We were establishing this PDF editor having the idea of allowing it to be as effortless make use of as it can be. That's the reason the actual procedure of creating the po box 7905 madison wi is going to be effortless as you go through the following steps:

Step 1: Choose the orange button "Get Form Here" on the web page.

Step 2: Now you are going to be within the file edit page. You can add, change, highlight, check, cross, add or erase areas or words.

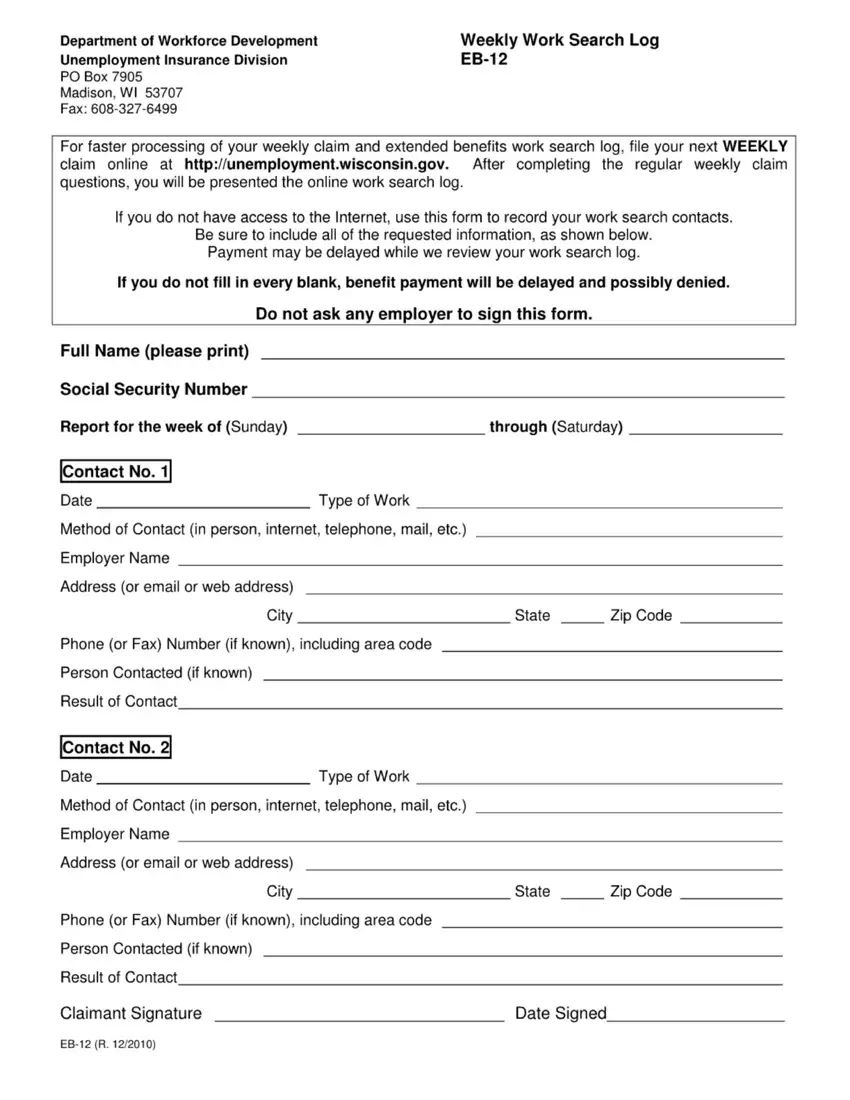

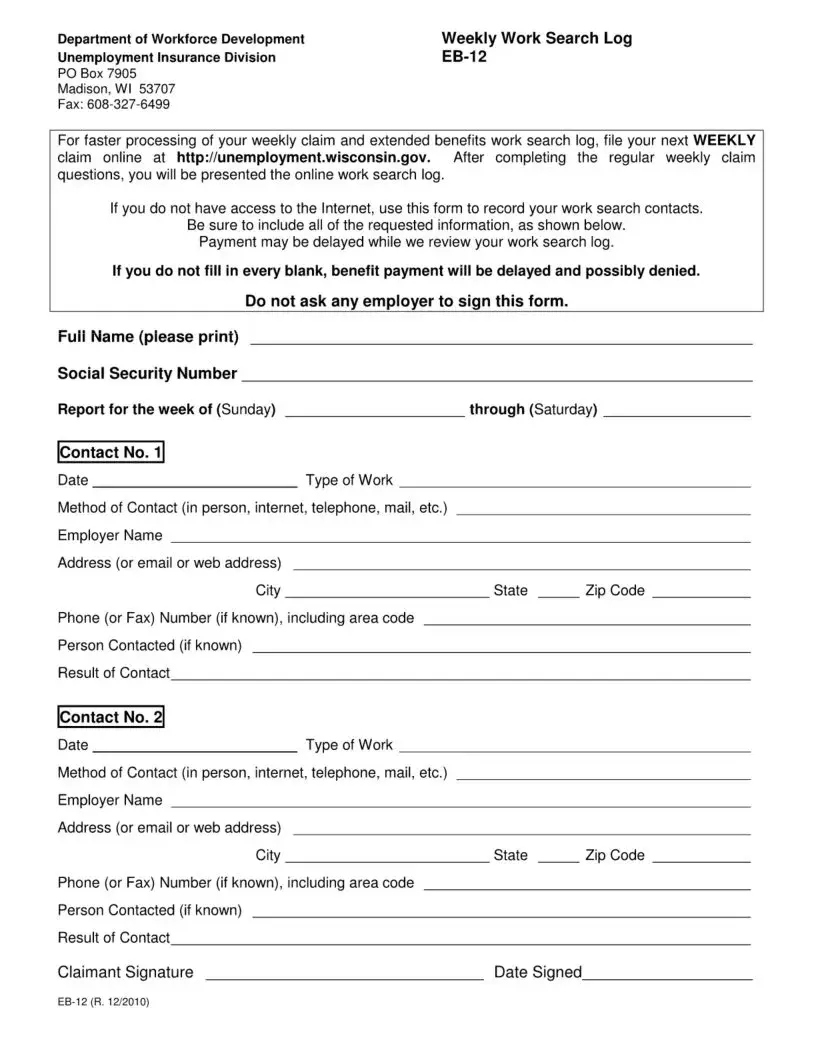

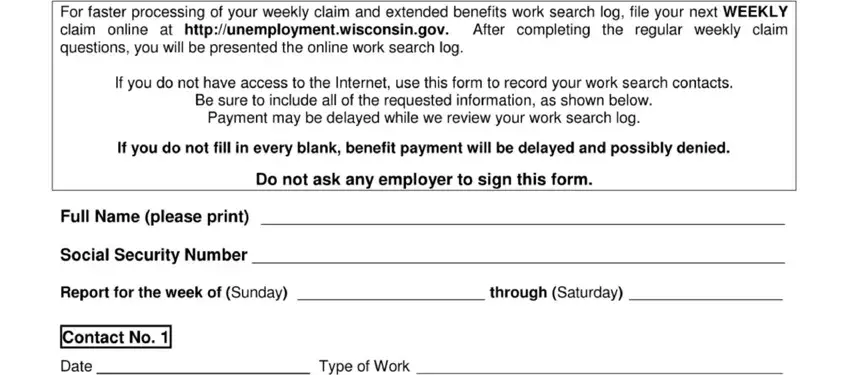

Get the po box 7905 madison wi PDF and provide the details for every area:

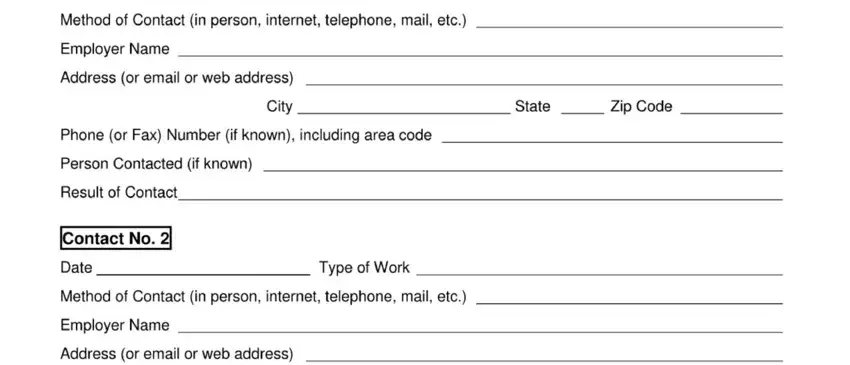

