|

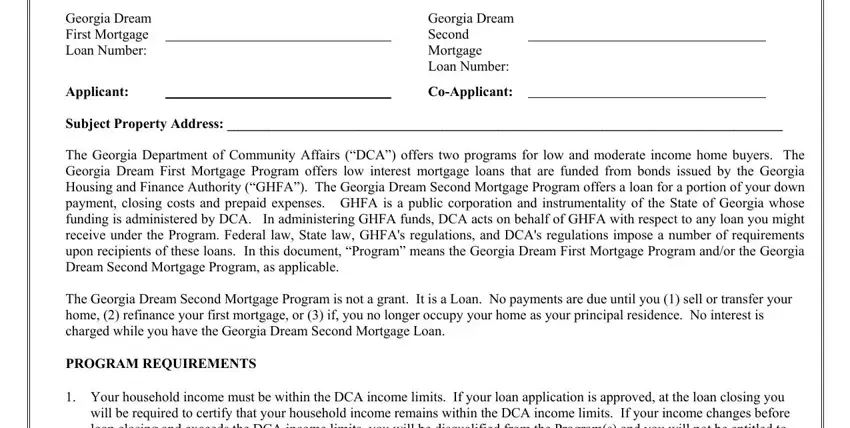

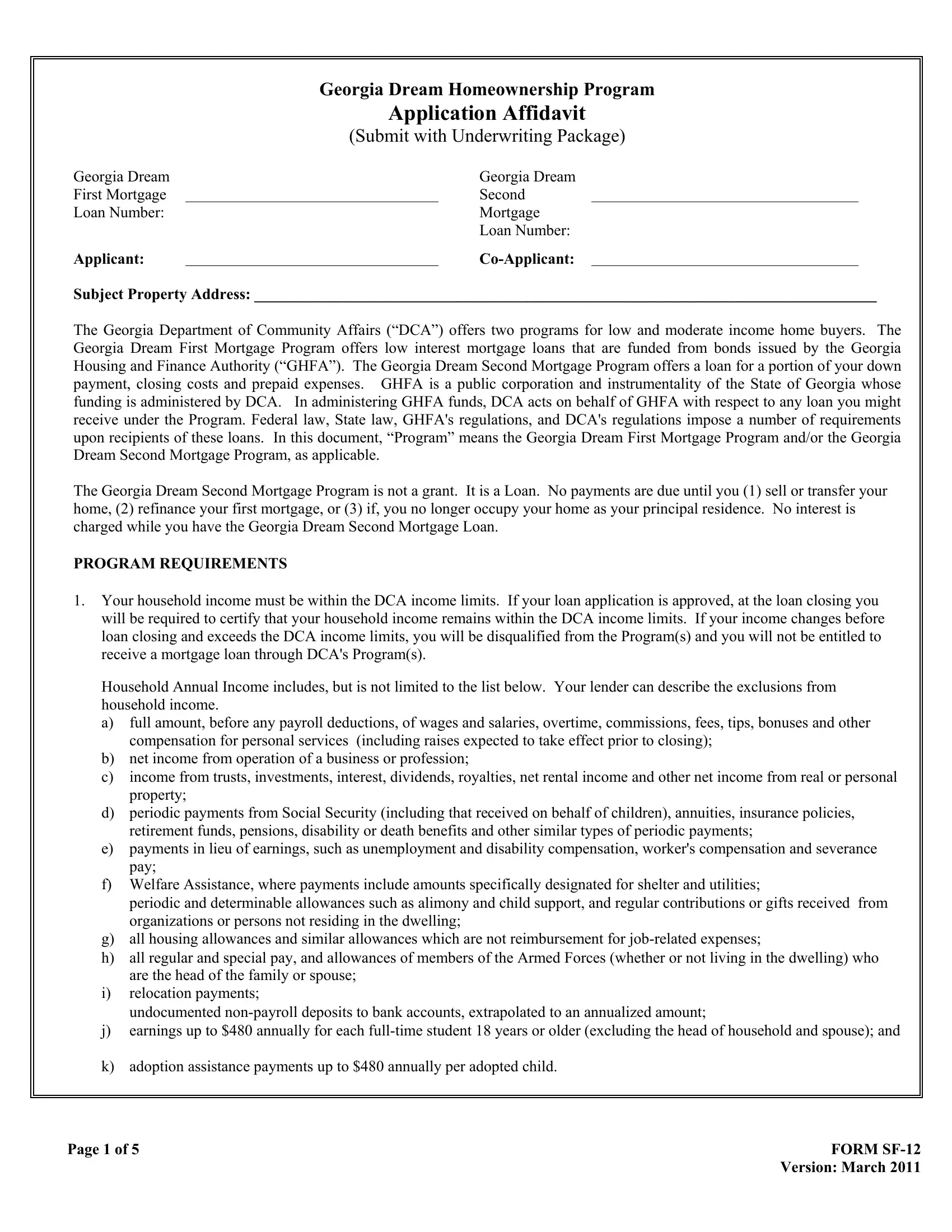

Georgia Dream Homeownership Program |

|

Application Affidavit |

|

(Submit with Underwriting Package) |

Georgia Dream |

|

Georgia Dream |

First Mortgage |

|

Second |

|

Loan Number: |

|

Mortgage |

|

|

Loan Number: |

Applicant: |

|

Co-Applicant: |

|

Subject Property Address: ________________________________________________________________________________

The Georgia Department of Community Affairs (“DCA”) offers two programs for low and moderate income home buyers. The Georgia Dream First Mortgage Program offers low interest mortgage loans that are funded from bonds issued by the Georgia Housing and Finance Authority (“GHFA”). The Georgia Dream Second Mortgage Program offers a loan for a portion of your down payment, closing costs and prepaid expenses. GHFA is a public corporation and instrumentality of the State of Georgia whose funding is administered by DCA. In administering GHFA funds, DCA acts on behalf of GHFA with respect to any loan you might receive under the Program. Federal law, State law, GHFA's regulations, and DCA's regulations impose a number of requirements upon recipients of these loans. In this document, “Program” means the Georgia Dream First Mortgage Program and/or the Georgia Dream Second Mortgage Program, as applicable.

The Georgia Dream Second Mortgage Program is not a grant. It is a Loan. No payments are due until you (1) sell or transfer your home, (2) refinance your first mortgage, or (3) if, you no longer occupy your home as your principal residence. No interest is charged while you have the Georgia Dream Second Mortgage Loan.

PROGRAM REQUIREMENTS

1.Your household income must be within the DCA income limits. If your loan application is approved, at the loan closing you will be required to certify that your household income remains within the DCA income limits. If your income changes before loan closing and exceeds the DCA income limits, you will be disqualified from the Program(s) and you will not be entitled to receive a mortgage loan through DCA's Program(s).

