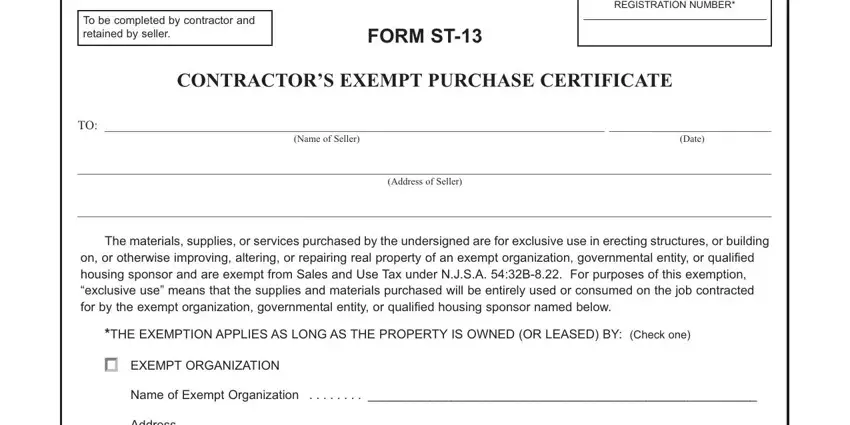

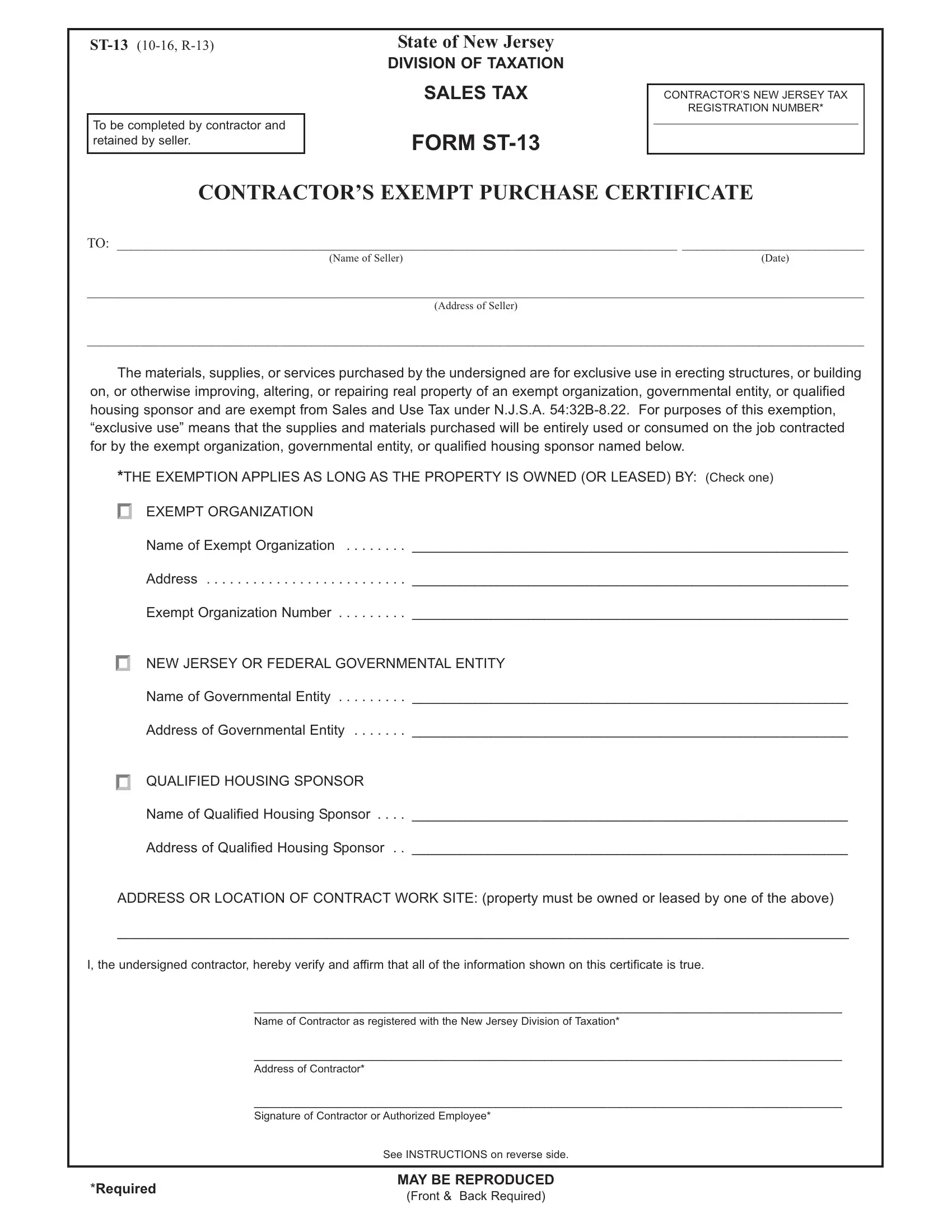

ST-13 (10-16, R-13)

To be completed by contractor and retained by seller.

State of New Jersey

DIVISION OF TAXATION

SALES TAX

FORM ST-13

CONTRACTOR’S NEW JERSEY TAX

REGISTRATION NUMBER*

CONTRACTOR’S EXEMPTPURCHASE CERTIFICATE

TO: ________________________________________________________________________________ __________________________

(Name of Seller)(Date)

_______________________________________________________________________________________________________________

(Address of Seller)

_______________________________________________________________________________________________________________

The materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering, or repairing real property of an exempt organization, governmental entity, or qualified housing sponsor and are exempt from Sales and Use Tax under N.J.S.A. 54:32B-8.22. For purposes of this exemption, “exclusive use” means that the supplies and materials purchased will be entirely used or consumed on the job contracted for by the exempt organization, governmental entity, or qualified housing sponsor named below.

