Form SSA-632-BK (04-2019) UF |

|

Discontinue Prior Editions |

Page 1 of 14 |

Social Security Administration |

OMB No. 0960-0037 |

|

|

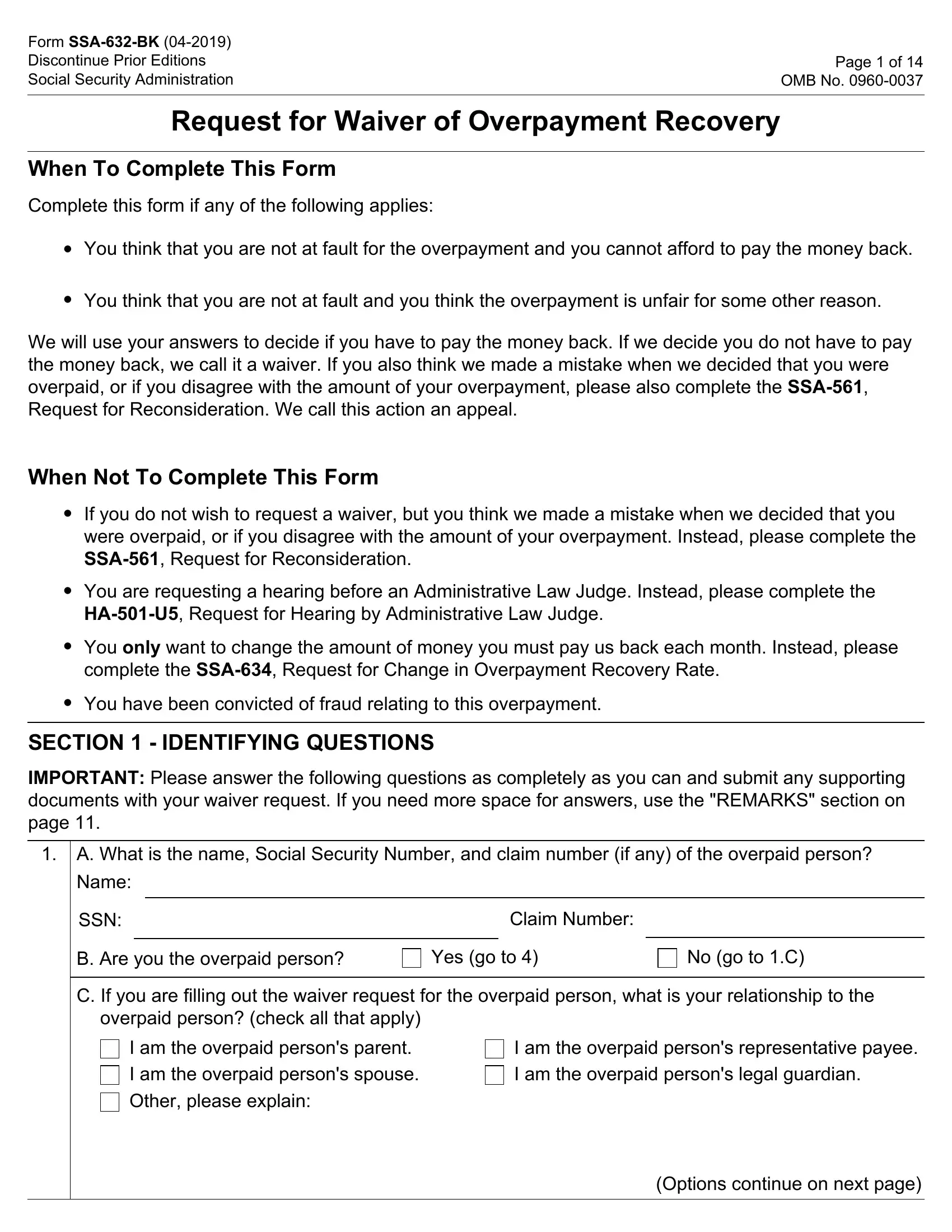

Request for Waiver of Overpayment Recovery

When To Complete This Form

Complete this form if any of the following applies:

You think that you are not at fault for the overpayment and you cannot afford to pay the money back.

You think that you are not at fault and you think the overpayment is unfair for some other reason.

We will use your answers to decide if you have to pay the money back. If we decide you do not have to pay the money back, we call it a waiver. If you also think we made a mistake when we decided that you were overpaid, or if you disagree with the amount of your overpayment, please also complete the SSA-561, Request for Reconsideration. We call this action an appeal.

When Not To Complete This Form

If you do not wish to request a waiver, but you think we made a mistake when we decided that you were overpaid, or if you disagree with the amount of your overpayment. Instead, please complete the SSA-561, Request for Reconsideration.

You are requesting a hearing before an Administrative Law Judge. Instead, please complete the HA-501-U5, Request for Hearing by Administrative Law Judge.

You only want to change the amount of money you must pay us back each month. Instead, please complete the SSA-634, Request for Change in Overpayment Recovery Rate.

You have been convicted of fraud relating to this overpayment.

