When you wish to fill out self assessment tax return form, it's not necessary to download and install any sort of applications - simply make use of our online tool. FormsPal development team is relentlessly endeavoring to develop the tool and help it become even easier for people with its extensive features. Unlock an endlessly revolutionary experience today - explore and find new opportunities along the way! For anyone who is seeking to get going, here's what it's going to take:

Step 1: Hit the "Get Form" button above. It'll open our pdf editor so that you can start completing your form.

Step 2: Once you open the file editor, you'll notice the form ready to be filled in. In addition to filling out different fields, you might also perform several other actions with the file, specifically adding custom words, modifying the initial text, adding graphics, affixing your signature to the form, and more.

It will be easy to complete the form with this helpful guide! This is what you need to do:

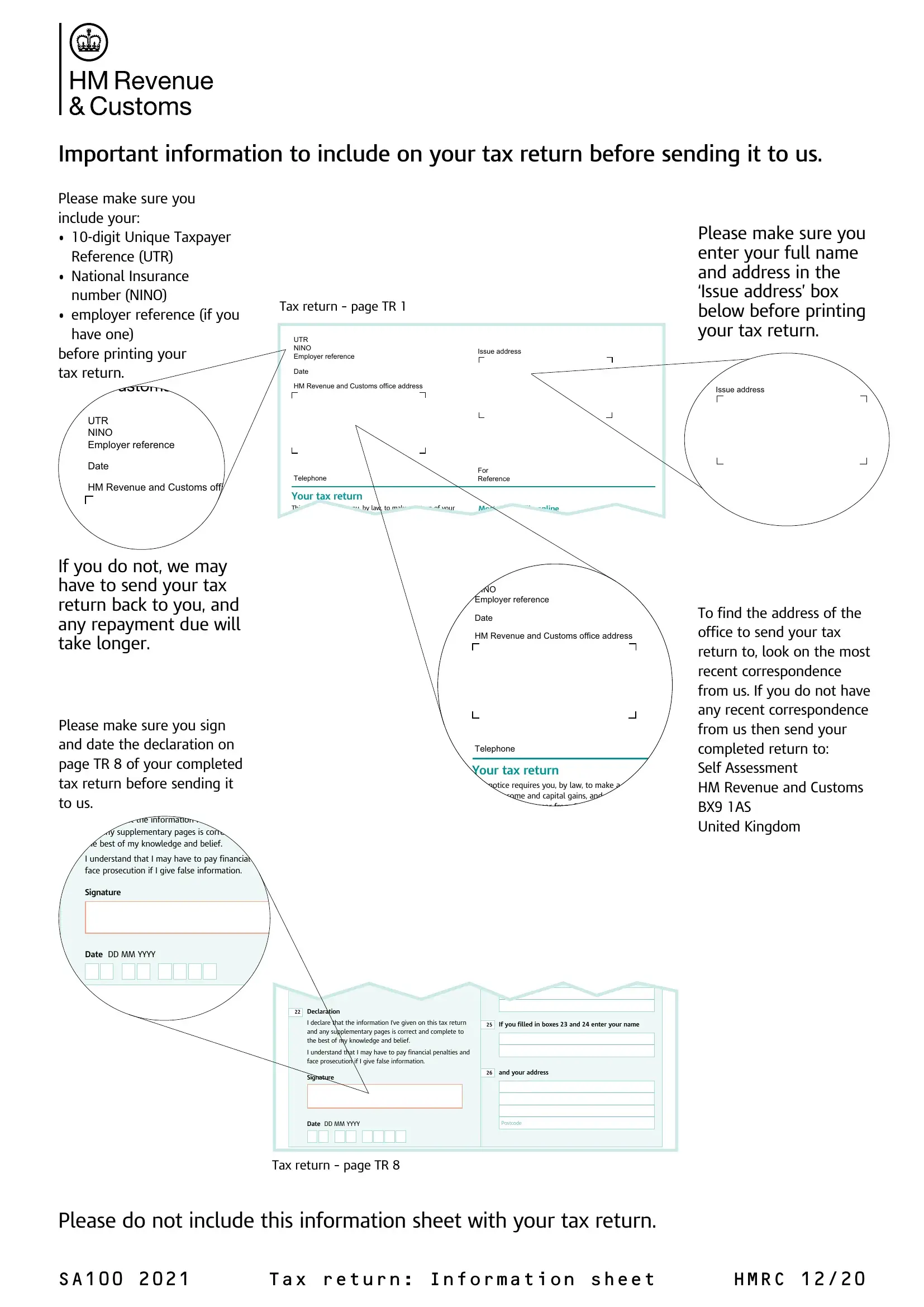

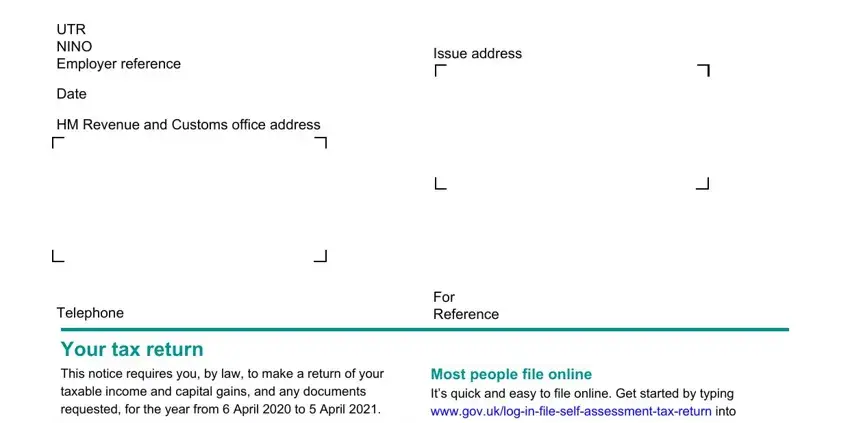

1. When filling out the self assessment tax return form, be sure to complete all of the essential blank fields in its associated section. This will help to facilitate the process, allowing your information to be processed swiftly and correctly.

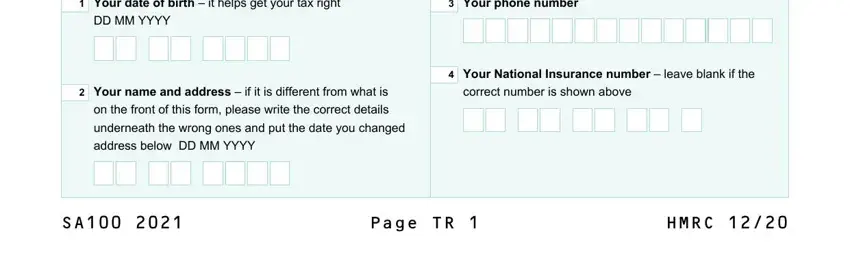

2. Once the last section is done, it is time to insert the essential specifics in Your date of birth it helps get, Your phone number, DD MM YYYY, Your name and address if it is, correct number is shown above, Your National Insurance number, on the front of this form please, underneath the wrong ones and put, address below DD MM YYYY, Page TR, and HMRC so you can progress further.