*THE EXEMPTION APPLIES AS LONG AS THE PROPERTY IS OWNED (OR LEASED) BY: (Check one)

EXEMPT ORGANIZATION

Name of Exempt Organization . . . . . . . . ________________________________________________________

Address . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________________________________________

Exempt Organization Number . . . . . . . . . ________________________________________________________

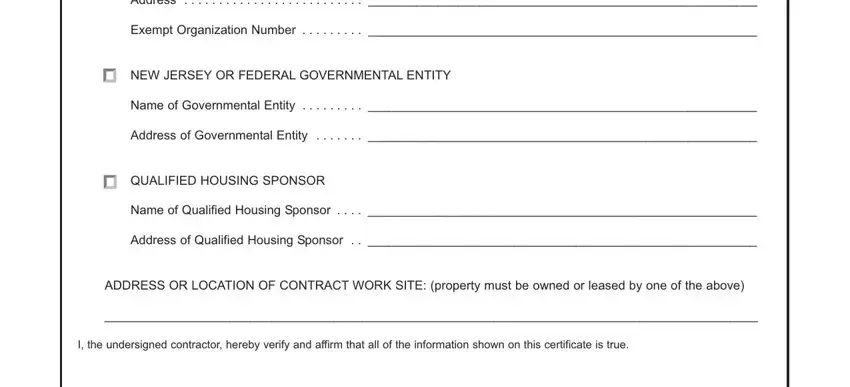

NEW JERSEY OR FEDERAL GOVERNMENTAL ENTITY

Name of Governmental Entity . . . . . . . . . ________________________________________________________

Address of Governmental Entity . . . . . . . ________________________________________________________

QUALIFIED HOUSING SPONSOR

Name of Qualified Housing Sponsor . . . . ________________________________________________________

Address of Qualified Housing Sponsor . . ________________________________________________________

ADDRESS OR LOCATION OF CONTRACT WORK SITE: (property must be owned or leased by one of the above)

______________________________________________________________________________________________

I, the undersigned contractor, hereby verify and affirm that all of the information shown on this certificate is true.

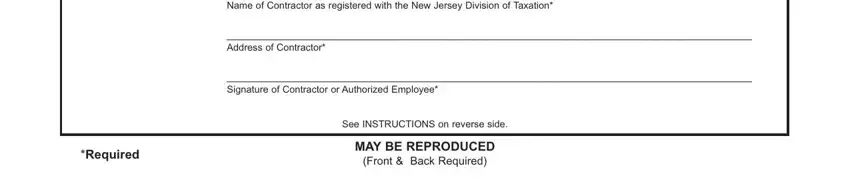

_____________________________________________________________________________________

Name of Contractor as registered with the New Jersey Division of Taxation*

_____________________________________________________________________________________

Address of Contractor*

_____________________________________________________________________________________

Signature of Contractor or Authorized Employee*

See INSTRUCTIONS on reverse side.

|

*Required |

MAY BE REPRODUCED |

|

(Front & Back Required) |

|

|

INSTRUCTIONSTO SELLERS CONCERNING

CONTRACTOR’S EXEMPTPURCHASE CERTIFICATES - ST-13

1.Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reasons(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the Federal employer identification number or out-of-State registration number. Individual purchasers must include their driver’s license number;

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name and address are not required and are not considered when determining if an exemption certificate is fully completed. Aseller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

2. Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

3.Acceptance of an exemption certificate in an audit situation – On and after October 1, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transaction, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the |

tax on |

the transaction unless it is discovered through |

the audit process that the seller had knowledge or had reason to know at the time such information |

was provided that the information |

relating to the exemption claimed was materially false or the seller otherwise knowingly |

participated |

in activity intended to purposefully |

evade the tax that is properly due on the transaction. The burden is on the Division |

to establish that the |

seller had knowledge or had reason |

to know at the time the information was provided that the information was materially false. |

|

|

|

4.AdditionalPurchasesbySamePurchaser-This Certificate will serve to cover additional purchases by the same purchaser of the same general type of property or service.

5.Definitions:

“Contractor” - means any individual, partnership, corporation or other commercial entity engaged in any business involving erecting structures for others, or building on, or otherwise improving, altering, or repairing real property of others.

“ExemptOrganization”- is any organization which holds a valid exempt organization permit issued pursuant to the provisions of N.J.S.A. 54:32B-9(b) which has issued an ST-5 Exempt Organization Certificate to the contractor.

“NewJerseyorFederalGovernmentalEntity”-isanyagency,instrumentality,politicalsubdivision,authority,orpubliccorporationofthegovernments of the United States ofAmerica or the State of New Jersey. Governmental agencies, instrumentalities or political subdivisions of states other than New Jersey do not qualify for exemption.

“QualifiedHousingSponsor”- is any person, partnership, corporation or association certified by the New Jersey Housing and Mortgage Finance Agency to have obtained financing, in addition to federal, state or local government subsidies, for a housing project from the New Jersey Housing Mortgage FinanceAgency pursuant to N.J.S.A. 55:14K-1, et seq. and has issued a New Jersey Sales and Use Tax Housing Sponsor Letter of Exemption to the contractor.

PRIVATE REPRODUCTION of Contractor’s Exempt Purchase Certificates may be made without the prior permission of the Division of Taxation.

FOR MORE INFORMATION: Read publication S&U-6 (Sales Tax ExemptionAdministration) at

http://www.state.nj.us/treasury/taxation/pdf/pubs/sales/su6.pdf

DO NOTMAILTHIS FORMTOTHE DIVISION OFTAXATION

This form is to be completed by contractor and given to and retained by seller.