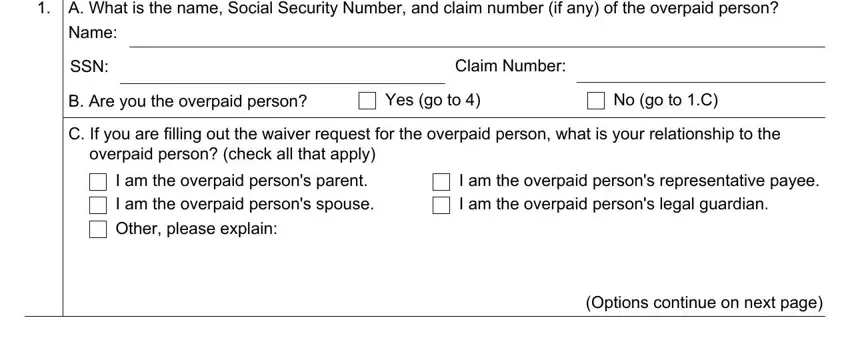

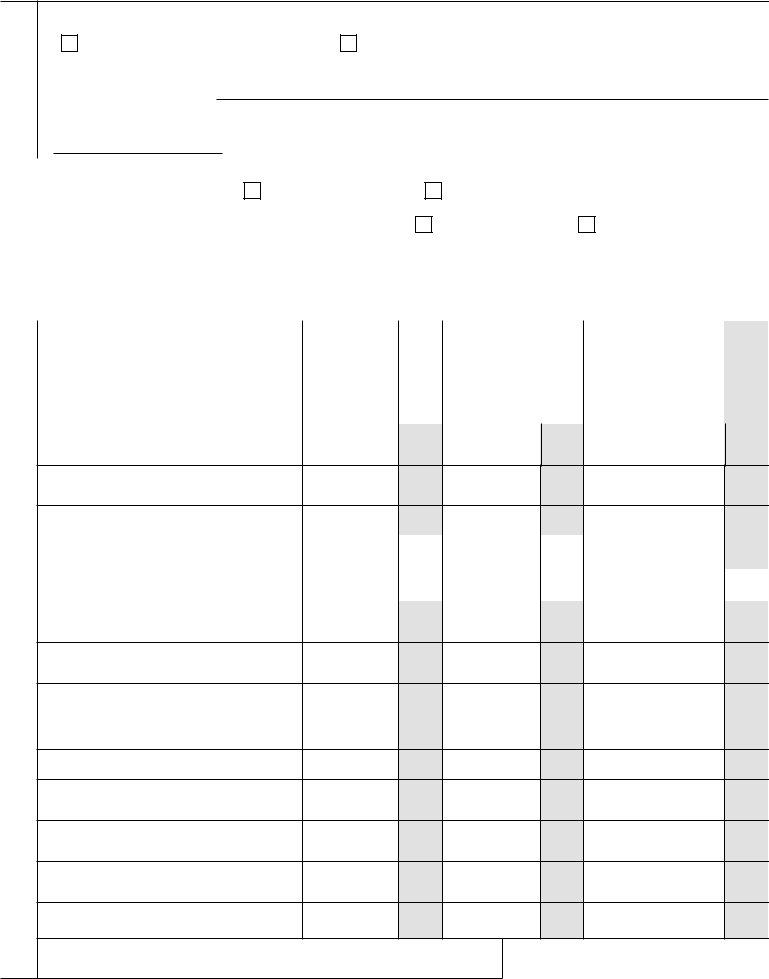

SECTION 1 - IDENTIFYING QUESTIONS

IMPORTANT: Please answer the following questions as completely as you can and submit any supporting documents with your waiver request. If you need more space for answers, use the "REMARKS" section on page 11.

A. What is the name, Social Security Number, and claim number (if any) of the overpaid person? Name:

SSN: |

|

Claim Number: |

|

|

|

|

|

|

B. Are you the overpaid person? |

Yes (go to 4) |

No (go to 1.C) |

C. If you are filling out the waiver request for the overpaid person, what is your relationship to the overpaid person? (check all that apply)

I am the overpaid person's parent. |

I am the overpaid person's representative payee. |

I am the overpaid person's spouse. |

I am the overpaid person's legal guardian. |

Other, please explain: |

|

(Options continue on next page)

Form SSA-632-BK (04-2019) UF |

Page 2 of 14 |

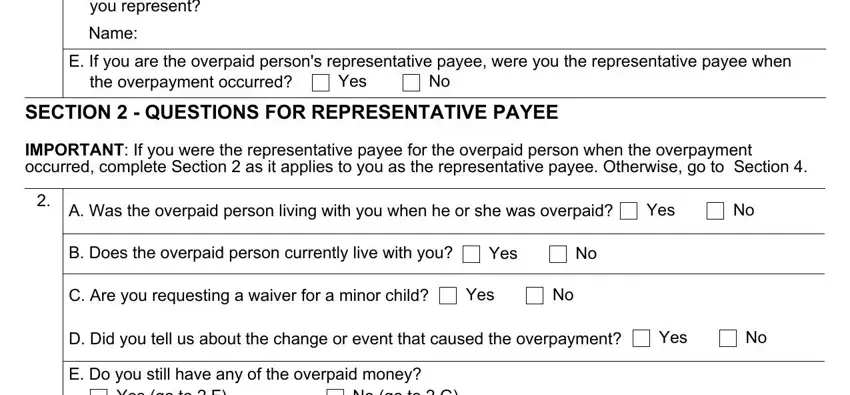

D. If you are not the overpaid person, what is your name or the name of the organization you represent?

Name:

E. If you are the overpaid person's representative payee, were you the representative payee when

the overpayment occurred? |

Yes |

No |

SECTION 2 - QUESTIONS FOR REPRESENTATIVE PAYEE

IMPORTANT: If you were the representative payee for the overpaid person when the overpayment occurred, complete Section 2 as it applies to you as the representative payee. Otherwise, go to Section 4.

