The RPD-41272 13 form, introduced by the New Mexico Taxation and Revenue Department as of January 4, 2013, is an essential document for individuals who choose to calculate their estimated personal income tax underpayment penalty using an alternative method. Designed to offer options for those whose financial circumstances do not align with the standard computation method, the form requires individuals to detail their estimated tax due, explaining various options for calculation on the second page of the instructions. Particularly beneficial for taxpayers with uneven income throughout the year, farmers, ranchers, or those who base their estimated payments on the actual dates of withholding tax, this form, when attached to the New Mexico PIT-1 form, serves as a declaration of opting for an alternative calculation method. It is critical to mark the corresponding indicator box on the PIT-1 form to alert the Department of this choice. Moreover, the form stipulates conditions under which no penalty is imposed, chiefly if the difference between the calculated tax and the amount withheld is less than $1,000, simplifying compliance for taxpayers. The document thoroughly guides through calculating required annual payments and installment amounts, culminating in the penalty computation for those who underpay or delay their estimated tax payments. With clear instructions for each section, including detailed formulae for penalty calculation, the RPD-41272 13 form is instrumental for taxpayers seeking to navigate their estimated tax payments effectively.

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41272 13 |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | Underpayment, 41272, IRC, New_Mexico |

New Mexico Taxation and Revenue Department

2013 Calculation of Estimated Personal Income Tax Underpayment Penalty

Print your name (irst, middle, last)

Enter your social security number

HOW TO USE THIS FORM

You need to complete this form only if you have elected to use an alternative method of computing estimated tax due. If you do not elect to use an alternative method, the Department will compute your liability, if any, using the standard

method and will send you an assessment for penalty due. Alternative methods of computing estimated tax are described on

page 2 of the instructions. If one of the alternative methods for calculation of penalty on underpayment of estimated income tax applies to you, complete this form and attach it to your 2013 New Mexico

NOTE: No penalty is imposed if the difference between line 4 in column 2 of Section II, and tax withheld and reported on Form 2013

Section I: Mark the box below that applies to you. Refer to Alternative Methods on page 2 of the instructions for further

details.

1. I may elect to use an alternative method of computing estimated tax due because (check one):

My income varied during the year, and I was not required to pay estimated personal income tax until after March 31, 2013; (Both statements must be true.)

I am a farmer or rancher who expects to receive

I wish to compute estimated payments based on the actual dates on which all amounts of withholding tax were withheld for tax year 2013.

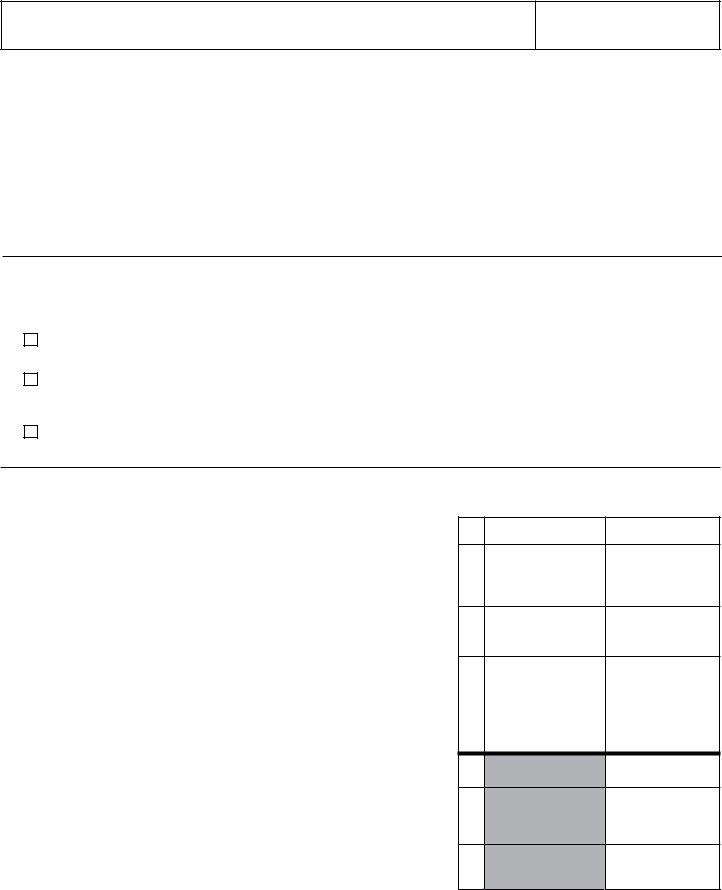

Section II: Calculate the required annual payment.

