Writing the tax grievance ny document is a breeze using our PDF editor. Keep up with these actions to obtain the document in a short time.

Step 1: Hit the orange "Get Form Now" button on the website page.

Step 2: At this point, you are on the document editing page. You may add information, edit current information, highlight certain words or phrases, insert crosses or checks, insert images, sign the template, erase unneeded fields, etc.

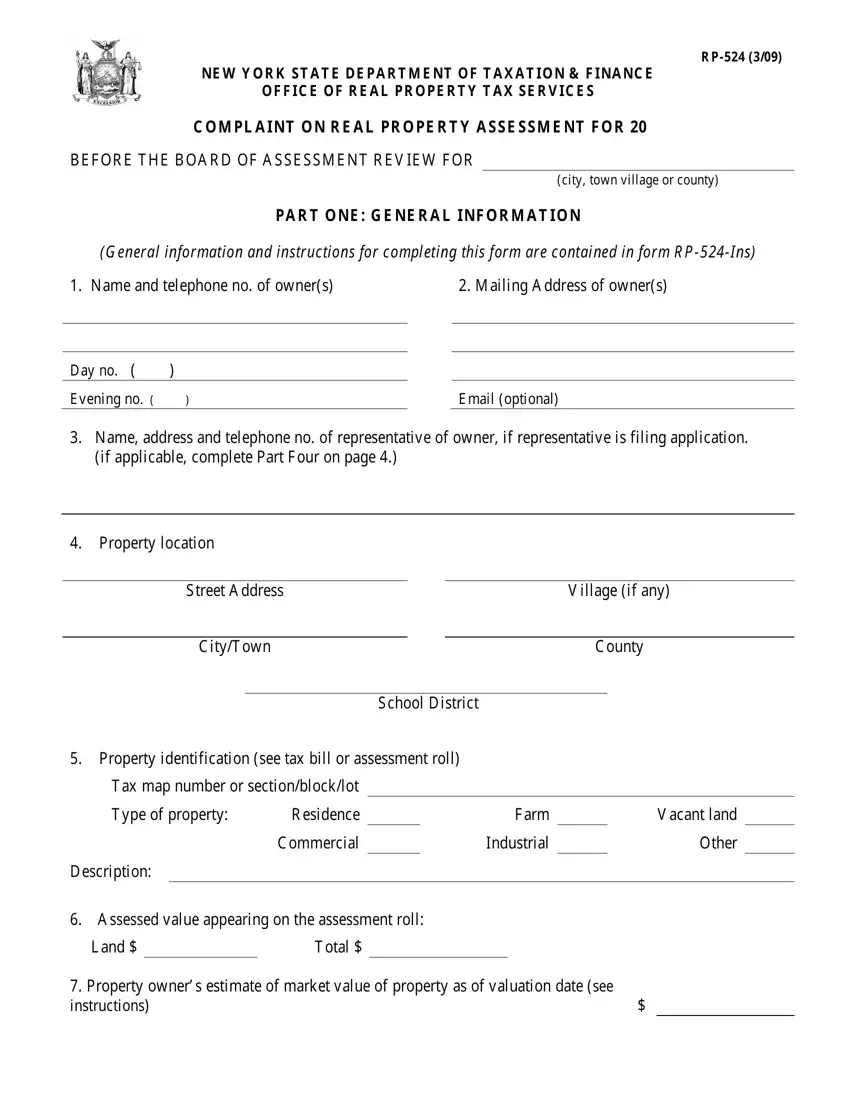

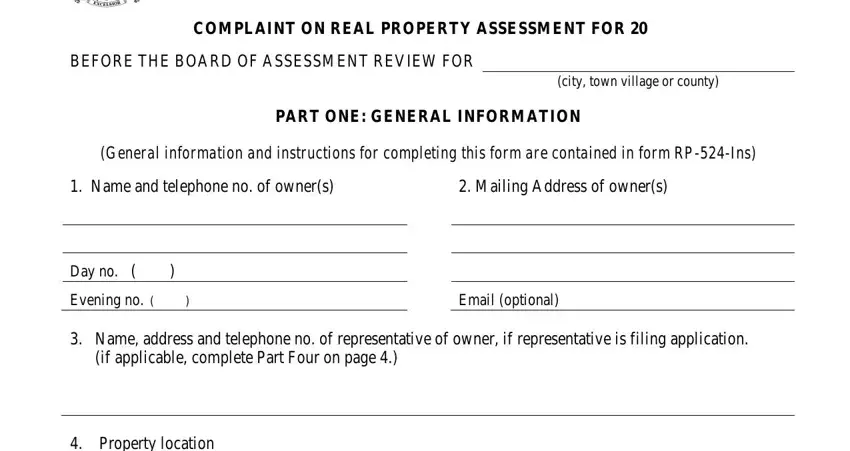

Prepare the next segments to fill out the template:

