The PDF editor that you can go with was designed by our leading computer programmers. You may submit the opm retirement forms file instantly and efficiently with our software. Merely keep up with the procedure to get going.

Step 1: Select the "Get Form Now" button to start out.

Step 2: You're now on the document editing page. You may edit, add content, highlight specific words or phrases, place crosses or checks, and insert images.

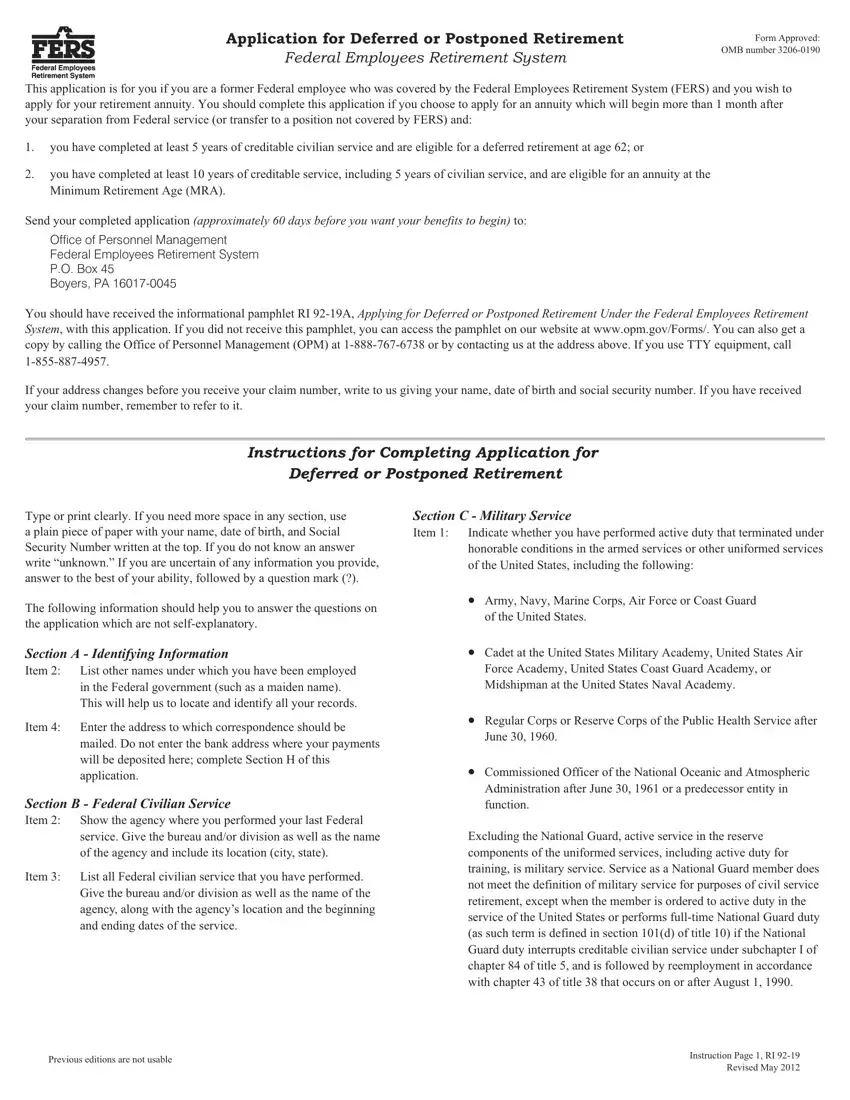

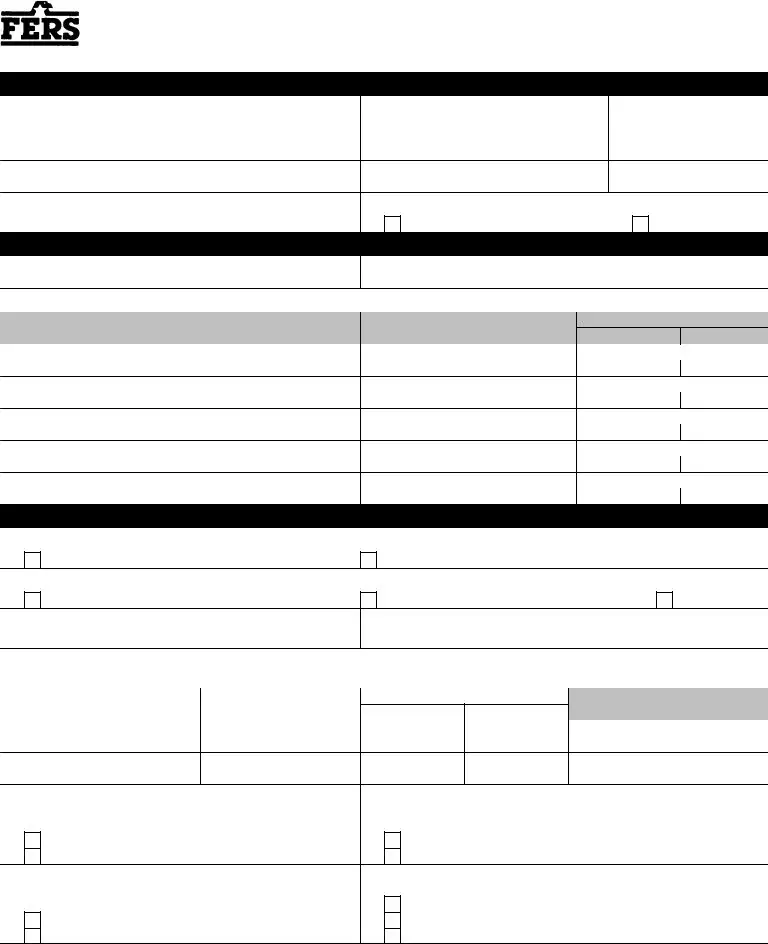

