It is possible to complete Form Rpd 41116 instantly in our PDFinity® PDF editor. To make our editor better and less complicated to work with, we consistently design new features, with our users' feedback in mind. To get the ball rolling, go through these easy steps:

Step 1: Click on the "Get Form" button above. It'll open our pdf editor so that you could start completing your form.

Step 2: When you open the online editor, you'll see the document prepared to be completed. Aside from filling in different fields, you may as well do some other things with the PDF, that is putting on any text, editing the initial textual content, inserting images, affixing your signature to the form, and a lot more.

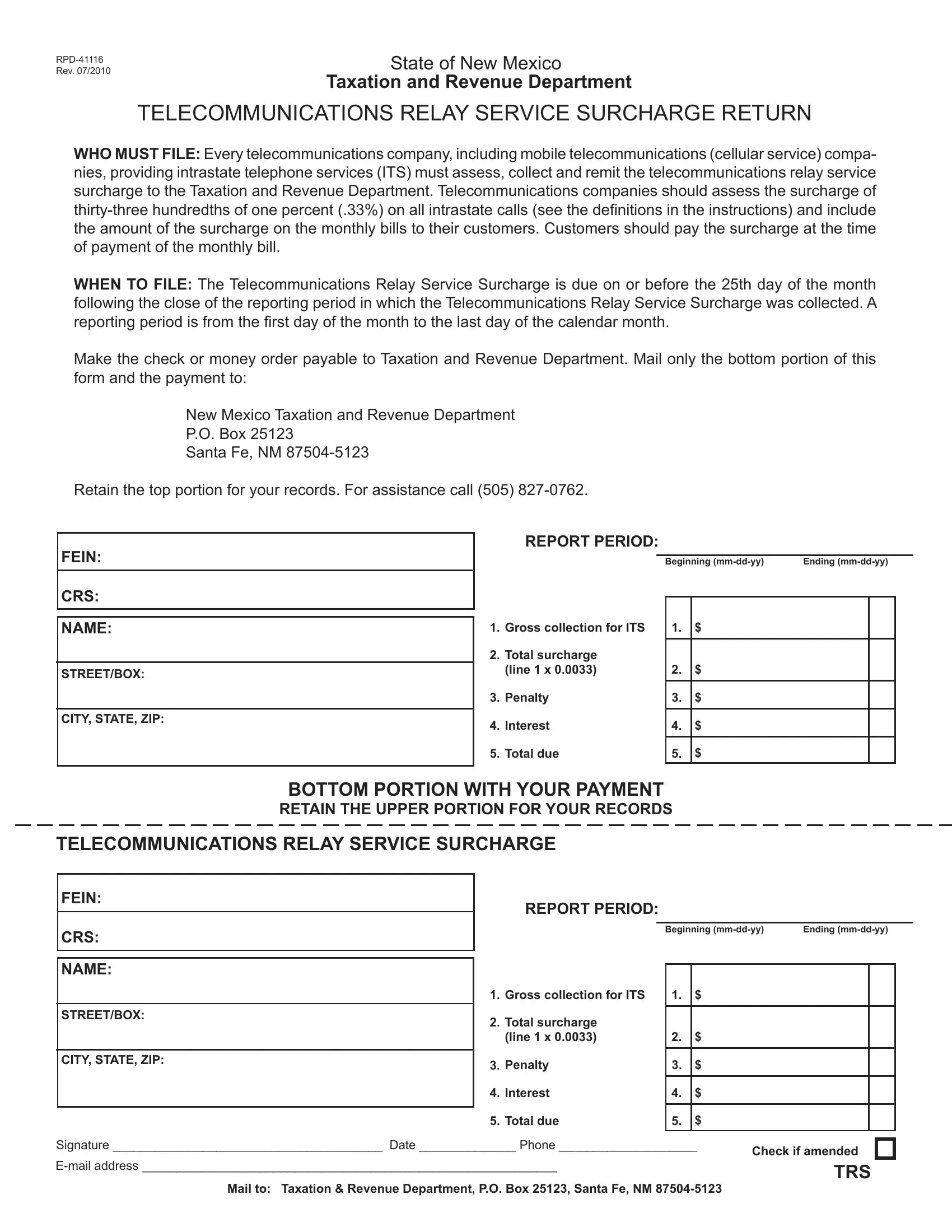

This PDF doc requires some specific details; in order to ensure accuracy and reliability, remember to adhere to the suggestions further on:

1. The Form Rpd 41116 will require specific information to be inserted. Make sure the following fields are finalized:

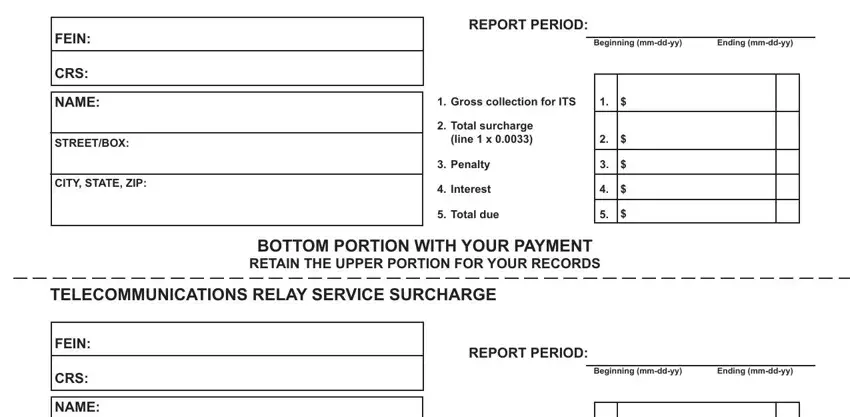

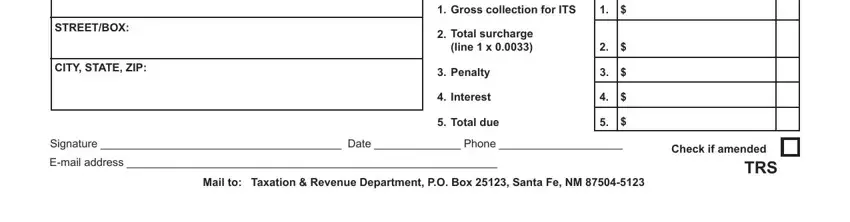

2. Immediately after this array of blank fields is done, proceed to type in the suitable details in all these - STREETBOX, CITY STATE ZIP, Gross collection for ITS, Total surcharge line x, Penalty, Interest, Total due, Signature Date Phone, Email address, Check if amended, TRS, and Mail to Taxation Revenue.

It is possible to make errors while filling out your Penalty, consequently be sure to take a second look before you'll submit it.

Step 3: Go through all the information you've inserted in the blanks and click on the "Done" button. Right after getting a7-day free trial account at FormsPal, you will be able to download Form Rpd 41116 or send it via email at once. The PDF file will also be easily accessible via your personal account with all your edits. FormsPal guarantees secure form completion without personal data record-keeping or any kind of sharing. Feel at ease knowing that your data is safe here!