You may fill out EG-13-B effortlessly by using our PDFinity® editor. Our expert team is ceaselessly working to expand the tool and help it become much easier for people with its cutting-edge features. Bring your experience to another level with continually improving and exceptional opportunities we offer! Should you be seeking to get started, here is what you will need to do:

Step 1: Open the PDF form inside our tool by clicking the "Get Form Button" above on this webpage.

Step 2: As soon as you open the PDF editor, you'll notice the form all set to be filled out. Apart from filling out different blank fields, you could also do other things with the file, such as writing your own words, editing the initial text, adding images, putting your signature on the document, and a lot more.

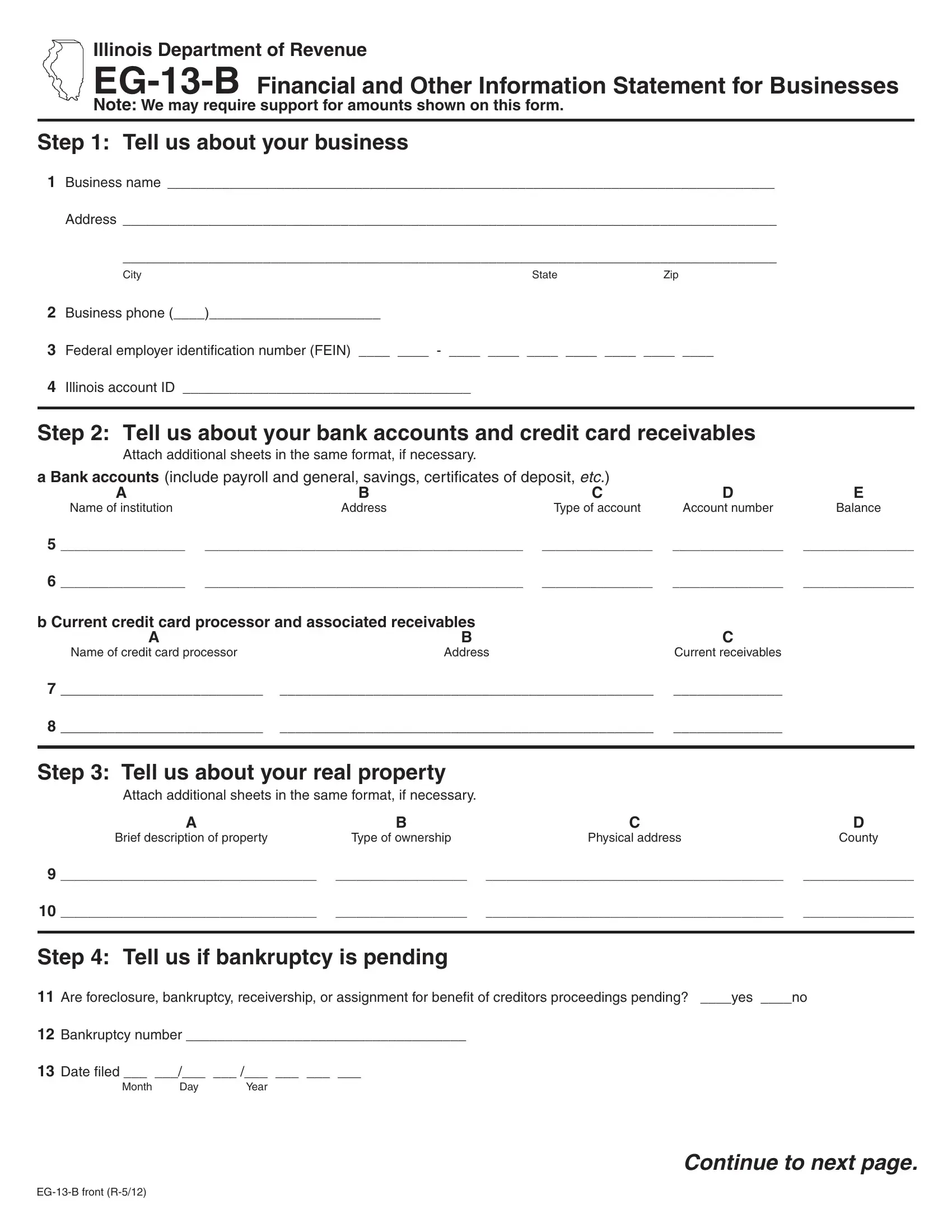

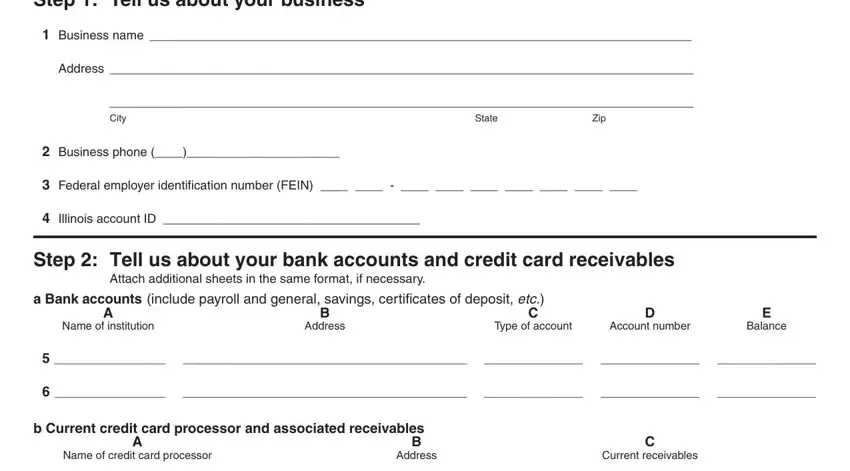

When it comes to blanks of this precise form, here is what you should consider:

1. While submitting the EG-13-B, ensure to include all necessary fields within the associated section. It will help expedite the work, allowing your details to be processed quickly and appropriately.