A. Was the overpaid person living with you when he or she was overpaid? |

Yes |

No |

|

|

|

|

|

B. Does the overpaid person currently live with you? |

Yes |

No |

|

|

|

|

|

|

|

C. Are you requesting a waiver for a minor child? |

Yes |

No |

|

|

D. Did you tell us about the change or event that caused the overpayment? |

Yes |

No |

E. Do you still have any of the overpaid money?

Yes (go to 2.F) |

No (go to 2.G) |

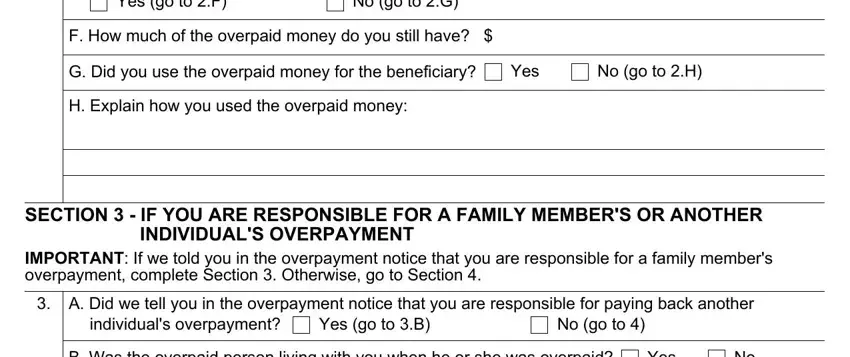

F. How much of the overpaid money do you still have? $

G. Did you use the overpaid money for the beneficiary? |

Yes |

No (go to 2.H) |

H. Explain how you used the overpaid money:

SECTION 3 - IF YOU ARE RESPONSIBLE FOR A FAMILY MEMBER'S OR ANOTHER INDIVIDUAL'S OVERPAYMENT

IMPORTANT: If we told you in the overpayment notice that you are responsible for a family member's overpayment, complete Section 3. Otherwise, go to Section 4.

A. Did we tell you in the overpayment notice that you are responsible for paying back another

individual's overpayment? |

Yes (go to 3.B) |

|

No (go to 4) |

|

|

|

|

|

B. Was the overpaid person living with you when he or she was overpaid? |

Yes |

No |

|

|

|

|

|

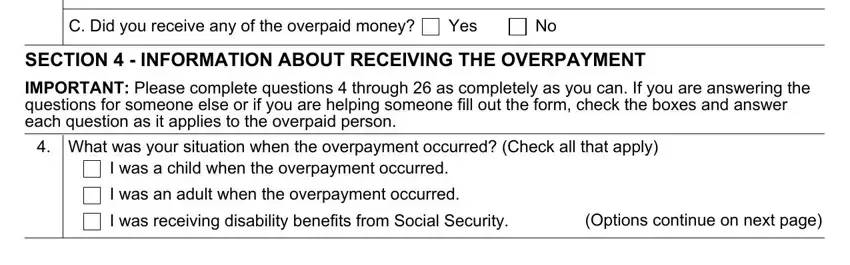

C. Did you receive any of the overpaid money? |

Yes |

No |

|

|

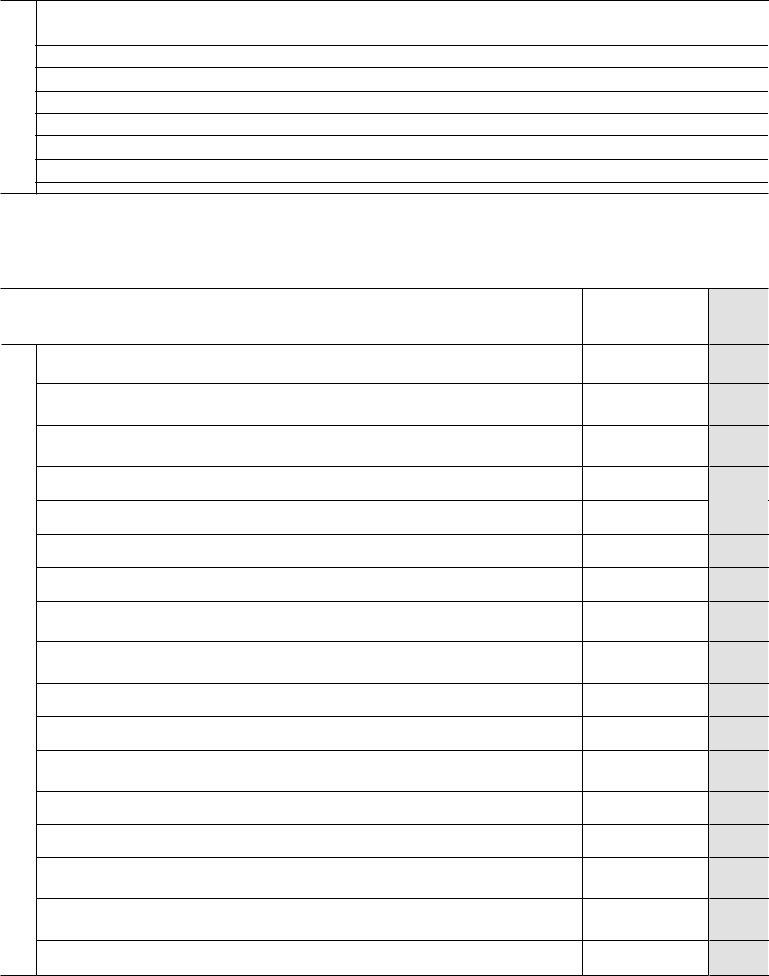

SECTION 4 - INFORMATION ABOUT RECEIVING THE OVERPAYMENT

IMPORTANT: Please complete questions 4 through 26 as completely as you can. If you are answering the questions for someone else or if you are helping someone fill out the form, check the boxes and answer each question as it applies to the overpaid person.

What was your situation when the overpayment occurred? (Check all that apply) I was a child when the overpayment occurred.

I was an adult when the overpayment occurred. |

|

I was receiving disability benefits from Social Security. |

(Options continue on next page) |

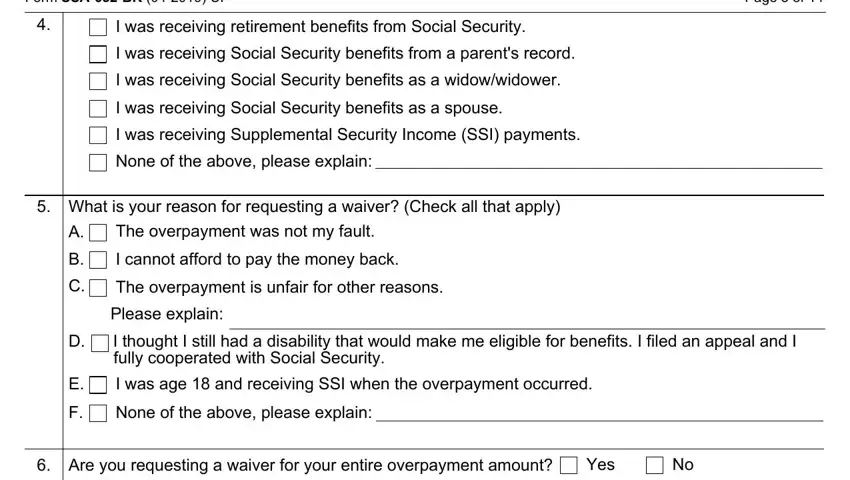

4.

