In the sprawling landscape of tax documentation and compliance, the RPD-41367 form emerges as a vital instrument for pass-through entities (PTEs) in New Mexico, navigating the specifics of withholding detail and tax reporting. The essence of this form can be distilled into its core purpose: to furnish a detailed account of withholding from the allocable net income of owners, partners, or members, thereby ensuring the accurate and timely remittance of taxes to the New Mexico Taxation and Revenue Department. Revised on August 19, 2019, it underscores state tax obligations for both resident and non-resident owners, embedding stipulations for electronic and paper filing predicated on the number of New Mexico payees a PTE reports. Furthermore, the form delineates the operational aspects of tax payments, adjustments for amended returns, penalties, and interest alongside directions for claiming refunds through the RPD-41373 form. Instructions integrated within or accompanying the RPD-41367 detail the procedural mechanics of filing, from the online submission nuances via the Taxpayer Access Point (TAP) website to specific directions for paper filers, encapsulating a comprehensive guide for PTEs to navigate their fiscal responsibilities. This form, therefore, not only acts as a submission vehicle but also as a blueprint for compliance, reflecting the broader regulatory framework governing pass-through entity taxation in New Mexico.

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41367 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | nm rpd 41367, new mexico form rpd 41367 instructions 2020, new mexico form rpd 41367, nm form rpd 41367 |

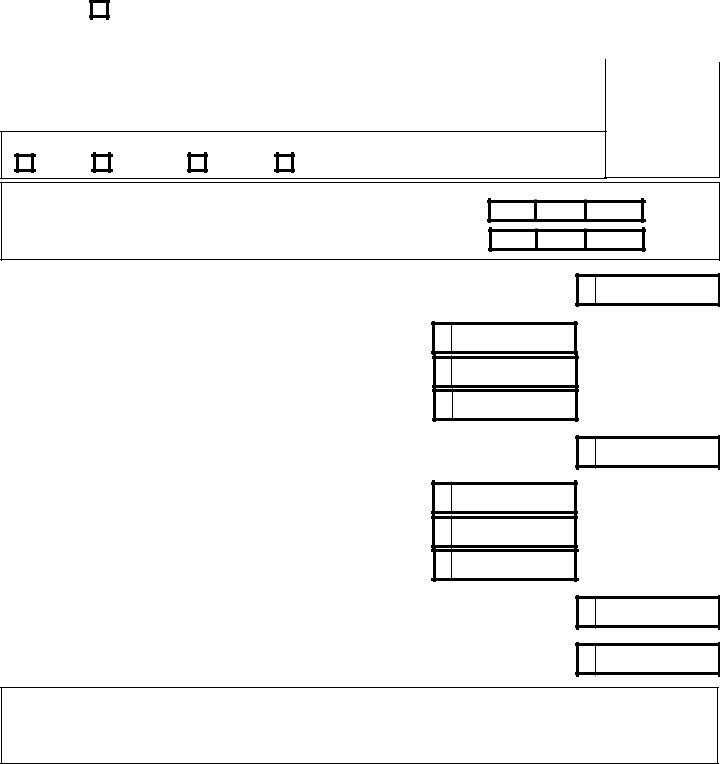

*199080200* |

|

Rev. 08/19/2019 |

|

New Mexico Taxation and Revenue Department |

|

2019 |

|

Withholding Detail |

|

You can

Check if amended |

Page ______ of _______ |

|

Name of PTE |

|

PTE’s FEIN |

|

|

Line 1. Total New Mexico net income |

||

|

|

|

|

|

|

|

|

PTE’s address (number and street) |

City |

|

|

State |

Postal/ZIP code |

|

FOR DEPARTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USE ONLY |

If foreign address, enter country |

Foreign province and/or state |

|

|

|

|||

|

|

|

|

||||

|

|

|

|

|

|

|

|

Mark the type of New Mexico income tax return the PTE is filing for the current tax year.

PTE |

Other ___________________________ |

PTE’s tax year if other than the full 2019 calendar year. Due date of the PTE’s federal return.

|

Beginning of tax year |

|

|

Last day of tax year |

Original Due Date |

||||

|

|

|

|

|

|

|

|

|

Extended Due Date |

MM |

|

DD |

CCYY |

|

MM |

|

DD |

CCYY |

|

Withholding Tax

Line 2. Total withholding from column 4 on all Supplemental Pages. ..........................................

2

Payments |

|

Line 3. Tax withheld from the PTE, then passed to owners |

3 |

(reported on your CIT, SCorp, or PTE return) |

|

Line 4. Total |

4 |

Line 5. For amended returns only. Refunds received |

5 |

(see the instructions) |

|

Line 6. Total tax payments. Subtract line 5 from the sum of lines 3 and 4 |

................................... 6 |

Amount Due

Line 7. Tax Due. If line 2 is greater than line 6, enter the difference .....

Line 8. Penalty (see the instructions) ....................................................

Line 9. Interest (see the instructions) ....................................................

7

8

9

Line 10. Total due. Add lines 7, 8, and 9.......................................................................................

10

Overpayment

Line 11. Overpayment. If line 6 is greater than line 2, enter the difference here ..........................