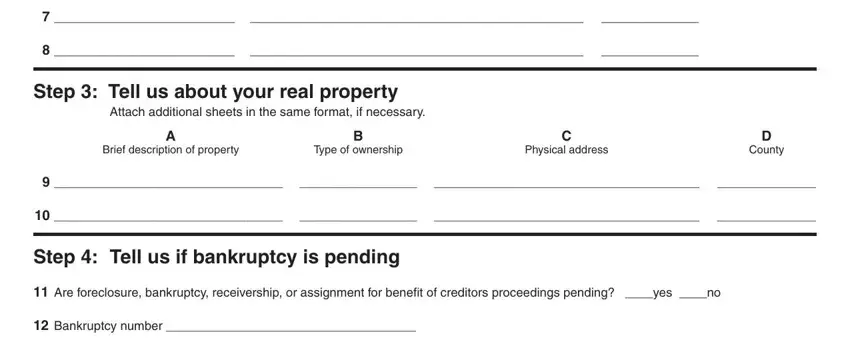

2. Once this section is done, proceed to enter the relevant information in all these - Step Tell us about your real, Attach additional sheets in the, Brief description of property, Type of ownership, Physical address, County, Step Tell us if bankruptcy is, Are foreclosure bankruptcy, and Bankruptcy number.

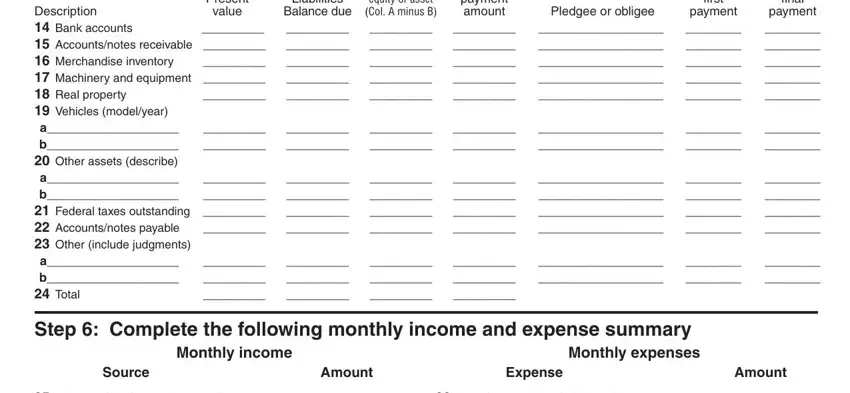

3. The third stage is going to be straightforward - fill out all the empty fields in Monthly payment amount, equity or asset Col A minus B, Liabilities Balance due, Step Complete the following, Pledgee or obligee, first, payment, final payment, Amount, Monthly expenses, Source, Amount, Expense, Monthly income, and Step Complete the following to conclude this segment.

Be extremely attentive when completing Step Complete the following and Pledgee or obligee, because this is where a lot of people make some mistakes.

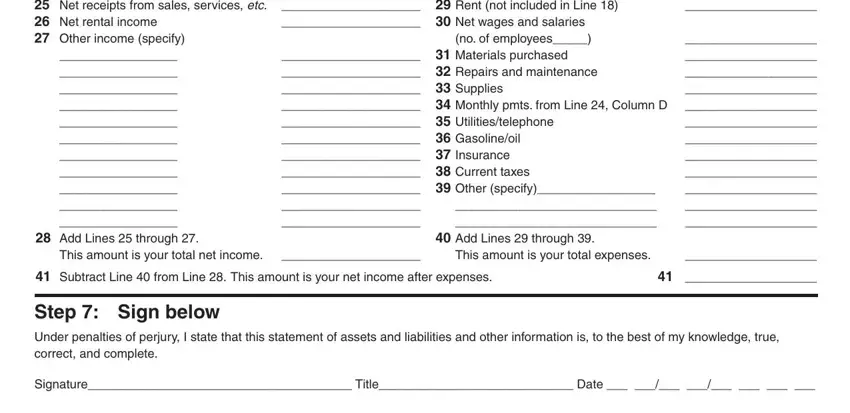

4. It is time to complete this next section! In this case you'll have all these Net wages and salaries no of, Step Complete the following, Materials purchased Repairs, This amount is your total net, This amount is your total expenses, Add Lines through, Subtract Line from Line This, Step Sign below Under penalties, and Signature Title Date form blanks to fill in.

Step 3: Immediately after taking one more look at your fields and details, press "Done" and you are done and dusted! Sign up with us today and easily get EG-13-B, available for downloading. Each modification you make is handily saved , which enables you to change the file at a later stage as required. Here at FormsPal.com, we aim to guarantee that all your details are maintained secure.