Form SSA-632-BK (04-2019) UF |

Page 3 of 14 |

I was receiving retirement benefits from Social Security.

I was receiving Social Security benefits from a parent's record.

I was receiving Social Security benefits as a widow/widower.

I was receiving Social Security benefits as a spouse.

I was receiving Supplemental Security Income (SSI) payments.

None of the above, please explain:

5.What is your reason for requesting a waiver? (Check all that apply)

|

A. |

The overpayment was not my fault. |

|

|

|

|

|

|

|

B. |

I cannot afford to pay the money back. |

|

|

|

|

|

|

|

C. |

The overpayment is unfair for other reasons. |

|

|

|

|

|

|

|

Please explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. |

I thought I still had a disability that would make me eligible for benefits. I filed an appeal and I |

|

|

fully cooperated with Social Security. |

|

|

|

|

|

|

|

E. |

I was age 18 and receiving SSI when the overpayment occurred. |

|

|

|

|

F. |

None of the above, please explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Are you requesting a waiver for your entire overpayment amount? |

Yes |

No |

|

|

|

|

7. |

Have you previously filed a waiver request for this overpayment? |

Yes |

No |

|

|

|

|

|

|

|

|

|

Do you have the notice for this overpayment? |

Yes |

No (go to 11) |

|

|

|

8. |

If you have the notice for this overpayment, please provide the date on that notice. |

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

If you have the notice for this overpayment, please provide the following information: First month you were overpaid

9.Last month you were overpaid

If you were overpaid only one month, please provide the month

10.If you have the notice for this overpayment, please provide the amount of the overpayment. $

11.What was the cause of the overpayment?

(Check all that apply)

A. |

I received too much income. |

|

B. |

My household received too much income. |

|

C. |

My resources were over the amount for SSI. |

|

D. |

I received help for food and shelter. |

|

E. |

I received more than one benefit payment for the same month. |

|

F. |

The Social Security Administration determined that I was no longer disabled. |

G. |

My marital status changed. |

|

H. |

I received workers' compensation. |

|

I. |

I was in a nursing home. |

|

J. |

I was in jail or prison. |

(Options continue on next page) |

Form SSA-632-BK (04-2019) UF |

|

Page 4 of 14 |

|

|

|

|

|

|

11. |

K. |

I lived outside the U.S. for 30 consecutive days. |

|

L. |

My immigration status changed. |

|

M. |

Another person became entitled on the same record. |

|

N. |

My attorney fee was not withheld from my benefits. |

|

O. |

I was no longer a student. |

|

P. |

I no longer had a child under age 16 or a disabled child in my care. |

|

Q. |

I was overpaid because: |

|

|

|

|

|

|

|

|

R. |

I do not know why I was overpaid. |

|

|

|

|

|

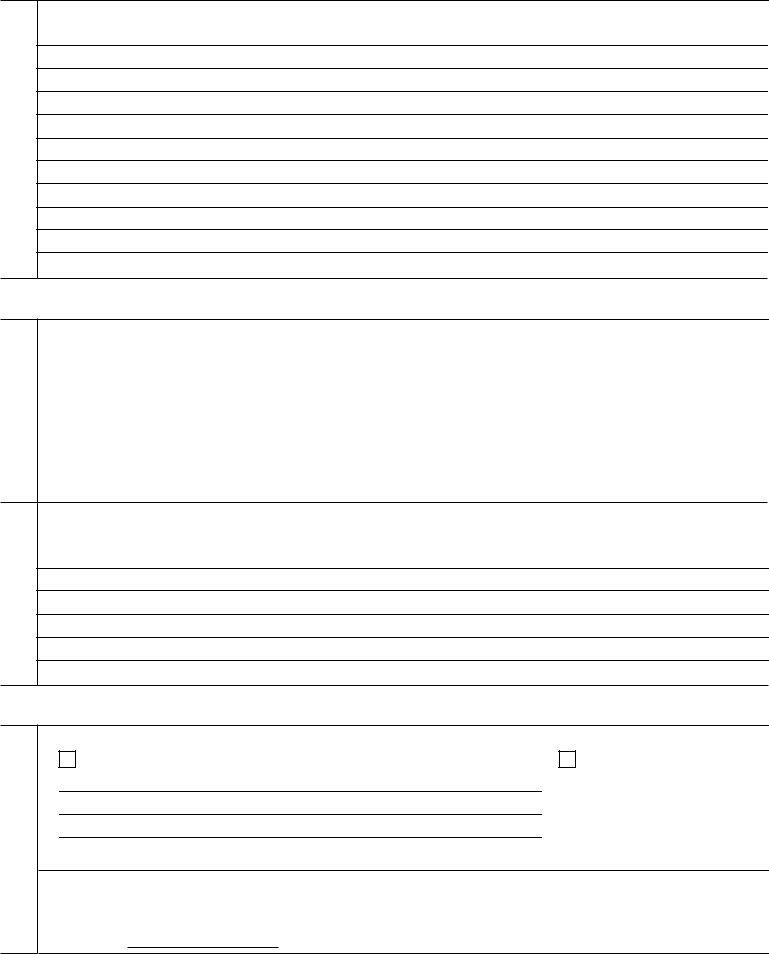

12. A. Do you understand that you are supposed to report changes to us, for example: |

|

|

• working |

• a change in resources |

|

|

• marriage |

• a change in income |

|

|

• divorce |

• a change in school attendance |

|

|

• moving |

• any other changes that may affect your benefits |

|

|

|

Yes |

|

|

|

|

|

|

No, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Is there anything that prevents you from reporting your changes to us?

