's time to put in the needed details in Date payment was made, Period for which payment was due, from to, Reference if known, Signature, Date on which payment due, Date, Enter in CAPITAL letters your name, Name, Address, and The person deducting the tax and so you're able to proceed to the 3rd stage.

Those who use this document often get some points wrong when completing Signature in this area. You need to go over everything you type in here.

3. Within this stage, take a look at Postcode, and HMRC. These will have to be taken care of with utmost accuracy.

Step 3: Before moving on, it's a good idea to ensure that all blanks have been filled in the right way. The moment you are satisfied with it, click on “Done." Grab your fill 185 as soon as you register online for a 7-day free trial. Readily use the pdf file in your FormsPal account page, together with any edits and adjustments automatically kept! When you use FormsPal, you'll be able to complete forms without having to get worried about information incidents or records getting distributed. Our secure platform makes sure that your personal details are kept safe.