Household Annual Income includes, but is not limited to the list below. Your lender can describe the exclusions from household income.

a)full amount, before any payroll deductions, of wages and salaries, overtime, commissions, fees, tips, bonuses and other compensation for personal services (including raises expected to take effect prior to closing);

b)net income from operation of a business or profession;

c)income from trusts, investments, interest, dividends, royalties, net rental income and other net income from real or personal property;

d)periodic payments from Social Security (including that received on behalf of children), annuities, insurance policies, retirement funds, pensions, disability or death benefits and other similar types of periodic payments;

e)payments in lieu of earnings, such as unemployment and disability compensation, worker's compensation and severance pay;

f)Welfare Assistance, where payments include amounts specifically designated for shelter and utilities;

periodic and determinable allowances such as alimony and child support, and regular contributions or gifts received from organizations or persons not residing in the dwelling;

g)all housing allowances and similar allowances which are not reimbursement for job-related expenses;

h)all regular and special pay, and allowances of members of the Armed Forces (whether or not living in the dwelling) who are the head of the family or spouse;

i)relocation payments;

undocumented non-payroll deposits to bank accounts, extrapolated to an annualized amount;

j)earnings up to $480 annually for each full-time student 18 years or older (excluding the head of household and spouse); and

k)adoption assistance payments up to $480 annually per adopted child.