C. Did you tell us about the change or event that led to the overpayment?

Yes, please check one or more reasons below |

No, please explain: |

|

I called in |

|

|

I sent a fax or letter |

|

|

|

|

I visited a local field office |

|

|

|

|

I used electronic wage reporting |

|

|

|

|

Other, please explain: |

|

|

|

|

|

|

|

|

|

|

Date(s) you told us about the change or event that led to the overpayment:

Do you have any documentation indicating that you told us about the change or event that led to the overpayment?

Yes, please send it with your waiver request

No, please explain:

D. Have you ever been overpaid before?

Yes (go to 12.E) |

No (go to 12.F) |

Form SSA-632-BK (04-2019) UF |

Page 5 of 14 |

E. If you were overpaid before, is this overpayment for the same reason?

F. Are you currently receiving any of the following? (Check all that apply)

I am receiving Supplemental Security Income (SSI) payments.

I am receiving Temporary Assistance for Needy Families (TANF).

My claim number is:

I am receiving a pension based on need from the Department of Veterans Affairs (VA)

My claim number is:

IMPORTANT: If you checked any boxes in question 12.F, go to page 13. Please sign, date, provide your address and phone number(s), and proof that you receive TANF or VA pension, if applicable. If this statement does not apply, go to question 13.A.

SECTION 5 - YOUR FINANCIAL STATEMENT

Documents to Support Your Statements

IMPORTANT: To complete Sections 5 through 8 of this form, you should refer to certain documents to support your statements. Please answer all questions and submit any supporting documents with your request. Your supporting documents should be no older than 3 months from the date you are requesting a waiver. Submit similar documents for your spouse and your dependents. A dependent is a person who depends on you for support and whom you can claim on your tax return.

Examples of supporting documents are:

• Current Rent or Mortgage Information |

• Recent Bank Statements (checking or |

• |

2 or 3 Recent Utility, Medical, Charge Card, |

• |

savings account) |

|

and Insurance Bills |

Current Pay Stubs |

• |

Canceled Checks |

• |

Your Most Recent Income Tax Return |

Please write only whole dollar amounts. Round any cents to the nearest dollar.

A. Did you still have any of the overpaid money at the time you received the overpayment notice?

Yes Amount $ |

|

(go to 13.B) |

No (go to 14) |

|

|

|

|

|

|

|

|

B. Do you still have any of the overpaid money? |

|

Yes Amount $ |

No |

|

|

|

|

(If yes, return the money to SSA following the instructions in the |

|

overpayment notice or contact SSA at 1-800-772-1213.) |

|

Did you receive any real estate after you received the overpayment notice?

Yes (provide the value) |

No |

Value: $

A. Did you give away any real estate after you received your overpayment notice?

Yes (provide the value) |

No |

Value: $

B. Did you sell any real estate after you received your overpayment notice?

Yes (provide the amount) |

No |

Amount you received after selling: $

Form SSA-632-BK (04-2019) UF |

Page 6 of 14 |

A. Did you give away any money after you received the overpayment notice?

Yes (provide the amount) Amount: $ |

|

No |

|

|

|

B. Did anyone give you money after you received your overpayment notice?

Yes (provide the amount) Amount: $ |

|

No |

|

|

|

SECTION 6 - MEMBERS OF HOUSEHOLD

A. If you are an adult requesting a waiver, list your spouse and dependents below. A dependent is a person who depends on you for support and whom you can claim on your income tax return.

If you are completing the waiver request for a minor child, only provide the child's name in Section 6 and the child's information is Sections 7, 8, and 9. If the child's income and assets help with food and household expenses, complete Sections 6, 7, 8, and 9 with the parents' and their dependents' information.

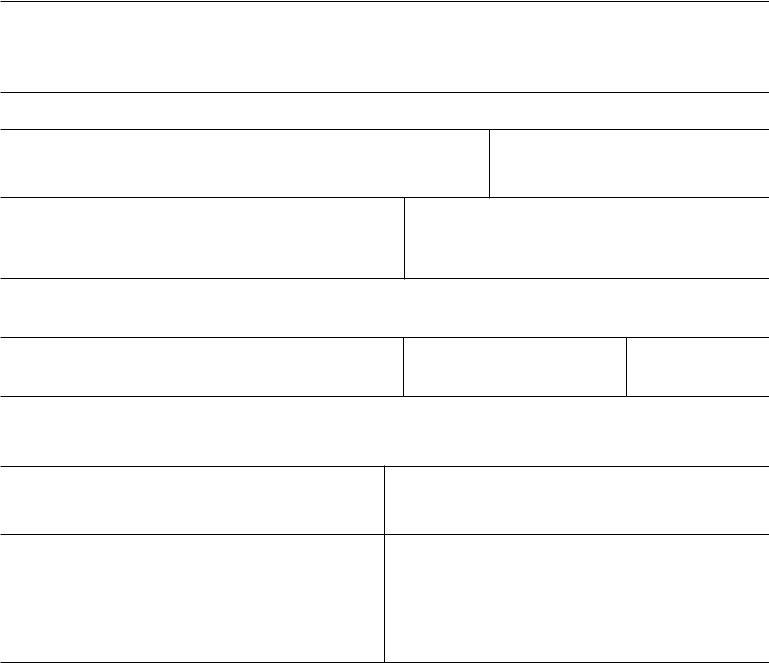

Name |

Age |

Relationship To You |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Does anyone live with you who you cannot claim on your income tax return?

If yes, does this person or persons give you any money to live with you or pay any of the household bills or expenses?

