Our main web developers worked hard to design the PDF editor we are delighted to present to you. The app permits you to simply create st12 and will save you valuable time. You only need to stick to this specific guideline.

Step 1: You should choose the orange "Get Form Now" button at the top of the page.

Step 2: Now, you're on the form editing page. You can add information, edit current details, highlight particular words or phrases, place crosses or checks, add images, sign the file, erase unnecessary fields, etc.

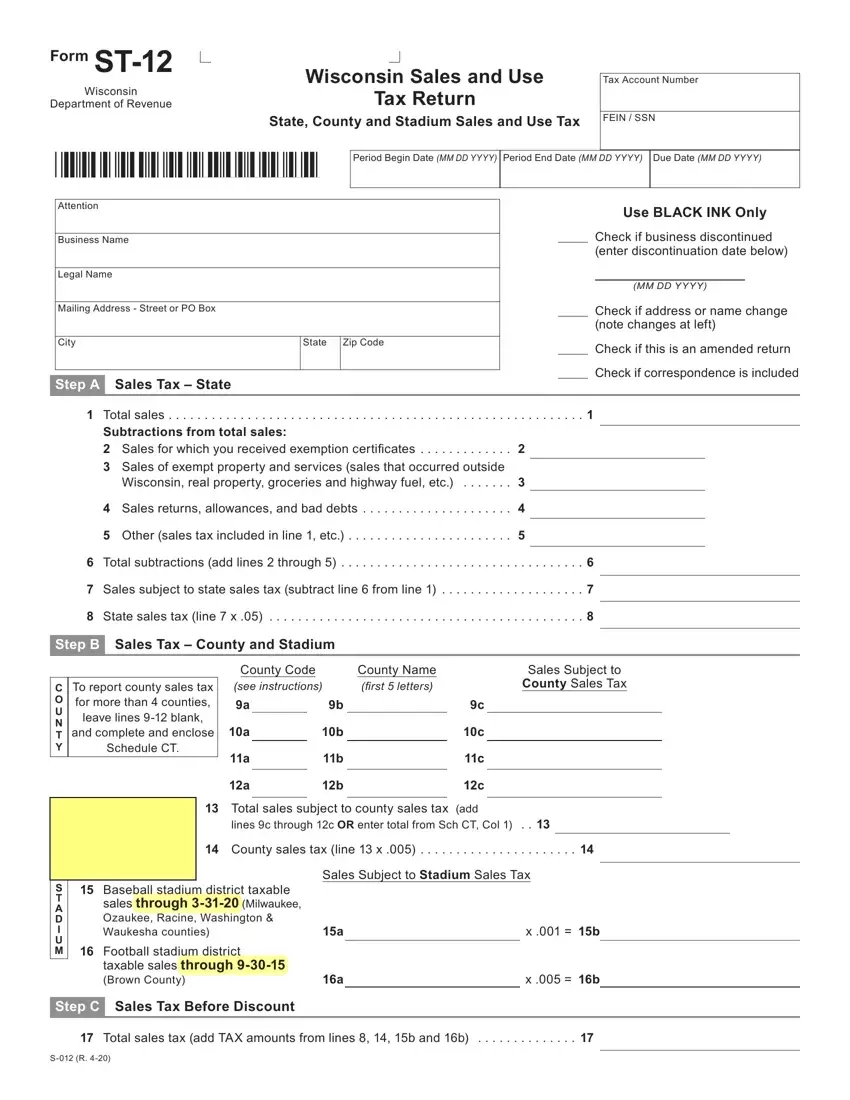

Complete the st12 PDF by entering the details required for each individual area.

