The RPD-41317 form, officially known as the Solar Market Development Tax Credit Claim Form, plays a pivotal role in encouraging the adoption of solar energy in New Mexico. Designed for taxpayers who have received certification from the Energy, Minerals and Natural Resources Department (EMNRD) for solar energy system installations, this form enables individuals and fiduciaries to claim a tax credit against their New Mexico personal or fiduciary income tax liability. Eligible systems include both photovoltaic and solar thermal setups installed in residences, businesses, or agricultural enterprises owned by the taxpayer. With a tax incentive that could reach up to $9,000, based on up to 10% of the purchase and installation costs, the form supports the state’s commitment to clean energy and sustainability. Significantly, the form caters to systems installed after January 1, 2006, and before December 31, 2016, with provisions for carrying forward unused credits for up to ten consecutive years. The shift in credit percentage—from up to 30% before 2009, adjusted for federal credits, to the current rate—reflects evolving policies toward sustainable energy incentives. Completing and submitting the RPD-41317, along with the required certification letter from EMNRD, attaches directly to one's New Mexico income tax return, punctuating the state's eco-friendly tax policies. This demonstrates an intricate marriage between tax policy and environmental stewardship, underscored by detailed instructions for claiming and calculating the credit to ensure proper application and compliance.

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41317 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | New_Mexico, nm rpd 41317, nm tax form rpd 41317, photovoltaic |

State of New Mexico - Taxation and Revenue Department

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM

Purpose of Form. Form

but before December 31, 2016, in a residence, business or agricultural enterprise in New Mexico owned by that taxpayer. To claim the credit, the taxpayer must attach to the personal or iduciary income tax return a completed

$9,000, is available for up to 10% of the purchase and installation costs. Unused solar market development tax credits may be carried forward for a maximum of ten consecutive years following the tax year for which the credit was approved.

NOTE: For tax years beginning before January 1, 2009, the solar market development tax credit allowed was up to 30% of the purchase and installation costs of a qualiied photovoltaic or solar thermal system, reduced by the allowable federal tax

credit, whether or not the federal credit was claimed. The credit could not exceed $9,000.

To apply for the credit contact the Energy Conservation and Management Division of EMNRD at (505)

Name of taxpayer |

|

|

|

Social security number (SSN) |

|

|

|

|

|

|

|

Mailing address |

City, state and ZIP code |

|

|

||

|

|

|

|

|

|

Name of contact |

|

Phone number |

|

||

|

|

|

|

|

|

1. Enter the beginning and ending date of the tax year of this claim. |

From |

to |

|

Tax years beginning prior to January 1, 2006 are NOT eligible. |

|||

|

|

2.Enter the Net New Mexico income tax calculated before applying any credit.

3.Enter the portion of total credit available (from Schedule A) claimed on your current New Mexico personal or iduciary income tax return. Do not enter more than the amount of Net New Mexico personal or iduciary income tax due. In a tax year the credit used may not exceed the amount of personal or iduciary income tax otherwise due. Also attach a completed Schedule CR for the applicable tax return.

2.$

3.$

Enter the credit claimed on the tax credit schedule

Apply unused credit from

carried forward for a maximum of 10 consecutive tax years following the tax year in which the solar thermal or photovoltaic system was certiied. Attach Schedule A.

NOTE: Failure to submit this form and other required attachments to your New Mexico personal or iduciary income tax return will result in denial of the credit.

Under penalty of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of taxpayer |

|

Date |

State of New Mexico - Taxation & Revenue Department

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM

Schedule A

Once a credit application is approved by EMNRD, complete and attach Form

Credit Claim Form, including Schedule A, to your New Mexico income tax return along with the applicable tax credit Schedule

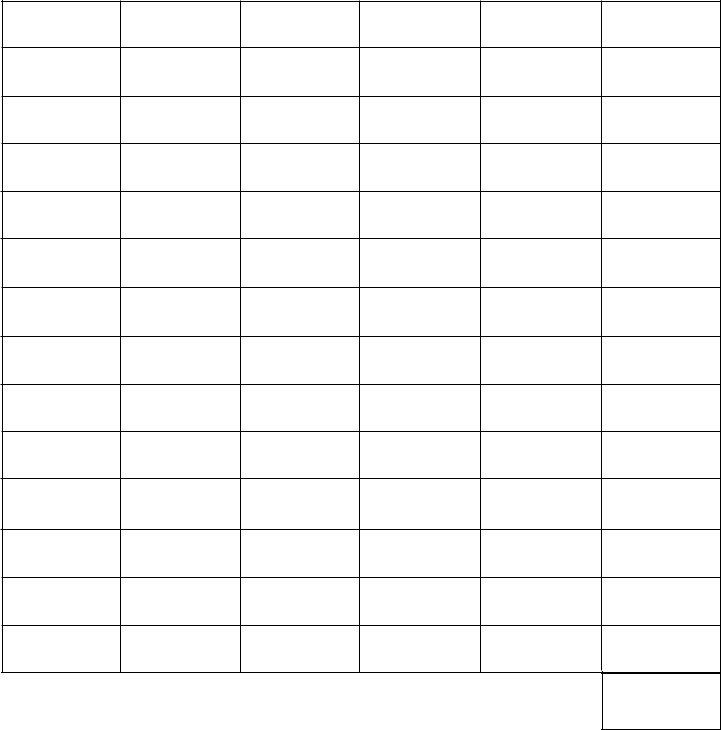

(a)

Project number

(b)

Year of approval

(c)

Amount of credit

approved

(d)

Total credit claimed in previous tax years

(e)

Unused credit [(c) - (d)]

(f)

Applied to the attached

return

TOTAL credit available

Enter the sum of column (f) here and on

line 3 of Form

State of New Mexico - Taxation & Revenue Department

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM

Schedule A

You must attach Schedule A with Form

Schedule A Instructions

For each solar market development tax credit approved by the New Mexico Energy, Minerals and Natural Resources Depart- ment (EMNRD) complete a row in Schedule A. Do not include credits approved in a tax year that is more than eleven years prior to the tax year for which this claim is iled. Unused solar market development tax credits may not be carried forward for

more than ten consecutive tax years following the tax year for which the credit was approved. Do not include credits which have been claimed in full in prior tax years..

Only the person to whom the certiicate of eligibility is issued may claim the credit.

COLUMN INSTRUCTIONS

(a)Project number. Enter the project number shown on the certiicate of eligibility for the solar market development tax credit issued to you by EMNRD.

(b)Year of approval. Enter the tax year for which the solar market development tax credit has been approved as indicated on the certiicate of eligibility.

(c)Amount of credit approved. For each certiicate listed, enter the amount of credit approved as indicated on the certii- cate of eligibility.

(d)Total credit claimed in previous tax years. For each credit amount listed in column (b), enter the total amount of credit claimed in all tax years prior to the current tax year.

(e)Unused credit. For each credit, subtract the amount in column (d) from the amount in column (c).

(f)Applied to the attached return. For each credit, enter in column (f) the amount that is applied to the attached New

Mexico income tax return.

When calculating the amount in column (f), apply the following rules:

•Applying credits: Apply solar market development tax credits in the order that they were approved. If you have both a

•The maximum amount of credit claimed in a tax year. The sum of tax credits applied to the tax due on the return may not exceed the income tax claimed on the New Mexico income tax return. That amount is the net New Mexico income tax calculated before applying any tax credits claimed.