Yes, total amount you receive $ |

|

No |

SECTION 7 - ASSETS - THINGS YOU HAVE AND OWN

18.A. How much cash do you, your spouse, and your dependents have in your possession? $

B.List all financial accounts for you, your spouse, and your dependents. Examples of accounts you should list include Checking, Online (e.g., PayPal), Savings, Certificate of Deposit (CD), Individual Retirement Accounts (IRAs), Money or Mutual Funds, Stocks, Bonds, Trust Funds, Prepaid Debit Cards, or any other accounts.

|

Type of |

Name and Address of |

Name on |

Balance or |

Income Per Month |

|

|

(interest or |

Account Number |

|

Account |

Institution |

Account |

Value |

|

dividends) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS

Form SSA-632-BK (04-2019) UF |

Page 7 of 14 |

A. Do you, your spouse, or your dependents own more than one family vehicle, including a car, sport utility vehicle (SUV), truck, van, camper, motorcycle, boat, or any other vehicle?

Yes (list all of the vehicles below) |

No (go to 19.B) |

|

|

|

|

|

|

Owner |

Year, Make/Model |

Present Value |

Loan Balance |

Main Purpose for Use |

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COUNTABLE VALUE $ 0.00

B. Do you, your spouse, or your dependents own any real estate other than where you live?

Yes (list below) |

|

No (go to 19.C) |

|

|

|

|

|

|

Owner |

Description |

Market Value |

Loan Balance |

Income Amount |

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS $ 0.00

C. Do you, your spouse, or your dependents own or have an interest in any business, property, or valuables?

Yes (list below) |

|

No (go to 20) |

|

|

|

|

|

|

Owner |

Description |

Market Value |

Loan Balance |

Income Amount |

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS $ 0.00

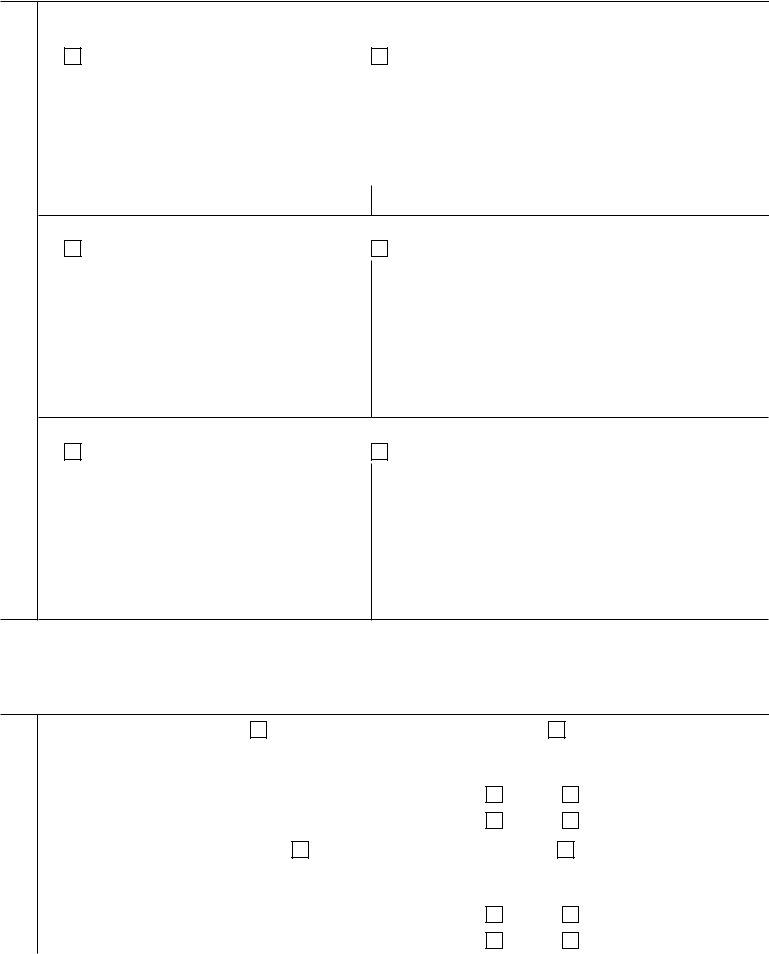

SECTION 8 - MONTHLY HOUSEHOLD INCOME

The next set of questions are about monthly take home pay. Enter your, your spouse, and your dependents' take home pay and check the box to show whether payment is received weekly, every 2 weeks, twice a month, or monthly. Add the monthly amount on line 22.A. If you need more space for answers, use the "REMARKS" section on page 11.

20. A. Are you employed? |

Yes (provide information below) |

No (go to 20.B) |

|

|

|

|

|

Employer(s) Name, Address, and Phone: (Write "self" if self-employed) |

Take home pay or earnings if |

$ |

|

|

|

self-employed (Net) Choose one: |

|

|

|

|

Weekly |

Every 2 Weeks |

|

|

|

|

Monthly |

Twice a Month |

|

|

|

|

|

|

|

|

B. Is your spouse employed? |

Yes (provide information below) |

No (go to 20.C) |

|

|

|

|

Employer(s) Name, Address, and Phone: (Write "self" if self-employed) |

Take home pay or earnings if |

$ |

|

|

|

self-employed (Net) Choose one: |

|

|

|

|

Weekly |

Every 2 Weeks |

|

|

|

|

Monthly |

Twice a Month |

|

|

|

|

|

|

|

(Options continue on next page)

Form SSA-632-BK (04-2019) UF |

Page 8 of 14 |

20. C. Are any of your dependents employed, including self-employment?

Yes (provide information below) |

No (go to 21) |

Name(s) of dependents:

Provide total monthly take home pay for dependent(s):

$

21. |

A. Do you, your spouse, or your dependents receive support or contributions from any person, |

|

|

agency, or organization? |

Yes (go to 21.B) |

|

No (go to 22) |

|

|

|

|

|

|

|

|

|

|

|

B. Is the support received under a loan agreement? |

Yes (go to 22) |

|

No (go to 21.C) |

|

|

|

|

|

|

|

C. How much money do you, your spouse, or your dependents receive each month? |

|

|

(Show this amount on line I of question 22) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

Source |

|

|

|

|

|

|

|

|

|

|

|

|

|

22. |

|

|

|

|

|

|

|

|

Income |

Overpaid |

SSA |

Spouse of |

SSA |

Dependent(s) of |

SSA |

|

(Be sure to show monthly |

person's |

Use |

Overpaid |

Use |

Overpaid Person |

Use |

|

amounts below) |

income |

Only |

Person |

Only |

(Total) |

Only |

|

|

|

|

|

|

|

|

A. Take Home Pay (Net)

(from questions 20.A, 20.B, and 20.C)

B. Social Security Benefits (retirement,

disability, widows, students, etc.)