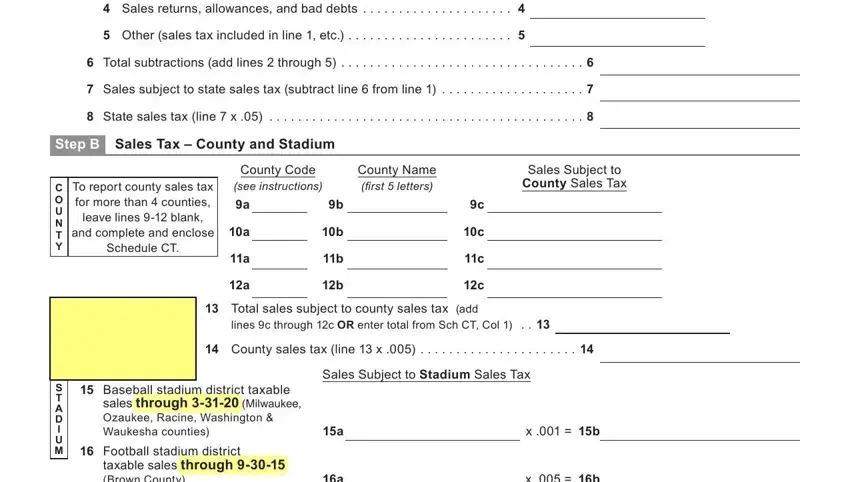

You have to fill in the Sales returns allowances and bad, Other sales tax included in line, Total subtractions add lines, Sales subject to state sales tax, State sales tax line x, Step B Sales Tax County and, C O U N T Y, To report county sales tax for, County Code see instructions, County Name first letters, Sales Subject to County Sales Tax, Total sales subject to county, lines c through c OR enter total, County sales tax line x, and Sales Subject to Stadium Sales Tax area with the required data.

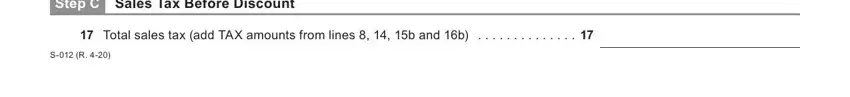

You need to emphasize the required details within the Step C Sales Tax Before Discount, Total sales tax add TAX amounts, and S R area.