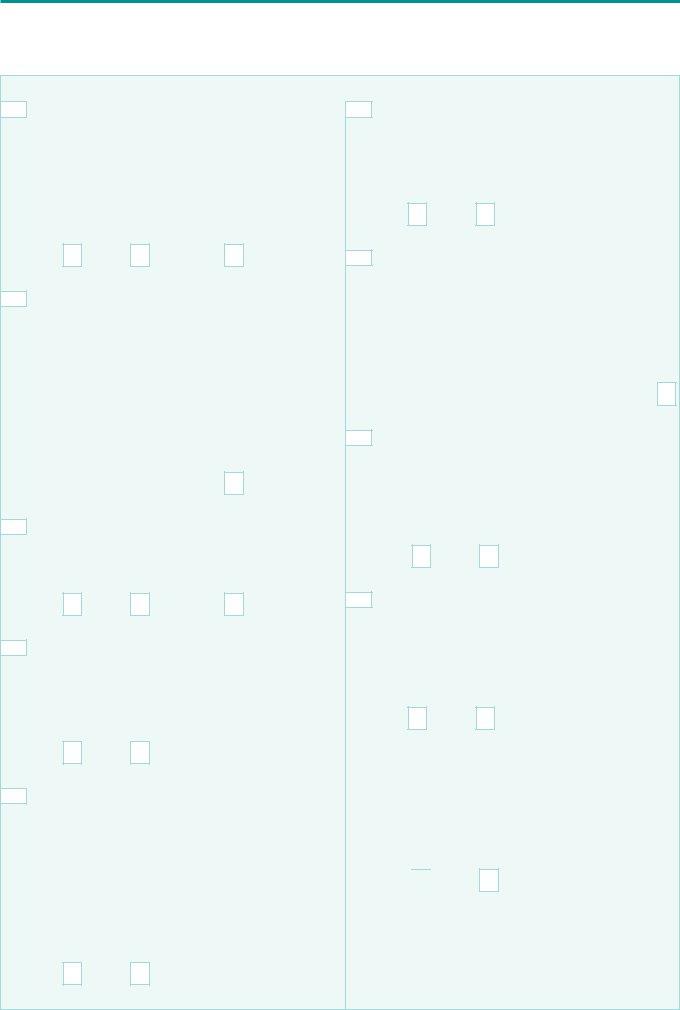

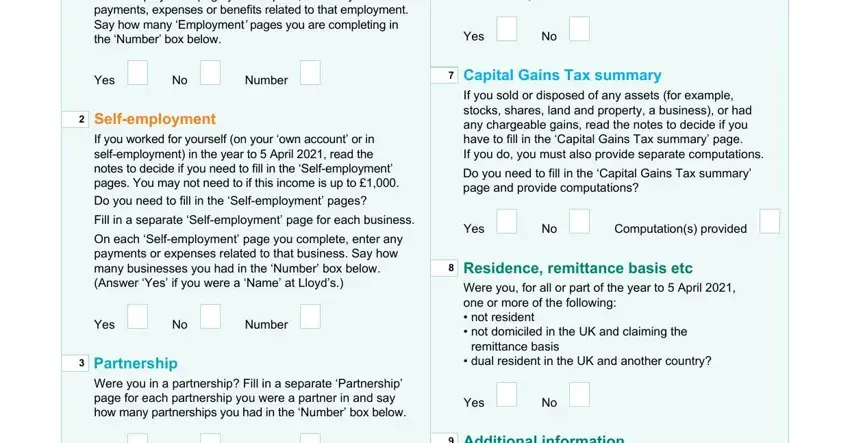

3. This third step is considered rather straightforward, Were you an employee director, Did you receive or are you treated, Yes, Yes, Number, Capital Gains Tax summary, Selfemployment, If you worked for yourself on your, Do you need to fill in the, Fill in a separate Selfemployment, On each Selfemployment page you, Yes, Number, Partnership, and If you sold or disposed of any - all these empty fields must be completed here.

It's simple to get it wrong while filling in the Capital Gains Tax summary, for that reason be sure to look again before you finalize the form.

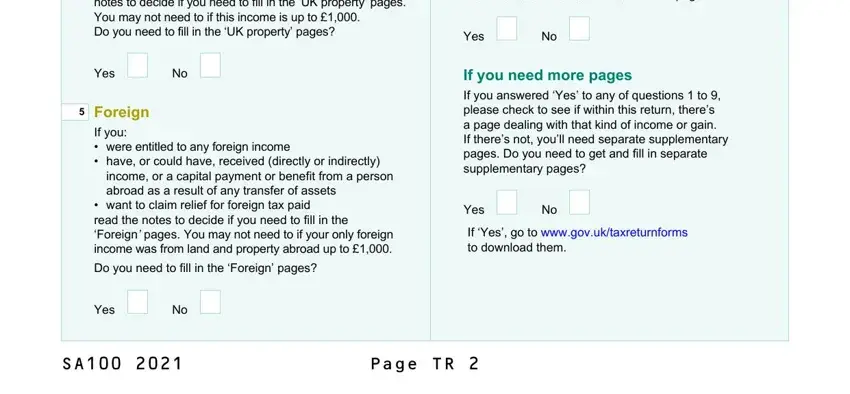

4. This next section requires some additional information. Ensure you complete all the necessary fields - If you received income from UK, Yes, Foreign, If you were entitled to any, income or a capital payment or, want to claim relief for foreign, Do you need to fill in the Foreign, Yes, Some less common kinds of income, Yes, If you need more pages If you, Yes, If Yes go to, and Page TR - to proceed further in your process!

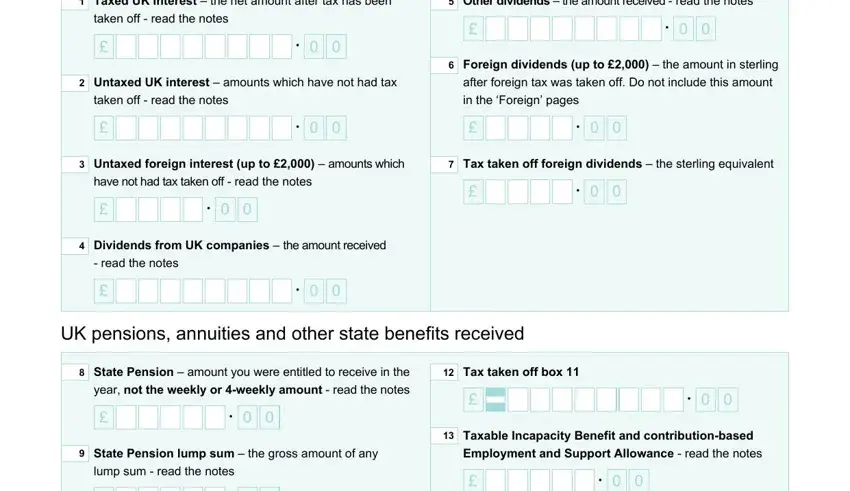

5. The pdf has to be finished by dealing with this part. Below there can be found a detailed list of fields that need specific information in order for your form usage to be faultless: Taxed UK interest the net amount, Other dividends the amount, taken off read the notes, Untaxed UK interest amounts, after foreign tax was taken off Do, taken off read the notes, in the Foreign pages, Foreign dividends up to the, Untaxed foreign interest up to, Tax taken off foreign dividends, have not had tax taken off read, Dividends from UK companies the, read the notes, UK pensions annuities and other, and State Pension amount you were.

Step 3: Prior to submitting this form, double-check that all blanks have been filled in the proper way. Once you establish that it is fine, press “Done." Right after setting up afree trial account with us, it will be possible to download self assessment tax return form or send it via email at once. The document will also be readily accessible through your personal cabinet with all of your changes. FormsPal provides safe form completion with no personal information record-keeping or distributing. Feel at ease knowing that your information is in good hands here!