We were building the PDF editor with the concept of allowing it to be as quick to work with as possible. For this reason the actual procedure of creating the nj state temporary disability forms will be easy perform the following steps:

Step 1: The first step should be to click the orange "Get Form Now" button.

Step 2: At the moment you are on the file editing page. You can change and add content to the form, highlight specified content, cross or check specific words, add images, insert a signature on it, delete needless areas, or remove them altogether.

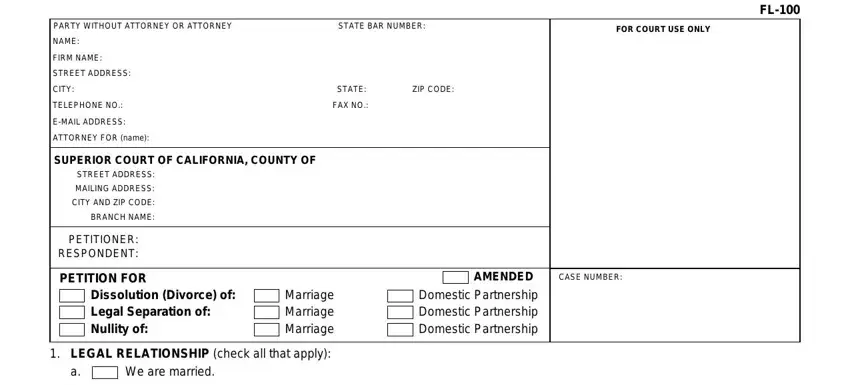

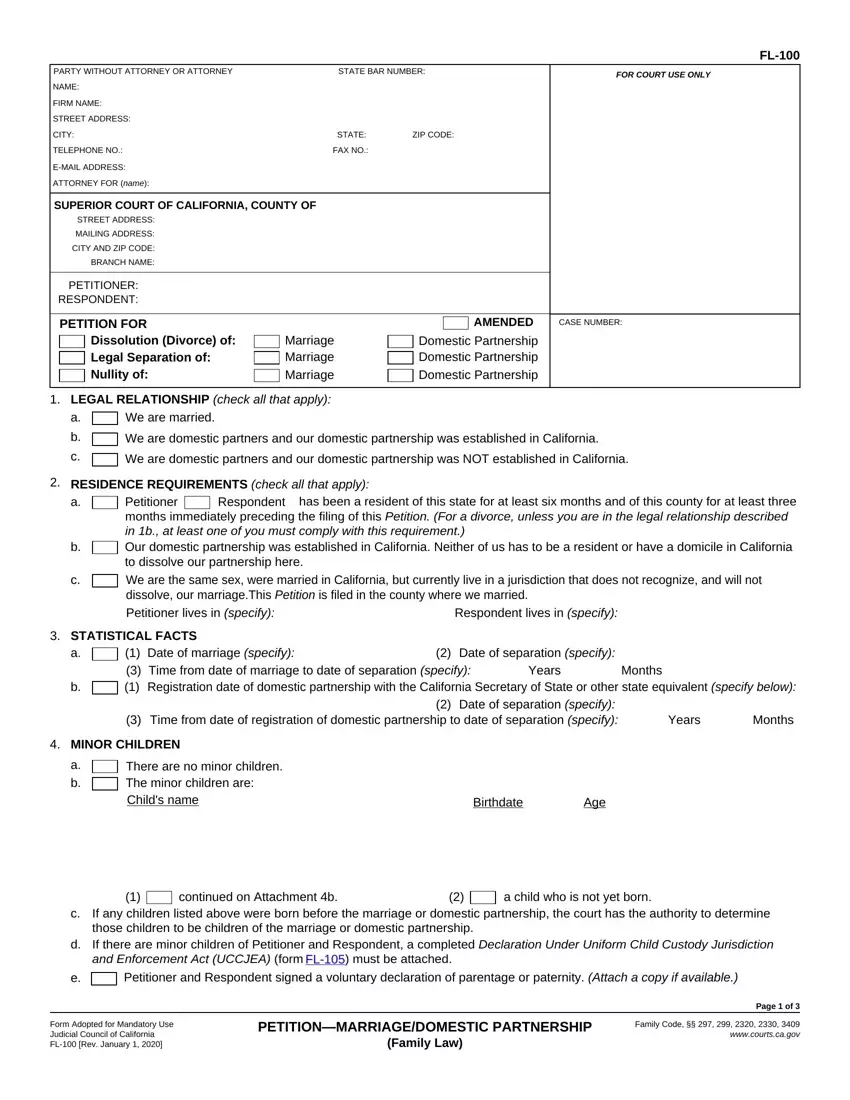

Complete the next areas to fill out the file:

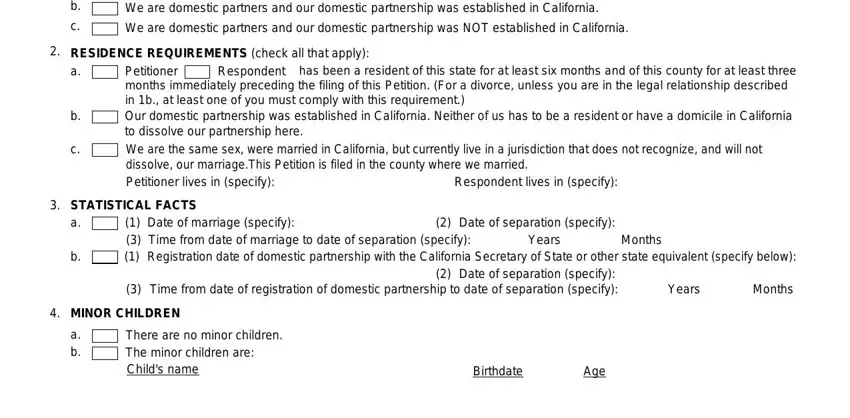

Type in the essential information in We are domestic partners and our, We are domestic partners and our, RESIDENCE REQUIREMENTS check all, Respondent, has been a resident of this state, Petitioner months immediately, Respondent lives in specify, STATISTICAL FACTS a, Date of marriage specify Time from, Date of separation specify, Months, Years, Date of separation specify Time, Years, and Months section.

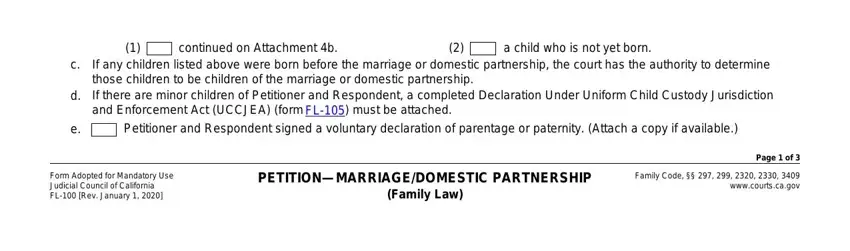

Within the section referring to continued on Attachment b, a child who is not yet born, If any children listed above were, Petitioner and Respondent signed a, Form Adopted for Mandatory Use, PETITIONMARRIAGEDOMESTIC, Page of, and Family Code wwwcourtscagov, you have to put in writing some significant data.