Page 1 of 5 |

FORM SF-12 |

|

Version: March 2011 |

2.If you have owned or had an ownership interest in a principal residence within the last 3 years, you are not eligible for DCA’s Programs, unless you qualify for specific exceptions that your lender can describe. You will be required to provide copies of your federal tax returns for the last 3 years and information about the location and type of your residence during the last 3 years, unless you qualify for these exceptions.

3.You will be required to certify that you intend to use the house for which you are applying for a loan as your principal place of residence. The First Mortgage loan cannot be used to finance the cost of additional land, rental property, a second home, or the expenses of a trade or business.

4.By signing this form you acknowledge and agree that the information and/or documentation submitted in connection with the DCA Programs may be subject to public disclosure.

5The maximum purchase price of the house you are intending to buy under these Programs is restricted by law and by Program regulations.

6.Your personal assets must be modest. You must be creditworthy as determined by your lender, DCA, FHA, VA, USDA/RD, the pool insurer, and/or the private mortgage insurer, as applicable.

7.The First Mortgage loan , and in some cases the Second Mortgage loan, that you are applying for will be financed with the proceeds of certain tax-exempt bonds issued by GHFA pursuant to certain state laws and federal income tax laws. Because you are receiving a mortgage loan(s) from the proceeds of a tax-exempt bond, you are receiving the benefit of a lower interest rate than is customarily charged on other mortgage loans. If you sell or otherwise dispose of your home during the 9 years after loan closing, this benefit may be “recaptured.” The recapture is accomplished by an increase in your federal income tax for the year in which you sell or otherwise dispose of your home. The recapture applies only if you sell your home at a gain and if your income increases above specified levels. The recapture tax will not apply in certain circumstances, which are explained in the Notice to Purchaser of Potential Recapture Tax on Sale of Home (Form SF-50) that you will receive at closing. Form SF-50 also contains more detailed information about the calculation of any recapture tax.

8.In the event that you receive a loan(s) under these Programs and it is subsequently discovered that you made a false statement, misrepresentation or misstatement, you may be required to make an immediate and full repayment of the loan(s) and you may also be subject to criminal prosecution.

9.DUE ON SALE CONSENT. If you receive a DCA loan, it is likely that when you sell your home the new purchaser will have to obtain new financing. (Land contracts are prohibited.) Your mortgage provides that you cannot sell your home to a person ineligible for assistance from DCA, unless you pay your loan in full. If you sell your home to a party ineligible for DCA's assistance and do not pay-off your loan in full, DCA may demand immediate and full repayment of the loan. This could result in foreclosure of your mortgage and repossession of the property. In addition, if you rent the property or committed fraud or intentionally misrepresented yourself when you applied for the loan, the lender may foreclose your mortgage and repossess the property. If the lender takes your home through foreclosure of the mortgage because of these reasons, the mortgage insurer (HUD, VA, USDA/RD, pool insurer or a private insurer) will not be able to help you.

If the money received from the foreclosure sale is not enough to pay the remaining balance you owe on the loan, DCA may obtain a deficiency judgment against you (a court ruling that you must pay whatever money is still owed on the loan after the foreclosure sale). Such judgment will be taken over by the insuring agency if DCA files an insurance claim against that agency because of the foreclosure. DCA or the insurer may bring an action against you to collect the judgment.

If you cease to use the residence as your principal residence for a period in excess of 12 months, no deduction will be allowed for mortgage interest accruing after the first day in such period in the calculation of your federal income taxes.

You may avoid such action by paying your loan in full when you sell your home, not renting your home, by occupying the property as your principal residence, by complying with all your agreements contained in this Form and by making certain that any person who assumes your loan meets the necessary qualifications established by DCA.

