Dealing with PDF documents online is actually a piece of cake with our PDF tool. Anyone can fill out taxing here with no trouble. We are devoted to making sure you have the absolute best experience with our editor by consistently releasing new features and improvements. Our editor is now even more user-friendly thanks to the most recent updates! Currently, working with PDF documents is a lot easier and faster than ever. With some basic steps, you are able to begin your PDF journey:

Step 1: Click on the "Get Form" button at the top of this webpage to access our editor.

Step 2: When you launch the online editor, there'll be the document prepared to be completed. Other than filling in different blanks, you could also perform various other things with the Document, specifically putting on your own text, editing the initial textual content, adding illustrations or photos, affixing your signature to the document, and much more.

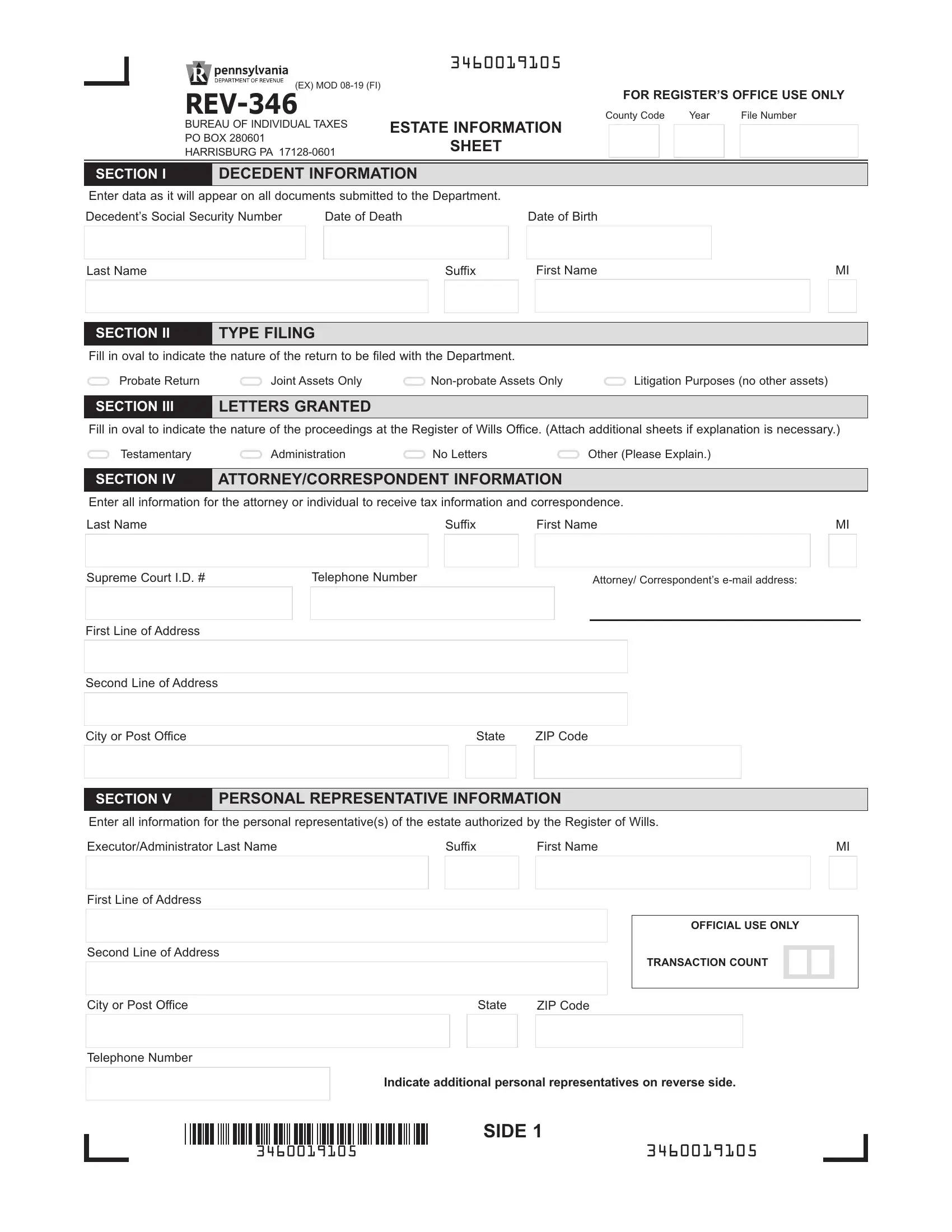

With regards to the blank fields of this particular PDF, here is what you need to do:

