You could fill out irs form 1190 effortlessly with our online editor for PDFs. Our professional team is ceaselessly endeavoring to expand the editor and ensure it is much easier for clients with its handy functions. Bring your experience one stage further with continuously developing and exceptional possibilities available today! To start your journey, consider these easy steps:

Step 1: Press the orange "Get Form" button above. It's going to open our tool so that you can begin filling out your form.

Step 2: Once you access the editor, you will find the document all set to be filled out. In addition to filling in various fields, you can also do other sorts of actions with the Document, namely adding custom words, editing the initial textual content, inserting illustrations or photos, affixing your signature to the document, and a lot more.

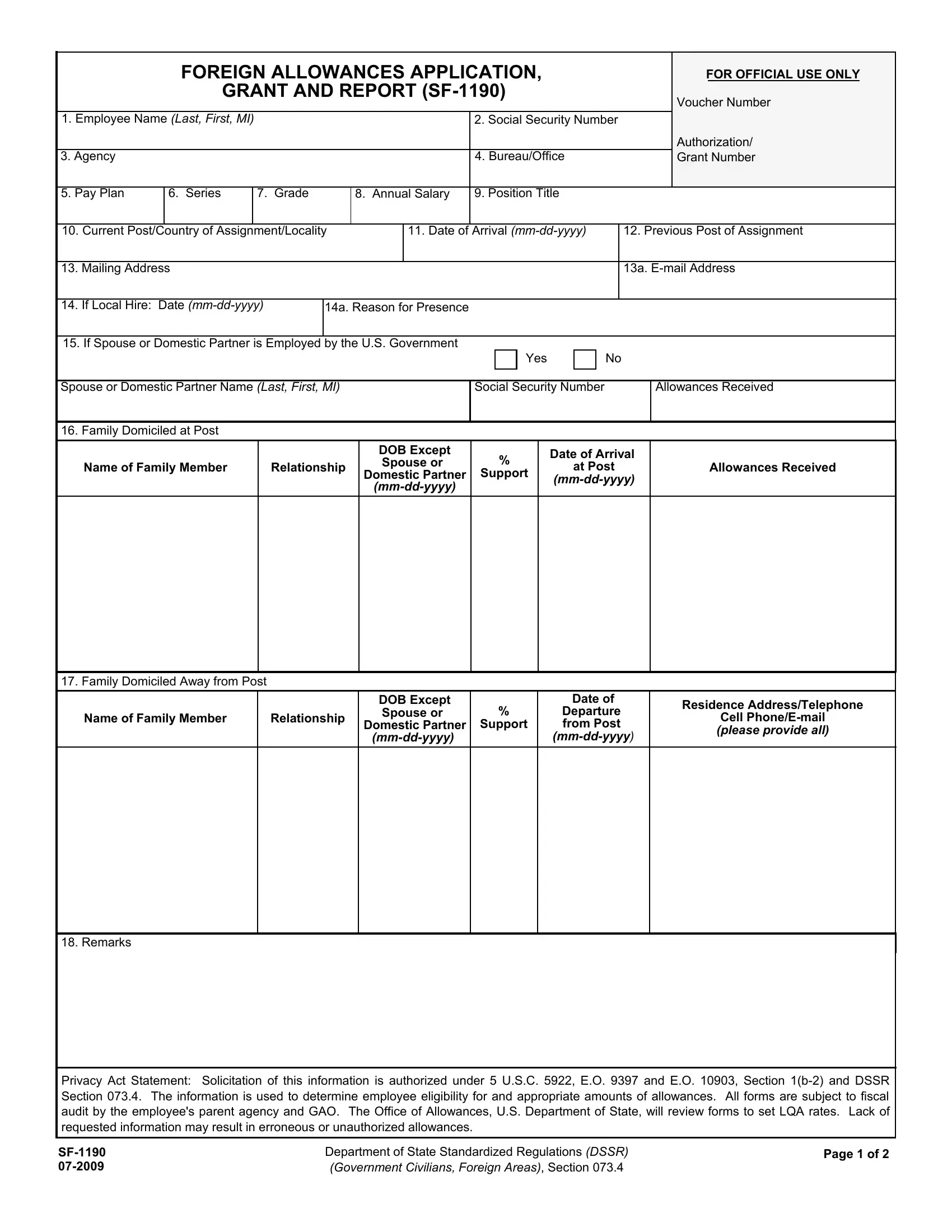

As for the fields of this specific PDF, here is what you should consider:

1. Before anything else, while completing the irs form 1190, begin with the part that includes the next fields:

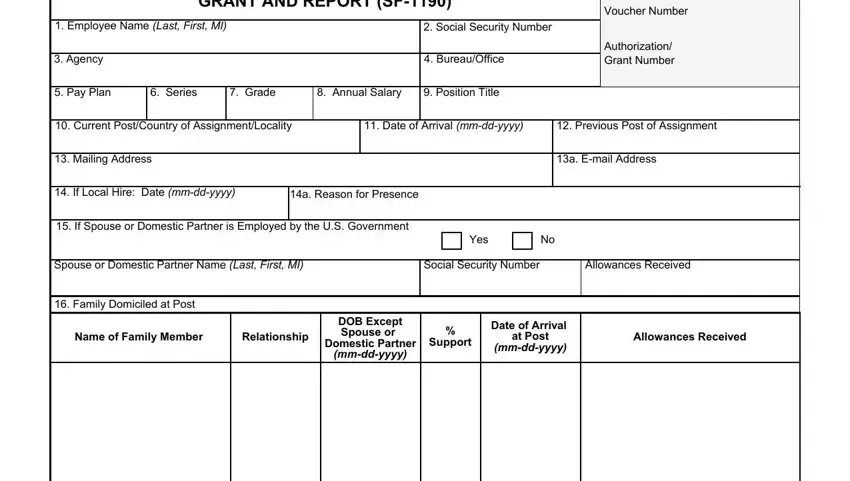

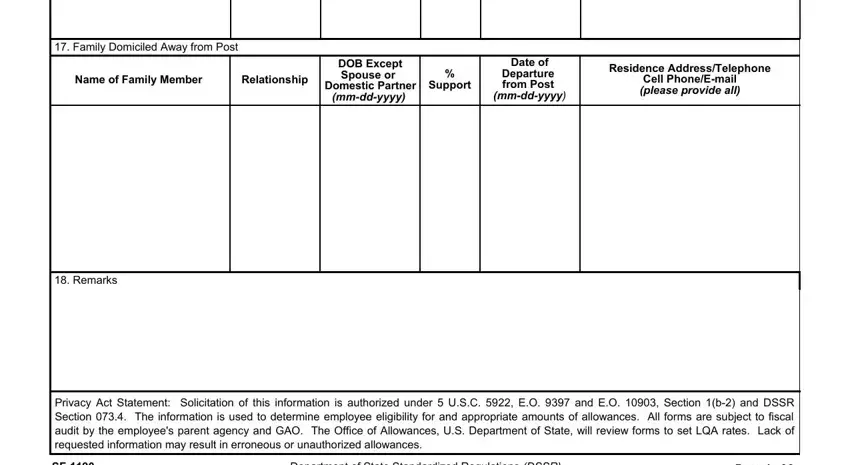

2. Soon after filling out this part, head on to the subsequent step and fill out the necessary particulars in these blanks - Family Domiciled Away from Post, Name of Family Member, Relationship, DOB Except Spouse or, Domestic Partner, mmddyyyy, Support, Date of, Departure from Post, mmddyyyy, Residence AddressTelephone, Cell PhoneEmail please provide all, Remarks, Privacy Act Statement Solicitation, and Department of State Standardized.

