Washington can be filled out easily. Just use FormsPal PDF editor to get the job done quickly. Our team is always working to enhance the editor and insure that it is much easier for users with its cutting-edge features. Enjoy an ever-improving experience today! To get the process started, consider these basic steps:

Step 1: Open the PDF inside our editor by hitting the "Get Form Button" above on this page.

Step 2: After you start the file editor, you'll notice the form prepared to be completed. Apart from filling in various blanks, you can also perform other sorts of things with the form, such as adding custom words, changing the original text, inserting graphics, affixing your signature to the PDF, and more.

Be attentive while completing this document. Ensure each field is filled out accurately.

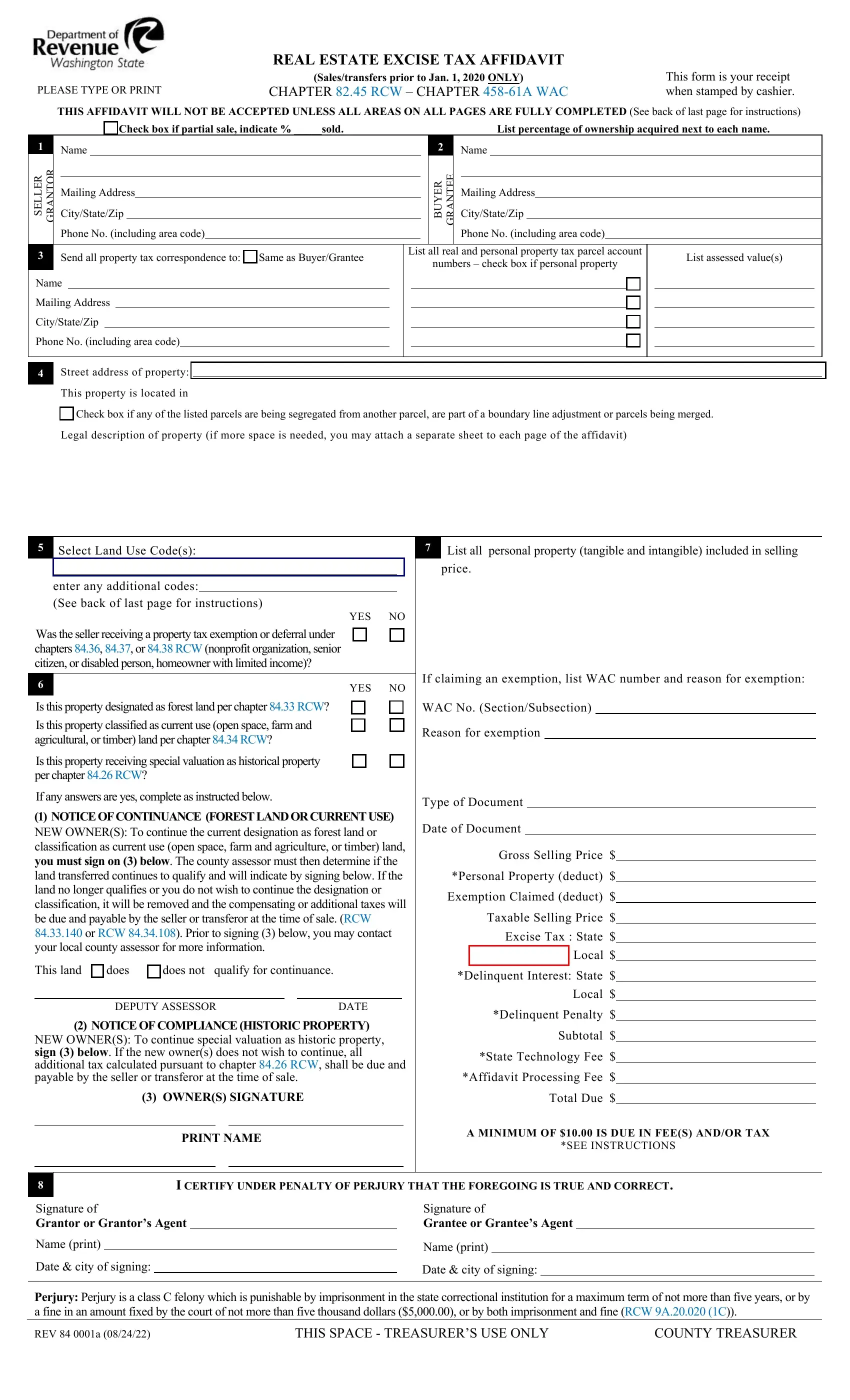

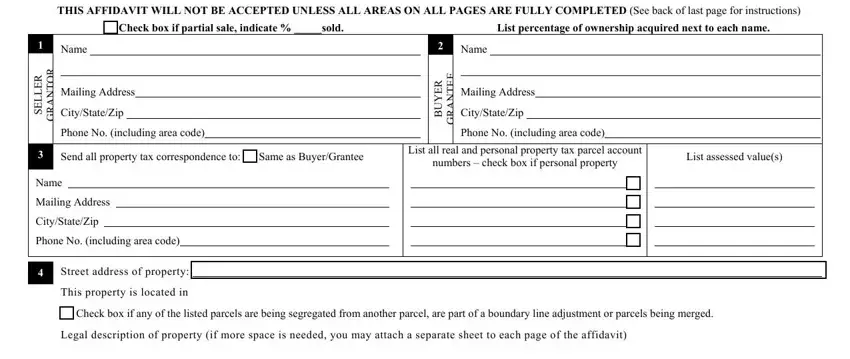

1. The Washington needs certain details to be typed in. Ensure the next blank fields are complete:

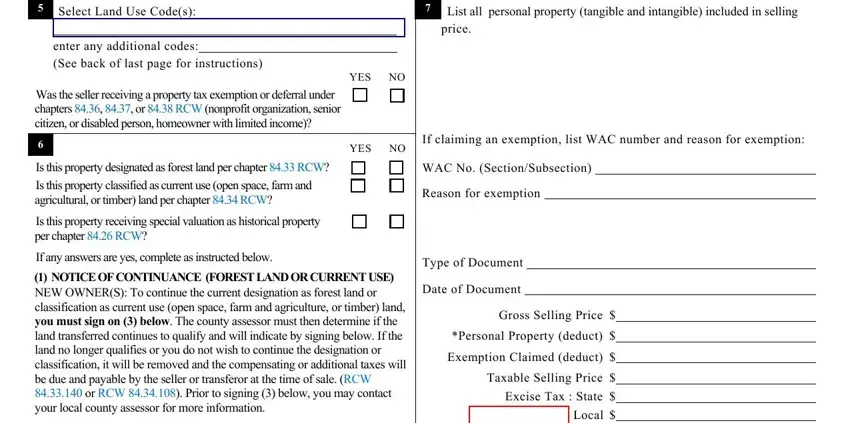

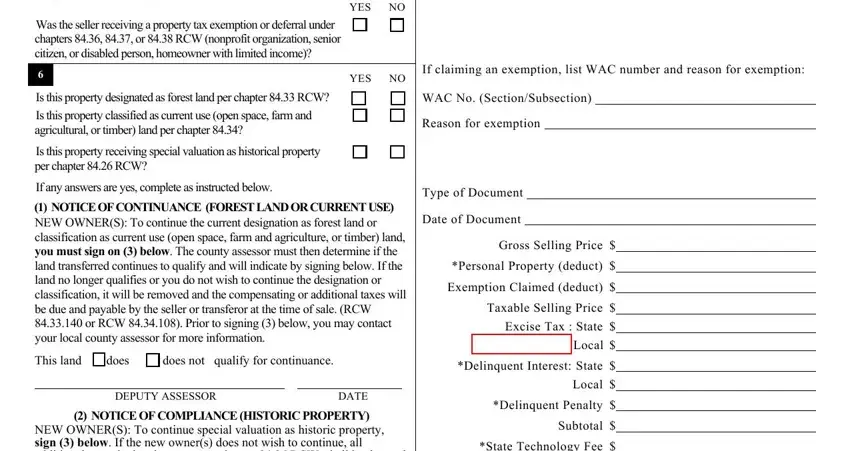

2. Your next step is to fill in the next few blank fields: Select Land Use Codes, List all personal property, price, enter any additional codes See, Was the seller receiving a, YES, YES NO, If claiming an exemption list WAC, Is this property designated as, WAC No SectionSubsection, Is this property classified as, Is this property receiving special, If any answers are yes complete as, NOTICE OF CONTINUANCE FOREST LAND, and Reason for exemption.

