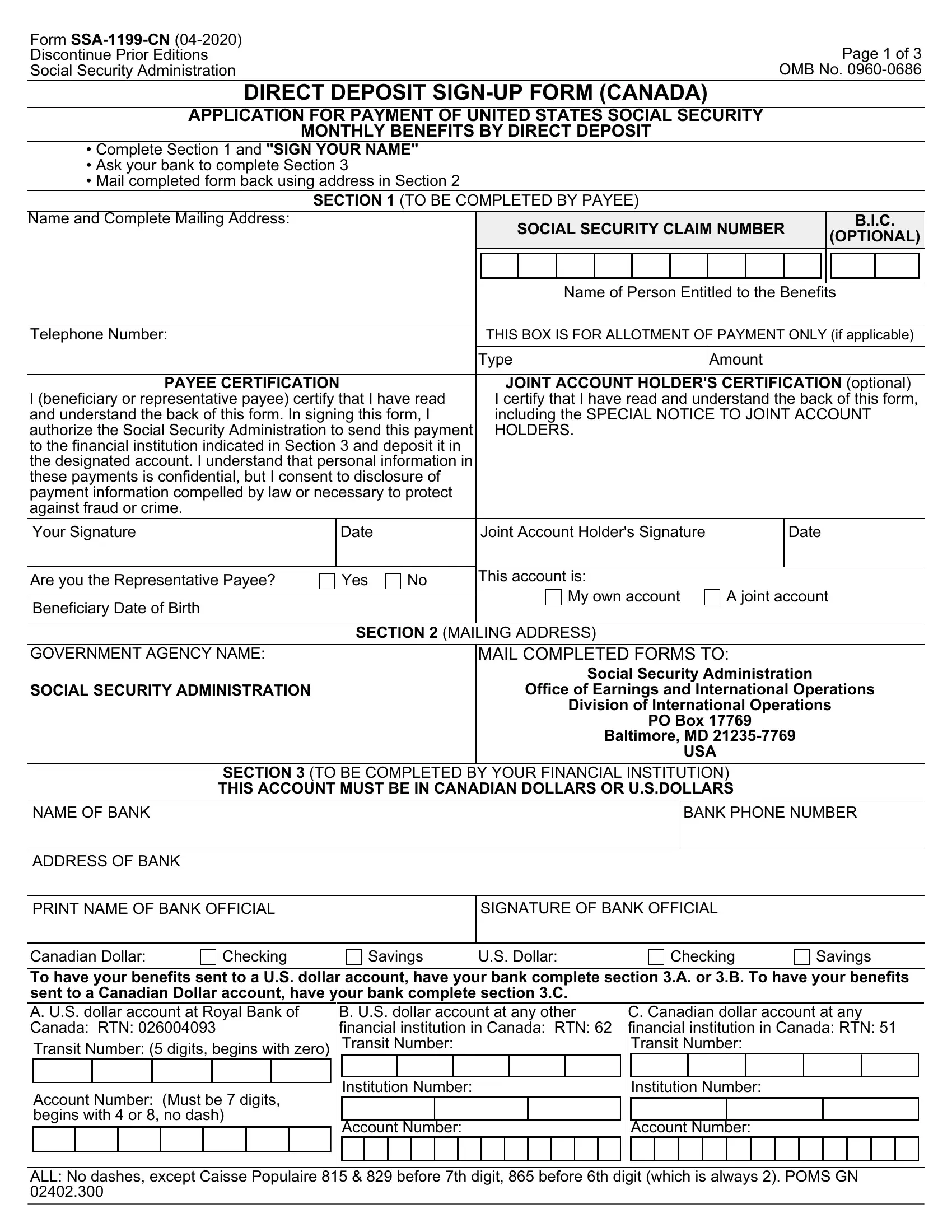

Form SSA-1199-CN (04-2020) |

Page 1 of 3 |

Discontinue Prior Editions |

Social Security Administration |

OMB No. 0960-0686 |

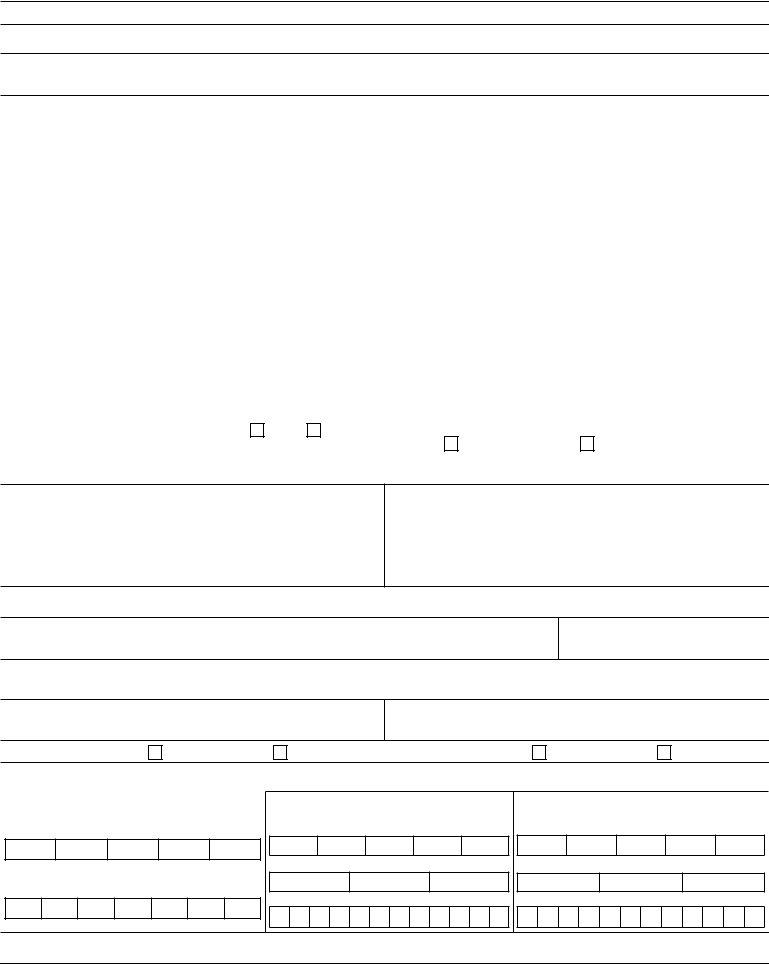

DIRECT DEPOSIT SIGN-UP FORM (CANADA)

APPLICATION FOR PAYMENT OF UNITED STATES SOCIAL SECURITY

MONTHLY BENEFITS BY DIRECT DEPOSIT

•Complete Section 1 and "SIGN YOUR NAME"

•Ask your bank to complete Section 3

•Mail completed form back using address in Section 2

|

SECTION 1 (TO BE COMPLETED BY PAYEE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

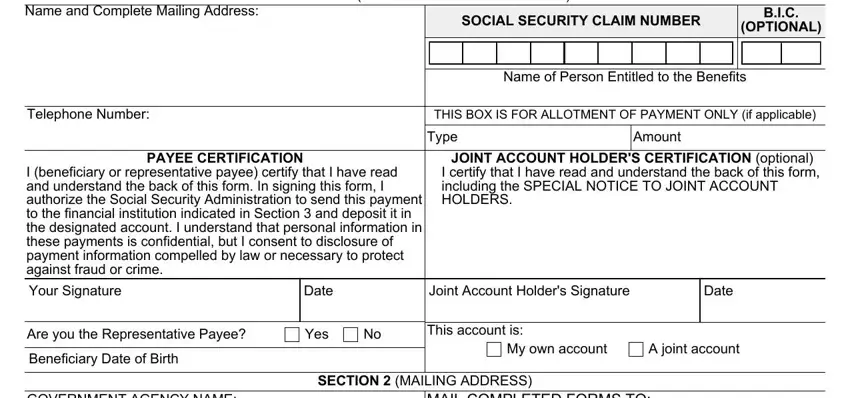

Name and Complete Mailing Address: |

|

|

|

SOCIAL SECURITY CLAIM NUMBER |

|

|

B.I.C. |

|

|

|

|

|

(OPTIONAL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Person Entitled to the Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number: |

|

|

|

THIS BOX IS FOR ALLOTMENT OF PAYMENT ONLY (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE CERTIFICATION |

|

JOINT ACCOUNT HOLDER'S CERTIFICATION (optional) |

I (beneficiary or representative payee) certify that I have read |

I certify that I have read and understand the back of this form, |

and understand the back of this form. In signing this form, I |

including the SPECIAL NOTICE TO JOINT ACCOUNT |

authorize the Social Security Administration to send this payment |

HOLDERS. |

|

|

|

|

|

|

|

|

to the financial institution indicated in Section 3 and deposit it in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the designated account. I understand that personal information in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

these payments is confidential, but I consent to disclosure of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

payment information compelled by law or necessary to protect |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

against fraud or crime. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Signature |

|

Date |

|

Joint Account Holder's Signature |

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Are you the Representative Payee? |

|

Yes |

No |

This account is: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

My own account |

A joint account |

|

|

|

|

Beneficiary Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (MAILING ADDRESS) |

|

|

|

|

|

|

|

|

GOVERNMENT AGENCY NAME:

SOCIAL SECURITY ADMINISTRATION

MAIL COMPLETED FORMS TO:

Social Security Administration

Office of Earnings and International Operations

Division of International Operations

PO Box 17769

Baltimore, MD 21235-7769

USA

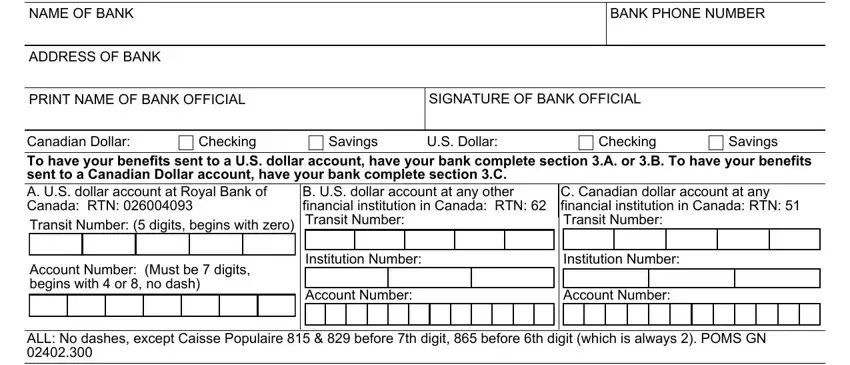

SECTION 3 (TO BE COMPLETED BY YOUR FINANCIAL INSTITUTION)

THIS ACCOUNT MUST BE IN CANADIAN DOLLARS OR U.S.DOLLARS

PRINT NAME OF BANK OFFICIAL

SIGNATURE OF BANK OFFICIAL

To have your benefits sent to a U.S. dollar account, have your bank complete section 3.A. or 3.B. To have your benefits sent to a Canadian Dollar account, have your bank complete section 3.C.

A. U.S. dollar account at Royal Bank of Canada: RTN: 026004093

Transit Number: (5 digits, begins with zero)

Account Number: (Must be 7 digits, begins with 4 or 8, no dash)

B. U.S. dollar account at any other financial institution in Canada: RTN: 62 Transit Number:

Institution Number:

Account Number:

C. Canadian dollar account at any financial institution in Canada: RTN: 51 Transit Number:

Institution Number:

Account Number:

ALL: No dashes, except Caisse Populaire 815 & 829 before 7th digit, 865 before 6th digit (which is always 2). POMS GN 02402.300

Form SSA-1199-CN (04-2020) |

Page 2 of 3 |

IMPORTANT INFORMATION - PLEASE READ CAREFULLY

The information you give on this form is confidential. We need the information to send your U.S. Social Security payments electronically to your Canada bank account.

WHEN YOU WILL RECEIVE YOUR DIRECT DEPOSIT PAYMENTS

You will receive your payment through the Canada banking system and will usually be in your bank account shortly after the regular payment date. With direct deposit, you will have immediate access to your money. This is the safest way of receiving your benefits.

INFORMATION ABOUT CURRENCY CONVERSION:

With direct deposit, your U.S. Social Security payment is automatically converted to Canadian Dollars or U.S. Dollars (if applicable) at the daily international exchange rate before being deposited to your account.

**SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS**

If you have a joint account with a person who receives Social Security payments, and that person dies, you must immediately contact your bank and the Social Security Administration or the Federal Benefits Unit in your area. You must return to Social Security any payments deposited into a joint account after the death of a beneficiary.

IF YOUR ADDRESS CHANGES:

If your address changes, you must inform the Federal Benefits Unit or the Social Security Administration. Your payments may stop if the Social Security Administration needs to contact you and cannot find your location.

CHANGING BANKS OR BANK ACCOUNTS:

If you change your bank or your account, you must notify the following office:

Social Security Administration

Office of Earnings and International Operations

Division Of International Operations

PO Box 17769

Baltimore, MD

21235-7769

USA

You may need to fill out a new Direct Deposit sign-up form.

Do not close your old account until payments have started coming to your new account.

Form SSA-1199-CN (04-2020) |

Page 3 of 3 |

|

|

|

Privacy Act Statement |

|

Collection and Use of Personal Information |

Section 205(a) of the Social Security Act, as amended, allows us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent you from receiving benefit payments through foreign financial institutions.

We will use the information you provide to process benefit payments with your financial institution. We may also share your information for the following purposes, called routine uses:

•To the Department of State and its agents for administering the Act in foreign countries through facilities and services of that agency; and

•To third party contacts where necessary to establish or verify information provided by representative payees or payee applicants.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person's eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notices (SORN) 60-0089, entitled Claims Folders Systems, as published in the Federal Register (FR) on April 1, 2003, at 68 FR 15784 and 60-0090, entitled Master Beneficiary Record, as published in the FR on January 11, 2006, at 71 FR 1826. Additional information and a full listing of all our SORNs are available on our website at https://www.ssa.gov/privacy.

Paperwork Reduction Act Statement

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 5 minutes to read the instructions, gather the facts, and answer the questions.

SEND OR BRING THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA's website at www.socialsecurity.gov. Offices are also listed under U. S. Government agencies in your telephone directory or you may call Social Security at 1-800-772-1213 (TTY 1-800-325-0778). You may send comments on our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401. Send only comments relating to our time estimate to this address, not the completed form.