Enter the amounts from the New Mexico personal income tax forms and schedules for the tax year shown at the top of the column. Do not complete the column for 2012 if you did not ile a full,

2.For column 1 enter the amount from line 22, Form 2012

3.For column 1 enter the sum of the amounts reported on lines 24 and 25

of Form 2012

4.Subtract line 3 from line 2 and enter here. If the difference between the amount on this line, column 2 and the income tax withheld on Form 2013

5.Multiply column 2, line 4, by 90% (0.90) and enter here.

6.Enter the amount of column 1, line 4 in column 2, line 6. If you did not complete column 1, or if column 1, line 4 is a negative number, enter zero.

Column 1 (2012) Column 2 (2013)

2

3

4

5

6

7.Enter the lesser of lines 5 and 6. This is your required annual payment.

7

Page 1 of 3

New Mexico Taxation and Revenue Department

2013 Calculation of Estimated Personal Income Tax Underpayment Penalty

Section III: Calculate the amount and timing of the required estimated tax payments due:

8.Standard Method: If you were required to make estimated tax payments on or before March 31, multiply the required annual payment, line 7, by 25% (0.25). Enter this amount on line 12 in each of the columns in the table below and go to line 11. Skip lines 9 and 10.

9.Annualized Income Method: If you did not have income suficient to require a payment until after March 31, review lines 9a, 9b and 9c and complete line 12 according to the instructions that apply. Then go to line 11. Skip line 10.

9a. If you were required to make estimated tax payments after March 31 but before June 1, multiply the required annual payment, line 7, by 50% and enter on line 12, column (b). Multiply the required annual payment, line 7, by 25% and enter that amount on line

12, columns (c) and (d).

9b. If you were required to make estimated tax payments after May 31 but before September 1, multiply the required annual pay- ment, line 7, by 75% and enter that amount on line 12, column (c). Then multiply the required annual payment, line 7, by 25% and enter that amount on line 12, column (d).

9c. If you were required to make estimated tax payments after August 31, enter 100% of the required annual payment, line 7, on line 12, column (d).

10.Farmers or Ranchers: If you are a qualiied farmer or rancher, enter 100% of the required annual payment on line 12,

column (d) and go to line 11. NOTE: Mark “5” on Form

11.Total withholding tax and estimated tax paid. To complete line 13, divide the tax withheld for the 2013 tax year by four and add an equal amount of tax withheld to the estimated tax paid per payment period. If you elect to compute estimated

installment payments based on the actual dates on which all amounts of withholding tax were withheld for the applicable year, enter the total taxes withheld for the quarter in columns (a) through (d), based on the actual date the amounts were withheld. Then, for each column enter the total tax withheld prior to the date above the column if it was a calendar tax year, and the equivalent payment period due date if it was a iscal year. For columns (b), (c) and (d), do not include amounts withheld and reported in the previous column. Include amounts carried forward from the

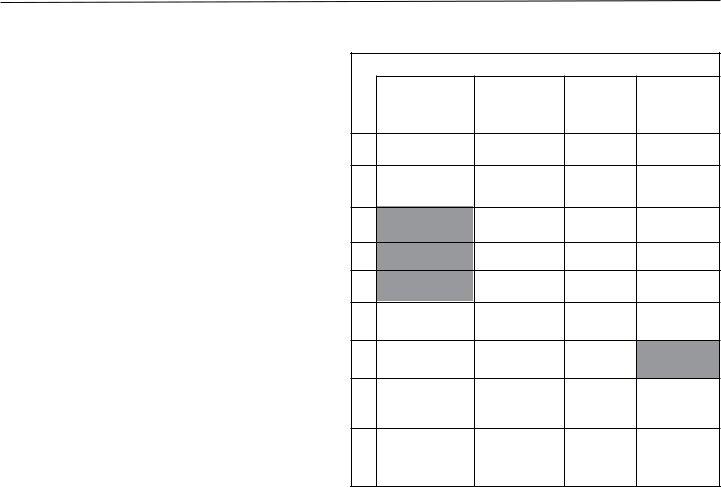

Section IV: Calculate the underpayment.

Complete rows 12 and 13 according to the instructions 8 through 11 above. Then continue with line 14. Complete lines 14 through 20 for each column before going on to the next column. Do not complete ields that are shaded.

Installment due dates. For calendar year taxpayers, the due dates of the installments are entered for you. If a is- cal year iler, strike through the dates entered and enter

the correct installment due dates. See WHEN IS EACH INSTALLMENT PAYMENT DUE? in the instructions.

