Using PDF files online can be super easy with our PDF tool. Anyone can fill out leaseholders here within minutes. To maintain our editor on the leading edge of practicality, we strive to put into action user-oriented capabilities and improvements on a regular basis. We're always grateful for any feedback - play a vital part in remolding PDF editing. Getting underway is effortless! Everything you should do is stick to these basic steps down below:

Step 1: Hit the "Get Form" button in the top section of this webpage to access our PDF editor.

Step 2: With our state-of-the-art PDF tool, it is easy to accomplish more than merely complete blank fields. Edit away and make your docs seem sublime with custom text put in, or optimize the file's original content to excellence - all backed up by an ability to incorporate stunning images and sign the document off.

With regards to the blanks of this precise PDF, here's what you should consider:

1. You need to fill out the leaseholders correctly, therefore pay close attention when filling out the sections that contain all these blank fields:

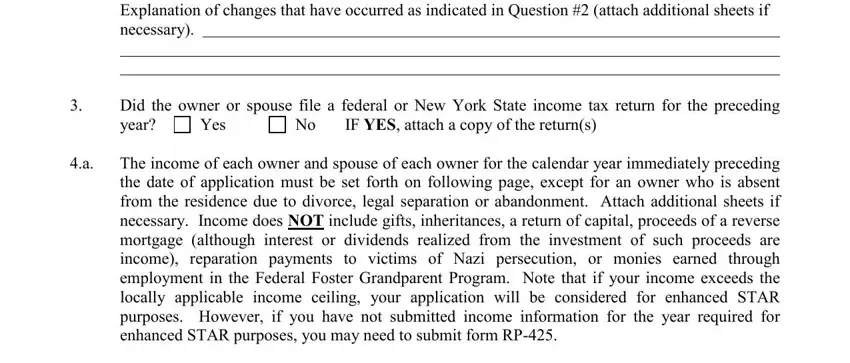

2. Right after filling in the last section, go on to the next part and fill out all required particulars in these fields - Explanation of changes that have, No IF YES attach a copy of the, Yes, and The income of each owner and.

When it comes to The income of each owner and and No IF YES attach a copy of the, be certain that you do everything properly in this section. Both of these are certainly the key fields in this form.

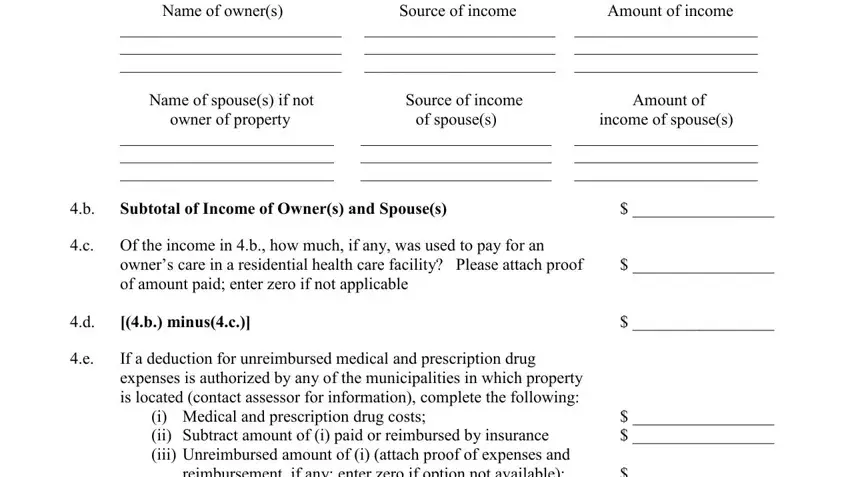

3. Completing RPRnw, Source of income, Amount of income, Name of spouses if not, Name of owners owner of, Amount of income of spouses, Source of income, of spouses, c Of the income in b how much if, and owners care in a residential is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

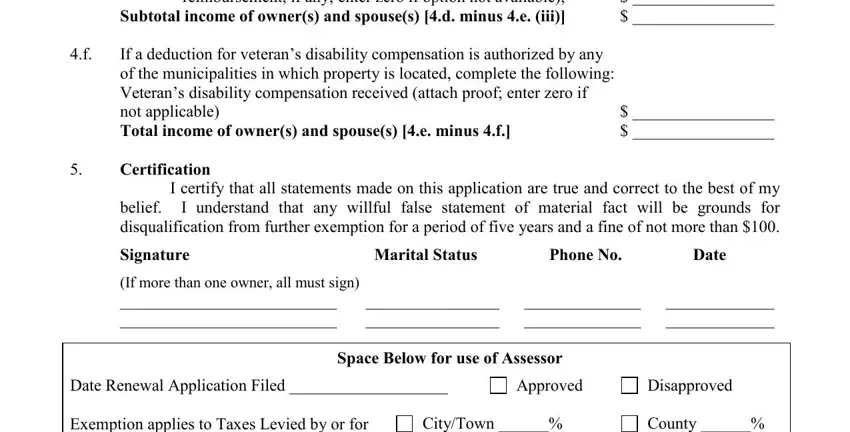

4. To go onward, this fourth section involves completing a couple of blank fields. Included in these are owners care in a residential, If a deduction for veterans, Signature, Marital Status, Phone No Date, If more than one owner all must, Space Below for use of Assessor, Approved, Disapproved, Date Renewal Application Filed, CityTown School, and County Village, which are crucial to continuing with this form.

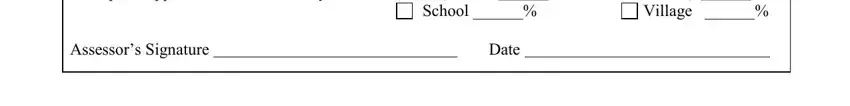

5. When you near the finalization of this form, you'll notice several more points to do. Mainly, Date Renewal Application Filed, CityTown School, County Village, and Date must be done.

Step 3: Before moving forward, you should make sure that all blank fields are filled out properly. When you think it is all fine, click on “Done." After creating afree trial account at FormsPal, you'll be able to download leaseholders or send it through email promptly. The file will also be at your disposal via your personal account with your every edit. We don't share any details you type in when completing forms at FormsPal.