1. First, while filling out the taxing, start with the page that includes the subsequent fields:

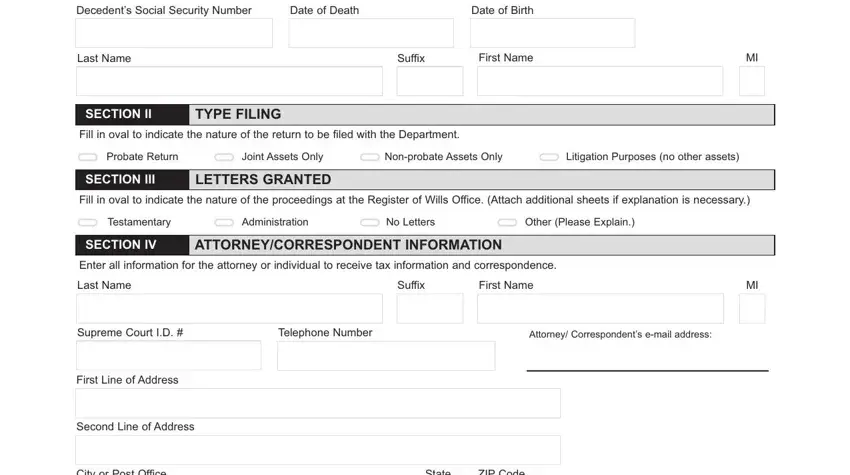

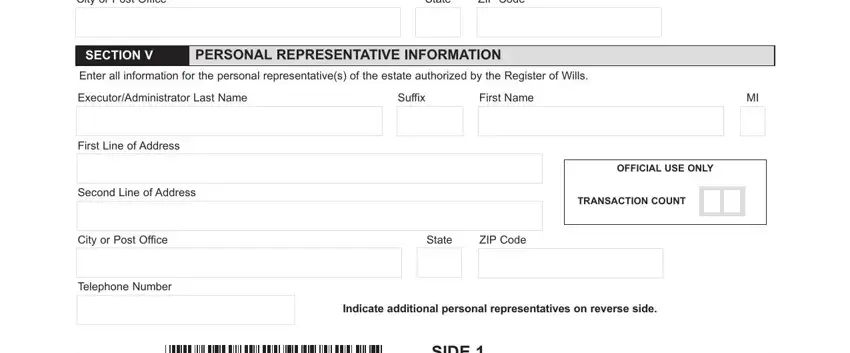

2. Once your current task is complete, take the next step – fill out all of these fields - City or Post Office, State, ZIP Code, SECTION V, PERSONAL REPRESENTATIVE INFORMATION, Enter all information for the, ExecutorAdministrator Last Name, Suffix, First Name, First Line of Address, Second Line of Address, OFFICIAL USE ONLY, TRANSACTION COUNT, City or Post Office, and State with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