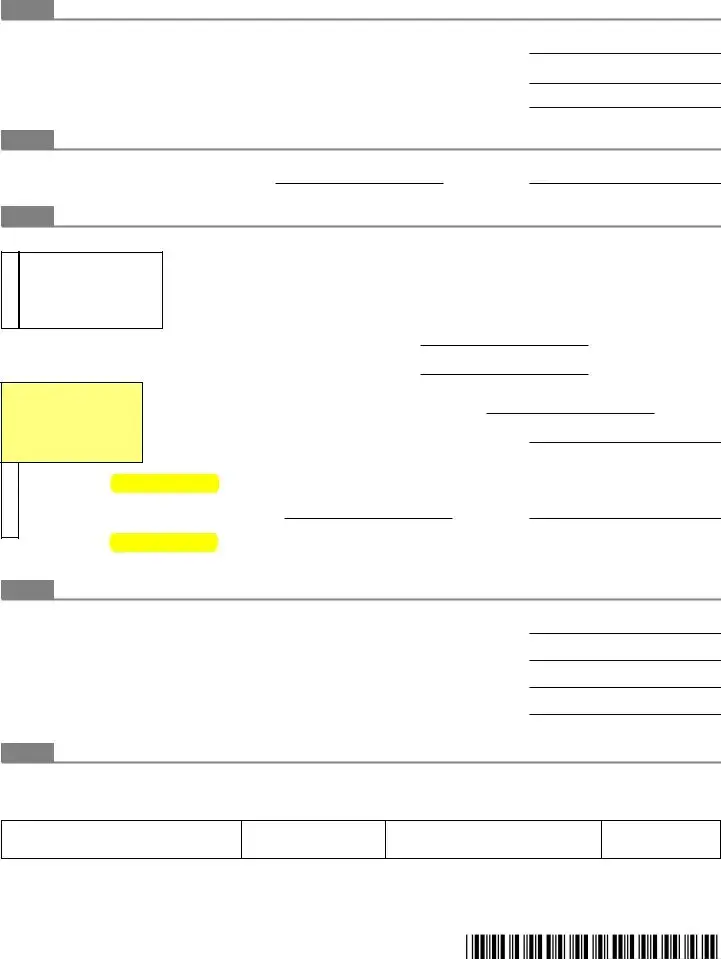

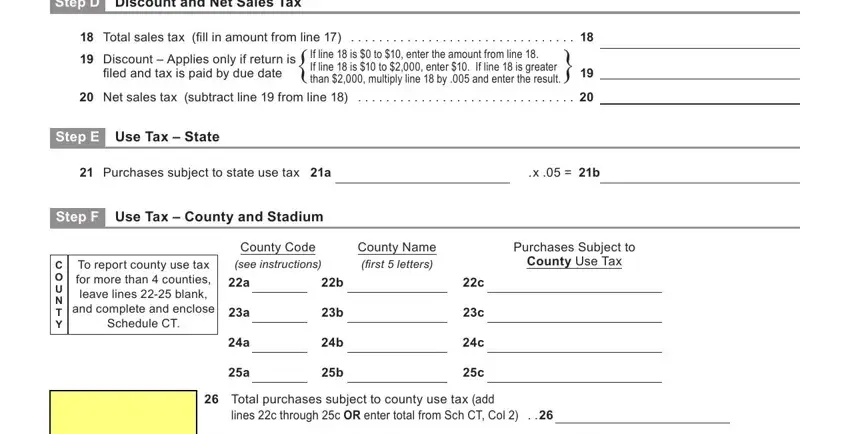

The Step D Discount and Net Sales Tax, Total sales tax fill in amount, Discount Applies only if return, If line is to enter the amount, Net sales tax subtract line from, Step E Use Tax State, Purchases subject to state use, x b, Step F Use Tax County and Stadium, C O U N T Y, To report county use tax for more, County Code see instructions, County Name first letters, Purchases Subject to County Use Tax, and Total purchases subject to county area allows you to specify the rights and obligations of each party.

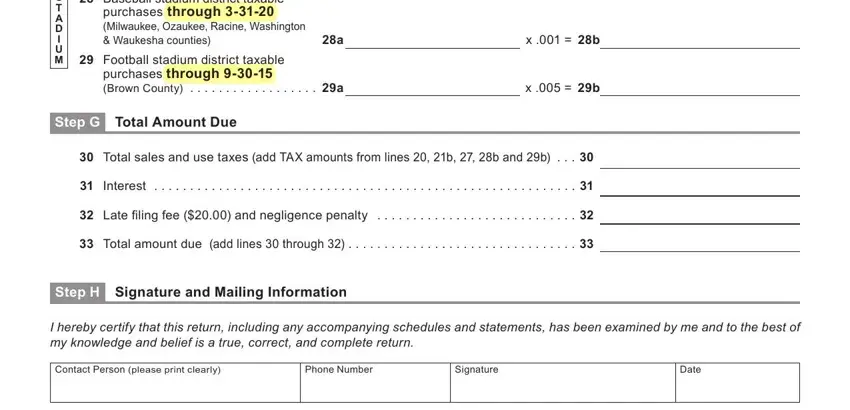

Terminate by looking at the following fields and filling them out as required: S T A D I U M, Baseball stadium district taxable, Football stadium district taxable, Step G Total Amount Due, x b, x b, Total sales and use taxes add TAX, Interest, Late filing fee and negligence, Total amount due add lines, Step H Signature and Mailing, I hereby certify that this return, Contact Person please print clearly, Phone Number, and Signature.

Step 3: When you have clicked the Done button, your file will be ready for transfer to any gadget or email you indicate.

Step 4: Ensure you remain away from possible future problems by preparing around a pair of copies of the file.