The PDF template you decide to fill out will contain the next segments:

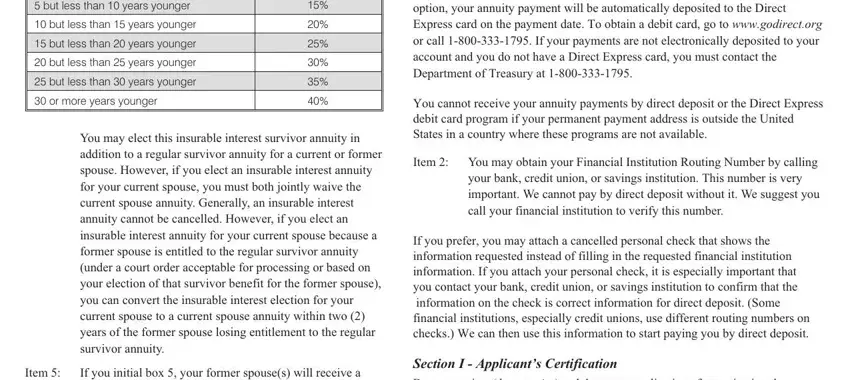

You should enter the particulars within the box but less than years younger, but less than years younger, but less than years younger, but less than years younger, but less than years younger, or more years younger, You may elect this insurable, Item, If you initial box your former, Section H Payment Instructions, You cannot receive your annuity, Item You may obtain your, your bank credit union or savings, If you prefer you may attach a, and Section I Applicants.

