Form Rd 440-9 is a State of Illinois form that can be used to apply for an exemption from paying real property taxes. The form must be completed and submitted to the local tax authority in order to be considered for the exemption. Eligibility requirements and application procedures vary by municipality, so it is important to contact your local tax authority for more information. This blog post will provide an overview of Form Rd 440-9, including eligibility requirements and application procedures. We will also discuss some of the benefits of obtaining an exemption from property taxes. If you are considering applying for this exemption, please consult with your local tax authority for more information.

| Question | Answer |

|---|---|

| Form Name | Form Rd 440 9 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | RD440 9 usda rural development supplementary payment agreement form |

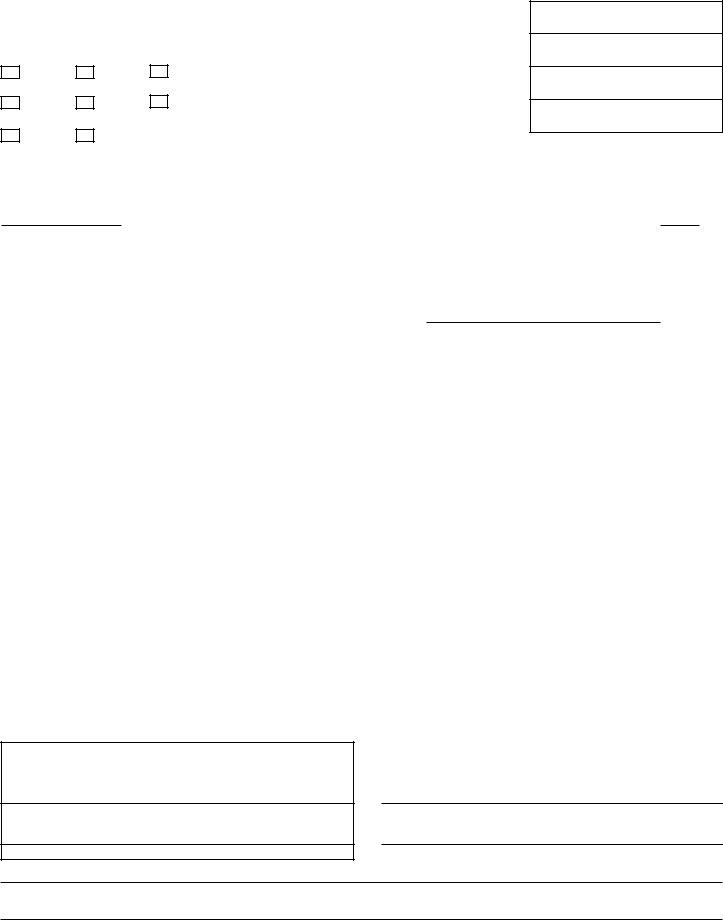

Form RD

TYPE OF LOAN

FO

RH

SW

RL

OTHER

UNITED STATES DEPARTMENT OF AGRICULTURE

RURAL DEVELOPMENT

FARM SERVICE AGENCY

SUPPLEMENTARY PAYMENT

OL |

AGREEMENT |

|

|

|

Position 2 |

EM |

|

|

|

(SPECIFY) |

|

OMB Control No.

STATE

COUNTY

CASE NO.

DATE

The undersigned (hereinafter called the ''Borrower'') being indebted for a loan made or insured by the United States of America, through the United States Department of Agriculture (hereafter called the ''Government'') as evidenced by a note or other debt instrument, (hereafter called the ''notes''), dated

, |

|

, |

|

, |

|

, |

|

, |

|

, |

|

, |

and desiring to provide for payment of such indebtedness by a supplementary plan of payments, hereby agrees with the Government, for good and valuable consideration, receipt of which is hereby acknowledged, as follows:

1.THE BORROWER WILL PAY ALL OR PART OF THE INSTALLMENTS OF PRINCIPAL AND INTEREST ON THE NOTES BY MAKING PARTIAL PAYMENTS EACH MONTH AS FOLLOWS:

(A)FOR THE REMAINDER OF THIS CALENDAR YEAR, BEGINNING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(month) |

|

(year) |

|

|

|

$ |

|

|

|

|

FOR |

|

|

|

MONTHS. |

|

|

|

|||

|

|

|

(amount per month) |

|

|

|

(number) |

|

|

|

|

|

|

|

|||

(B) DURING EACH YEAR FOR THE REMAINDER OF THE TERM OF THE NOTE, BEGINNING JANUARY |

|||||||||||||||||

|

|

|

|

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(year) |

|

|

|

|

|

|

|

|

|

|

|

|

||

JANUARY. . |

. . $. |

|

|

MAY |

$ |

|

|

|

SEPTEMBER. . . . |

$ |

|

|

|||||

FEBRUARY. |

. . $ |

|

. . . . . . .JUNE |

$ |

|

|

|

. . . . . .OCTOBER |

$ |

|

|

||||||

. .MARCH . |

. . . $ |

|

. . . . . . .JULY |

$ |

|

|

|

. . . . .NOVEMBER |

$ |

|

|

||||||

. .APRIL. . . . |

. . $ |

|

|

. . . .AUGUST |

$ |

|

|

|

. . . . .DECEMBER |

$ |

|

|

|||||

EACH PAYMENT SHOWN ABOVE SHALL BE MADE ON OR BEFORE THE |

|

|

DAY OF THE RESPECTIVE MONTH |

||||||||||||||

INDICATED, AND ANY REMAINING UNPAID PORTION OF THE YEARLY PAYMENT SHALL BE MADE ON OR BEFORE THE ANNUAL INSTALLMENT DUE DATE SHOWN IN THE NOTES.

2Nothing herein shall be construed as affecting any of the terms or conditions of the notes or the instrument securing them, other than the payment

. schedule set forth in the notes,

3 Upon DEFAULT by the Borrower in any of the terms or conditions of this agreement, the Government at its option may declare the entire

. indebtedness of the notes immediately due and payable.

4 This agreement may be canceled or amended at any time by mutual agreement in writing between the Borrower and the Government.

.However, if the total indebtedness of the Borrower to the Government is increased because of money advanced pursuant to the terms of the notes, mortgages, deeds of trust, or security agreements or because of a reduction in the amount of interest credit or payment assistance allowed the Borrower under the provisions of the Housing Act of 1949, as amended, this agreement will be modified by the Government to increase the monthly payments of the Borrower in an amount sufficient to pay the entire indebtedness on or before the due date shown in the notes.

Make Check or Money Order payable to and

Mail or Deliver your payment to

Street Address or P.O. Box |

(Borrower) |

|

Town |

State |

Zip Code |

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid UMB control number. The valid UMB control number for this information collection is