C. Supplemental Security Income (SSI)

D. Pension(s) |

TYPE |

|

|

|

|

|

(VA, Military, Civil |

|

|

|

|

|

|

|

|

|

|

|

|

Service, Railroad, etc.) |

TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

E. Supplemental Nutrition Assistance

Program (SNAP) Benefits

F. Income from Real Estate, Business, etc. (from questions 19.B and 19.C)

G. Room and/or Board Payments from a Person who is not a Dependent (from question 17.B). Put the amount in the overpaid person's column.

H. Child Support/Alimony

I. Other Support (from question 21.C)

J. Income from Assets |

(from question 18.B) |

K. Other (from any source, explain in |

REMARKS on next page) |

TOTALS: |

Grand Total $

(Add all TOTAL blocks above) |

(Options continue on next page) |

|

|

Form SSA-632-BK (04-2019) UF |

Page 9 of 14 |

22. REMARKS:

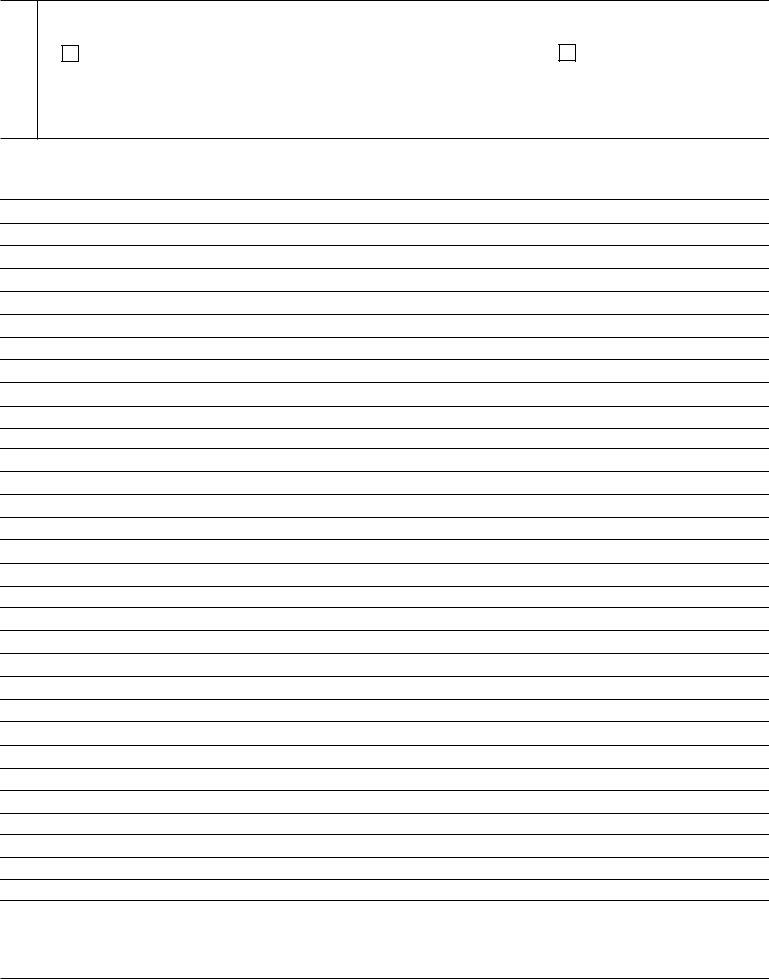

SECTION 9 - MONTHLY HOUSEHOLD EXPENSES

Do not list an expense that is withheld from your paycheck (such as medical insurance, child support, alimony, wage garnishments, etc.) (Be sure to show monthly amounts in number 23) Please write only whole dollar amounts and round any cents to the nearest dollar.

Type of Expense

23.A. Rent or Mortgage (if mortgage payment includes property or other local taxes, insurance, etc., DO NOT list it again below)

B.Food (groceries, including food purchased with SNAP benefits, and food at restaurants, work, etc.)

C.Utilities (gas, electric, telephone (cell or land line), internet, trash collection, water, and sewer)

D.Other Heating/Cooking Fuel (oil, propane, coal, wood, etc.)

E.Clothing

F.Household Items (personal hygiene items, etc.)

G.Property Tax (State and local)

H.Insurance (life, health, fire, homeowner, renter, car, and any other casualty or liability policies)

I.Medical/Dental (prescriptions and medical equipment, if not paid by insurance)

J.Loan/Lease Payment for Family Vehicle

K.Expenses (gas and repairs) for Family Vehicle

L.Other Transportation (bus, taxi, etc., used for medical appointments, work, or other necessary travel)

M.Tuition and School Expenses

N.Court Ordered Payments Paid Directly to the Court

O.Credit Card Payments (show minimum monthly payment). DO NOT include any expenses already listed above

P.Any expenses not shown above

(Options continue on next page) |

TOTAL |

|

Form SSA-632-BK (04-2019) UF |

Page 10 of 14 |

EXPENSE REMARKS (Please provide any additional information not captured in Section 9)

SECTION 10 - INCOME AND EXPENSES COMPARISON

|

A. Monthly Income |

$ |

|

Write the amount here from the Grand Total from number 22. |

|

|

|

B. Monthly Expenses |

|

|

$ |

|

Write the amount here from the Total from number 23. |

|

|

|

|

|

C. Add this amount to your expenses. |

|

+ $25 |

|

|

|

|

|

D. Adjusted Monthly Expenses (Add B and C) |

$ |

25.00 |

|

|

|

|

|

E. TOTAL (Subtract D from A) |

$ |

(25.00) |

|

|

|

|

|

If your expenses in 24.D are more than your income in 24.A, explain how you are paying your bills. If you are not paying your bills, explain which bills have unpaid balances.