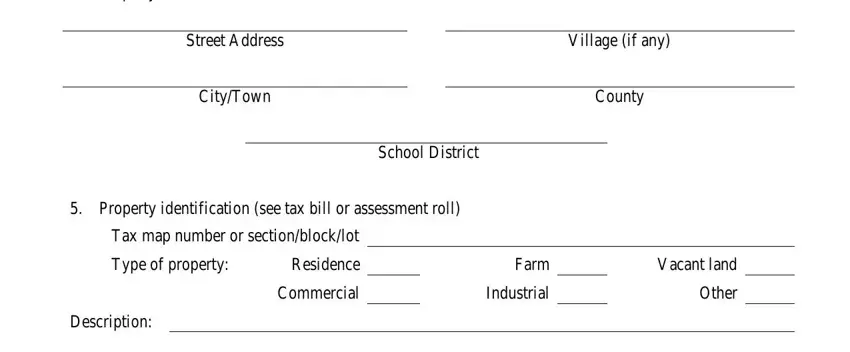

Provide the requested particulars in the Property location, Street Address, CityTown, Village if any, County, School District, Property identification see tax, Tax map number or sectionblocklot, Type of property, Residence, Commercial, Description, Farm, Industrial, and Vacant land section.

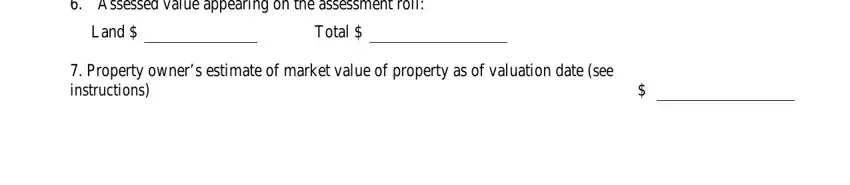

You can be demanded specific relevant particulars to be able to complete the Assessed value appearing on the, Land, Total, and Property owners estimate of area.

