You may work with ri form 100a without difficulty with our online PDF tool. Our editor is continually evolving to grant the best user experience achievable, and that is thanks to our dedication to continuous development and listening closely to comments from customers. Should you be looking to get started, here is what it will require:

Step 1: Simply click the "Get Form Button" above on this site to see our pdf file editing tool. Here you will find everything that is needed to work with your document.

Step 2: Once you open the file editor, you will see the form ready to be completed. Apart from filling out various blank fields, you may as well perform several other things with the PDF, that is writing custom text, editing the original text, inserting illustrations or photos, putting your signature on the form, and a lot more.

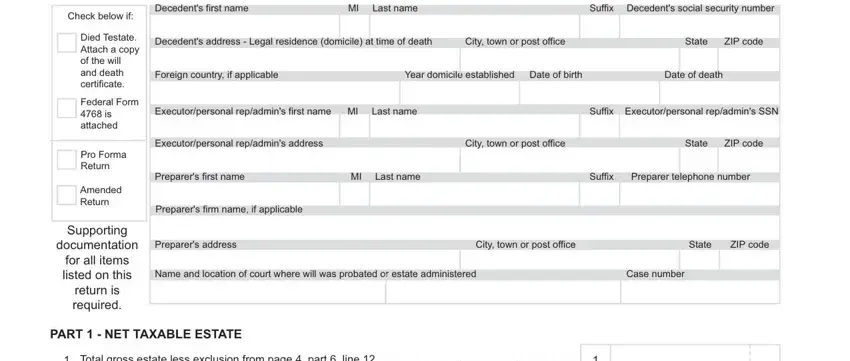

This document will need specific details to be filled out, thus be sure to take some time to type in precisely what is asked:

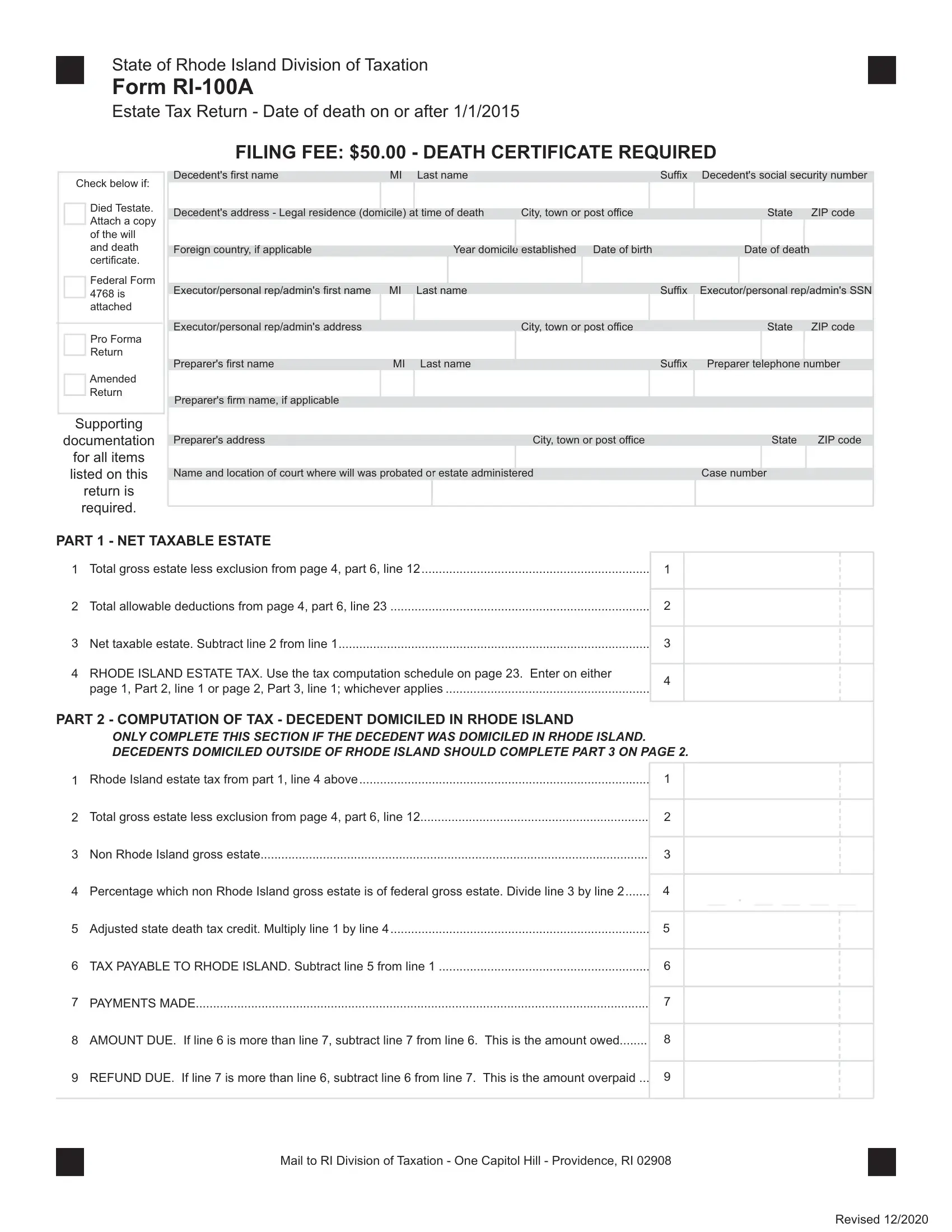

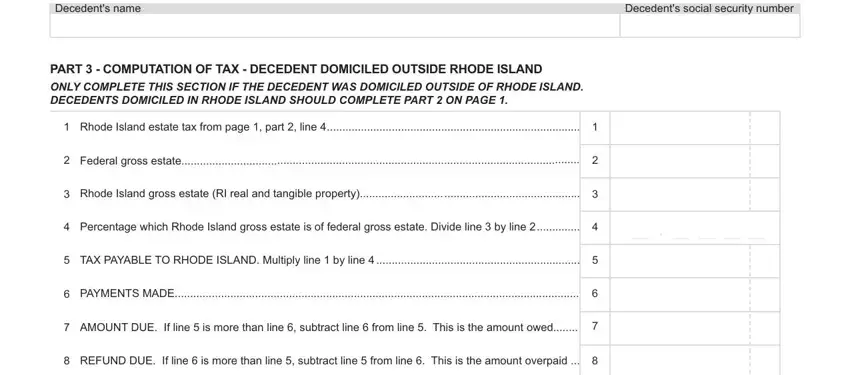

1. The ri form 100a involves certain information to be inserted. Ensure that the next blank fields are completed:

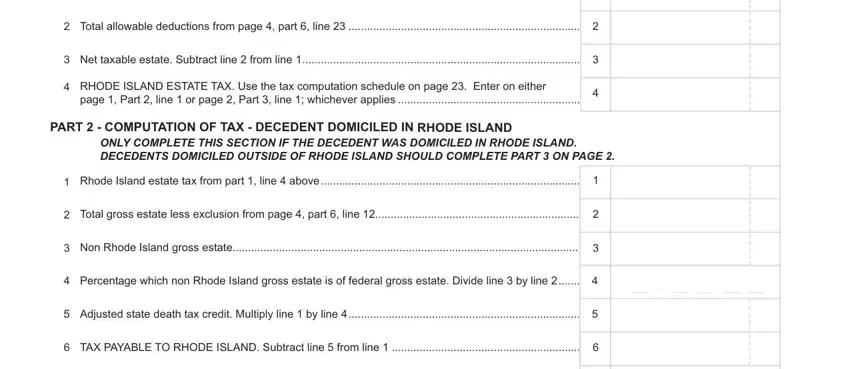

2. Once your current task is complete, take the next step – fill out all of these fields - with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to this field and next field, make sure you double-check them in this section. Both of these are viewed as the most significant ones in the file.

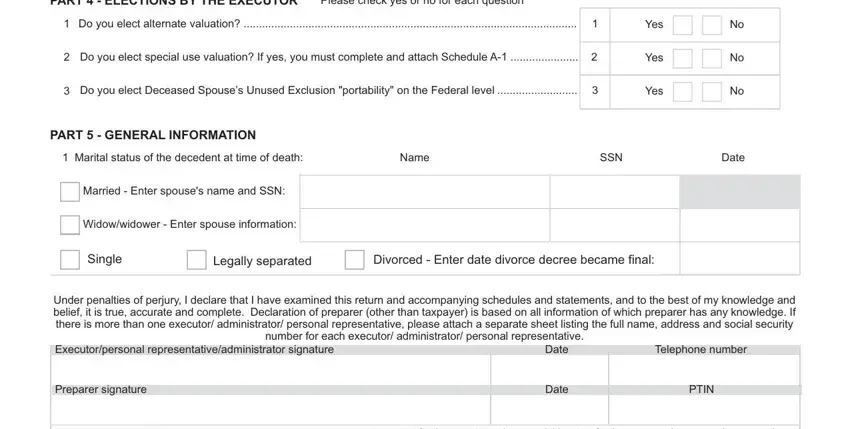

3. The following part is mostly about - type in every one of these fields.

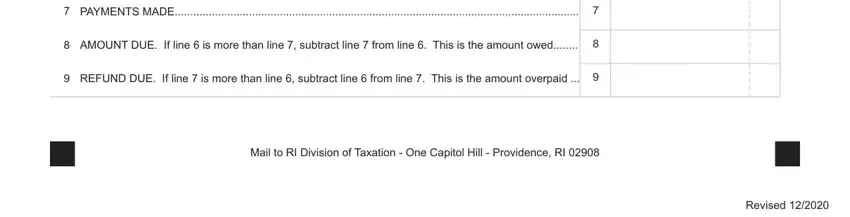

4. To move ahead, the next stage involves filling out a handful of form blanks. Examples include , which are integral to carrying on with this document.

5. While you approach the conclusion of the form, there are a few extra requirements that have to be satisfied. Particularly, should all be filled in.

Step 3: As soon as you've glanced through the details provided, click "Done" to complete your form. Right after setting up a7-day free trial account at FormsPal, you will be able to download ri form 100a or send it through email without delay. The PDF file will also be accessible via your personal account with your each change. When using FormsPal, you're able to fill out forms without needing to be concerned about personal information incidents or entries getting shared. Our secure platform ensures that your private data is kept safe.