You must attach Form

11

I declare I have examined this form and to the best of my knowledge and belief, it is true, correct, and complete.

Authorized signature ___________________________________________________ Date ____________________________________________

Phone number ___________________________________ Email address _________________________________________________________

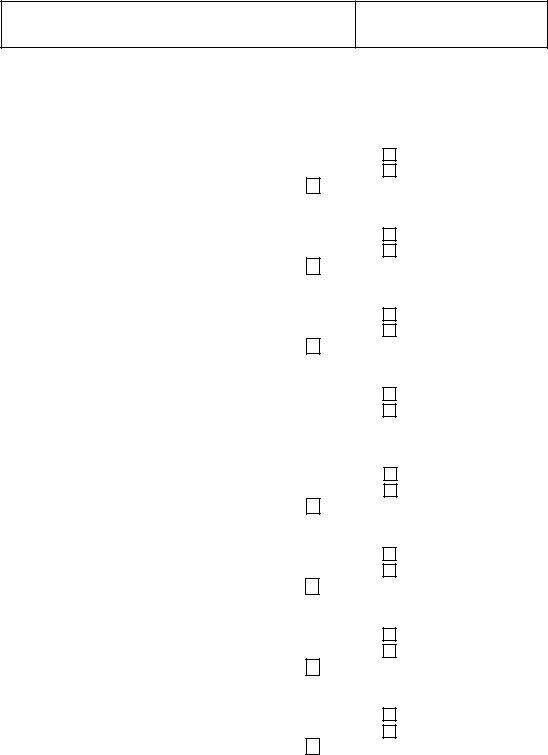

Withholding Detail |

*199090200* |

|

Rev. 08/19/2019

New Mexico Taxation and Revenue Department

2019

Supplemental Page

Name of

PTE’s FEIN

Page ______ of _______

Do not file

Owner’s Name, Street Address, |

Column 2 |

Column 3 |

Column 4 |

Col. 5 |

|||||

City, State, and ZIP code |

Owner’s SSN |

Owner’s share of |

Owner’s share of |

Reason Code |

|||||

(see Who Must File in the instructions) |

or FEIN |

|

allocable net income |

withholding tax |

withholding |

||||

|

not required |

||||||||

|

|

|

|

|

|

|

|||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

SSN |

|

|

|

|

|

Mark if outside the U.S. |

|

|

|

|

|

|

|

||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

SSN |

|

|

|

|

|

Mark if outside the U.S. |

|

|

|

|

|

|

|

||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

SSN |

|

|

|

|

|

Mark if outside the U.S. |

|

|

|

|

|

|

|

||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

SSN |

|

|

|

|

|

Mark if outside the U.S. |

|

|

|

|

|

|

|

|

|

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

SSN |

|

|

|

|

|

Mark if outside the U.S. |

|

|

|

|

|

|

|

||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

Mark if outside the U.S. |

|

SSN |

|

|

|

|

|

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

Mark if outside the U.S. |

|

SSN |

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

|

|

Mark one: |

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

Mark if outside the U.S. |

|

SSN |

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

If you need more space, print this supplemental form directly |

|

Total withholding |

|

|

|

|

|||

from the website and attach the additional supplemental forms |

|

on this page |

|

|

|

|

|||

to the first page of this form. Reproducing from a photocopy |

|

|

|

|

|

|

|||

reduces the readability of the barcode on scanning equipment. |

|

|

|

|

|

|

|||

New Mexico Taxation and Revenue Department

2019

Withholding Detail

ANSWERS TO FREQUENTLY ASKED QUESTIONS

1.If no tax is withheld for its owners, does a

The PTE must file a

2.What is the withholding tax rate?

The effective rate is 4.9%. The rate table shows the current tax rate. When the rate changes, the rate table reflects the new rate. The Department is required to give remitters a

If your report period begins on or after

January 1, 2011, the effective rate is 4.9%.

3.If I have an overpayment amount on line 11 of the

According to Section

WHO MUST FILE

Annually, a PTE subject to withholding tax from the allocable net income of its owners, partners, or members (owners), according to the Oil and Gas Proceeds and

●Report each owner’s share of net income allocable to New Mexico.

●List only payees who have New Mexico net allocable income and losses.

●Remit the New Mexico tax withheld for each

The PTE reports all resident and

NOTE: For tax years beginning on or after January 1, 2011, a PTE was required to remit the tax quarterly. The requirement to remit the tax annually was reinstated for tax years beginning on or after January 1, 2012.

Except for a PTE that is a personal services business, if the PTE entered into an agreement with the owner for the owner to file and pay tax due on the owner’s share of

allocable net income of the PTE, the PTE enters 2 in the

Reason Code box in Supplemental Page, column 5.

Personal Services Business

A personal services business is a business organization that receives payments for the services of a performing artist for purposes of the film production tax credit.