In order for a purchaser to be eligible to assume your DCA loan (1) the purchaser must meet income requirements, (2) the purchaser must not have held an ownership interest in a principal residence during the prior 3 years, unless the property is located within a “Targeted Area” or otherwise exempt from this requirement under federal law, (3) the purchaser must intend the home to be his or her principal residence, and (4) the sales price allowed to be paid to you must meet the purchase price requirements. Regarding the sales price restriction, the Internal Revenue Service requires that all homes are subject to the maximum sales price permitted for an “existing” home at the time of loan assumption even though the home may have been financed as “new” at the time you closed your loan.

Page 2 of 5 |

FORM SF-12 |

|

Version: March 2011 |

Therefore, having read and understood the above, each of the undersigned being duly sworn, deposes and says under oath and seal, I (we) certify that :

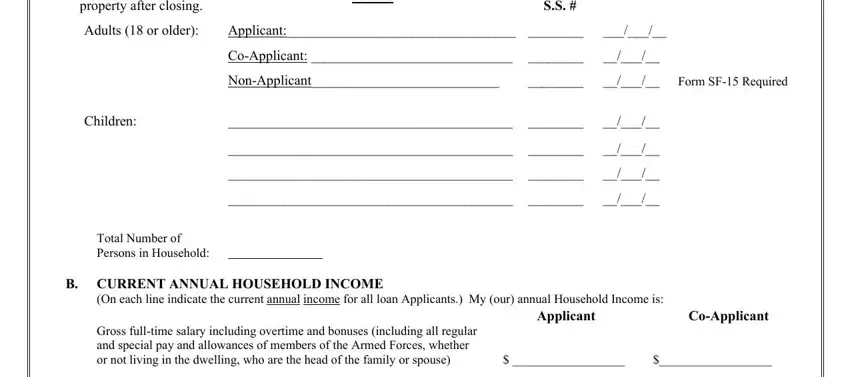

A.HOUSEHOLD SIZE

The following people will occupy the subject property:

List all persons that will

occupy the subjectName property after closing.

Last 4 |

Date of |

digits of |

Birth |

S.S. # |

|

Adults (18 or older): |

Applicant:_________________________________ |

________ |

___/___/__ |

|

Co-Applicant: _____________________________ |

________ |

__/___/__ |

|

Non-Applicant___________________________ |

________ |

__/___/__ Form SF-15 Required |

Children: |

_________________________________________ |

________ |

__/___/__ |

|

_________________________________________ |

________ |

__/___/__ |

|

_________________________________________ |

________ |

__/___/__ |

|

_________________________________________ |

________ |

__/___/__ |

Total Number of

Persons in Household:

B.CURRENT ANNUAL HOUSEHOLD INCOME

(On each line indicate the current annual income for all loan Applicants.) My (our) annual Household Income is:

|

|

|

|

Applicant |

Co-Applicant |

Gross full-time salary including overtime and bonuses (including all regular |

|

|

|

and special pay and allowances of members of the Armed Forces, whether |

|

|

|

or not living in the dwelling, who are the head of the family or spouse) |

$ __________________ |

$__________________ |

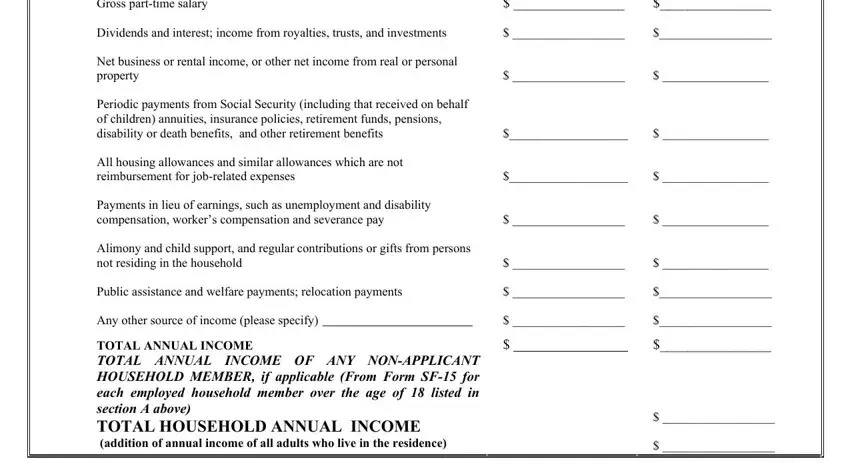

Gross part-time salary |

$ ________________ |

$________________ |

Dividends and interest; income from royalties, trusts, and investments |

$ __________________ |

$__________________ |

Net business or rental income, or other net income from real or personal |

|

|

|

property |

$ __________________ |

$ _________________ |

Periodic payments from Social Security (including that received on behalf |

|

|

|

of children) annuities, insurance policies, retirement funds, pensions, |

|

|

|

disability or death benefits, and other retirement benefits |

$___________________ |

$ _________________ |

All housing allowances and similar allowances which are not |

|

|

|

reimbursement for job-related expenses |

$___________________ |

$ _________________ |

Payments in lieu of earnings, such as unemployment and disability |

|

|

|

compensation, worker’s compensation and severance pay |

$ __________________ |

$ _________________ |

Alimony and child support, and regular contributions or gifts from persons |

|

|

|

not residing in the household |

$ __________________ |

$ _________________ |

Public assistance and welfare payments; relocation payments |

$ __________________ |

$__________________ |

Any other source of income (please specify) |

|

|

$ __________________ |

$__________________ |

TOTAL ANNUAL INCOME |

$ |

|

$________________ |

TOTAL ANNUAL INCOME OF ANY NON-APPLICANT |

|

|

|

HOUSEHOLD MEMBER, if applicable (From Form SF-15 for |

|

|

|

each employed household member over the age of 18 listed in |

|

|

|

section A above) |

|

|

$ __________________ |

TOTAL HOUSEHOLD ANNUAL INCOME |

|

|

|

|

|

(addition of annual income of all adults who live in the residence) |

|

|

$ __________________ |

|

|

|

|

|

|

Page 3 of 5 |

FORM SF-12 |

|

Version: March 2011 |

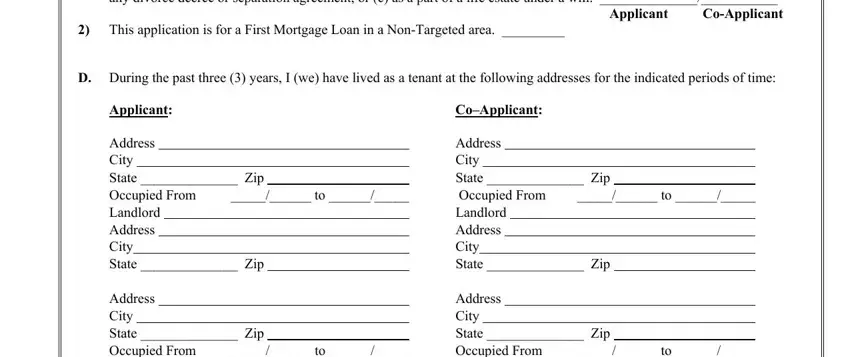

C.PREVIOUS PRINCIPAL RESIDENCE: (please initial all that apply)

1)During the past 3 years to the best of my (our) knowledge and belief, I (we) have not had an ownership interest in my (our) principal residence, including, but not limited to, interests: (a) under the terms of a trust, or (b) under the terms of any divorce decree or separation agreement, or (c) as a part of a life estate under a will. ______________/___________

Applicant Co-Applicant

2)This application is for a First Mortgage Loan in a Non-Targeted area. _________