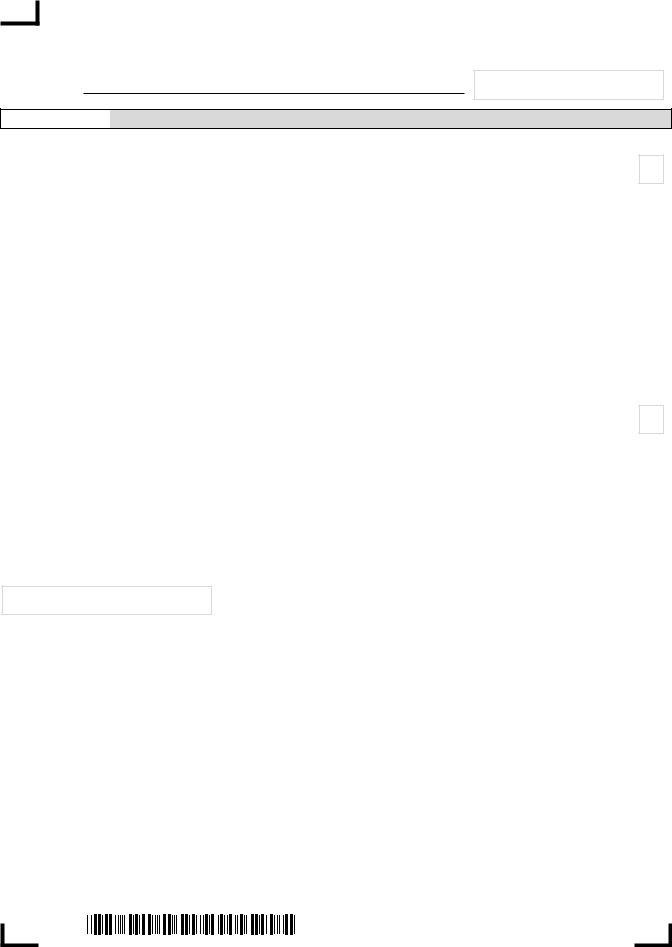

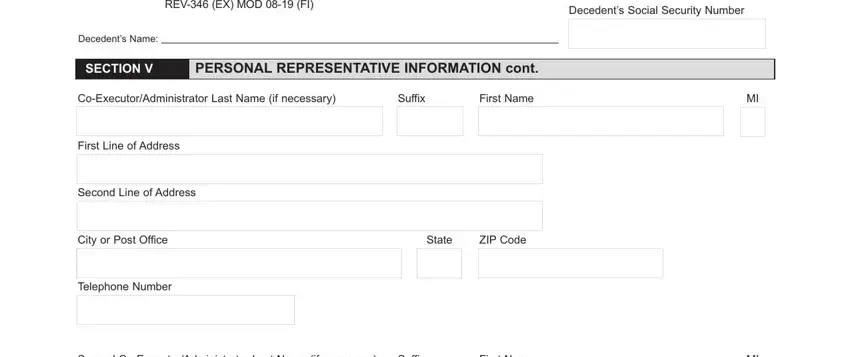

3. This next section is related to REV EX MOD FI, Decedents Social Security Number, Decedents Name, SECTION V, PERSONAL REPRESENTATIVE, CoExecutorAdministrator Last Name, Suffix, First Name, First Line of Address, Second Line of Address, City or Post Office, State, ZIP Code, Telephone Number, and Second CoExecutorAdministrator - complete all these blank fields.

You can easily get it wrong while completing your PERSONAL REPRESENTATIVE, hence make sure you take a second look before you send it in.

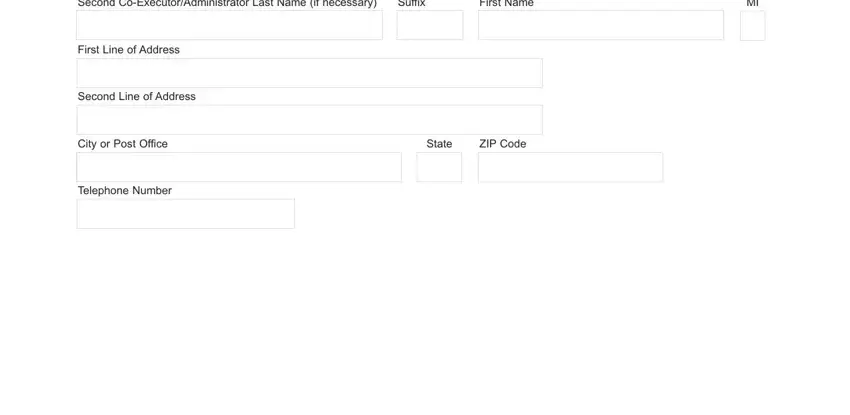

4. Filling in Second CoExecutorAdministrator, Suffix, First Name, First Line of Address, Second Line of Address, City or Post Office, State, ZIP Code, and Telephone Number is key in this fourth section - ensure that you be patient and be attentive with every single empty field!

Step 3: Before addressing the next stage, check that all blanks are filled out the right way. The moment you are satisfied with it, click on “Done." Get the taxing the instant you subscribe to a 7-day free trial. Readily use the pdf file within your personal cabinet, along with any modifications and adjustments being all kept! FormsPal ensures your data privacy by using a secure system that never records or distributes any kind of personal information used in the file. Be confident knowing your paperwork are kept confidential whenever you work with our tools!