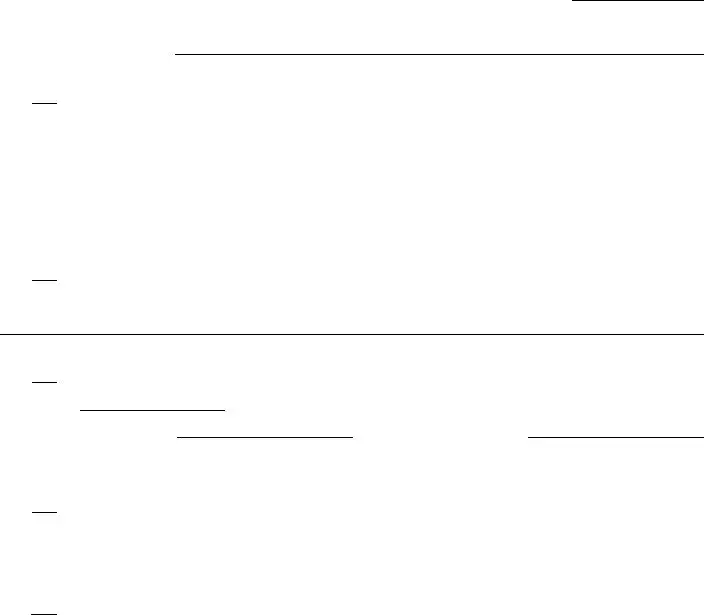

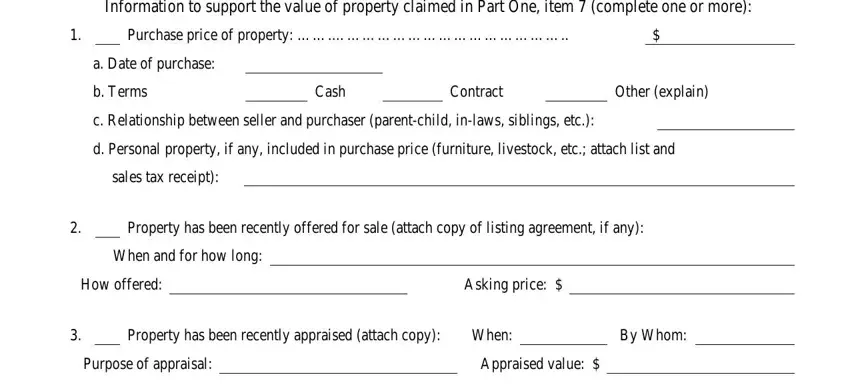

For paragraph Information to support the value, Purchase price of property, a Date of purchase, b Terms, Cash, Contract, Other explain, c Relationship between seller and, d Personal property if any, sales tax receipt, Property has been recently offered, When and for how long, How offered, Asking price, and Property has been recently, state the rights and responsibilities.

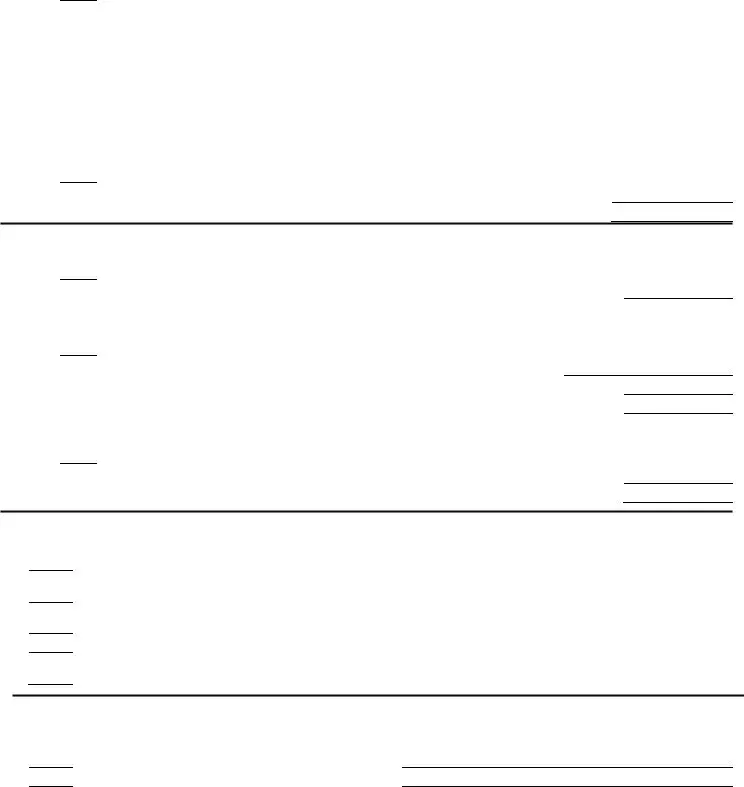

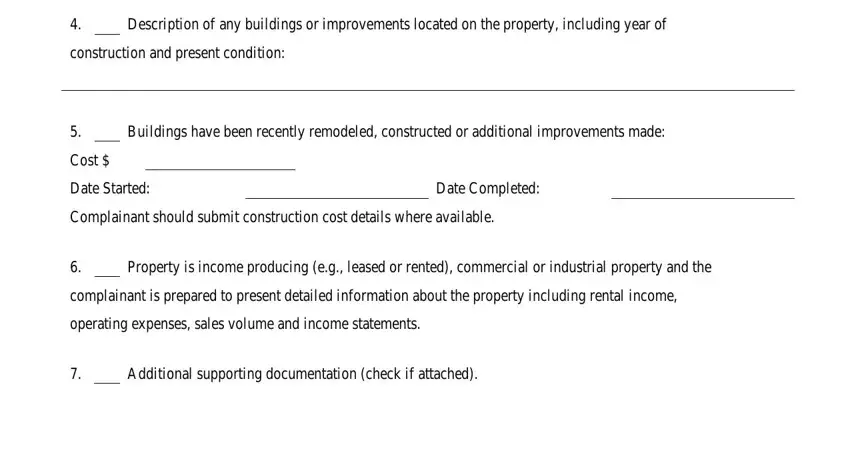

Complete the file by taking a look at all these sections: Description of any buildings or, construction and present condition, Buildings have been recently, Cost, Date Started, Date Completed, Complainant should submit, Property is income producing eg, complainant is prepared to present, operating expenses sales volume, and Additional supporting.

Step 3: As soon as you've hit the Done button, your form should be readily available upload to any gadget or email address you indicate.

Step 4: Make duplicates of your document. This may prevent future difficulties. We do not watch or disclose your data, so be sure it will be protected.