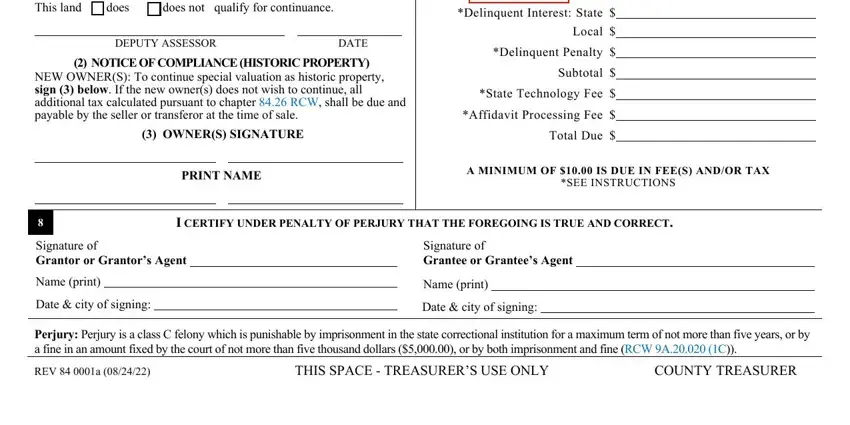

3. In this specific part, examine This land, does, does not qualify for continuance, DEPUTY ASSESSOR, DATE, NOTICE OF COMPLIANCE HISTORIC, NEW OWNERS To continue special, OWNERS SIGNATURE, Delinquent Interest State, Local, Delinquent Penalty, Subtotal, State Technology Fee, Affidavit Processing Fee, and Total Due. All of these should be filled out with greatest accuracy.

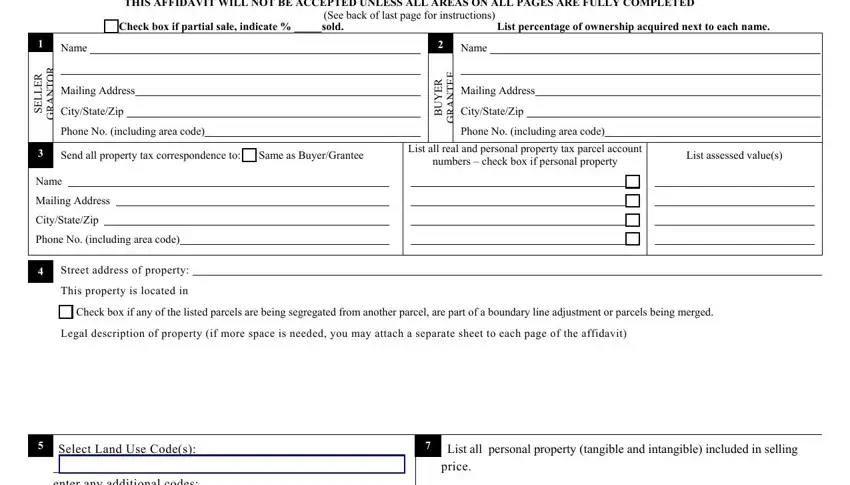

4. To move ahead, this next section involves typing in several form blanks. These include THIS AFFIDAVIT WILL NOT BE, Check box if partial sale, See back of last page for, Name, R E L L E S, R O T N A R G, Mailing Address, CityStateZip, List percentage of ownership, Name, R E Y U B, E E T N A R G, Mailing Address, CityStateZip, and Phone No including area code, which you'll find essential to carrying on with this particular PDF.

5. Now, the following final subsection is what you should wrap up before closing the form. The blanks here include the next: enter any additional codes See, Was the seller receiving a, YES, YES NO, If claiming an exemption list WAC, Is this property designated as, WAC No SectionSubsection, Is this property classified as, Is this property receiving special, If any answers are yes complete as, NOTICE OF CONTINUANCE FOREST LAND, This land, does, does not qualify for continuance, and DEPUTY ASSESSOR.

Be really attentive while filling out does not qualify for continuance and If claiming an exemption list WAC, since this is the part where most people make errors.

Step 3: As soon as you have reviewed the information you filled in, click "Done" to complete your FormsPal process. Right after registering afree trial account at FormsPal, it will be possible to download Washington or email it right off. The document will also be easily accessible in your personal account menu with your changes. We do not share the information that you use when filling out documents at FormsPal.