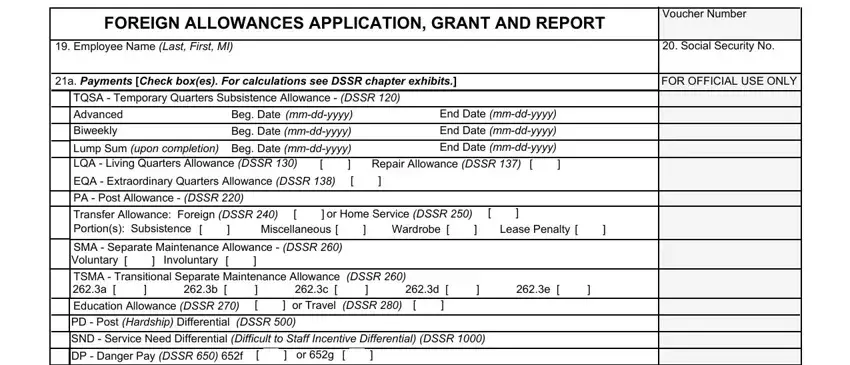

3. This next stage is generally simple - complete all the empty fields in FOREIGN ALLOWANCES APPLICATION, Employee Name Last First MI, a Payments Check boxes For, TQSA Temporary Quarters, Advanced, Biweekly, Beg Date mmddyyyy, End Date mmddyyyy, Beg Date mmddyyyy, End Date mmddyyyy, Voucher Number, Social Security No, FOR OFFICIAL USE ONLY, Lump Sum upon completion LQA, and Beg Date mmddyyyy to complete this part.

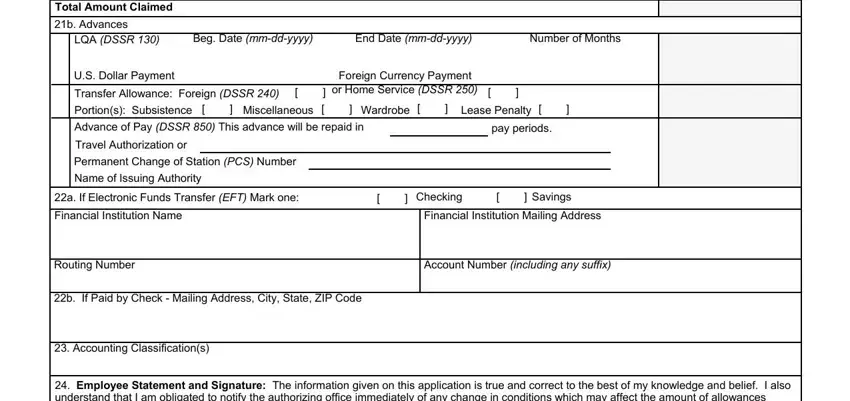

4. This next section requires some additional information. Ensure you complete all the necessary fields - Total Amount Claimed, b Advances, LQA DSSR, Beg Date mmddyyyy, End Date mmddyyyy, Number of Months, US Dollar Payment, Transfer Allowance Foreign DSSR, Portions Subsistence, Miscellaneous, Foreign Currency Payment, or Home Service DSSR, Wardrobe, Lease Penalty, and Advance of Pay DSSR This advance - to proceed further in your process!

Many people frequently make some mistakes while filling in b Advances in this part. Be sure to go over everything you type in here.

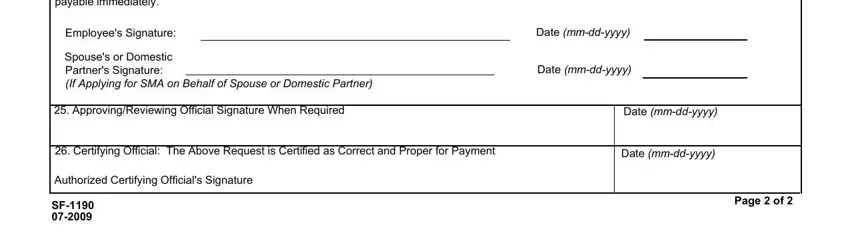

5. And finally, the following last section is what you'll want to finish prior to finalizing the PDF. The blanks here include the next: Employee Statement and Signature, Employees Signature, Spouses or Domestic Partners, Date mmddyyyy, Date mmddyyyy, ApprovingReviewing Official, Date mmddyyyy, Certifying Official The Above, Date mmddyyyy, Authorized Certifying Officials, and Page of.

Step 3: Soon after proofreading the fields and details, click "Done" and you are good to go! Find the irs form 1190 the instant you register online for a free trial. Immediately gain access to the document inside your FormsPal account page, together with any edits and adjustments being automatically saved! FormsPal guarantees secure document tools devoid of data record-keeping or distributing. Be assured that your information is secure with us!