It is possible to fill in Form Rcg 25 instantly with the help of our PDFinity® online tool. Our team is always endeavoring to expand the editor and help it become even faster for users with its many features. Uncover an endlessly innovative experience now - check out and uncover new opportunities along the way! With a few simple steps, you may start your PDF journey:

Step 1: First, access the editor by clicking the "Get Form Button" above on this page.

Step 2: With our state-of-the-art PDF editor, it's possible to accomplish more than just complete blanks. Try all of the functions and make your forms look sublime with customized textual content added, or fine-tune the original input to excellence - all accompanied by an ability to insert stunning pictures and sign the PDF off.

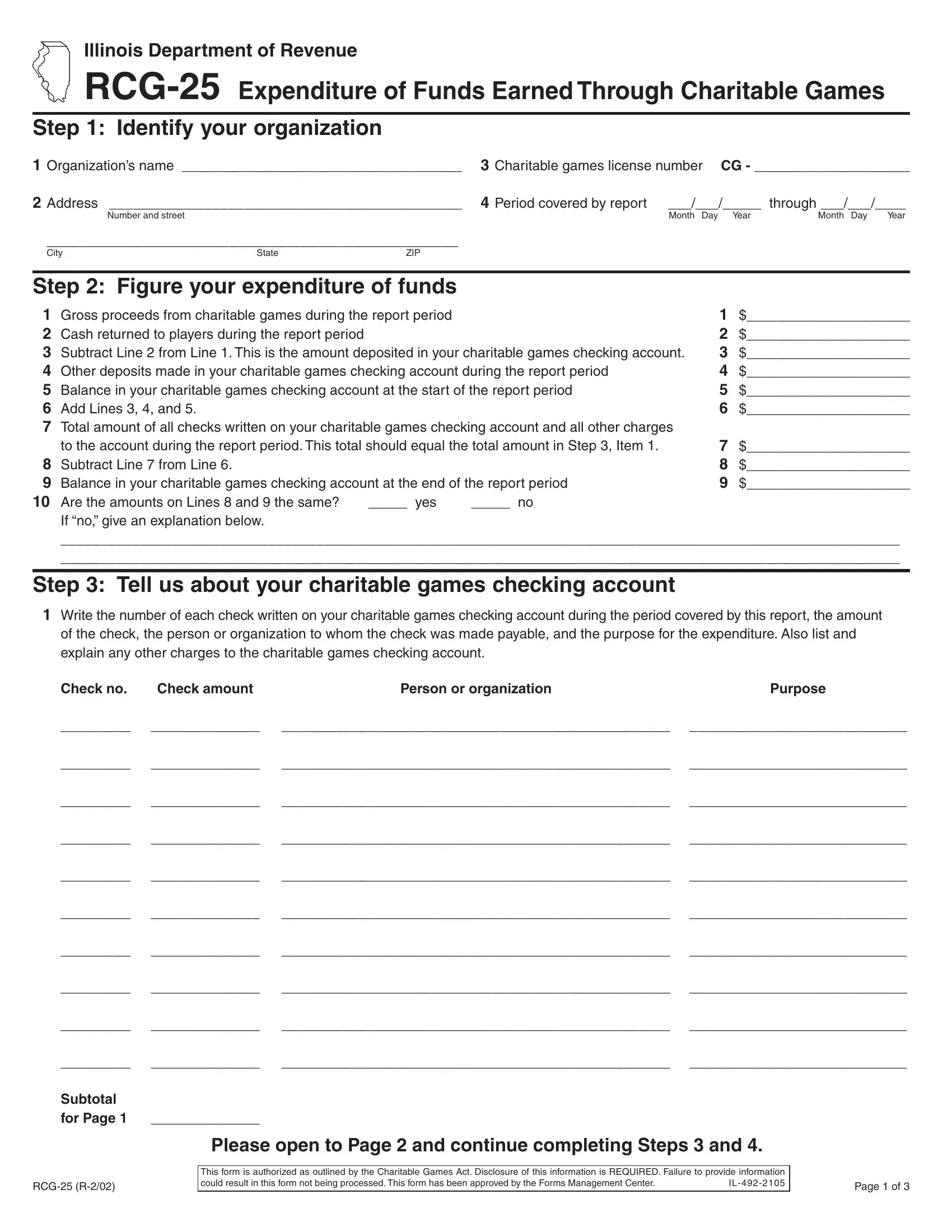

As for the fields of this precise document, here is what you need to know:

1. It is important to complete the Form Rcg 25 accurately, hence be mindful when filling in the areas containing all these fields:

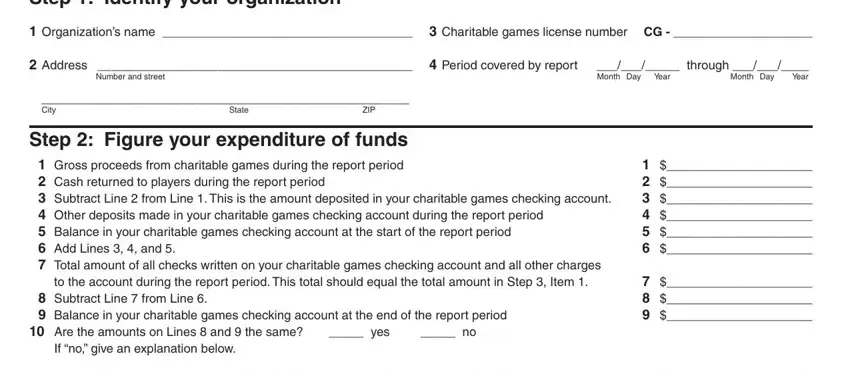

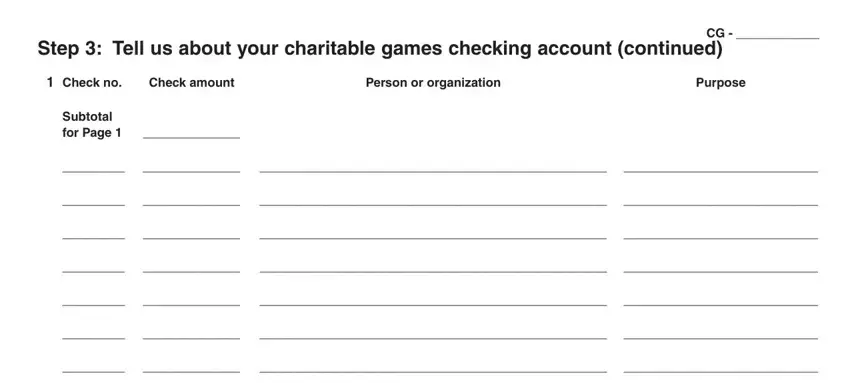

2. Now that the last array of fields is completed, you need to put in the necessary details in If no give an explanation below, Step Tell us about your, Write the number of each check, of the check the person or, Check no, Check amount, Person or organization, and Purpose so that you can progress to the 3rd part.

You can potentially make errors while filling in your of the check the person or, hence make sure that you take another look prior to deciding to send it in.

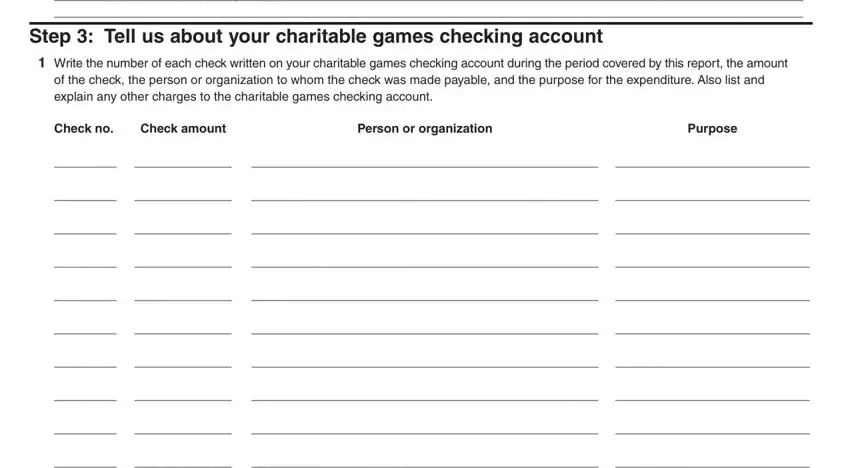

3. This next part is straightforward - fill in all the blanks in Subtotal for Page, Please open to Page and continue, RCG R, This form is authorized as, and Page of in order to complete this process.

4. The following section will require your attention in the following parts: Step Tell us about your, Check no, Check amount, Person or organization, Purpose, and Subtotal for Page. Be sure to give all required information to go further.

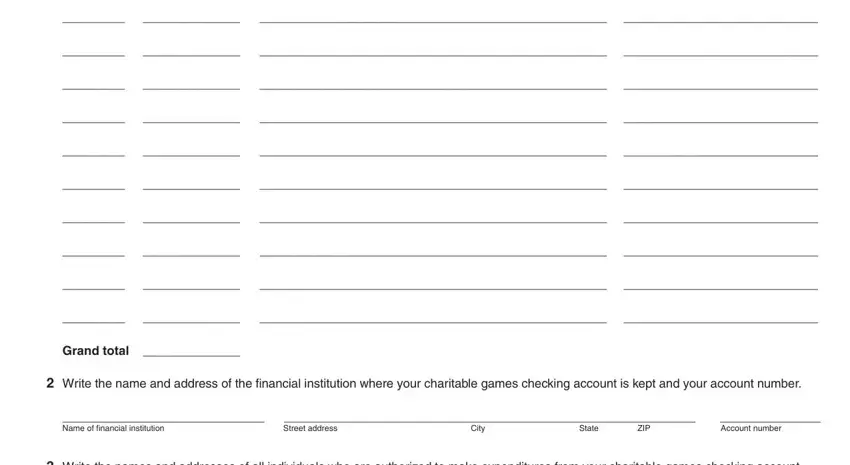

5. This pdf needs to be completed with this particular section. Below you will see a full listing of blank fields that require specific details for your document usage to be faultless: Grand total, Write the name and address of the, Name of financial institution, Street address, State, City, ZIP, Account number, and Write the names and addresses of.

Step 3: Proofread the details you've entered into the blank fields and then press the "Done" button. Join us now and easily use Form Rcg 25, prepared for download. All changes you make are kept , enabling you to change the pdf later on when required. FormsPal is focused on the confidentiality of our users; we make sure that all information handled by our editor continues to be confidential.