Working with PDF documents online is quite easy using our PDF tool. You can fill out Form Ss 4436 here within minutes. FormsPal is dedicated to providing you with the ideal experience with our editor by regularly presenting new functions and improvements. With these improvements, using our editor becomes better than ever! This is what you would have to do to start:

Step 1: First of all, access the tool by clicking the "Get Form Button" above on this page.

Step 2: As soon as you open the file editor, there'll be the document all set to be filled in. Other than filling in different blanks, you may as well perform other things with the file, specifically putting on custom words, modifying the initial text, adding graphics, affixing your signature to the form, and a lot more.

With regards to the blank fields of this precise document, this is what you should do:

1. The Form Ss 4436 necessitates certain information to be entered. Ensure that the following fields are complete:

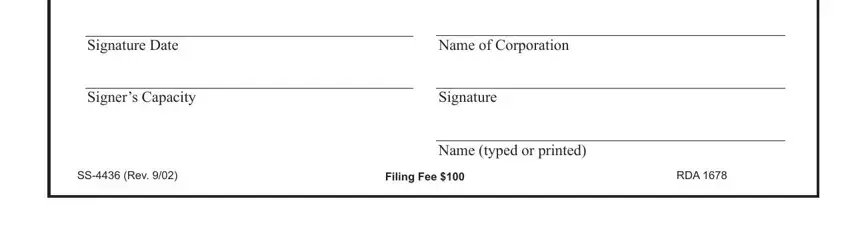

2. The third step would be to fill out the next few blank fields: Signature Date, Signers Capacity, SS Rev, Name of Corporation, Signature, Name typed or printed, Filing Fee, and RDA.

People often make some errors when completing SS Rev in this section. Be sure you revise everything you enter here.

Step 3: Spell-check the information you have inserted in the form fields and then click the "Done" button. Right after starting a7-day free trial account with us, you'll be able to download Form Ss 4436 or send it through email directly. The PDF form will also be readily accessible via your personal account page with all your modifications. If you use FormsPal, you'll be able to complete forms without stressing about database incidents or entries being shared. Our secure system makes sure that your personal information is maintained safely.