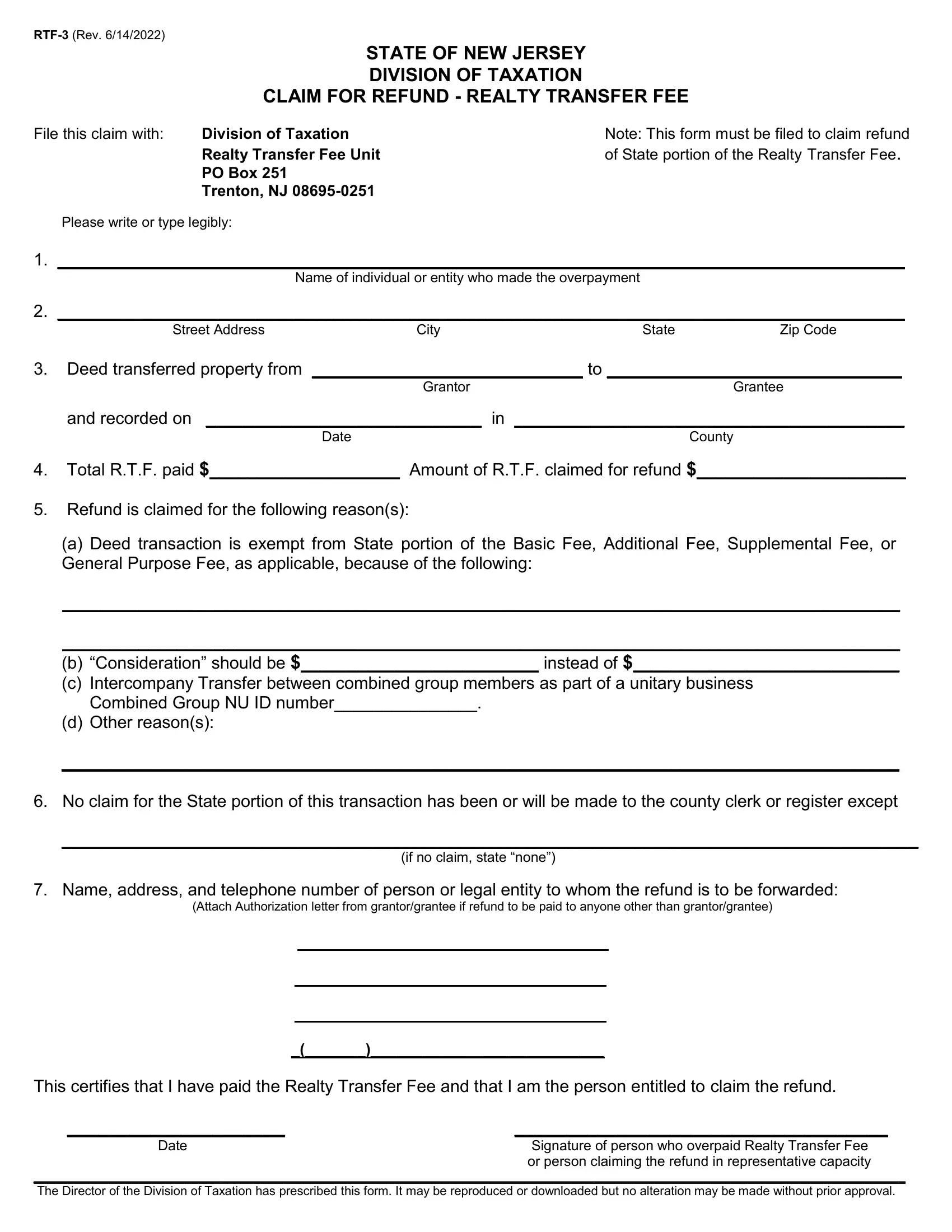

RTF-3 (Rev. 10/19/2015)