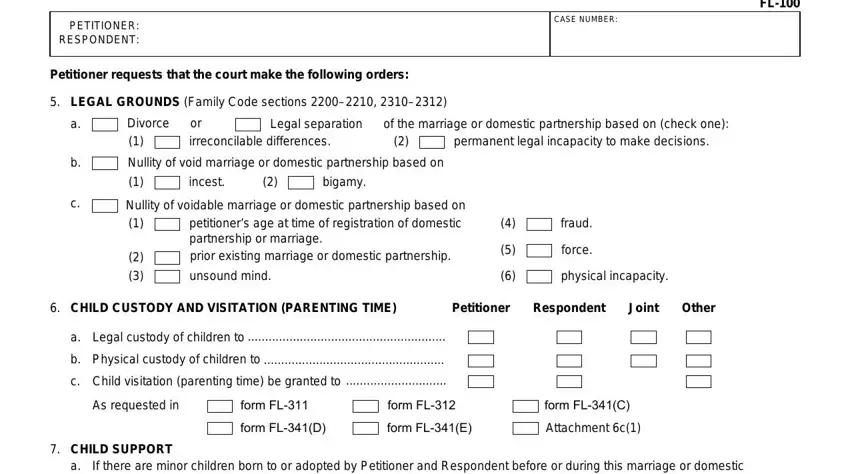

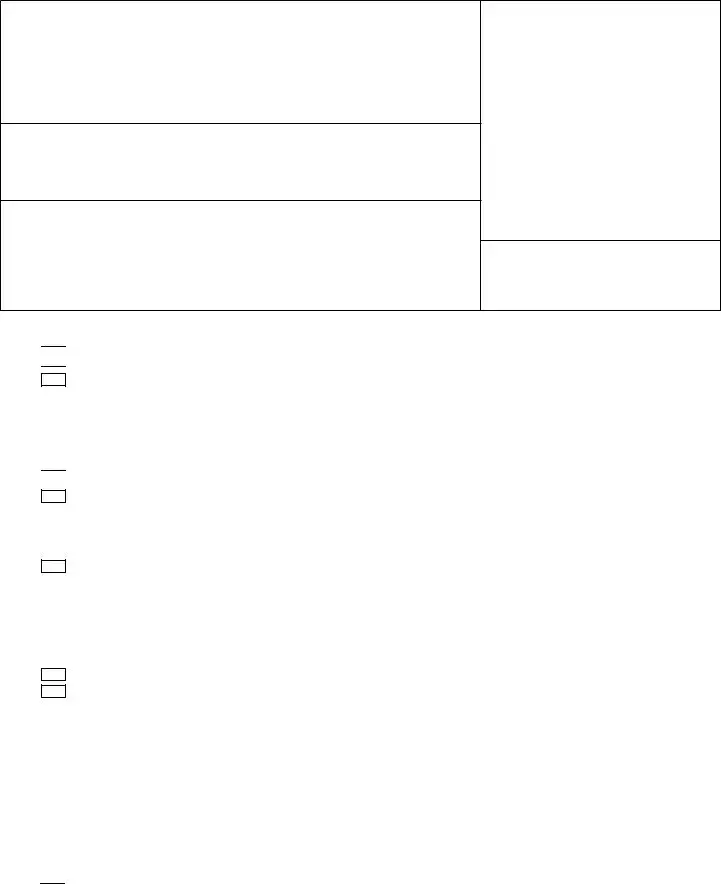

The PETITIONER RESPONDENT, Petitioner requests that the court, LEGAL GROUNDS Family Code, CASE NUMBER, Divorce or, Legal separation of the marriage, irreconcilable differences, permanent legal incapacity to make, Nullity of void marriage or, incest, bigamy, Nullity of voidable marriage or, petitioners age at time of, unsound mind, and fraud field can be used to indicate the rights and responsibilities of both sides.

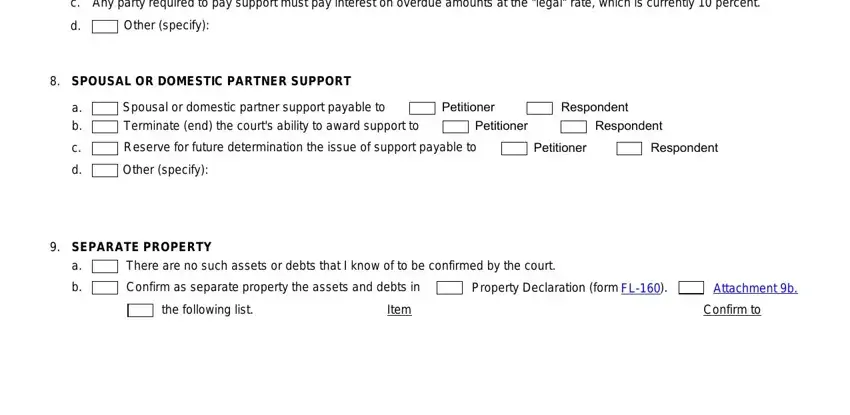

Fill in the template by reviewing all these fields: b c, If there are minor children born, Other specify, SPOUSAL OR DOMESTIC PARTNER SUPPORT, a b, Spousal or domestic partner, Petitioner, Respondent, Petitioner, Respondent, Reserve for future determination, Petitioner, Respondent, Other specify, and SEPARATE PROPERTY.

Step 3: Click the button "Done". Your PDF file is available to be exported. You can easily save it to your pc or send it by email.

Step 4: Ensure you stay away from forthcoming issues by having a minimum of two duplicates of your file.

We are married.

We are married.

We are domestic partners and our domestic partnership was established in California.

We are domestic partners and our domestic partnership was established in California. Our domestic partnership was established in California. Neither of us has to be a resident or have a domicile in California to dissolve our partnership here.

Our domestic partnership was established in California. Neither of us has to be a resident or have a domicile in California to dissolve our partnership here. Petitioner and Respondent signed a voluntary declaration of parentage or paternity.

Petitioner and Respondent signed a voluntary declaration of parentage or paternity.

petitioner’s age at time of registration of domestic partnership or marriage.

petitioner’s age at time of registration of domestic partnership or marriage. prior existing marriage or domestic partnership.

prior existing marriage or domestic partnership. unsound mind.

unsound mind.

form

form

Petitioner's former name be restored to

Petitioner's former name be restored to

Other

Other