NOTE: A PTE that is a personal services business cannot enter into an agreement with its owners using

Owner’s or Remittee’s Agreement to Pay Withholding On Behalf of a

Estates and Trusts

An estate or trust that distributes New Mexico net income taxable to its recipients is a PTE and subject to withholding pursuant to the Oil and Gas Proceeds and

The estate or trust must file and pay the tax withheld using Fiduciary

*For tax years 2011 and 2012, estates and trusts that are PTEs were required to file

WHEN TO FILE

The

Timely Postmark

If the due date of the return falls on a Saturday, Sunday, or a state or national legal holiday, the return is timely if the postmark bears the date of the next business day.

Extensions

If the PTE obtains a federal automatic extension or a New Mexico extension for its return, the extension also applies to filing the

1

New Mexico Taxation and Revenue Department

2019

Withholding Detail

HOW TO FILE AND PAY

New Mexico approves software you can use to

1.Click

2.Click the search icon and search for Approved Software for Online Filing.

Requirements for

●

●

●Paper filing is only acceptable for PTEs with 50 or fewer New Mexico payees.

IMPORTANT: The Department rejects

Department must receive the request at least 30 days before the taxpayer’s

Sign Up Now.

To learn more about setting up your account, watch these videos:

1.On TAP HOME, click

Create a Logon.

2.To add your PTW Remitter account, click Adding Access to Accounts.

Bulk Filing

Bulk filing lets you upload multiple returns and payments into TAP for processing. The primary users of bulk filing are tax preparers who file for their clients. To use bulk filing, do the following:

1.Click https://tap.state.nm.us and log in.

2.Under I WANT TO, click Upload XML Bulk File to display the Instructions page.

3.Read the instructions, click Next, and then continue to complete the upload process.

To watch a video about bulk filing, do the following on TAP

HOME:

1.Under Menu, click

2.On the left, click Bulk Filing in TAP.

For more information about bulk filing, do the following on

TAP HOME:

1.Under TAP HOME, click Frequently Asked

Questions.

2.In the first row of tabs, click Bulk and then click your question to see the answer.

Importing an Excel File

You can use an Excel template from the Department website to show owner information. To find and complete the template and then import an Excel file, do the following:

1.Under TAP HOME, click Frequently Asked

Questions.

2.In the first row of tabs, click Templates and then click next to Q4, How do I get the latest templates for importing

3.Complete the template and save this copy.

4.Log into your TAP account

5.Click

6.In the bottom right corner of your TAP account, click the Import button and load the Excel template you completed and saved in step 3.

For more information about templates and importing Excel files, do the following:

1.On the TAP home page, click Frequently Asked Questions.

2.Click the Templates tab and then click a question about

To

1.Click https://tap.state.nm.us.

2.Under WITHOUT LOGGING ON, click Make a

Payment, and then click Business.

3.From the

PTW Remitter.

Paper Filing

If the PTE has 50 or fewer New Mexico payees, you can file a paper

New Mexico Taxation and Revenue Department P.O. Box 25127

Santa Fe, NM

2

New Mexico Taxation and Revenue Department

2019

Withholding Detail

Paying with a Check or Money Order

You can pay tax due by check or money order and a payment voucher. To pay tax due with a check or money order, follow these steps:

1.Use one of these vouchers, even when submitting the payment with your return:

♦

♦

2.Mail the payment and the payment voucher to the address on the voucher.

When you provide a check as payment, you authorize the Department to use information from your check to make a

REFUNDS

If you request a refund due to an overpayment of tax withheld, you must file

of Tax Withheld From

NOTE: The Department requires you to file both the PTE’s income tax return and its

PTE WITHHOLDING REQUIREMENTS

PTEs are required to provide sufficient information to enable the owners to comply with the provisions of the Income Tax Act and the Corporate Income and Franchise Tax Act with respect to the owners’ share of the net New Mexico income.

Requirements for Sufficient Information

●For your owners to receive proper credit for withholding, you must issue one of these withholding statements to the owner:

♦RPD- 41359, Annual Statement

♦Form

●A PTE must provide these statements to owners by February 15th of the year following the year for which the statement is made.

●PTEs do not submit to the Department statements they issue to owners. The filed

IMPORTANT: The Department does not accept Schedule

VERIFICATION OF INCOME TAX INFORMATION

The Department is required to compare the tax information received from a PTE with the records of the owners who file returns with New Mexico.

●If the Department determines that an owner is not paying the proper tax on net income, the Department may request the PTE to show reasonable cause for not withholding.

●If a PTE and an owner entered into tax agreement

Withholding On Behalf of a

IMPORTANT: If a PTE and

Remittee's Agreement To Pay Withholding On Behalf of a

TO GET HELP

If you have questions, call (505)

(866)

INSTRUCTIONS TO COMPLETE THE REPORT

This is the sequence of items to complete:

1.Line 1, at the top right after Name of PTE and PTE's

FEIN (page 1)

2.Supplemental Page (page 2 plus additional pages if the PTE has more than 8 owners)

3.Lines 2 to 11 (page 1)

4.Signature and contact information (page 1)

Tax Year and Due Dates

Tax Year. If the PTE is filing for a tax year that is not a full calendar year, enter the first day and the last day of the tax year. Otherwise, leave blank.

NOTE: The tax year for the New Mexico return must be the same as the tax year for the PTE's federal return.

Due Date Of Federal Return. Enter the due date of the

PTE’s federal income tax return. If no federal income tax

3