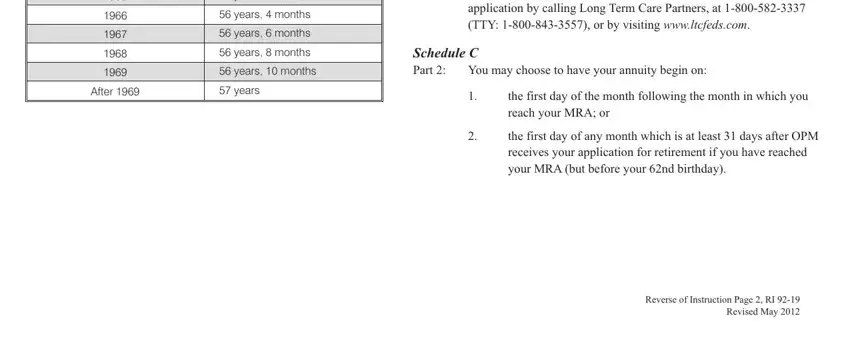

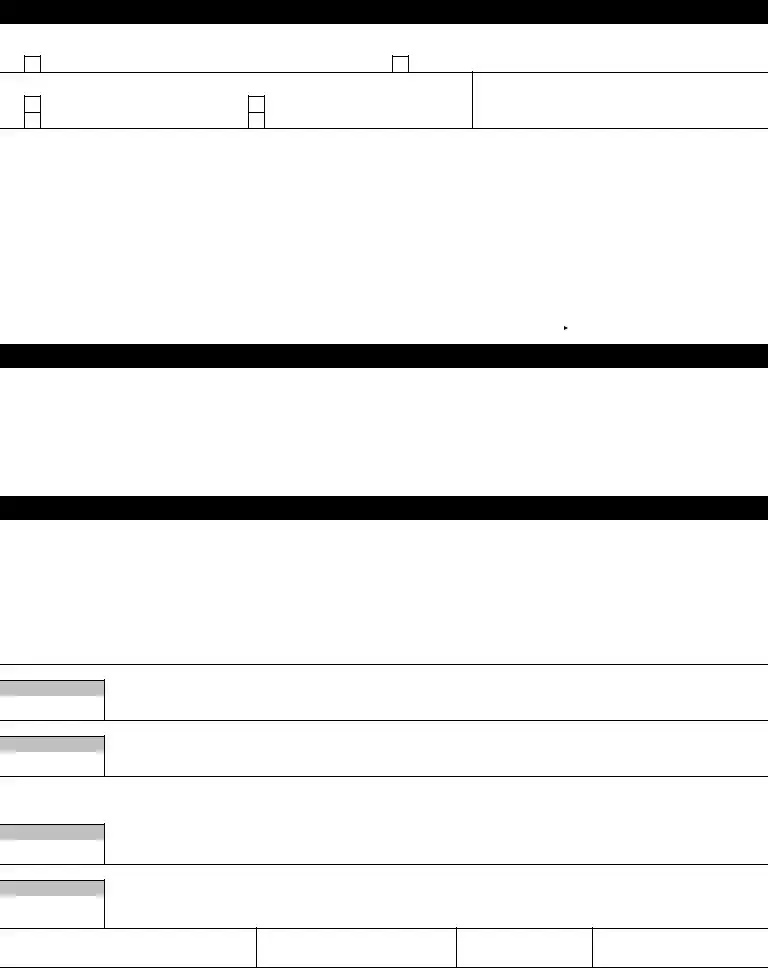

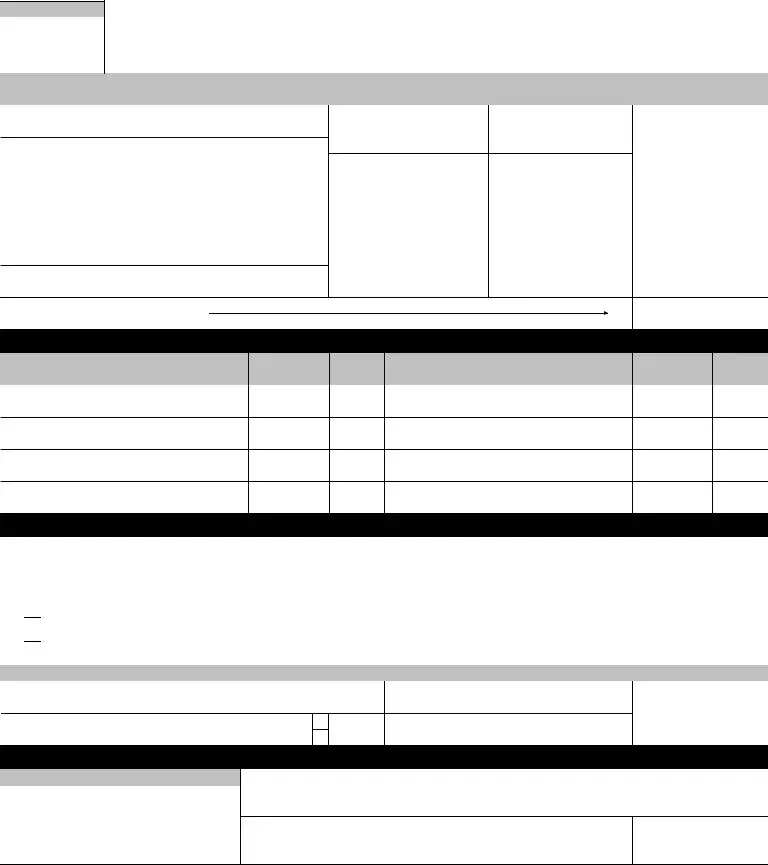

It's essential to point out the relevant details within the years months, years months, years months, years months, years months, After, years, If you are not currently enrolled, Schedule C Part, You may choose to have your, the first day of the month, the first day of any month which, and Reverse of Instruction Page RI area.