SECTION 11 - FINANCIAL EXPECTATION AND FUNDS AVAILABILITY

A. Do you expect to receive an inheritance within the next 6 months? |

|

Yes, explain |

No (go to 26.B) |

B. Please provide the total of you, your spouse, and your dependents' assets from questions, 18.A, 18.B, 19.A, 19.B, and 19.C.

Total $:

(Options continue on next page)

Form SSA-632-BK (04-2019) UF |

Page 11 of 14 |

C. Is there any reason you cannot convert or sell the “Balance or Value” of any financial assets shown in items 18.B, 19.A, 19.B or 19.C to cash?

REMARKS SECTION - If you are continuing an answer to a question, please write the number (and letter, if any) of the question first.

IMPORTANT: Please provide your documents to support the information you provided. Complete and sign the following statements.

Form SSA-632-BK (04-2019) UF |

Page 12 of 14 |

|

|

Below is an authorization for the Social Security Administration to obtain your financial account information. We may need to access your financial records in order to determine if we can waive your overpayment.

IMPORTANT: If the overpaid individual is a minor child, a parent or legal guardian must complete and sign the form on the child's behalf. If a court has assigned a legal guardian to an adult individual, the legal guardian must complete and sign the form. Adults who do not have a court appointed legal guardian must complete and sign the form, even if they have a representative payee.

AUTHORIZATION FOR THE SOCIAL SECURITY ADMINISTRATION TO OBTAIN ACCOUNT RECORDS FROM A FINANCIAL INSTITUTION AND REQUEST FOR RECORDS

Please review the following, make selection, and sign below:

Iunderstand:

•I have the right to revoke this authorization at any time before any records are disclosed;

•The Social Security Administration may request all records about me from any financial institution;

•Any information obtained will be kept confidential;

•I have the right to obtain a copy of the record which the financial institution keeps concerning the instances when it has disclosed records to a government authority unless the records were disclosed because of a court order;

•This authorization is not required as a condition of doing business with any financial institution.

•The Social Security Administration will request records to determine the ability to repay an overpayment in conjunction with a waiver determination;

•Failing to provide or revoking my authorization may result in the Social Security Administration determining, on that basis, that adjustment or recovery of the overpayment will not deprive me of funds to pay my bills for food, clothing, housing, medical care, or other necessary expenses;

•This authorization is in effect until the earliest of: 1) a final decision on whether adjustment or recovery of my overpayment would deprive me of funds to pay my bills for food, clothing, housing, medical care, or other necessary expenses; or 2) my revocation of this authorization in written notification to the Social Security Administration.

I authorize any custodian of records at any financial institution to disclose to the Social Security Administration any records about my financial business or that of the person named above whom I legally represent or whose benefits I manage.

I do not authorize any custodian of records at any financial institution to disclose to the Social Security Administration any records about my financial business or that of the person named above whom I legally represent or whose benefits I manage. I understand that if I do not give permission to obtain financial records or if I cancel my permission, SSA may not approve my waiver request.

Customer's Signature/Authorization |

Mailing Address |

Date |

|

|

|

Legal Representative's |

Legal Representative's Mailing Address |

Date |

Signature/Authorization |

|

|

|

|

|

Form SSA-632-BK (04-2019) UF |

Page 13 of 14 |

|

|

PENALTY CLAUSE, CERTIFICATION, AND PRIVACY ACT STATEMENT

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and may be subject to a fine or imprisonment.

SIGNATURE OF OVERPAID PERSON OR REPRESENTATIVE PAYEE

Signature (First name, middle initial, last name) (Write in ink)

Home Telephone Number (include area code)

Work Telephone Number If We May Call You At Work (include area code)

Mailing Address (Number and street, Apt. No., PO Box, or Rural Route

Witnesses are required ONLY if this statement has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the individual must sign below, giving their full addresses.

1. Signature of Witness (Write in ink)

2. Signature of Witness (Write in ink)

Address (Number and street, City, State, and ZIP Code)

Address (Number and street, City, State, and ZIP Code)

Paperwork Reduction Act Statement

Form SSA-632-BK (04-2019) UF |

Page 14 of 14 |

Privacy Act Statement

Collection and Use of Personal Information

Sections 204, 1631, and 1879 of the Social Security Act, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent an accurate and timely decision on your overpayment waiver request.

We will use the information to make a waiver determination and to obtain your financial account information. We may also share your information for the following purposes: called routine uses:

•To student volunteers and other worker, who technically do not have the status of Federal employees, when they are performing work for Social Security Administration (SSA) as authorized by law, and they need access to personally identifiable information in SSA records in order to perform their assigned agency functions; and

•To third party contacts such as private collection agencies and credit reporting agencies under contract with SSA and other agencies, including the Veterans Administration, the Armed Forces, the Department of the Treasury, and State motor vehicle agencies, for the purposes of their assisting SSA in recovering program debt.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person's eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notices (SORN) 60-0094, entitled Recovery of Overpayments, Accounting and Reporting/Debt Management System, as published in the Federal Register (FR) on August 23, 2005, at 70 FR 49354; 60-0231, entitled Financial Transactions of SSA Accounting and Finance Offices, as published in the FR on January 11, 2006, at 71 FR 1849; and

60-0320, entitled Electronic Disability Claims File, as published in the FR on July 25, 2006, at 71 FR 42159. Additional information, and a full listing of all of our SORNs, is available on our website at www.ssa.gov/ privacy.

- This information collection meets the clearance requirements of 44

U.S.C. §3507, as amended by Section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 120 minutes to read the instructions, gather the facts, and answer the questions. SEND THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA's website at www.socialsecurity.gov. Offices are also listed under U.S. Government agencies in your telephone directory or you may call Social Security at 1-800-772-1213. You may send comments on our time estimate above to: SSA, 1338 Annex Building, Baltimore, MD 21235-0001. Send only comments relating to our time estimate to this address, not the completed form.