12.Required estimated payments. See instructions 8 through 10.

13.Estimated tax paid and tax withheld. See instruction 11 to complete this line.

14.Enter amount of overpayment, if any, from line 20 of the previous column.

15.Add lines 13 and 14.

16.Enter the sum of lines 18 and 19 from previous column.

17.Subtract line 16 from line 15. If zero or less, enter zero. For column (a) only, enter the amount from line 13.

18.If the amount on line 17 is zero, subtract line 15 from line 16; otherwise, enter zero.

19.Underpayment. If line 12 is equal to or more than line 17, subtract line 17 from line 12. Then go to line 14 of the next column; otherwise, go to line 20.

20.Overpayment. If line 17 is more than line 12, subtract line 12 from line 17. Then go to line 14 of the next column.

Installment Due Dates

(a) |

(b) |

(c) |

(d) |

4/15/13 |

6/18/13 |

9/17/13 |

1/15/14 |

12.

13.

14.

15.

16.

17.

18.

19.

20.

Page 2 of 3

New Mexico Taxation and Revenue Department

2013 Calculation of Estimated Personal Income Tax Underpayment Penalty

Check here if you wish the Department to compute the penalty on underpayment of estimated personal income tax that you owe. If you choose to have the Department compute the penalty, you do not need to complete Section V. You must complete Sections I through IV, however, or the Department cannot calculate your penalty using an alternative method of computing estimated tax and you may be assessed based on the standard method. To compute the penalty,

continue with Section V.

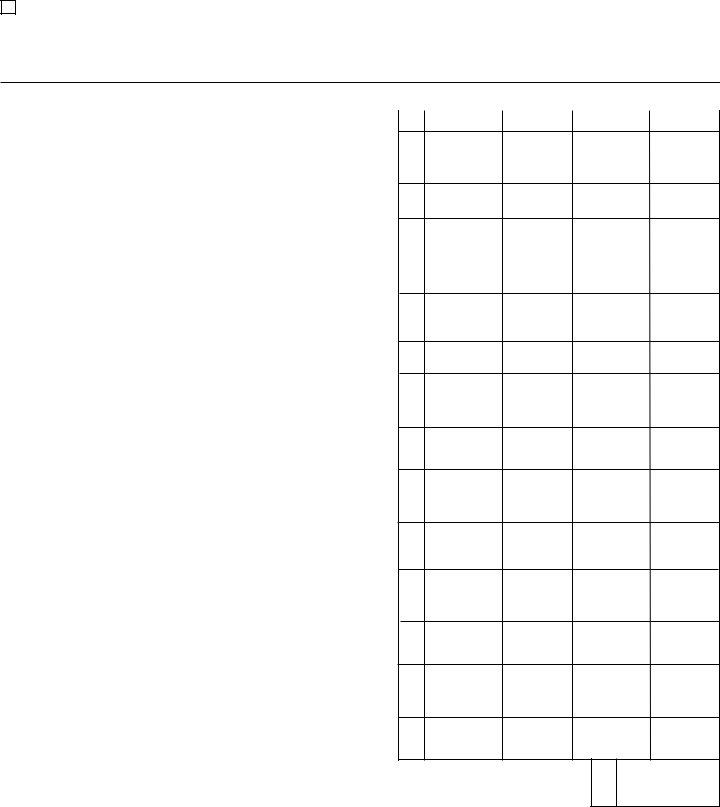

Section V: Compute the penalty on underpayment of estimat-

ed installment payments. Complete this section to calculate the penalty you owe.

21.Enter the underpayment of estimated tax for the quarter, from line 19, Section IV.

22.Enter the due date of the installment from the table in Section IV.

23.Enter the date the underpayment on line 21 was paid or the 15th day of the fourth month after the close of the tax year, whichever is earlier. See HOW INSTALLMENT PAYMENTS ARE APPLIED in the instruc- tions.

24.Number of days from the due date of the installment (line 22) to the date shown on line 23.

25.Number of days on line 24, after 4/15/2013 and before 7/1/2013.

26.Underpayment on line 21 X Number of days on line 25 X ___% = 365

27.Number of days on line 24, after 6/30/2013 and before 10/1/2013.

28.Underpayment on line 21 X Number of days on line 27 X ___% = 365

29.Number of days on line 24, after 9/30/2013 and before 1/1/2014.

30.Underpayment on line 21 X Number of days on line 29 X ___% = 365

31.Number of days on line 24, after 12/31/2013 and before 4/15/2014.

32.Underpayment on line 21 X Number of days on line 31 X ___% = 365

33.For each column, add lines 26, 28, 30 and 32.

