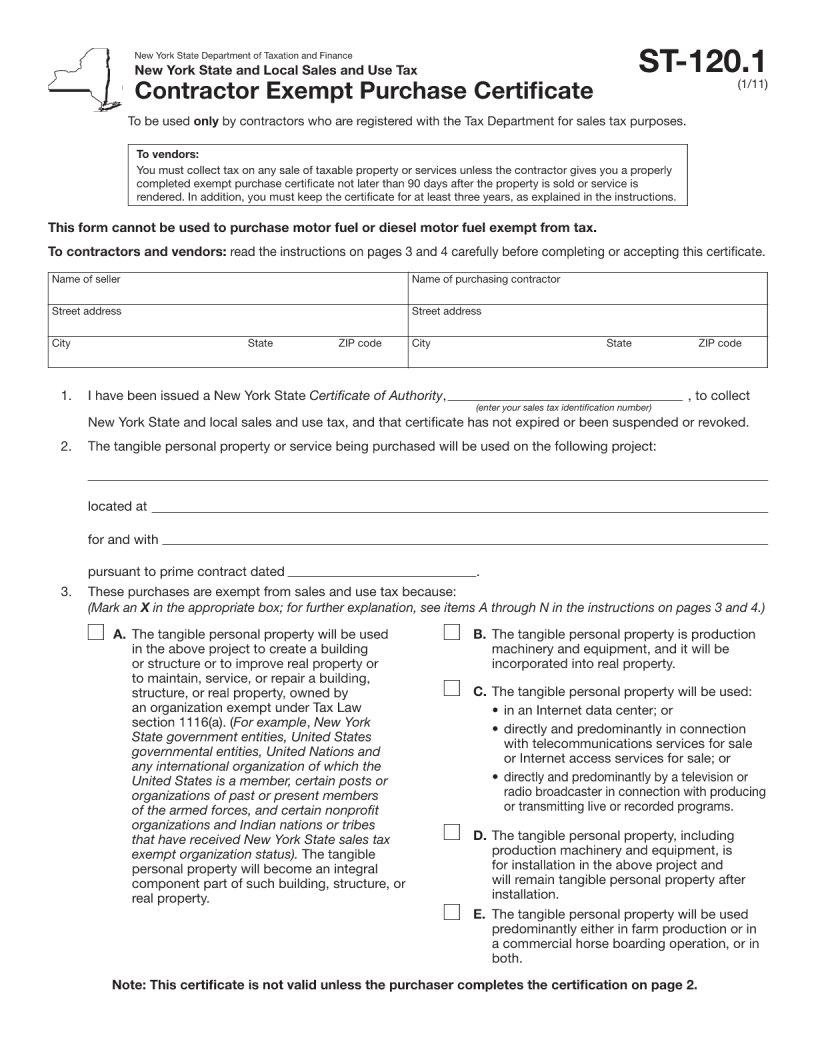

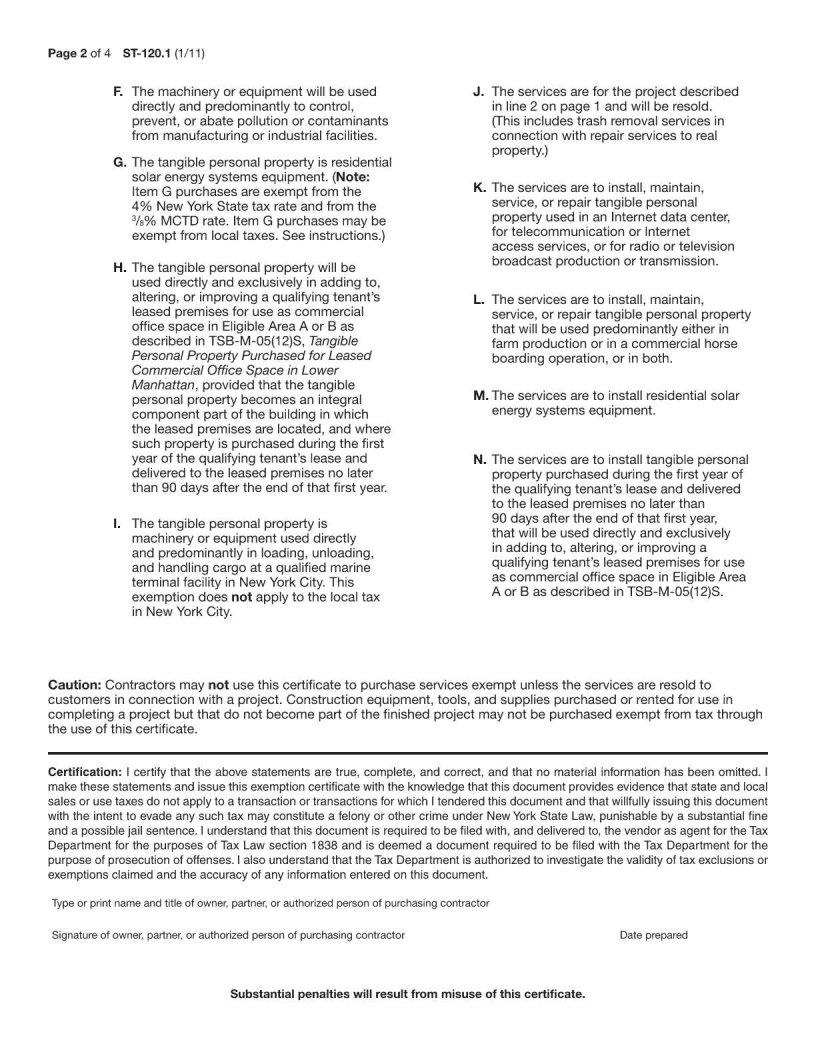

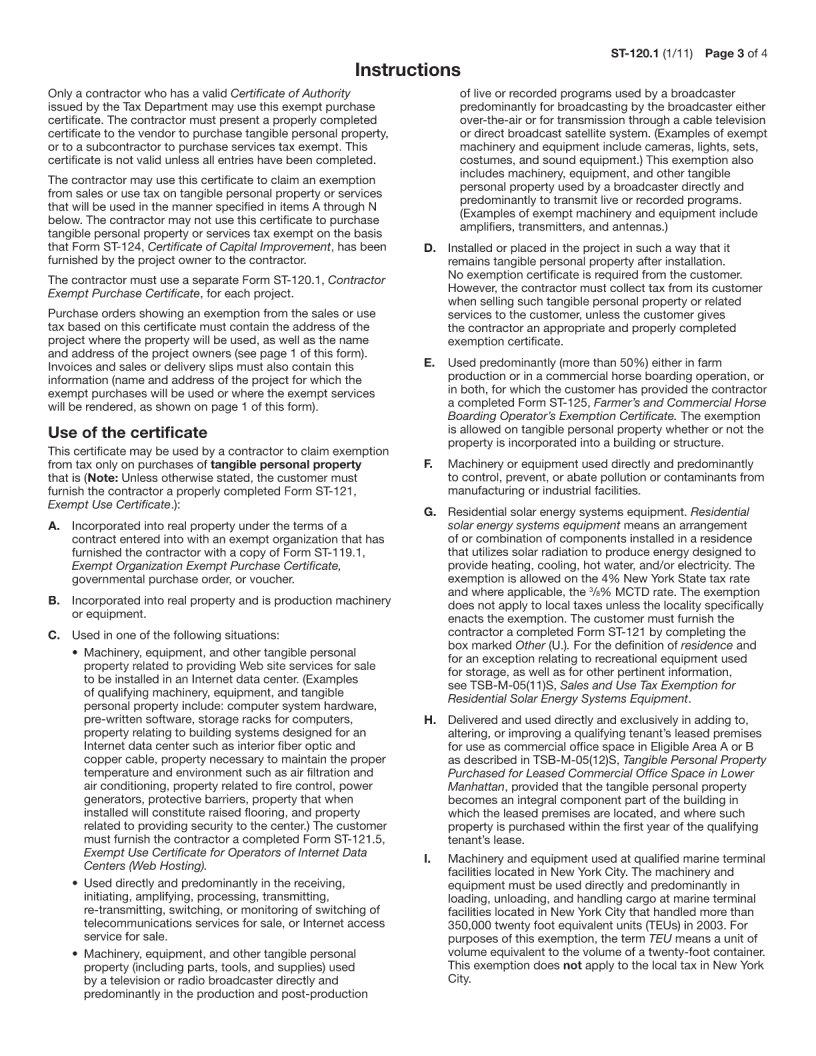

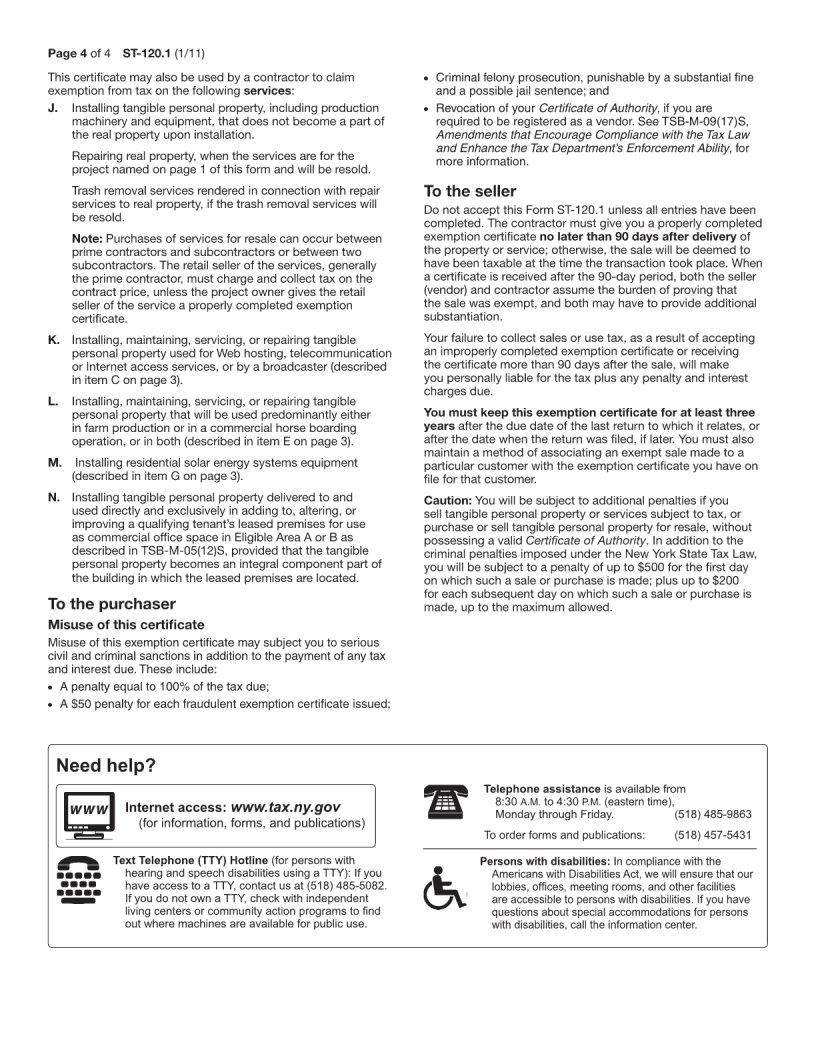

When engaging in transactions that might be exempt from sales tax, businesses and individuals often need to navigate complex tax regulations to ensure compliance and benefit from potential savings. This is where the ST-120.1 form, commonly known as the New York State Department of Taxation and Finance Contractor Exempt Purchase Certificate, plays a crucial role. Designed to streamline the process of claiming tax exemptions on purchases made for specific projects, this form serves as a declaration by contractors that the goods or services bought will be used in a manner qualifying them for tax exemption. It is vital for contractors to understand the precise conditions under which this form can be utilized, as improper use can lead to penalties. Furthermore, vendors receiving this form must validate the information provided to avoid being held liable for unpaid taxes. The ST-120.1 is not a one-size-fits-all solution; it requires careful attention to the details of each transaction to ensure its appropriate use, making it a critical document in the realm of New York State tax law.

| Question | Answer |

|---|---|

| Form Name | Form St 120 1 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | TSBM05, retransmitting, ST120, MCTD |