STATE OF NEW JERSEY

DIVISION OF TAXATION

CLAIM FOR REFUND - REALTY TRANSFER FEE

File this claim with: |

Division of Taxation |

Note: This form must be filed to claim refund |

|

Realty Transfer Fee Unit |

of State portion of the Realty Transfer Fee. |

|

PO Box 251 |

|

|

Trenton, NJ 08695-0251 |

|

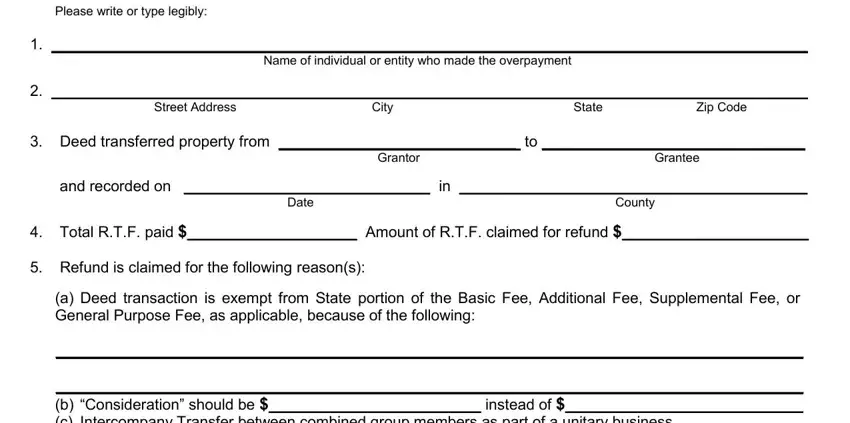

Please write or type legibly:

1._________________________________________________________________________________________

Name of individual or entity who made the overpayment

2._________________________________________________________________________________________

Street Address |

City |

State |

Zip Code |

3.Deed transferred property from ____________________________ to _______________________________

Grantor |

Grantee |

and recorded on _____________________________ in |

_________________________________________ |

Date |

County |

4.Total R.T.F. paid $____________________ Amount of R.T.F. claimed for refund $______________________

5.Refund is claimed for the following reason(s):

(a)Deed transaction is exempt from State portion of the Basic Fee, Additional Fee, Supplemental Fee, or General Purpose Fee, as applicable, because of the following:

________________________________________________________________________________________

________________________________________________________________________________________

(b)“Consideration” should be $_________________________ instead of $____________________________

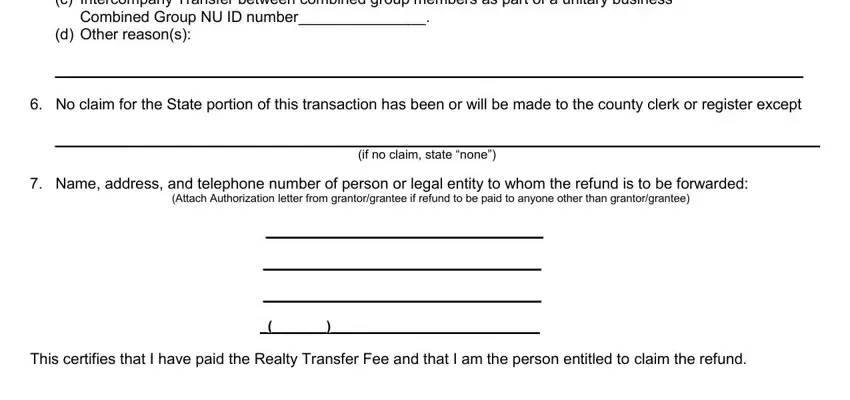

(c)Grantee refund as a result of Chapter 33, P.L. 2006 (See Section II on reverse side.) Property class at time of sale _______________.

(d)Other reason(s):

________________________________________________________________________________________

6. No claim for the State portion of this transaction has been or will be made to the county clerk or register except

__________________________________________________________________________________________

(if no claim, state “none”)

7.Name, address, and telephone number of person or legal entity to whom the refund is to be forwarded:

____________________________________

____________________________________

____________________________________

_(_______)___________________________

This certifies that I have paid the Realty Transfer Fee and that I am the person entitled to claim the refund.

_____________________ |

____________________________________ |

Date |

Signature of person who overpaid Realty Transfer Fee |

|

or person claiming the refund in representative capacity |

______________________________________________________________________________________________________________________________

The Director of the Division of Taxation has prescribed this form. It may be reproduced or downloaded but no alteration may be made without prior approval.

PROCEDURES FOR REFUNDING THE STATE PORTIONS OF THE REALTY TRANSFER FEE

I.GRANTOR FILING A CLAIM FOR REFUND OF THE REALTY TRANSFER FEE

1.All claims for refunds of the Realty Transfer Fee filed by grantors must be submitted in writing with this Division on form RTF-3 in accordance with N.J.S.A. 54:49-14. The taxpayer may file a claim under oath for refund at any time within four years after the payment of any original Realty Transfer Fee. Claims received beyond the four-year filing period will NOT be approved.

2.A deed that was originally recorded without a claim for exemption MUST BE RE-RECORDED at the office of the county clerk or register of deeds to reflect the exemption claimed.