34.Add columns (a) through (d) of line 33. Enter the total here.This is your total penalty on underpayment of estimated income tax.

1st Qtr |

2nd Qtr |

3rd Qtr |

4th Qtr |

|

|

|

|

(a) |

(b) |

(c) |

(d) |

21

22

23

24

25

26

27

28

29

30

31

32

33

34

If you have multiple payments for any quarter, the column for the quarter will need to be repeated. Each payment for a quarter

should be computed in a separate column. A spreadsheet can be attached that is in the same format as Section V. When completing line 21, for subsequent columns for the same quarter, subtract the previous payment(s) for the quarter from the underpayment of estimated tax for the quarter (line 19, Section IV).

Page 3 of 3

New Mexico Taxation and Revenue Department

2013 Calculation of Estimated Personal Income Tax Underpayment Penalty

Instructions

Page 1 of 2

WHO MUST MAKE ESTIMATED PAYMENTS?

Every individual who must ile a personal income tax return

under the Income Tax Act also must pay estimated income tax. The way to do this is through either withholding or esti- mated tax payments. There is a penalty for underpayment or nonpayment of estimated tax.

There is no penalty for underpayment of estimated income tax if:

•You are a

•The tax (net New Mexico income tax less total rebates and credits) shown on your return for the current year, less total income tax withheld on Form

•Your tax liability for the tax year is less than $1,000; or

•You are a

HOW MUCH ESTIMATED TAX SHOULD YOU PAY?

To calculate estimated tax, irst determine the “required an- nual payment” or the total amount of estimated tax to be paid

during the tax year.

The required annual payment is the lesser of:

•90% of the tax on the current year’s return (or the tax for the year if no return is iled), or

•100% of the tax on the

When you have igured the required annual payment, then

determine the amount and timing for each estimated tax installment payment.

WHEN IS EACH INSTALLMENT PAYMENT DUE?

Generally, four equal installments of the required annual payment are due on or before the 15th day of the fourth, sixth, and ninth months of the tax year and the irst month of

the following year. For most

dates are: |

|

April 15 |

June 15 |

September 15 |

January 15 |

Sometimes a due date for an estimated payment is a Satur- day, Sunday, state or national legal holiday. The estimated payment is timely when the postmark bears the date of the

next business day. Delivery by a private delivery service is

timely if the date on the delivery service records is on or before the required mailing date.

SPECIAL RULES APPLY TO CERTAIN TAXPAYERS.

There are exceptions to the general rules for determining the timing and amount of each estimated installment payment and for determining receipt of estimated payments.

Each exception is described on page 2 of these instructions.

If one of the special rules applies, you may use a special

method of calculating penalty on underpayment of estimated income tax by using Form

of Estimated Personal Income Tax Underpayment Penalty.

HOW TO REPORTASPECIAL METHOD OF CALCULATION OF ESTIMATED PERSONAL INCOME TAX UNDERPAY- MENT PENALTY.

If you qualify for a special method of calculating estimated per- sonal income tax underpayment penalty, you may reduce your penalty by iling Form

timated Personal Income Tax Underpayment Penalty with your

will determine any estimated personal income tax penalty due based on the standard method.

HOW TO COMPLETE THE INDICATOR BOX ON LINE 31, FORM

If you qualify, you must enter 1, 2, 3, 4 or 5 in the indicator box on Form

of underpayment of estimated tax penatly or your estimated per- sonal income tax underpayment penalty will be calculated using the standard method. Enter 1 if you wish to compute estimated payments based on the actual dates on which all amounts of with-

holding tax were withheld for the applicable tax year. If you have annualized income and are required to ile estimated payments beginning with the 2nd, 3rd, or 4th quarter estimated installment due date, enter 2, 3, or 4 respectively. If you qualify for special rules because you are a farmer or rancher, enter 5. NOTE: Enter 5, even when you iled and paid the tax due by March 1, 2014.

HOW TO COMPLETE THIS FORM.

To calculate estimated tax using this form, irst determine the “required annual payment” in Section II. When you have igured the required annual payment, determine the amount and timing

for each estimated tax installment payment in Sections III and IV.

Use Section V to compute the penalty on underpayment of esti-

mated installment payments. If you have multiple payments for any quarter, the column for the quarter will need to be repeated. Each payment for a quarter should be computed in a separate

column. A spreadsheet can be attached that is in the same format as Section V. When completing line 21, for subsequent columns for the same quarter, subtract the previous payment(s) for the quarter from the underpayment of estimated tax for the quarter (line 19, Section IV).