In the Method of Contact in person, Employer Name, Address or email or web address, City, State, Zip Code, Phone or Fax Number if known, Person Contacted if known, Result of Contact, Contact No, Date, Type of Work, Method of Contact in person, Employer Name, and Address or email or web address area, type in your data.

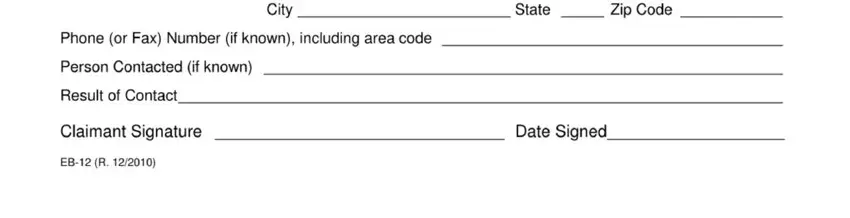

The system will ask you to give specific necessary particulars to effortlessly complete the segment Phone or Fax Number if known, City, State, Zip Code, Person Contacted if known, Result of Contact, Claimant Signature, EB R, and Date Signed.

Step 3: Click the Done button to save the file. At this point it is ready for upload to your gadget.

Step 4: Make a copy of each single file. It may save you time and enable you to prevent concerns down the road. By the way, the information you have is not distributed or viewed by us.