D.During the past three (3) years, I (we) have lived as a tenant at the following addresses for the indicated periods of time:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applicant: |

|

|

|

|

|

Co–Applicant: |

|

|

Address |

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

|

|

City |

|

|

|

State ______________ Zip |

|

|

State ______________ Zip |

|

Occupied From |

_____/______ to ______/_____ |

Occupied From |

_____/______ to ______/_____ |

Landlord |

|

|

|

|

|

|

Landlord |

|

|

|

Address |

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

|

|

City |

|

|

|

State ______________ Zip |

State ______________ Zip |

Address |

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

|

|

City |

|

|

|

State ______________ Zip |

|

|

State ______________ Zip |

|

Occupied From |

_____/______ to ______/_____ |

Occupied From |

_____/______ to ______/_____ |

Landlord |

|

|

|

|

|

|

Landlord |

|

|

|

Address |

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

|

|

City |

|

|

|

State ______________ Zip |

State ______________ Zip |

Address |

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

|

|

City |

|

|

|

State ______________ Zip |

|

|

State ______________ Zip |

|

Occupied From |

_____/______ to ______/_____ |

Occupied From |

_____/______ to ______/_____ |

Landlord |

|

|

|

|

|

|

Landlord |

|

|

|

Address |

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

|

|

City |

|

|

|

State ______________ Zip |

|

|

State ______________ Zip |

|

E.RESIDENCE REQUIREMENTS

The property is located within the State of Georgia. The property I (we) have contracted to purchase is a single family residence. I (we) will occupy the property as my (our) principal residence not later than 60 days after the date of closing of the loan. The property will be my (our) principal residence and not a vacation or second home. No portion of the property will be used as an investment property or in the conduct of a trade or business (including child care services on a regular basis for compensation) or as a recreational home or rental property. The property does not contain any buildings, portion of any buildings or excess land that will be used to produce income. At the time of this application, I (we) do not intend to rent, sell, assign, or transfer the property at any time within the foreseeable future to any other person for the term of the mortgage loan.

F.I (we) certify that I (we) have read and understood this Application Affidavit and that I (we) have been provided a copy of this Certification along with the Form SF-16 “Acquisition Cost Certification.”

Page 4 of 5 |

FORM SF-12 |

|

Version: March 2011 |

Applicant

Co-Applicant

Sworn to and subscribed before me this ____ day of _________,

20___.

____________________________________________________

Notary Public

My Commission expires on _____________________________

G.CERTIFICATIONS

1.The statements and information set forth in this affidavit and the information submitted in conjunction with my (our) application for a loan under DCA's program, including, but not limited to, all federal income tax forms and data, are true and correct and this information does not contain an untrue statement of a material fact or omit the statement of a fact required to be stated or state any misleading facts;

2.I (we) have read and understood the definition of annual income on page 1 and that by definition, I am (we are) the sole wage earner(s) in the household as defined by DCA, unless otherwise disclosed in Section B of this affidavit and supported by a fully executed Form SF-15, “Affidavit of Non-Applicant Household Member,” submitted with this affidavit;

3.I (we) fully understand that the above statements and the information set forth in this affidavit are material to the application for a mortgage loan from the Program of the Georgia Housing and Finance Authority and the Georgia Department of Community Affairs, are public information and may be subject to public disclosure and/or verification by DCA, and I (we) declare under penalty of perjury, which is a felony offense in the State of Georgia, that the above statements and information are true, correct and complete;

4.I (we) fully understand that in the event that any of the information set forth in this affidavit is no longer true at the time of the loan closing and has changed such that I (we) no longer qualify for a loan under DCA’s program, then I (we) will not be entitled to obtain or close the loan;

5.I (we) fully understand that in the event that I (we) receive a mortgage loan, I (we) hereby acknowledge that any false statement, representation or misstatement made by me (us) create(s) a legal and binding obligation for me (us) to make immediate and full repayment of the mortgage loan, and may result in a fine and/or imprisonment;

6.I (we) fully understand that by financing the applied-for loan through its Program, DCA shall in no event be determined to have made any representations to me (us) with respect to the residence being financed, including, without limitation, the habitability, construction or value of the residence; and

7.I (we) fully understand that I (we) hereby release GHFA and DCA and the originating lender from any claims related in any way to my (our) application for this loan or to their verification or enforcement of the requirements of DCA’s Program.

Date

Date

(Notary Seal Affixed Here)

Page 5 of 5 |

FORM SF-12 |

|

Version: March 2011 |