If you wish the Department to calculate the penalty for you, complete Sections I through IV, mark the box on page 3 of Form

calculation method.

HOW INSTALLMENT PAYMENTS ARE APPLIED.

A payment of estimated tax is credited against unpaid or under- paid installments in the order in which the installment is required to be paid. Therefore, an installment payment is applied irst to the earliest installment payment due. Section IV, computes the underpayment on line 19, applying each payment irst to any

balance due on a prior underpaid installment.

New Mexico Taxation and Revenue Department

2013 Calculation of Estimated Personal Income Tax Underpayment Penalty

Instructions

HOW TO CALCULATE THE PENALTY FOR UNDERPAY- MENT OR NONPAYMENT OF ESTIMATED PERSONAL INCOME TAX.

Underpayment or nonpayment of estimated tax is subject to

penalty on the difference between the estimated tax payment and the actual amount of estimated tax due. Penalty accumu- lates from the due date of the estimated tax payment until the earlier of:

•the date the payment is made, or

•the 15th day of the fourth month following the close of the tax year.

New Mexico calculates penalty (in the form of interest) on

underpayment of estimated tax at the annual rate established each quarter for individual income tax purposes under the U.S. Internal Revenue Code (IRC). Penalty is computed on a

daily basis for each day the payment is late. The formula for calculating penalty is:

Underpay- X |

number of days late |

X effective annual |

ment due |

total days in the year |

interest rate |

|

|

for the quarter |

Beginning January 1, 2008, the interest rate is reduced to the annual rate established each quarter for individual income tax purposes under the U.S. Internal Revenue Code (IRC). The

IRC rate for each

No penalty applies to the fourth estimated payment if the tax- payer iles a return and pays the entire amount on or before January 31 of the following year.

If the balance due is $1,000 or more, the Department irst de- termines if the required annual payment was made in timely installments. If it was not, the Department calculates the un-

derpayment penalty and issues an assessment. If you believe

an assessment is in error, you can protest the assessment and

provide more information.

NOTE: A special rule applies for computing the underpayment

penalty for personal estimated income tax. The interest rate that applies to the 1st quarter following the tax year also applies to

the 1st 15 days of the 4th month (April) following the tax year.

HOW TO PAY AN ESTIMATED INSTALLMENT PAYMENT.

You may pay through the Department’s web site at www.tax. newmexico.gov. Click on “Online Services”. You may pay by electronic check at no charge. An electronic check authorizes the Department to debit your checking account in the amount you specify. You may also make tax payments via credit card.

A convenience fee of 2.49% is required to use this service. The fee reimburses the state for fees charged by the credit card company.

To make an estimated installment payment by check, obtain the

Page 2 of 2

Department’s web site, one of the Department’s district ofices,

or from your tax return preparation software. Ensure that your

form indicates the correct tax year on the

and the tax year of the return to which the payment applies

on the check or money order. Make the payment payable to

New Mexico Taxation and Revenue Department and mail with Form

New Mexico Taxation and Revenue Department

P.O. Box 8390

Santa Fe, NM

ALTERNATIVE METHODS FOR CALCULATION OF ES- TIMATED PERSONAL INCOME TAX.

Annualized income. Taxpayers with seasonal income can use a modiied annualization method to determine the amount

and timing of their estimated payments. If a taxpayer does not have annualized income based on actual income received through March 31 suficient to require a payment, no payment is required. The test dates for subsequent payments are May 31, August 31 and December 31. Based on actual income received, if a taxpayer is not required to make a payment for a speciic period, the taxpayer may have to make up later in

the year for not paying the earlier installment. See Publication

Farmers and Ranchers. The law provides a special rule, identical to the federal rule, for farmers and ranchers who

expect to receive at least

their GROSS income from farming or ranching in the prior year. Farmers and ranchers who meet the gross income test may:

1)make one estimated payment in the amount of the “required annual payment” on or before January 15 of

the year following the tax year of the return, or

2)ile and pay in full on or before March 1 of the year following the tax year of the return.

On joint returns the farmer or rancher must consider the spouse’s gross income in determining whether the

Individuals who wish to compute estimated installment payments based on the actual dates on which all amounts of withholding tax were withheld for the applicable tax

year. The New Mexico income tax deducted and withheld by an employer is a payment of estimated tax. An equal amount

of the tax withheld shall be considered as paid on each install- ment due date unless the taxpayer establishes the dates on which all amounts were actually withheld. This provision may be applied separately to wage and pension withholding and other amounts withheld under the Withholding Tax Act.