With the help of the online PDF editor by FormsPal, you'll be able to fill out or change 420-b here and now. To make our editor better and less complicated to utilize, we consistently design new features, taking into consideration suggestions from our users. With some simple steps, you'll be able to start your PDF editing:

Step 1: Hit the "Get Form" button above. It's going to open our editor so that you can begin filling in your form.

Step 2: With the help of our state-of-the-art PDF editor, you can actually accomplish more than just fill in forms. Try all the features and make your documents appear high-quality with customized text put in, or tweak the original content to excellence - all that comes with an ability to incorporate any kind of pictures and sign it off.

Concentrate while filling in this form. Ensure that each blank field is done properly.

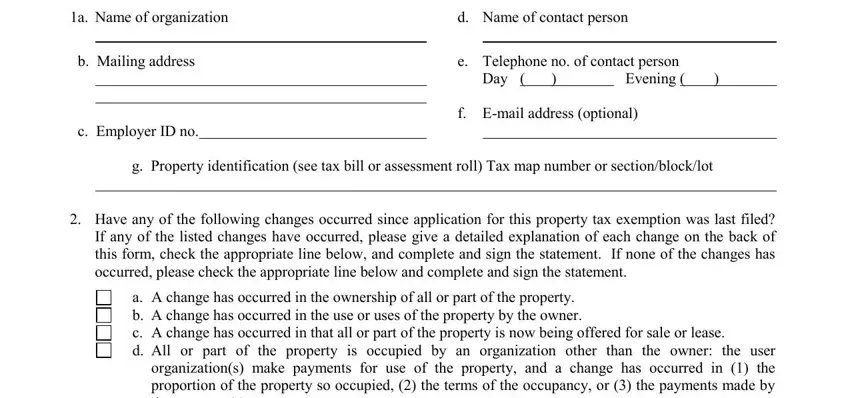

1. To get started, once completing the 420-b, begin with the area that includes the following fields:

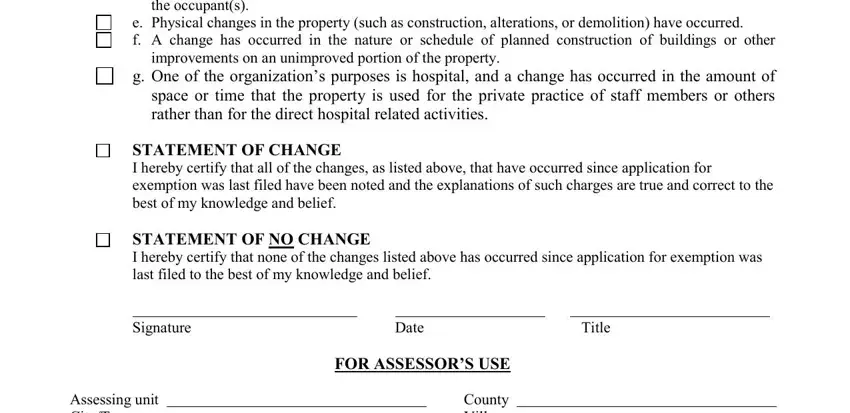

2. Once your current task is complete, take the next step – fill out all of these fields - a A change has occurred in the, improvements on an unimproved, the occupants, g One of the organizations, STATEMENT OF CHANGE, I hereby certify that all of the, STATEMENT OF NO CHANGE, I hereby certify that none of the, Signature, Date, FOR ASSESSORS USE, Assessing unit CityTown School, County Village, and Title with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. This next part will be about Assessing unit CityTown School, and County Village - complete each of these empty form fields.

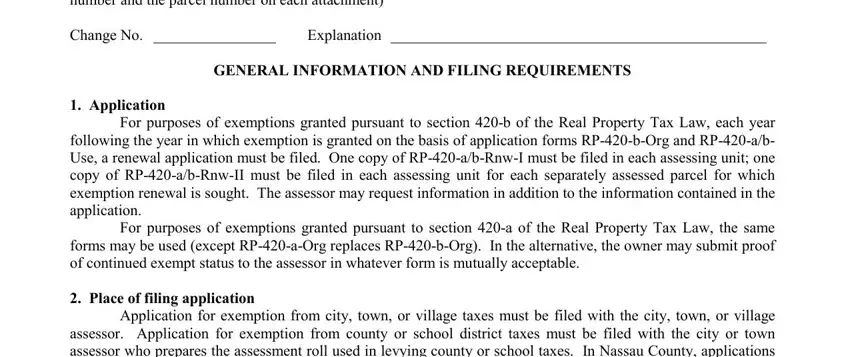

4. This particular paragraph arrives with all of the following blank fields to complete: If more space is needed attach, Explanation, GENERAL INFORMATION AND FILING, and Application For purposes of.

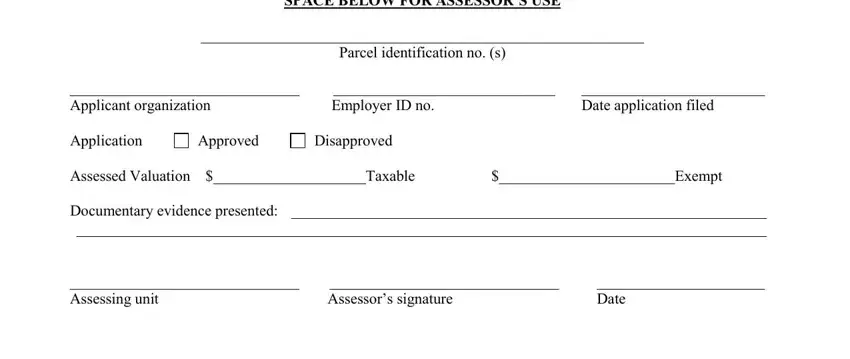

5. To finish your document, this particular section includes a number of additional blank fields. Entering SPACE BELOW FOR ASSESSORS USE, Parcel identification no s, Approved, Disapproved, Employer ID no, Date application filed, Applicant organization, Assessors signature, and Date will conclude everything and you will be done quickly!

It's simple to make an error while filling in your Employer ID no, consequently ensure that you look again prior to deciding to finalize the form.

Step 3: As soon as you've looked once again at the details provided, click "Done" to conclude your FormsPal process. Sign up with us today and easily obtain 420-b, ready for downloading. All adjustments made by you are kept , enabling you to modify the pdf later if necessary. When you use FormsPal, you can certainly fill out documents without needing to be concerned about personal data breaches or entries being distributed. Our secure system helps to ensure that your personal data is kept safe.