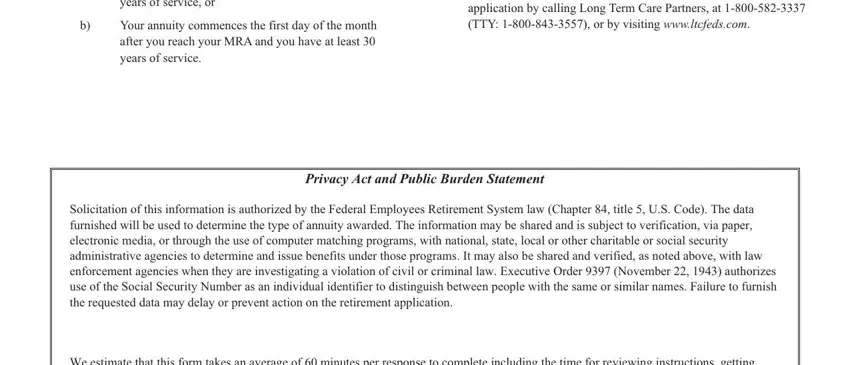

The Your annuity commences the first, Your annuity commences the first, If you are not currently enrolled, Privacy Act and Public Burden, Solicitation of this information, and We estimate that this form takes section is the place to include the rights and obligations of each side.

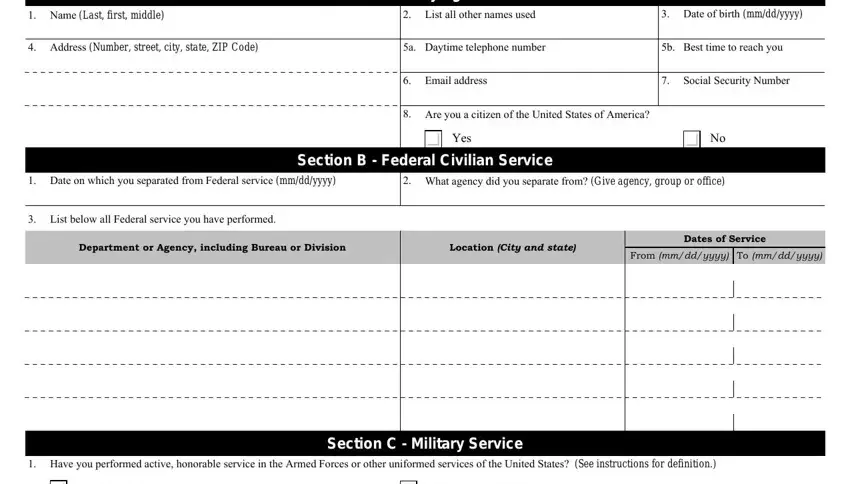

Complete the template by reviewing the following areas: Section A Identifying Information, Name Last first middle, List all other names used, Date of birth mmddyyyy, Address Number street city state, a Daytime telephone number, b Best time to reach you, Email address, Social Security Number, Are you a citizen of the United, Yes, Section B Federal Civilian Service, Date on which you separated from, What agency did you separate from, and List below all Federal service.

Step 3: Click "Done". You can now export your PDF form.

Step 4: To protect yourself from all of the issues in the long run, you will need to make around several duplicates of your form.

Please send my annuity payments directly to my checking or savings account.

Please send my annuity payments directly to my checking or savings account.  Please send my annuity payments to my Direct Express debit card.

Please send my annuity payments to my Direct Express debit card.  My permanent payment address is outside the United States in a country not accessible via Direct Deposit/Direct Express.

My permanent payment address is outside the United States in a country not accessible via Direct Deposit/Direct Express.