3.An “Affidavit of Consideration for Use by Seller” (form RTF-1) must accompany the deed to be re-recorded, attesting to the exemption claimed. Individuals claiming that a real property transfer occurred prior to August 1, 2004 must remit the Realty Transfer Fee at the rates provided by Chapter 66, Laws of 2004 when the deed is offered for recording and file a fully completed Claim for Refund (form RTF-3) to request a refund for the difference between the rates established by Chapter 113, Laws of 2003 and the current rates. Claimants must submit a copy of the settlement statement provided to them at the real estate closing evidencing that the transfer occurred prior to August 1, 2004, and follow all established procedures.

4.The claimant or his representative must file a CLAIM FOR REFUND - REALTY TRANSFER FEE with the Division of Taxation. Evidence to show that the deed has been re-recorded must accompany the claim form. Include a copy of the Affidavit of Consideration for Use by Seller or the page in the body of the deed that contains the county recording officer’s notation documenting that the deed has been re-recorded.

5.The Fee is imposed upon the grantor (seller) at the time the deed is offered for recording (N.J.S.A. 46:15-7) with the exception of the 1% fee imposed upon the grantee (buyer) by Chapter 19, P.L. 2005 as amended by Chapter 33, P.L. 2006 as shown below. Refunds are thus paid to a qualifying grantor/grantee. Any individual other than the grantor/grantee claiming a refund must support such claim by submitting documentation that he, not the grantor, remitted the original Realty Transfer Fee payment. Documentation must include a copy of the canceled check submitted to the county clerk and an affidavit that explains why the claimants(s) paid the Realty Transfer Fee. Documentation must include a signed statement that grantor/grantee received no prior reimbursement of R.T.F. payment.

II.GRANTEE FILING A CLAIM FOR REFUND PURSUANT TO CHAPTER 33, P.L. 2006, EFFECTIVE AUGUST 1, 2006

Chapter 33, Laws of 2006 amended the Realty Transfer Fee law, effective August 1, 2006, and applies to transfers of property on or after that date. The 1% fee is imposed upon the grantee of a deed for consideration in excess of $1,000,000 for the transfer of real property classified as:

1.Class 2 “residential”;

2.(a). Class 3A “farm property (regular)” but only if the property includes a building or structure intended or suited for residential use; and

(b). any other real property, regardless of class, that is effectively transferred to the same grantee in conjunction with farm property as described above; or

3.a cooperative unit (contained in property class 4C) and defined in section 3 of P.L. 1987, c. 381 (C.46: 8D-3); and

4.Class 4A “commercial properties.”

The Realty Transfer Fee law exempts from the 1% fee an organization determined by the federal Internal Revenue Service to be exempt from federal income taxation pursuant to section 501 of the federal Internal Revenue Code of 1986, 26 U.S.C. s. 501 that is the grantee in a deed for consideration in excess of $1,000,000.

For a Claim for Refund from the 1% fee for a real property transfer that was classified pursuant to the requirements of N.J.A.C. 18:12-2.2 as Class 4A “commercial property” at the time of deed recording, provided that the deed was recorded on or before November 15, 2006, and transferred pursuant to a contract that was fully executed before July 1, 2006, the fee imposed pursuant to section 8 of Chapter 66, P.L. 2004, as amended by Chapter 33, P.L. 2006, shall be refunded to the grantee by the filing, within one year following the date of deed recording, of a claim with the New Jersey Division of Taxation for a refund of the 1% fee paid. Such claims for refund shall be accompanied by the submission of documentation including deed photocopy and complete copy of fully executed contract of sale signed by all parties, Closing Disclosure form or other settlement statement fully executed by grantor and grantee, and any other proofs that the Director of the Division of Taxation may require.

III.GRANTEE FILING A CLAIM FOR REFUND OF 1% FEE

Claims for Refund of the 1% fee imposed upon grantees must be submitted in writing with the Division of Taxation on form RTF-3. The 1% fee imposition upon grantees is subject to the provisions of the State Uniform Tax Procedure Law, R.S. 54:48-1 et seq. In accordance with Chapter 33, P.L. 2006, with the exception of claims for refund by grantees pursuant to a contract of sale that is fully executed before July 1, 2006 as outlined above, a taxpayer may file a claim under oath for refund at any time within 90 days after the payment of any original fee. Subsection b. of R.S. 54:49-14 shall not apply to any additional fee assessed. Claims for refunds in such instances received beyond this statutory 90-day filing period will NOT be approved.

Fax completed claim forms to (609) 292-9439 or forward to:

Division of Taxation

Realty Transfer Fee Unit

PO Box 251

Trenton, NJ 08695-0251

For questions regarding these procedures, call (609) 292-7813 or visit www.state.nj.us/treasury/taxation/lpt/localtax.htm.